In a climate of heightened anticipation, the crypto community eagerly awaits the SEC's verdict on Bitcoin spot ETFs. Several U.S. lawmakers, recognizing the significance of the matter, are actively urging the SEC to approve these ETFs without further delay.

Theme Crypto regulation

Huobi has become a hacker's latest target! While the cryptocurrency exchange, now known as HTX, had a bright future ahead of it, an unfortunate event has disrupted its day-to-day operations. However, things should be less difficult to deal with as the identity of the hacker is not unknown.

After complying with the FSMA's decision, the Belgian regulator for cryptocurrencies and finance, Binance had to suspend its activities in the country back in June. Three months later, the world's largest cryptocurrency exchange announces a triumphant return to Belgium. What has changed since then? Let's delve into it.

In an environment where crypto regulation is tightening and legal battles are intensifying, Binance, the world's leading exchange platform, is facing challenges in several jurisdictions. We had the opportunity to interview David Prinçay, CEO of Binance France, to find out more about the current situation.

Recently, the CEO of Binance stepped up to defend his highly popular cryptocurrency exchange. According to the latest news, Changpeng Zhao, aided by Binance.US lawyers, has asked the court to dismiss the US SEC's lawsuits. Let's break it down!

The Fed has maintained its benchmark interest rate unchanged at 5.50% after eleven increases since March 2022.

"When you think of Bitcoin, you often think of economic superpowers or cryptocurrency havens like El Salvador. However, a recent study reveals a significant surprise: Nigeria dominates the ranking of countries most interested in this digital currency, even overshadowing El Salvador. This phenomenon raises several questions and deserves a deeper analysis. So, what is really happening in Nigeria?

In recent days, the Fed and CBDC have drawn significant attention from the crypto community. Fifty pro-crypto Republican lawmakers have just introduced a bill aimed at countering the CBDC. These elected officials raise valid concerns about financial privacy and individual freedom.

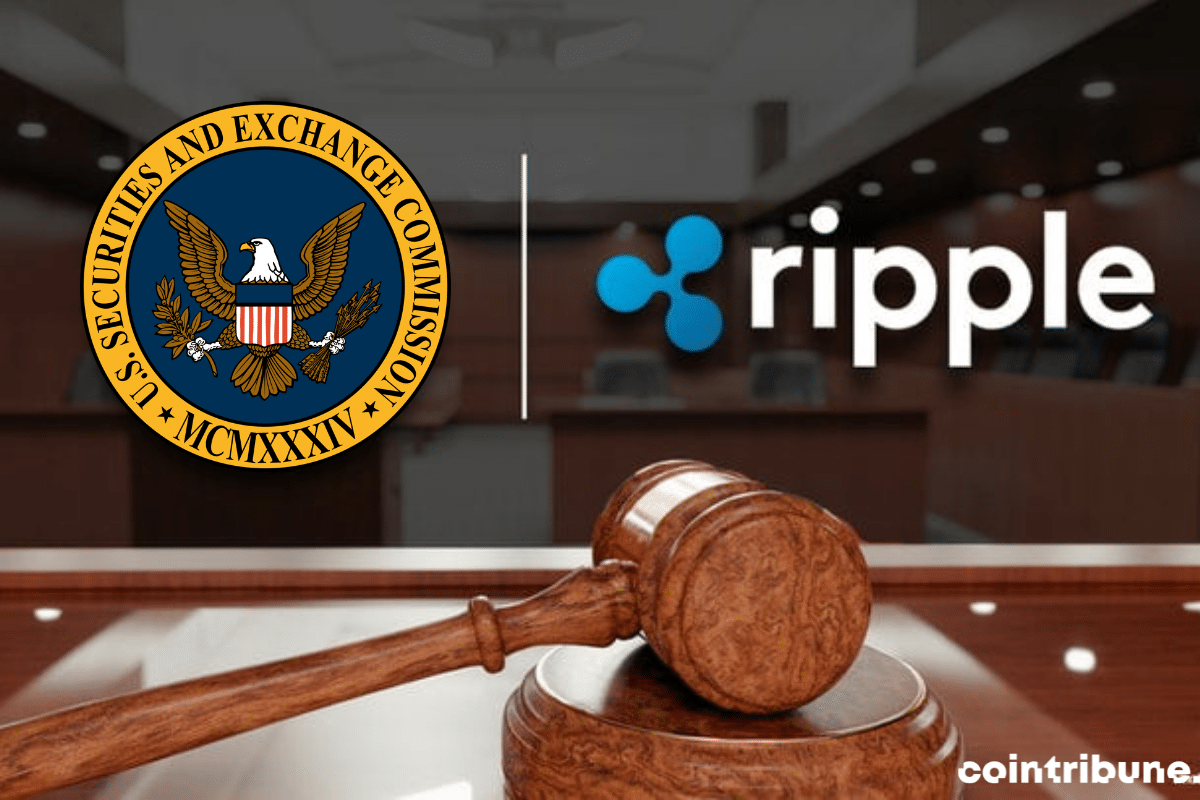

Given its trajectory, the legal battle between Binance and the SEC is expected to persist, akin to the Ripple case. The Securities and Exchange Commission appears to have multiple strategies at its disposal, while Binance remains resolute. Recently, its CEO, Changpeng Zhao (CZ), defended his cryptocurrency exchange on X (formerly Twitter). Here are the key points:

