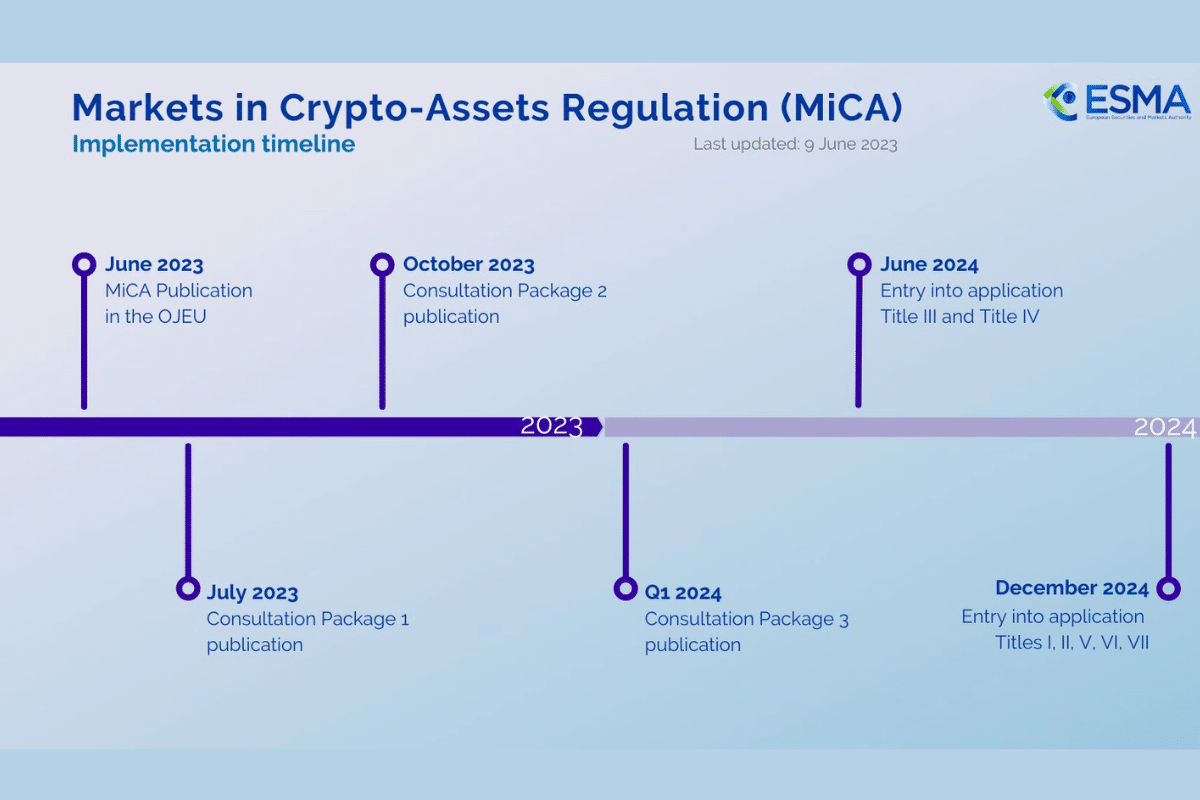

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.

Theme Crypto regulation

No cryptocurrency transaction should go unnoticed by the Bank for International Settlements (BIS), as they develop a suitable system to track cryptocurrency exchange flows throughout the European territory. Several European central banks have joined them in this initiative. Let's take a closer look!

The crypto community continues to closely monitor the legal battle between Ripple and the SEC. The reason is simple: the outcome of this legal saga will be crucial for the cryptocurrency market. And precisely, some news could change the game definitively. At the very least, it hints at a victory for Ripple against the SEC.

Global financial regulators are increasingly concerned about the rapid growth of the cryptocurrency market. The International Monetary Fund (IMF) has just proposed a matrix for assessing national-level cryptocurrency-related risks to countries worldwide. This was on September 29th. Details follow.

Since Grayscale's recent victory over the SEC, the potential approval of a Bitcoin ETF has piqued the hopes of the crypto community. A recent rumor on the matter seems to fan these hopes even further. However, it remains to be confirmed.

In the Canadian crypto landscape, a media storm is brewing. With increasingly strict regulations and recent announcements related to online censorship, Canada stands at a crossroads. Elon Musk, the influential tech mogul, wasted no time in reacting and delivered scathing criticisms of Justin Trudeau. What is the reality of the situation in Canada? And what impact could these events have on the crypto future?

Did Binance exacerbate the situation as FTX showed signs of fragility? That's what Nir Lahav and his group believe, and they didn't hesitate to file a class-action lawsuit accusing CZ and Binance of contributing to their competitor's downfall through their November tweets.

