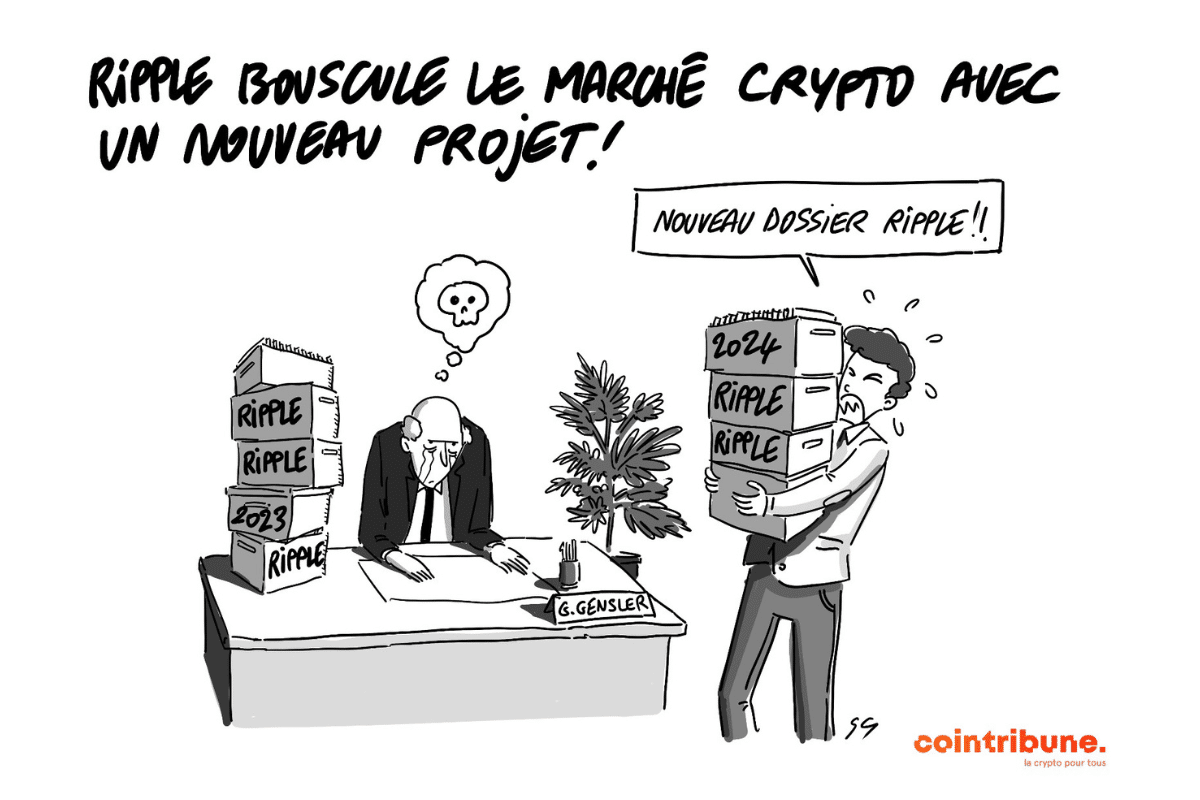

In a context of a general surge in the crypto market, XRP, the native cryptocurrency of Ripple, seems to be facing a particular situation. While several cryptos have managed to reach their all-time price high again, XRP is struggling to follow the trend. The asset raises concerns related to its depreciation over the past 6 years.

Cryptoactif

Currently, the price of bitcoin (BTC) in the market is around 67,180 dollars. In Egypt, this same bitcoin has increased by one million Egyptian pounds. The valuation of the flagship crypto in the land of the pharaohs has recently exploded as the local currency has undergone a substantial devaluation in a challenging economic context.

The legal battle over the movable nature of cryptos is once again making headlines. A US judge has just ruled that some of the crypto transactions carried out on the secondary market constitute securities transactions. A decision whose significance and implications are being discussed among crypto industry players.

In an era where blockchain technology and cryptocurrencies are redefining the boundaries of global finance, the BRICS are positioning themselves as pioneers of radical change. With the announcement of an innovative payment system, these emerging powers challenging the hegemony of the US dollar are outlining the contours of a new global economic order based on inclusivity, security, and the speed of financial transactions.