In a matter of minutes, the image of Brad Garlinghouse standing in front of the SEC headquarters with Ripple's General Counsel, Stuart Alderoty, went viral within the crypto community. The photo appears to highlight the ongoing tensions between Ripple and the SEC.

During the last few years, the cryptocurrency industry has grown exponentially. The number of users joining the crypto world daily is rapidly increasing.

Will the ECB stop raising its key interest rate soon? Some governors hope so.

The Emir of Qatar, Sheikh Tamim bin Hamad Al Thani, is set to step foot in El Salvador during an official visit scheduled for this week. As El Salvador recently made headlines by adopting Bitcoin, this diplomatic initiative piques curiosity. Could Qatar be considering a similar adoption?

India announces 5 revolutionary measures for the crypto sector at the G20

In a sector where crypto is upending traditional financial paradigms, India is emerging as a revolutionary leader, leading the BRICS in a bold turn at the heart of the G20. This transformation, epitomized by the G20's keen interest in the crypto roadmap proposed by the IMF and FSB, is just the premise of a radically reimagined economic future. Let's dive into the heart of this epic where crypto intertwines with global politics, finance and a futuristic vision embodied by India.

China is one of the United States' fiercest competitors for global hegemony. At least in economic terms. To achieve this, the country seems to be pursuing a strategy of limiting or even reducing its investments in the United States. Saudi Arabia, which has just joined the BRICS, also seems to be doing the same, further confirming its plans to leave the dollar behind.

The eventual validation of the Ether Futures ETF by the US SEC could shake up the crypto sector. Beyond Ethereum, iconic Ethereum network currencies such as Polygon and Uniswap could feel significant impacts.

Recently, no fewer than 6 countries joined the BRICS in what is now known as BRICS+. Although the organization has rejected the membership applications of some countries, it seems to be calling on others to join. Such is the case of Indonesia.

In recent years, cryptocurrencies have grown exponentially in the European region. Cryptocurrencies can be used for different purposes, such as investment, trading, savings, or payment methods.

The financial sector in the United States is anticipating a significant revision in the accounting of cryptocurrencies, particularly Bitcoin. This recent decision aims to enhance clarity, accuracy, and confidence in the valuation of digital assets by businesses.

In the vibrant financial hub of Mumbai, an announcement rings out, echoing like the dawn of a new era in the crypto universe. India's Finance Minister, Nirmala Sitharaman, has revealed that the Indian presidency of the G20 has initiated crucial discussions, aiming to establish a global regulatory framework for cryptocurrencies. But what does this move mean for the sector? And what role is India playing in this regulatory revolution?

The BRICS want to get rid of the dollar's influence in international transactions. The organization reaffirmed this objective at its recent summit in South Africa. As the group's currency strategy is gradually unveiled, we learn that Ripple's XRP could contribute to this dynamic.

In the bubbling vortex of the digital age, India is waking up to a message that is resonating in every corner of the globe. The nation, which proudly stands as a pioneer of the crypto revolution, is throwing a stone into the pond of established conventions, by advocating a global harmonization of regulations framing the cryptocurrency sector. An impetus driven by an unexpected figurehead, marking a decisive chapter in the digital odyssey of our century.

