The surprising decision by U.S. President Donald Trump to temporarily suspend reciprocal tariff rights has quickly reassured the markets and reduced the prospects of an economic recession.

Donald Trump

Long suppressed by regulations deemed hostile, the American crypto industry may be on the brink of a major turnaround. Indeed, Donald Trump's return to the White House is accompanied by a clear shift in direction: to make the United States a bastion of financial technologies. An unprecedented discourse is taking root at the top of the state, driven by a desire to break away from the Biden era. Behind the announcements, a strategy is taking shape, promising a new momentum for cryptos and a rehabilitation of the sector in the eyes of regulators.

The American markets experienced a spectacular turnaround this Wednesday, April 9, leading to a surge in bitcoin-related stocks. The cause: the 90-day pause on tariffs announced by President Donald Trump. A partial truce that excludes China but was enough to rekindle the appetite for crypto assets.

In just a matter of minutes, bitcoin crossed a symbolic threshold: $82,000. A meteoric rise, directly linked to Donald Trump's surprise announcement. The American president declared a 90-day truce on reciprocal tariffs with several countries while toughening his stance against China. The markets, thirsty for certainty, reacted in a cascade. But behind these spectacular figures lies a more complex reality: bitcoin, far from being just a speculative asset, is establishing itself as a barometer of geopolitical tensions.

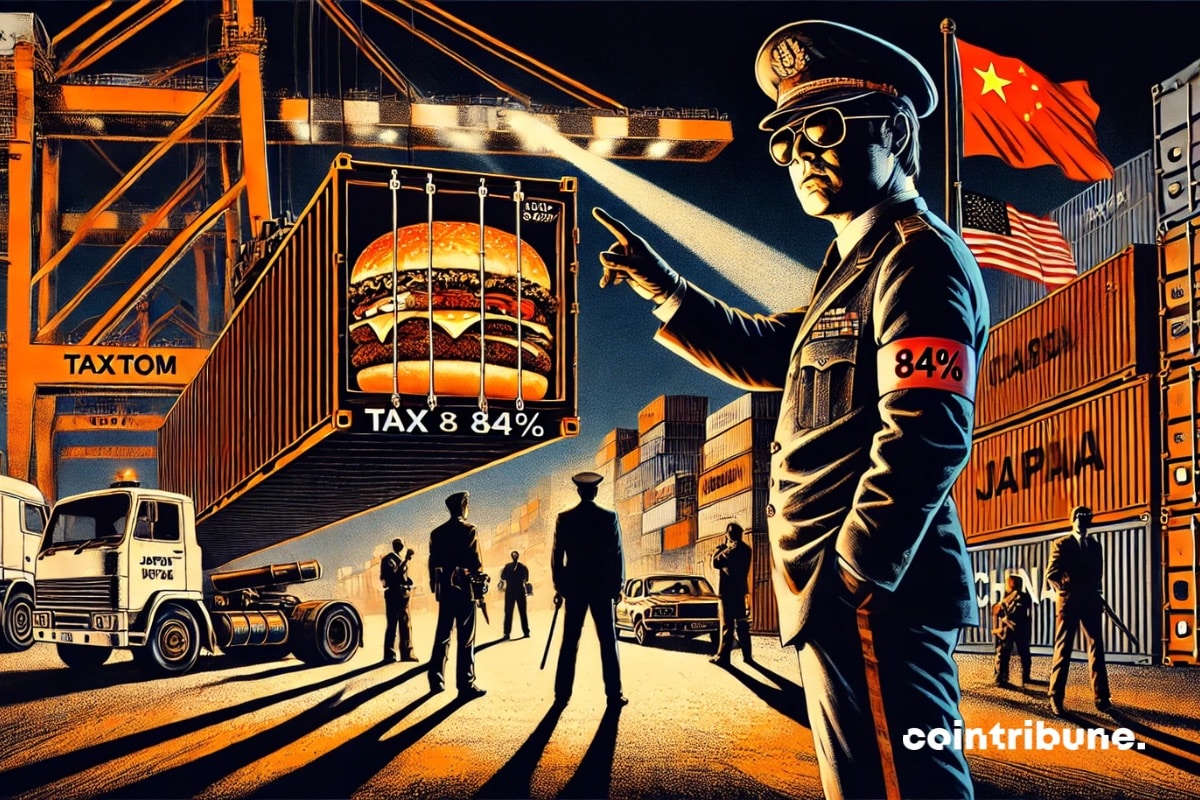

China announced on April 9 a dramatic increase in tariffs on American products, which will rise to 84% starting April 10, 2025 at 12:01 AM. This decision is a direct response to Donald Trump, who had raised tariffs on Chinese imports to 104% the day before!

