At the beginning of 2026, memecoins establish themselves as the stars of the crypto market. PEPE, Dogecoin and Shiba Inu record spectacular gains, driven by massive whale accumulations and short position liquidations. This spectacular rebound, marked by a 20% increase in the sector's capitalization in a few days, raises questions: is it a simple technical rebound or the start of a new memecoin season?

Dogecoin (DOGE)

Crypto in orbit? Not so fast! Three grains of sand could well jam the rocket... What if Wall Street or the US Congress hit pause?

Crypto markets are showing a notable shift, with major altcoins recording solid gains. Bitcoin’s share of the overall market has weakened and is now nearing 59%. Capital rotation toward higher-beta assets has followed, renewing discussion around a potential altcoin-led phase.

Once shining symbols of speculative euphoria, memecoins are going through a major crisis. Their market capitalization has collapsed from 100 to 35 billion dollars within twelve months, reflecting a radical shift in retail investors' appetite. Does this spectacular drop mark the end of an era for these controversial digital assets?

In December 2024, memecoins were leading the trends. Their capitalization flirted with unprecedented highs. And then, in 2025... everything collapsed. Who would have thought that only one year would separate the spotlight from oblivion? Digital fortunes melted away. Beloved tokens disappeared. What could possibly have happened? Volatility, scams, saturation, or mutation? An analysis of a sharp turn in the ruthless world of the most bizarre cryptos. Nothing hinted at such a reversal for such a popular crypto market.

While Washington refines its Clarity Act, bitcoin is falling. Regulation on display, volatility behind the scenes: what if the real shock came from somewhere other than laws?

Memecoins are dead, long live memecoins? While the entire market is burying them, some see... a nap. The crypto circus may not have said its last word.

Dogecoin struggles to convince institutional investors. Despite a strong capitalization and a media-covered launch, crypto-backed ETFs show volumes in free fall. In a sector where Bitcoin and Ethereum concentrate the bulk of flows, the disinterest in DOGE illustrates the limits of assets perceived as too speculative.

Dogecoin just blew out its twelfth candle. As often with this unlikely project, the celebration looks more like a nod to the Internet than a classic birthday. Born to mock the very serious Bitcoin universe, DOGE has become in twelve years one of the most endearing and sometimes the most baffling emblems of crypto.