Blast, a layer 2 scaling solution for Ethereum, has just experienced a new development. It has joined the Web 3.0 wallet of the crypto exchange Binance. A development that promises significant impacts, especially in terms of user experience.

Discover how Alfa-Bank's 'Evergreen Portfolio' is revolutionizing the digital assets and crypto market in Russia.

The past week has been particularly rich in major developments for the crypto sector. From the imminent Bitcoin halving that promises to reshape the mining landscape to the announcement of the successful deployment of the Dencun upgrade on Ethereum's testnets, along with Binance's asset recovery initiatives and Ripple's legal challenges, each event carries the potential to redefine the future of the crypto market. This article provides an overview of the most significant news and gives you an essential insight to understand current dynamics and anticipate future movements in the crypto space.

In a universe where volatility reigns supreme, Solana (SOL) stands out with a stunning growth, reaching an unmatched peak for 23 months. This surge of over 30% in just one week has sparked both confidence and curiosity within the cryptocurrency community. This article explores the dynamics underlying this spectacular rise and highlights the key factors and implications for the future of Solana and the crypto market as a whole.

As it tries to get back on its feet after the legal troubles that have cost a lot, the crypto exchange Binance is facing new regulatory challenges. This time, the problems come from Nigeria where authorities are criticizing the potential influence of the platform on the country's economy, causing concerns among local traders.

According to latest reports, MicroStrategy's investments in bitcoin (BTC) are proving to be very profitable. Despite some suggestions, the company seems determined not to cash out these profits. On the contrary, it is doubling down on its acquisition strategy as evidenced by MicroStrategy's recent significant purchases of bitcoins. This is happening as the price of the leading cryptocurrency continues its remarkable surge.

Bitcoin (BTC) is not the only one attracting attention from the crypto community. Several cash-settled ETFs linked to the leading crypto are also gaining traction through their trading volumes. In the past 24 hours, they have seen a remarkable surge. Here is exactly what happened.

The crypto firm Ripple has not yet ended its legal battle with the SEC when another lawsuit could involve it. Ripple is accused by individuals and companies of "illegally" selling them XRP. Here is what is specifically at issue in the context of what appears to be a class action lawsuit.

The crypto project team Shiba Inu (SHIB) recently announced the launch of its latest collection of non-fungible tokens (NFTs), named "SHEboshis". This initiative marks a significant milestone for the project as it introduces the use of the ERC-404 standard, a first in the Ethereum ecosystem. The Ethereum ERC-404 standard promises to bring increased fluidity and promote the fractionalization of NFTs, thus opening up new opportunities for holders and investors. In this article, we will explore the implications of this advancement.

The financial ecosystem is experiencing a new trend involving baby boomers. This class of investors born between 1943 and 1965 is losing interest in gold. Now, they are turning to Bitcoin Spot ETFs. This dynamic raises questions for many financial market analysts. Historically, gold is considered an asset that secures wealth against financial risks such as inflation. From this perspective, this evolution represents a significant change in the investment preferences of this cohort of investors. What factors are driving this transition and what are the implications for the future of investments? In this article, we provide an analysis on this issue.

The year 2024 is distinguished by significant developments in the cryptocurrency sector. Between Bitcoin's halving, Ripple's expansion in crypto custody, and strategic collaborations such as Solana and Filecoin, the crypto landscape is experiencing unprecedented dynamics. These developments, along with Bitcoin's rise in the global asset rankings and increased commitment from Ethereum, as well as calls for appropriate regulation of Bitcoin ETFs by U.S. banks, reflect a growing maturity and integration of cryptocurrencies into the global financial system. Here is a summary of the most notable news from the past week.

The Total Value Locked (TVL) in the context of decentralized finance (DeFi) defines the total value of assets locked in DeFi protocols and smart contracts. In other words, it measures the total amount of locked and utilized cryptocurrencies in various decentralized financial services, including liquidity pools, borrowing and lending protocols, decentralized exchange (DEX) platforms, among others. TVL is often seen as an indicator of the popularity and adoption of different DeFi protocols. It acts as a barometer of this crypto ecosystem. Indeed, according to recent data, the TVL of DeFi is in its best shape thanks to the dynamism of Ethereum. This article explains the ins and outs of this trend.