A new trade tension is shaking relations between Washington and Tokyo. Donald Trump's recent decision to impose massive tariffs on Japanese products is causing a shockwave. Japan is reacting, setting up a delegation, and trying to contain the crisis before it worsens.

The blockchain analysis company Bubblemaps revealed on Monday that over 30 million dollars worth of the memecoin MELANIA were transferred and sold discreetly, without any official communication from the project team.

According to Arthur Hayes, founder of BitMEX, China's reaction to the new American tariffs could trigger a massive capital flight towards bitcoin. This dynamic, which has already been observed in the past, could reignite the bullish trend of the crypto market in 2025.

Global trade is wobbling under the effect of a new escalation between Washington and Beijing. Donald Trump is reigniting the tariff offensive against China, rekindling a trade war that marked his previous term. Beijing, far from backing down, is deploying a firm response, determined to defend its strategic interests. This renewed showdown between the two superpowers resonates well beyond customs, threatens global economic balances, and stirs tensions in international markets. A confrontation whose implications could be felt well beyond American and Chinese borders.

In a move that further intensifies the economic tensions between Donald Trump and China, the White House announced the imposition of an additional 104% tariffs on Chinese imports. This measure comes after China has evidently maintained its own 34% duty on American exports.

Global stock markets regained some stability on Tuesday after three days of historic turbulence, despite worsening trade tensions triggered by Donald Trump's new protectionist measures.

WLFI, whose partner is the Trump family, is testing its stablecoin with a USD1 airdrop. While this initiative attracts attention, it also raises concerns about regulation.

Tether, the leader of USDT, is preparing a new American stablecoin aimed at financial institutions. This strategic project emerges as Washington moves towards a regulatory framework for these dollar-backed digital currencies.

The crypto market is regaining its colors after the "Black Monday" on April 7, which led to over one billion dollars in liquidations within 24 hours. Currently, the global crypto market capitalization stands at 2.53 trillion dollars, up 3.08% in a day, signaling a possible return of investor confidence.

Donald Trump reignited trade tensions with China on Monday, April 7, by threatening to impose "additional" tariffs of 50% on Chinese products. This new escalation would occur as soon as April 9, if Beijing does not reverse its decision to retaliate against the U.S. customs offensive. China had indeed announced an increase of its own tariffs to 34% on American imports, effective April 10.

A new trade confrontation is beginning between the two shores of the Atlantic. Through the announcement of a 20% tariff on all European products, Washington directly targets exports from the Old Continent. France, on the front line, faces the threat of a major economic shock. Between the vulnerability of strategic sectors and diplomatic urgencies, Paris must react quickly. Behind this American decision lies much more than a tariff battle: the entire architecture of transatlantic trade relations is at stake.

Bitcoin, often regarded as a safe haven against the volatility of traditional markets, finds itself this week caught in a global storm fueled by trade tensions between the United States and the rest of the world. Following a series of economic shocks, some analysts do not hesitate to compare the current situation to a Black Monday 2.0. But is it really the end of the bull market for Bitcoin or just a simple correction phase? Here are five key points to remember this week to understand the challenges Bitcoin is facing.

Trump's new taxes destabilize the markets. What are the consequences for the American economy? The full analysis here!

The Trump administration has just triggered a real commercial earthquake. Through the imposition of a universal customs tax of 10%, soon raised to 34% for certain countries, Washington is reviving an aggressive protectionist strategy. This decision, counter to multilateral rules, threatens to reconfigure global trade and is already prompting reactions from more than 50 states. In a tense international context, this major shift could well mark the beginning of a new era of economic confrontation.

As the American economy wobbles, Donald Trump secures a strategic victory in the Senate with the unlocking of a controversial budget. Behind this success lies a political clash with global repercussions. For both investors and crypto players, this vote opens an uncertain sequence that could redefine financial balances and impact the trajectory of markets.

The billionaire Trump has transformed his setbacks into financial levers. Thanks to Truth Social and his crypto projects, he is multiplying his wealth by playing with expectations and speculations.

JPMorgan has revised its economic forecasts for 2025, raising the probability of a global recession to 60% due to the new tariffs imposed by the Trump administration. According to a report released this Thursday, titled "There will be Blood," the investment bank warns that the tariffs, which will take effect next week, risk plunging not only the United States but the entire global economy into a recession.