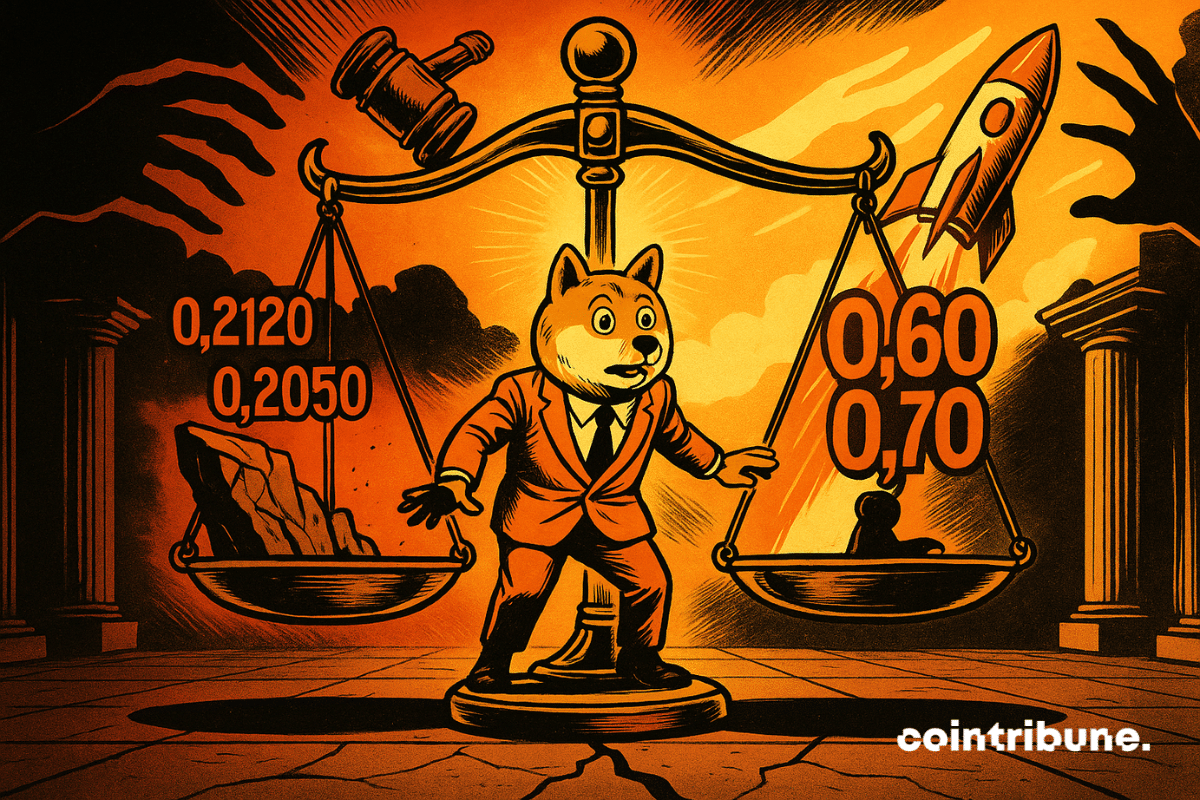

Dogecoin remains under pressure but rising on-chain activity and growing investor participation hint at a potential rebound.

Billy Markus, creator of Dogecoin, has just torn apart the manipulation accusations that bloom after every crypto crash. His sarcastic message on X is timely: the market just lost 200 billion dollars in 24 hours. Who to blame this time?

Bitwise's Dogecoin ETF has just received the long-awaited approval from the NYSE, but one question remains: will the market show up for DOGE? Between hopes and uncertainties, this launch could redefine the future of the most famous memecoin. Discover the stakes and projections for investors.

Bitwise sees Bitcoin, Ethereum, XRP and Uniswap as the stars of 2026. Between major technological updates, institutional adoption and expected rebounds, these cryptos could explode at any moment. Discover the price forecasts for December 2025 and the winning strategies to profit before everyone else.

The crypto market is going through an unstable period, marked by a sharp decline in the most speculative assets. In 24 hours, memecoins lost more than 5 billion dollars, bringing their capitalization to an annual floor. NFTs follow the same trajectory, reaching their lowest level since April. This plunge is part of a broader flight-to-safety movement, with investors massively deserting high-risk assets.

VanEck's Solana ETF has just entered the scene, and it's not just another product on the altcoin shelf. We are witnessing a real flood of crypto funds on the stock market, with Solana and soon Dogecoin at the forefront. Between slash fees, integrated staking, and a race against regulatory time, a new battle is playing out far from traditional exchange platforms.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Dogecoin, the quirkiest crypto on the market, could soon enter institutional portfolios. Bitwise has filed a new spot ETF application with the SEC, removing the last administrative barriers. The green light could come within twenty days… triggering a new rush towards Elon Musk's favorite meme.

Shocking ranking in crypto: XRP climbs to the top of altcoins against Dogecoin and Solana. More details in this article.

The crypto market experienced a sharp decline at the start of the week. While US stocks remained in the green, Bitcoin, Ethereum, and Dogecoin collapsed, triggering over $1.1 billion in liquidations within 24 hours. A sudden drop, without a clear catalyst, revealing the weaknesses of an ecosystem still unstable and vulnerable to panic movements. This massive setback rekindles doubts about the market's strength and investors’ resilience amid an ever unpredictable volatility.

After one of the steepest selloffs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.

The crypto market finds bullish momentum again. Some altcoins benefit from massive short covering. Details in this article!

Dogecoin crypto tests the 0.24 $ threshold between negative technical signals and hope for an imminent ETF. Which scenario will win?

The first U.S. Dogecoin ETF has launched, drawing strong trading activity even as Dogecoin’s price dips and large holders accumulate.

Usually September bleeds, this time bitcoin smiles: +8%. But behind the miracle, the Fed pulls the strings and the crypto ecosystem holds its breath.

Pump.fun handled over 1 billion in daily trading volume, setting a new milestone for the platform. Meanwhile, the wider memecoin market experienced a broad rally, with trading activity and market capitalisation surging.

The first ETFs exposed to XRP and Dogecoin will be launched this week in the United States. Carried by Rex Shares and Osprey Funds, these products mark an unprecedented regulatory breakthrough for two cryptos long kept away from traditional markets. This milestone broadens the range of assets accessible to investors, beyond bitcoin and Ethereum.

The iconic memecoin Dogecoin continues its rise, driven by market enthusiasm. Despite another delay in the launch of its first American ETF, institutional investors remain alert and seem little affected by this announcement.

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decisions regarding two highly anticipated crypto ETFs. The Bitwise Dogecoin and Grayscale Hedera ETFs will have to wait until November 12 to learn their fate.

Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

While the entire crypto market oscillates between consolidation and correction, Dogecoin stands out with a unique behavior. Its open interest, a barometer of open positions on futures contracts, remains stable at a historically high level, nearing 16 billion DOGE, or approximately 3.36 billion dollars. This threshold is remarkable in a climate where speculative activity is significantly declining across the majority of altcoins.