On the eve of July 4th, the U.S. Congress passed one of the most radical budget texts of the modern era. Championed by Donald Trump, this law reshapes America's economic priorities with massive tax cuts, social spending reductions, and a sharply rising debt. The vote, secured despite Republican fractures, marks a strategic turning point in the post-Biden era. More than just a budget, it is a political declaration that reshuffles the cards of power and reignites ideological tensions in Washington.

Donald Trump

While the stock market progresses timidly, it is the dollar that falters, weakened by the dual pressure of the new trade taxes imposed by Donald Trump and the ongoing hesitation of the Federal Reserve. In this tense atmosphere, investors oscillate between the quest for yield and the caution dictated by the surrounding instability. The apparent calm conceals a palpable nervousness: that of a market that knows that everything can tip at the slightest jolt.

Trump enriched by tokens, his sons in mining, blocked laws: when crypto becomes the secret weapon of a president who loves neither banks nor brakes.

When the guru of Ethereum worries about his own creature, there is something fishy under Web3. Vitalik pulls out the tests… and his anti-glitter blockchain scalpel.

While markets were expecting a clear monetary shift in 2025, Jerome Powell, the chairman of the Federal Reserve, dampened hopes by pointing to an unexpected culprit: Trump. Yes, Donald Trump, back in the White House since January, is leaving his mark on the American economy, to the point of forcing the Fed to play for time. In a context where every word matters, Powell dropped a diplomatic bombshell, accusing Trump's policies of blocking interest rate cuts.

Trump exults, Warren rises up, Lummis screams into the wilderness... The Senate votes, cuts through, carefully avoids crypto, and signs a XXL law, as silent as it is deafening for digital miners.

Musk is pumping 10 billion dollars into his AI circuits, while Trump fumes, threatens to cut off the taps... and discovers that AI doesn't like public debt.

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

It's hard to believe, but Donald Trump is favorable to bitcoin becoming the international reserve currency par excellence.

President Trump has criticised debanking, echoing concerns from the crypto sector as the White House revisits executive action.