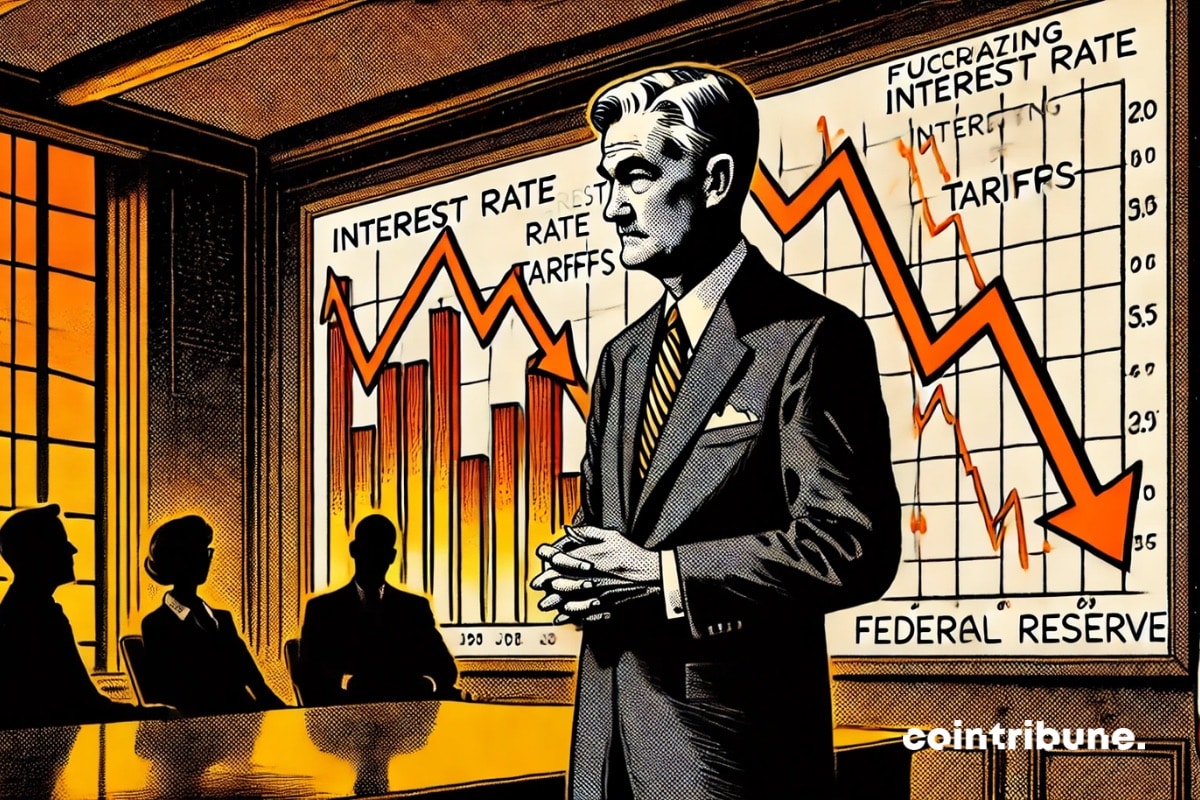

Donald Trump recently triggered an economic shockwave by announcing new tariffs. In response, Jerome Powell, the Chair of the Federal Reserve (FED), warned that these measures could exacerbate inflation while slowing down growth. What will be the impact on interest rates? Find out here.

Arthur Hayes, co-founder of Bitmex and a prominent figure in the crypto ecosystem, recently expressed his support for tariff policies as a lever to strengthen assets such as Bitcoin and Gold. In an uncertain global context, marked by economic and geopolitical tensions, Hayes believes that these assets can serve as shields against inflation and market volatility.

Donald Trump is once again making his mark at the helm of the United States. By launching a vast tariff offensive against almost all of the country's trading partners, the president is triggering an economic and diplomatic earthquake. Wall Street is falling, allies are worried, and Beijing is retaliating. This decision, as much strategic as ideological, marks the overt return of hard protectionism and places American economic sovereignty at the center of the global game.

Donald Trump has caused an economic shockwave by announcing significant tariffs targeting almost all countries in the world. The figures presented by the White House are being thoroughly analyzed by experts and raise questions among the United States' trading partners.

Paul Atkins takes the stage, Gensler exits through the back door, and Trumpian stablecoins dance on the blurry line between regulation and personal ambition. It's a true crypto western.

Donald Trump triggered a new trade earthquake on the night of April 2 to 3, 2025. By announcing an increase in tariffs of up to 20% on products from the European Union, the current head of the White House is reviving transatlantic tensions. But France and Europe are not going to take it lying down and are going on the offensive!

Trump reheats the old dish of protectionism. Result? The markets are nauseous and Polymarket pulls out the thermometer: 50% of recession fever announced.

A simple political speech can sometimes shake the entire crypto market. This Tuesday, an announcement by Donald Trump about new tariff increases triggered a wave of liquidations exceeding 500 million dollars. Bitcoin, Ethereum, and Solana plunged within a few hours, revealing the market's fragility in the face of geopolitical tensions. While leveraged traders were racking up losses, some institutions quietly took the opportunity to strengthen their positions.