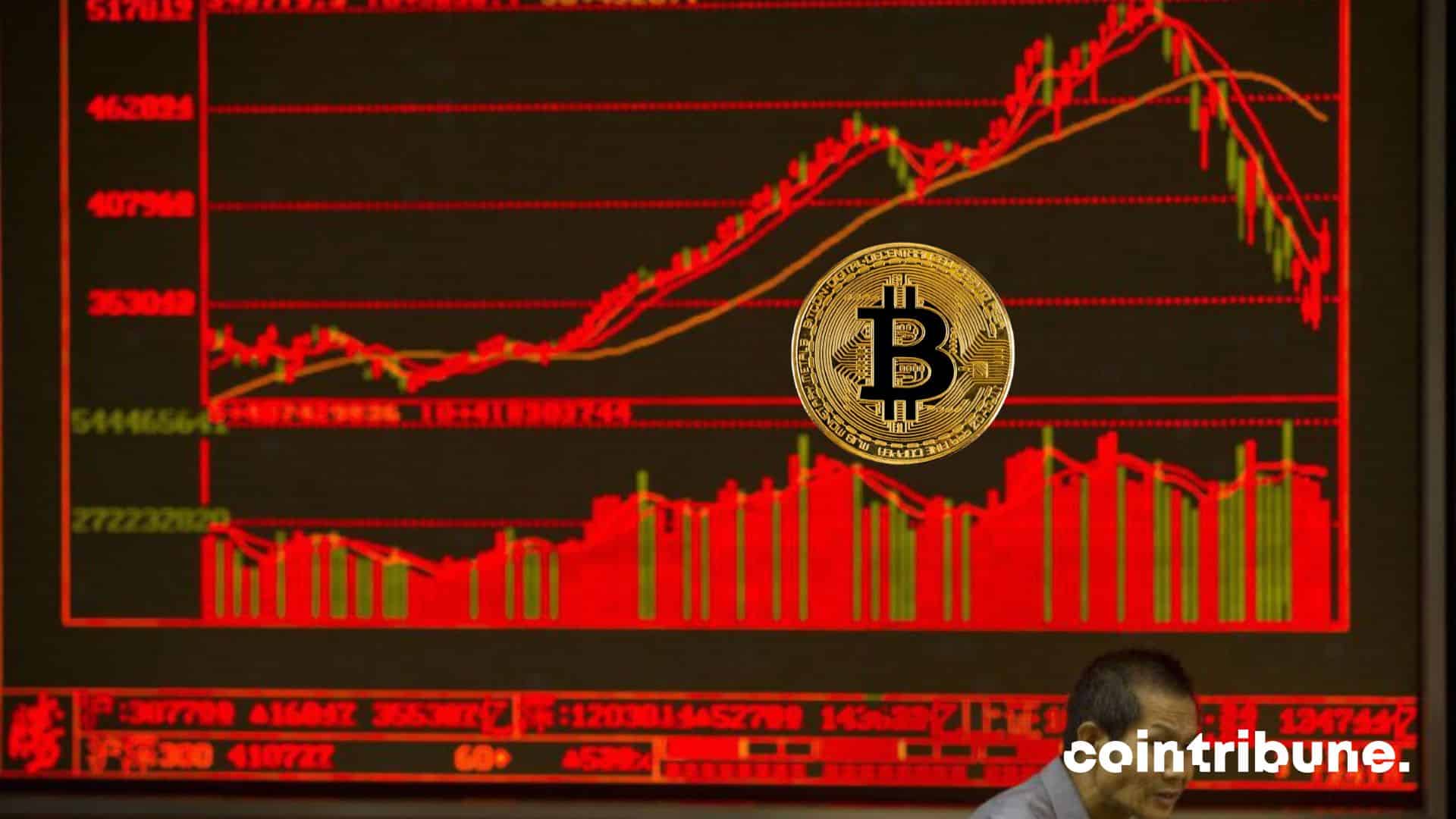

A recent data analysis reveals that bitcoin reserves held by several exchanges are falling sharply. This trend could have major implications for the crypto market. In particular, exchanges could soon run out of liquidity and see their trading volumes plummet.

The ever-changing crypto arena recently witnessed a major victory for Grayscale, marking a significant rout for the SEC. At the heart of this event, two giants of the cryptosphere, Ripple and Coinbase, scan the horizon with renewed confidence.

September 1ᵉʳ is the deadline given to the U.S. Securities and Exchange Commission (SEC) to rule on Bitcoin ETF applications. This is the date by which Bitwise will know whether its ETF will win SEC approval. Five other applicants will receive a response from the regulator the following day, while one will have to wait until September 04.

The journey towards a potential Bitcoin ETF has so far been long and arduous. But some key decisions in the race are likely to be made this week. Meanwhile, the crypto faithful are waiting to see how things play out this time.

The legal battle between Ripple and the SEC remains fierce, constantly bringing new dimensions. Veteran crypto lawyer John Deaton has lifted the veil on a secret XRP memo, potentially decisive in influencing the outcome of the ongoing trial.

The 15th BRICS summit ended on Thursday, August 24, with some big news. That of the creation of BRICS+. An expanded version of the organization's membership. Members that include some of the world's biggest crude oil suppliers. Global geopolitics are potentially no longer the same.

The legal battle between Ripple and the SEC has reached a crucial stage, with major announcements regarding upcoming hearing dates and related deadlines. This battle, which has major implications for the future of Ripple and the crypto market, is taking a decisive turn. Let's dive into the latest developments in this thorny case.