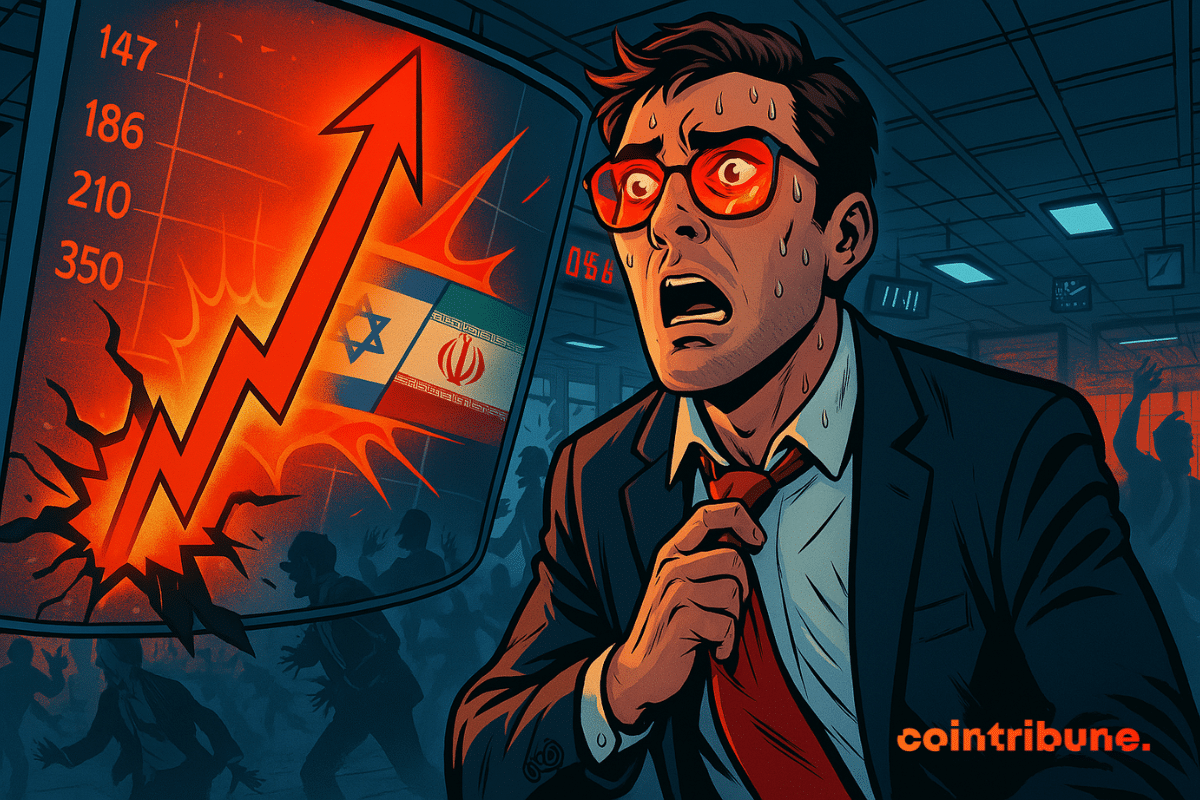

Bitcoin is gaining altitude, energized by the ceasefire agreement between Iran and Israel. A new high is in sight.

