Crypto 2025: invisible hackers, billions lost, a rogue state involved... What if your wallet was the next silent victim?

Theme DeFi

Aave enters a new growth phase after the SEC ends its investigation, planning V4, Horizon, and a mobile app to drive growth in 2026.

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

In a DeFi market seeking stability, the launch of StandX on November 24, 2025, does not go unnoticed. This new DEX, dedicated to perpetual contracts, introduces an automatic yield stablecoin, without staking action. Supported by a team from Binance Futures and Goldman Sachs, the project claims a community-driven and self-financed approach. Unlike classic models, StandX aims to establish itself in a sector still largely dominated by centralized platforms.

Traditional finance is shifting into the era of RWAs: Real Finance just raised 29 million dollars to tokenize 500 million in real assets. With Nimbus Capital and giants like Goldman Sachs lurking, this revolution will redefine investment.

Solana’s lending sector is dealing with one of its most visible internal disputes of the year, raising concerns about how public conflicts may affect trust in the ecosystem. A tense exchange between Kamino Finance and Jupiter Lend has now pulled in Solana Foundation president Lily Liu, who urged both projects to direct their energy toward growing Solana’s overall lending market.

Grayscale's Chainlink ETF recorded $41 million in inflows on its first day, an impressive figure at first glance. Yet, experts are already talking about disappointment. Why does this launch, despite being solid, fail to convince? Analysis of a "blockbuster" that did not live up to its promises.

An arithmetic bug, billions of tokens, a hurried hacker… and Yearn retrieving $2.4M in commando mode. In the crypto jungle, treasure hunts are intensifying.

Kalshi is pushing prediction markets further into the crypto space as global demand accelerates. Rising interest in event-based trading has prompted the platform to tokenize event contracts on Solana, giving users more in sensitive markets. Analysts say this shift could position Kalshi to challenge competitors and keep pace with the industry’s rapid growth.

A hacker, a forgotten division, and nine million vanished... The arithmetic falters, the vaults empty, and Yearn's coders mourn their yETH. Crypto drama or bad comedy?

The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

Solana is booming, but CoinShares is backing down: the ETF leaves the stage before entering. The crypto market, meanwhile, is still applauding... Go figure where the real show is.

Coinbase Ventures has just unveiled its investment strategy for 2026, outlining the strong points of a changing Web3 ecosystem. Nine key areas have been identified, revealing the sectors where capital could soon flow. More than a simple manifesto, this roadmap lays out the technological and economic bets of one of the most influential players in the crypto industry, a strong signal sent to developers, investors, and builders of the decentralized web.

DeFi is no longer a promise, but a revolution underway. According to Chainlink, it could dominate global finance by 2030—under one condition: regulation. How are institutional funds and stablecoins accelerating this historic adoption? All the answers here.

Trump buys back his WLFI token relentlessly. Between crappy shitcoin and dwindling fortune, the family crypto empire is rocking hard. And to think they saw it as digital freedom...

For over a decade, Bitcoin has remained frozen in apparent simplicity. Its Script language, deliberately limited, has sacrificed expressiveness on the altar of security. Meanwhile, Ethereum, Solana, and Avalanche have captured hundreds of billions of dollars in liquidity by offering programmable smart contracts. But this expressiveness came with vulnerabilities: reentrancy, unpredictable execution costs, critical attacks.

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

While the ECB dreams of a well-behaved digital euro, a French crypto startup is spending £30 million to hack the bank... but with the regulator's approval. Hats off.

Trump tightens the screws: after flirting with crypto, he is now ready to unleash the IRS on digital havens... Soon audits on wallets hidden in the Bahamas?

Growing U.S. interest in tightening oversight of offshore digital assets is gaining traction in Washington. Momentum is building as a proposed rule allowing the IRS to access data on Americans’ foreign crypto accounts moves into White House review. Signaling a stronger push to align U.S. tax policy with global reporting standards, the step places cooperation with foreign regulators closer to reality.

Aave announces a new savings app offering up to 9% APY, real-time interest tracking, and higher yields than traditional banks.

A site fades away, a token collapses: DappRadar takes its bow, leaving its DAO stranded and the crypto market searching for a new GPS for its scattered data.

No bridges but with panache, Pact Swap slashes fees and smashes complexity: crypto finally discovers a DEX that does not chain its users.

When crypto plays central banker, the Fed sweats under its suit. Stablecoins, hidden treasures, and plummeting rates: guess who really runs the world?

