During the past 24 hours, cryptocurrencies TAO, NEO, and Quantum have experienced spectacular increases in their value and price.

Cryptomarket

The high and persistent inflation levels in the United States have disappointed expectations with significant repercussions for the bitcoin market!

The U.S. Treasury is seeking new powers to better crack down on and penalize abuses related to crypto.

Ethereum's cryptocurrency hits hard and fast, recording a dramatic 8% jump in just 24 hours. This soaring climb has propelled it toward the dizzying heights of $3,710 on Binance! But the climb doesn't stop there. Riding the wave of this week, the blockchain star has scaled an additional 3.0%. This has boosted its value from $3,510.48 to new heights. Although still below its record of $4,878.26, Ethereum displays an unwavering determination to redefine the limits of its potential.

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic struggles. Here is a summary of the most significant news of the past week around Bitcoin, Ethereum, Binance, Solana, etc.

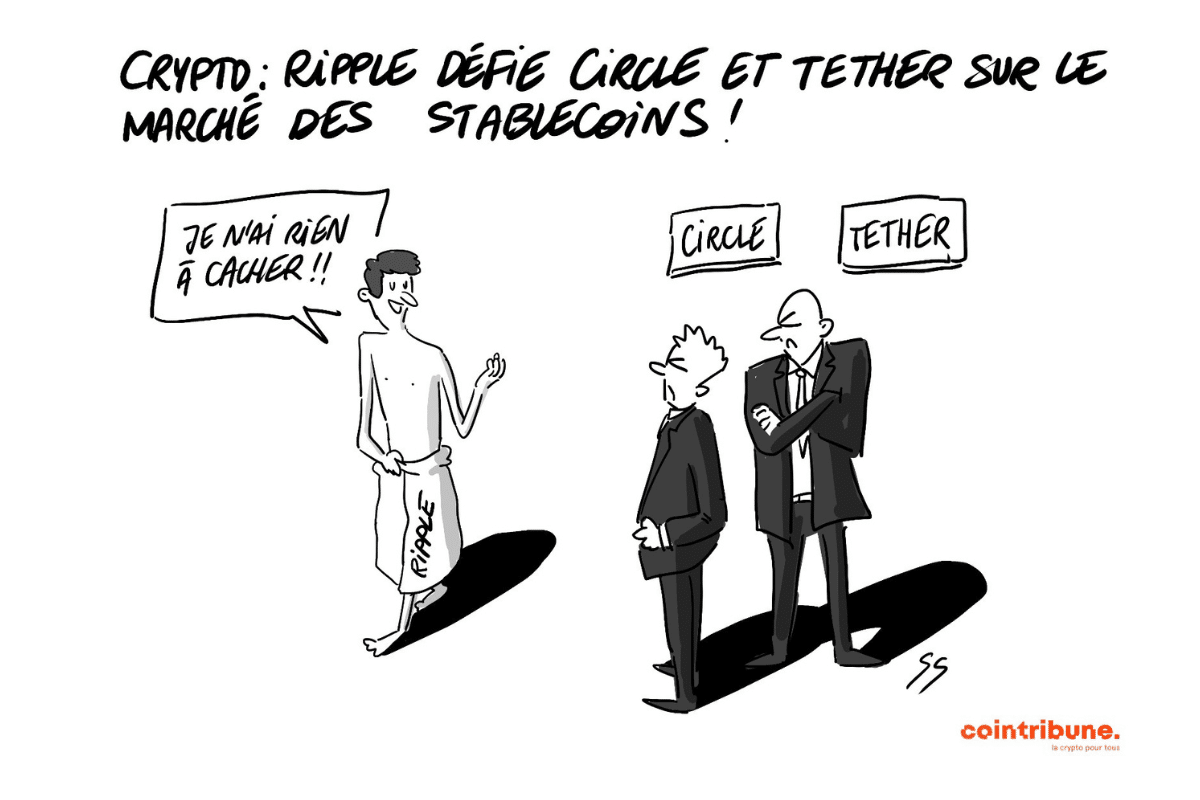

The CEO of Ripple predicts that the crypto market will double to reach $5 trillion by the end of this year 2024!

Faced with the threat of Bitget being blocked by the AMF, French investors are urged to take measures to protect themselves.

Binance challenges while enhancing user protection and addressing crypto compliance.

Explore the revolutionary rise of AI in the crypto world, an explosive marriage that could potentially disrupt the ecosystem!

As Bitcoin approaches new highs, the prospects for an Ethereum ETF are dimming, underscoring the persistent regulatory challenges.

Let's explore the implications of a significant decrease in Bitcoin reserves held by major cryptocurrency exchanges.

Bitcoin fluctuates between peaks and valleys! Let's look together at the key factors that have influenced this roller coaster.

Fueled by a meteoric rise in crypto, the number of billionaires from the industry has surged by nearly 50% in a year!

This year, the most surprising trends have shaken up the established order in the fast-paced world of crypto

Despite the headwinds in the crypto universe, AVALANCHE (AVAX) is showing resilience, offering investors a glimmer of hope!

In the United States, federal agents discreetly move $139 million in bitcoin from the black market!

Explore the 5 major crypto events in April 2024 that will make the markets more volatile than ever!

At the heart of the crypto ecosystem, Tether (USDT) has recently made headlines with a significant action. The acquisition of 8,889 bitcoins (BTC), worth around $627 million, marks a strategic turning point for the stablecoin giant. This bold move not only strengthens its reserves but also powerfully asserts Tether’s long-term…

The crypto market is bubbling as the halving approaches, propelling Bitcoin to $71,000 before a sudden drop.

Displaying Bitcoin address balances on Google is a great step for crypto adoption! However, it raises some questions

While the legal battle between Coinbase and the SEC rages on, the court's decision is a blow to the leading crypto exchange

After the successful launch of the Bitcoin ETF, Fidelity files for an Ethereum ETF with the crypto regulator

Crypto: Should you flee or remain loyal to the KuCoin platform: between serious accusations and assurances from the CEO.

Tether plans to launch a pioneering division to establish multimodal AI models, revolutionizing crypto accessibility.

Is Bitcoin gearing up for a major correction in 2024? Discover the hidden opportunities in the crypto market turmoil.

Explore how crypto, at the recommendation of the IMF, could reshuffle the financial power dynamics in the Pacific islands!

Binance drops USDC support on Tron, calling into question established crypto alliances and opening the door to new challenges

As the appetite for crypto resurfaces, Wall Street's ogre, Goldman Sachs, positions itself to devour this nascent market!

The awakening of Bitcoin whales is shaking the crypto markets, triggering unprecedented volatility!

The influence of ETFs on Bitcoin is fading, paving the way for a reinvented market dynamic with new key players.