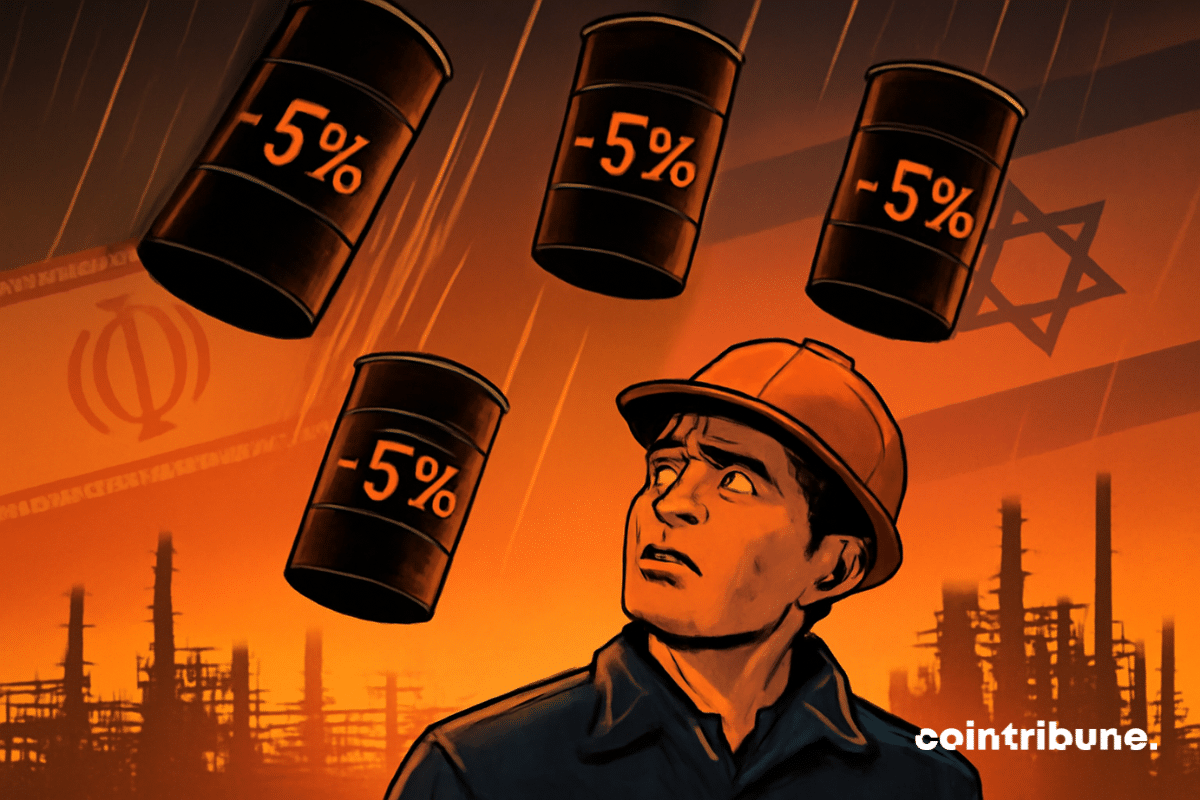

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

The crypto market exploded upwards on Monday evening, propelling bitcoin above $105,000 after Donald Trump announced a ceasefire agreement between Iran and Israel. This news instantly transformed investor sentiment. But is this euphoria sustainable in an ongoing fragile geopolitical context?

Trump rewards holders of his memecoin with a private dinner. Immediate reaction: Adam Schiff, a Democratic senator, draws up a law to regulate the use of cryptocurrency by political officials. A confrontation that mixes digital assets, conflicts of interest, and electoral calculations.

Trump Media dives into bitcoin with $2.3 billion. But behind the announcement, there is a colossal stock buyback and a strategy that is shaking up U.S. regulations. Will it take everything?

The conflict between Israel and Iran raises fears of a major escalation, yet U.S. indices are flirting with their all-time highs. Following U.S. bombings in Iran, this situation could change very quickly, casting doubt on a sudden market collapse.

Trump targets Iran, Bitcoin stumbles, traders are jittery, and indicators falter: what if war determined the next peak of crypto?

The president of Strategy has just revised his projections for Bitcoin. His new target? 21 million dollars in 21 years. A prediction that is causing debate within the crypto community and raises questions about the foundations of this heightened optimism.

Symbol of a Sino-American tug-of-war, TikTok once again crystallizes the tensions between digital sovereignty and trade war. With 170 million users in the United States, the ByteDance application is facing a third deadline extended by Donald Trump. By extending the deadline for the sale, the president is reviving an explosive file where geopolitical pressure, technological stakes, and legal battles are intertwined. TikTok remains at the heart of a strategic struggle, at the crossroads of economic interests and national security concerns.

Economist Peter Schiff is openly opposing the U.S. government on the future of stablecoins. While Washington relies on these cryptocurrencies to strengthen the dollar, Schiff predicts the opposite. But is he right to be concerned?

American President Donald Trump is urging Congress to promptly pass the GENIUS Act on stablecoins. A race against time is on to make the United States the global leader in digital assets. But does this rush conceal personal interests?

By maintaining its benchmark rates for the fourth consecutive time, the Fed has not simply extended a monetary policy. It has taken a stance in a tense economic and political landscape. Stubborn inflation, weakened growth, barely concealed political pressure... The status quo decided on June 18 resembles a statement of intent. Behind the silence of the numbers, a strategy of resistance is taking shape as the central bank finds itself at the heart of an increasingly unstable balancing act.

Bitcoin and crypto markets dip as rising concerns over Middle East tensions and Trump’s unexpected actions stir uncertainty.

Israeli airstrikes against Iran are disrupting the calculations of the American Federal Reserve (Fed). While Donald Trump is ramping up pressure for monetary easing, central bankers must now contend with a new factor of uncertainty: the geopolitical escalation that is driving oil prices up.

The announcement fell like a stone in a pond: Trump Media and Technology Group (TMTG) has taken a decisive step. The Securities and Exchange Commission (SEC) has officially approved the registration of its financial agreement related to Bitcoin. This approval gives the company a free hand to integrate crypto into its cash strategy. And like its founder, the initiative is anything but timid.