A steady shift toward digital assets is underway across the hedge fund sector, as an increasing number of managers incorporate crypto positions. Rising market activity and clearer signals from U.S. policymakers have been key drivers of this trend. In fact, recent survey data indicate a broad transition that is gradually pulling crypto further into mainstream finance.

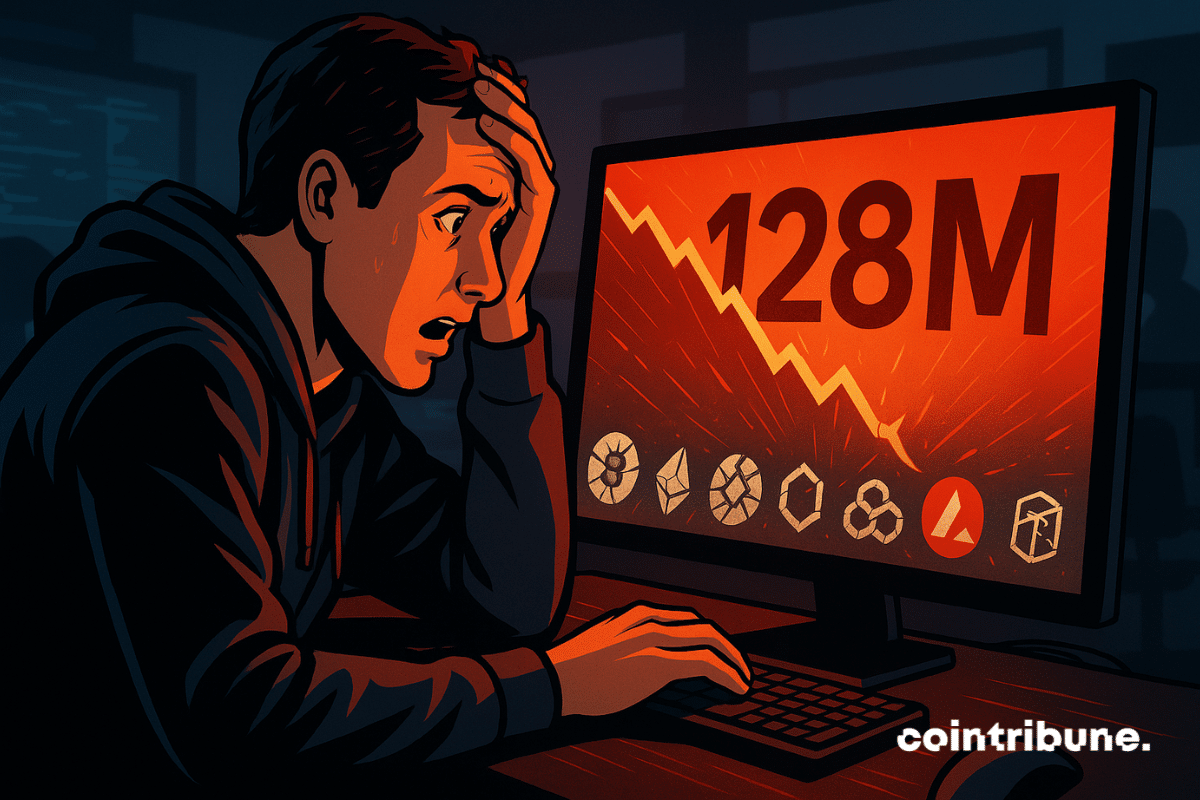

Balancer has just published its preliminary report on the attack that shook the DeFi protocol on November 3. A technical flaw in the V2 pools allowed hackers to siphon 128 million dollars across seven different blockchains. But the real bill is much higher: the total value locked (TVL) collapsed by 58% in just two days. How could a protocol audited eleven times fall victim to such a debacle?

Aster, a decentralized perpetuals exchange, surged over the weekend after Binance founder Changpeng “CZ” Zhao revealed a personal investment of more than $2 million in its native token. His entry into the project reignited market excitement, drawing investors back to the fast-growing DeFi platform and reaffirming his lasting influence over digital-asset markets.

Eleven audits, a brilliant architecture, but 128 million gone... The crypto-miracle Balancer falls hard. Who said code was better than a good old banker?

A heated discussion is brewing in the crypto world after Solana Foundation manager Vibhu publicly invited Ripple executives and members of the XRP community to a live debate focused solely on on-chain data. His open call on X seeks a “facts-only” discussion about network activity and challenges long-standing claims about XRP’s real-world adoption.

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.