In the particularly thriving context of the crypto market lately, choosing wisely to position oneself on Bitcoin or Ethereum can be quite a dilemma. These two crypto ecosystems are market leaders. But they are distinct from each other in terms of functionalities and advantages. Understanding this divergence can be crucial for crypto investment choices.

Exactly one year ago, the price of bitcoin (BTC) was around $20,000. Throughout the year 2023, the flagship cryptocurrency made headlines for its remarkable dynamism despite the ups and downs. Today, the asset is valued at over $50,000. A level it had not reached since December 2021. The surge of BTC to reach this level is from this point of view a major event for the crypto industry, whose resurgence in 2024 has been announced by a panel of experts. But how can we reasonably explain that in the space of a week, BTC has increased its valuation by 19% to currently trade around $51,600? This article will provide you with some answers.

Despite the legal challenges it is involved in, the crypto firm Ripple wants to expand its operational scope. Latest news has it that the company wants to venture into the crypto custody segment. The company still needs to obtain regulatory approval.

Two years ago, the crypto platform Polygon (MATIC), created to solve Ethereum's scalability issues, unveiled zkEVM. A solution that helps address the scalability challenges of Blockchain. The improvements in this regard have not stopped, as stakeholders have gone even further by developing a type 1 zkEVM prover. Here's what it's all about.

Towards the end of the 1990s, the emerging Internet technology at the time raised doubts and skepticism about its adoption potential. However, here we are nearly three decades later, with the Internet having become ubiquitous in everyday life. Will cryptocurrencies, which cannot be issued without blockchain technology, follow the same path? Or, on the contrary, will they experience a different fate and fizzle out over time? In a recent report, leading investment bank Architect Partners attempts to answer these crucial questions in light of the crypto industry's recent momentum. Here, in this article, is the essence of what should be remembered from it.

According to JPMorgan, the growing dominance of USDT in the stablecoin market is negative for the overall crypto ecosystem.

Solana has broken records with a staggering transaction volume of 951.9 billion, a growth of 30% since December.

For the past few days, bad news has been piling up for Bitcoin (BTC). The flagship cryptocurrency has lost ground in recent days. This bearish trend has had a negative impact on smaller BTC portfolios, resulting in a total decline. BTC is clearly under pressure, but has just managed to shake it off.

Tether's stablecoin is counted among the most popular cryptos on the market. But this asset, which is pegged to the US dollar, is facing difficult times. Like many of its counterparts, USDT, as it is commonly called, had a particularly tough year in 2023. An analysis by Moody's analysts indicates that during that year, the asset "depegged" several times. In other words, the crypto lost its peg to the dollar, which is the essence of its stability compared to conventional cryptos. In this context, knowing that depeg situations reached new highs in 2023, wouldn't it be wiser to be cautious of USDT? This article will try to answer this important question for investors.

Crypto: The Canadian court's decision to unfreeze the cryptocurrency funds of the protesters marks a turning point for freedom.

In 2024, the adoption of cryptocurrencies remains a subject of great interest, influencing financial markets and sparking debates on regulation. While financial giants integrate blockchain solutions, countries are exploring the creation of official digital currencies. However, persistent challenges such as price volatility and security concerns hinder widespread adoption. At the same time, communities and businesses are exploring new applications of crypto, from decentralized finance to asset tokenization. The future of crypto adoption continues to be dynamically influenced by technological, regulatory, and social factors. In this article, let's take a look back at the state of crypto adoption despite the tumultuous context of this industry.

"In the crypto sphere, navigating calm waters requires an infallible compass and a flair for catching favorable winds. While the waves of decline seem to engulf the hopes of many investors, some crypto sailors, armed with their audacity and insight, are preparing to hoist their sails to profit from this storm. Let's take a closer look at three cryptocurrencies - Bitcoin (BTC), Shiba Inu (SHIB), and Avalanche (AVAX) - which, despite the gusts, show signs of recovery and promise sunny days on the horizon."

"""You are translator in the blockchain field

Cryptocurrency trading relies heavily on the interpretation of signals. These signals, key indicators for buying and selling decisions, play a crucial role in any trader's strategy. However, understanding them and using them effectively is not always straightforward. Certain strategies and tricks can help you decipher these signals. This article discusses the different types of trading signals, strategies for using them to your advantage and common mistakes to avoid for optimal interpretation.