And what if the greatest store of value of tomorrow was no longer backed by a state, but coded into a protocol? In a world plagued by inflation and soaring sovereign debt, Bitcoin is increasingly establishing itself as a credible alternative to U.S. Treasury bonds. Hunter Horsley, CEO of Bitwise, argues that this transition is no longer a marginal theory, but a fundamental trend driven by growing adoption and disenchantment with traditional safe havens.

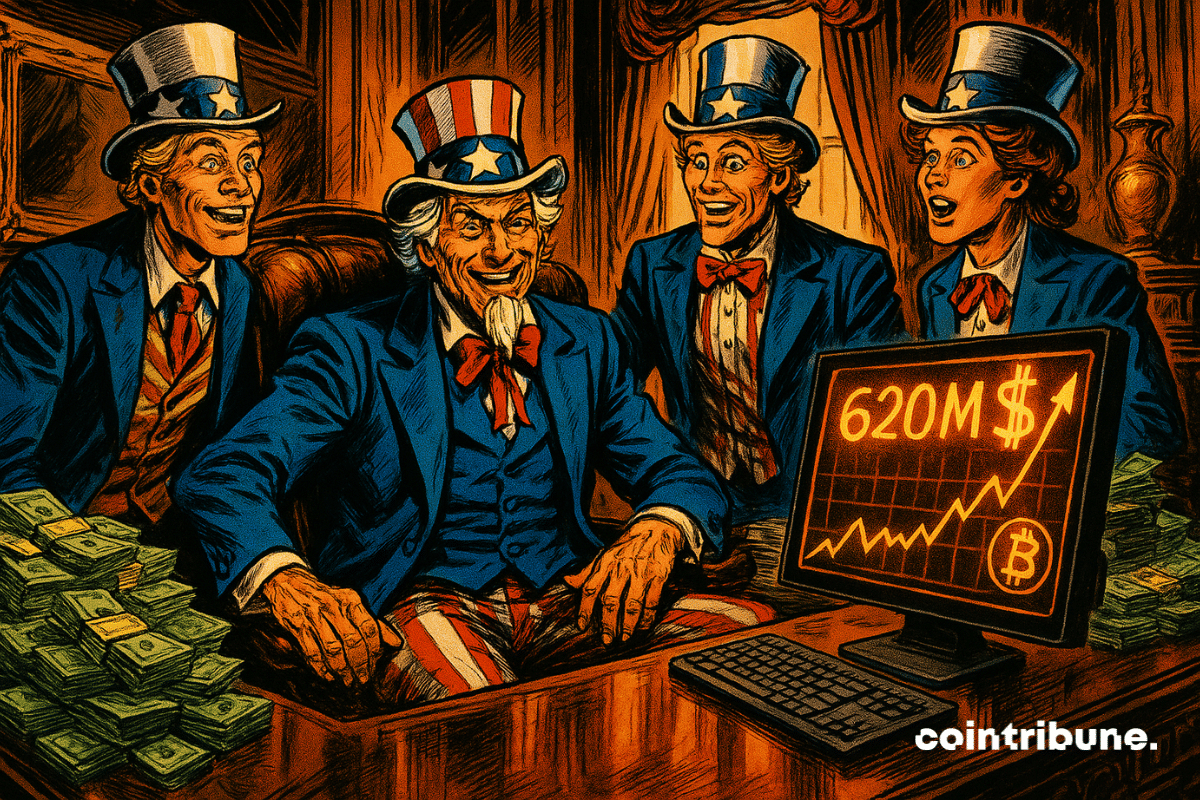

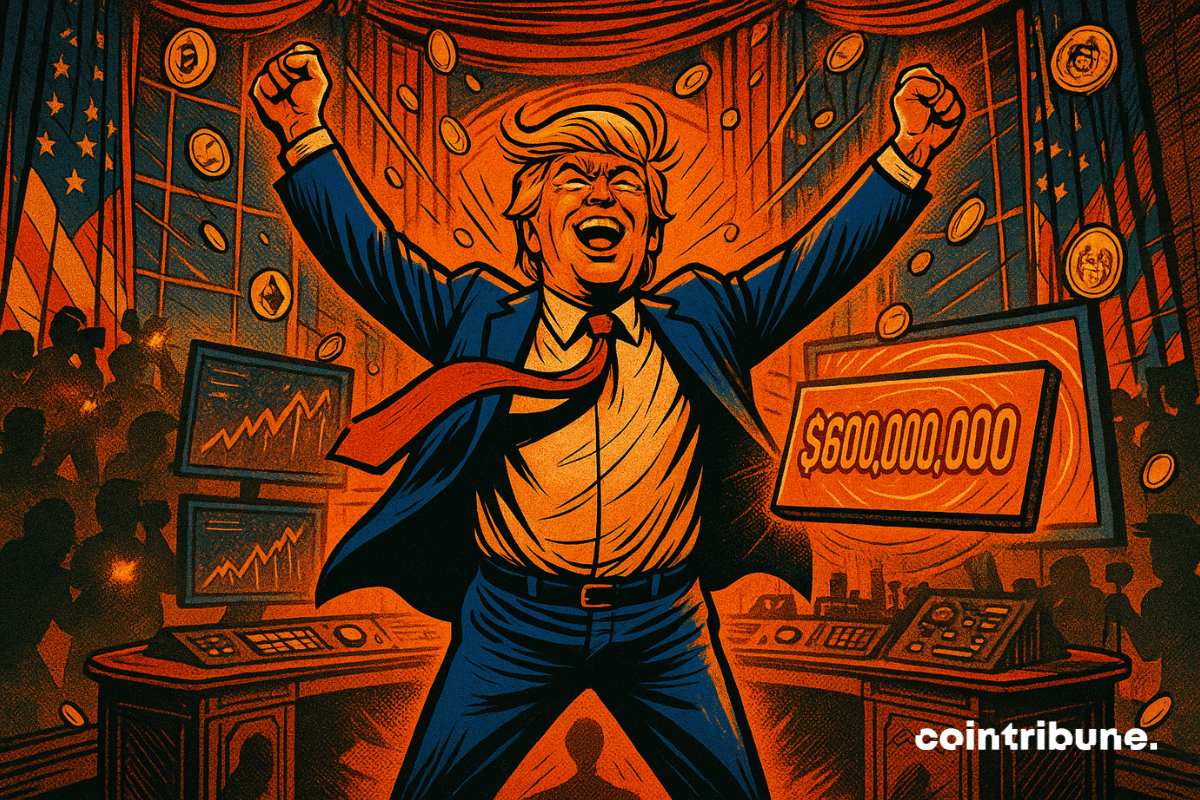

Donald Trump generated over 600 million dollars in 2024, with a major portion coming from the crypto universe. This figure, drawn from a financial disclosure document signed on June 13, confirms the president's strategic entrenchment in the crypto ecosystem. Between memecoins bearing his name and large-scale DeFi operations, Trump is no longer just observing the market: he is becoming a central player, with major financial and political stakes.

Missiles in the Middle East, markets in turmoil: while the economy catches a cold, some are making a fortune off barrels... and others prefer to flee into solid gold. Guess who is pulling the strings?

The regulation of stablecoins in the United States has just reached a historic milestone. The U.S. Senate voted 68 to 30 to advance the GENIUS Act, paving the way for a plenary session debate. Does this advancement finally mark the birth of a federal regulatory framework for dollar-backed cryptocurrencies?

In an economic context where every trade tension weighs on global markets, Washington has chosen firmness. On June 11, Howard Lutnick, Secretary of Commerce, ruled out any reduction in tariffs imposed on China. An unambiguous announcement, despite an agreement announced as "concluded" by both capitals. This tariff status quo reinforces uncertainty about global supply chains and sends a clear signal: the time is not for easing, even amid diplomatic dialogue.