While Binance finds itself in the SEC's crosshairs, another crypto, USDC, finds itself caught up in this storm. But what's really going on, and why is Circle concerned?

The European Union is to fork out nearly €1 million (in fiat or crypto?) to assess the environmental impacts of cryptocurrencies and bitcoin mining activities. Does this mean that Brussels prefers strict regulation of these activities to the ban? In any case, crypto-enthusiasts will be sure to follow the progress of this study, especially the publication of the first reports. The fate of bitcoin mining and crypto activities in Europe will in fact depend on it.

During a congressional hearing, SEC Chairman Gary Gensler reaffirmed that Bitcoin is not a security. However, he refrained from categorizing it as a commodity, leaving doubts about the exact classification of this flagship cryptocurrency.

It's truly the end! Binance and PaySafe are now heading in opposite directions. But after the contract expiration, the cryptocurrency giant is struggling to find new banking partners in France. However, it appears that the crypto exchange may have found a solution to its problems.

The crypto arena is on the verge of a revolution. According to Bloomberg analysts, the first Ethereum Spot ETFs could make their debut in the U.S. market as early as next week.

No, it's not over yet! The ongoing dispute between Binance and the SEC seems far from reaching a resolution. However, it appears that BAM Trading and BAM Management, two entities of the crypto company, have been granted an extension to respond to court orders.

Tourmentée par des dizaines de milliers de sanctions infligées par l’Occident, la Russie, bourreau de l’Ukraine, n’a de choix que de se tourner vers les cryptomonnaies et les technologies connexes. Rouble numérique, plateforme nationale d’échange de devises numériques, DAO… forment actuellement un bouquet d’alternatives pour rehausser une économie russe en plein plongeon. Sauf que les États-Unis n’ont pas l’intention de lui faciliter les choses, même avec les cryptos. Washington n’hésiterait pas à faire pression sur Binance pour couper le pont entre les Russes et les actifs numériques. Détails !

With over 100 million users, Binance easily claims the title of the world's largest cryptocurrency exchange. If CZ's exchange were to fall victim to the initiatives of U.S. regulators, others (Kraken, Coinbase, and the like) would melt away like snow in the sun. And apparently, the U.S. Department of Justice is preparing to launch an assault on this crypto behemoth with feet of clay.

In a climate of heightened anticipation, the crypto community eagerly awaits the SEC's verdict on Bitcoin spot ETFs. Several U.S. lawmakers, recognizing the significance of the matter, are actively urging the SEC to approve these ETFs without further delay.

Huobi has become a hacker's latest target! While the cryptocurrency exchange, now known as HTX, had a bright future ahead of it, an unfortunate event has disrupted its day-to-day operations. However, things should be less difficult to deal with as the identity of the hacker is not unknown.

After complying with the FSMA's decision, the Belgian regulator for cryptocurrencies and finance, Binance had to suspend its activities in the country back in June. Three months later, the world's largest cryptocurrency exchange announces a triumphant return to Belgium. What has changed since then? Let's delve into it.

In an environment where crypto regulation is tightening and legal battles are intensifying, Binance, the world's leading exchange platform, is facing challenges in several jurisdictions. We had the opportunity to interview David Prinçay, CEO of Binance France, to find out more about the current situation.

Recently, the CEO of Binance stepped up to defend his highly popular cryptocurrency exchange. According to the latest news, Changpeng Zhao, aided by Binance.US lawyers, has asked the court to dismiss the US SEC's lawsuits. Let's break it down!

The Fed has maintained its benchmark interest rate unchanged at 5.50% after eleven increases since March 2022.

"When you think of Bitcoin, you often think of economic superpowers or cryptocurrency havens like El Salvador. However, a recent study reveals a significant surprise: Nigeria dominates the ranking of countries most interested in this digital currency, even overshadowing El Salvador. This phenomenon raises several questions and deserves a deeper analysis. So, what is really happening in Nigeria?

In recent days, the Fed and CBDC have drawn significant attention from the crypto community. Fifty pro-crypto Republican lawmakers have just introduced a bill aimed at countering the CBDC. These elected officials raise valid concerns about financial privacy and individual freedom.

Given its trajectory, the legal battle between Binance and the SEC is expected to persist, akin to the Ripple case. The Securities and Exchange Commission appears to have multiple strategies at its disposal, while Binance remains resolute. Recently, its CEO, Changpeng Zhao (CZ), defended his cryptocurrency exchange on X (formerly Twitter). Here are the key points:

In a matter of minutes, the image of Brad Garlinghouse standing in front of the SEC headquarters with Ripple's General Counsel, Stuart Alderoty, went viral within the crypto community. The photo appears to highlight the ongoing tensions between Ripple and the SEC.

During the last few years, the cryptocurrency industry has grown exponentially. The number of users joining the crypto world daily is rapidly increasing.

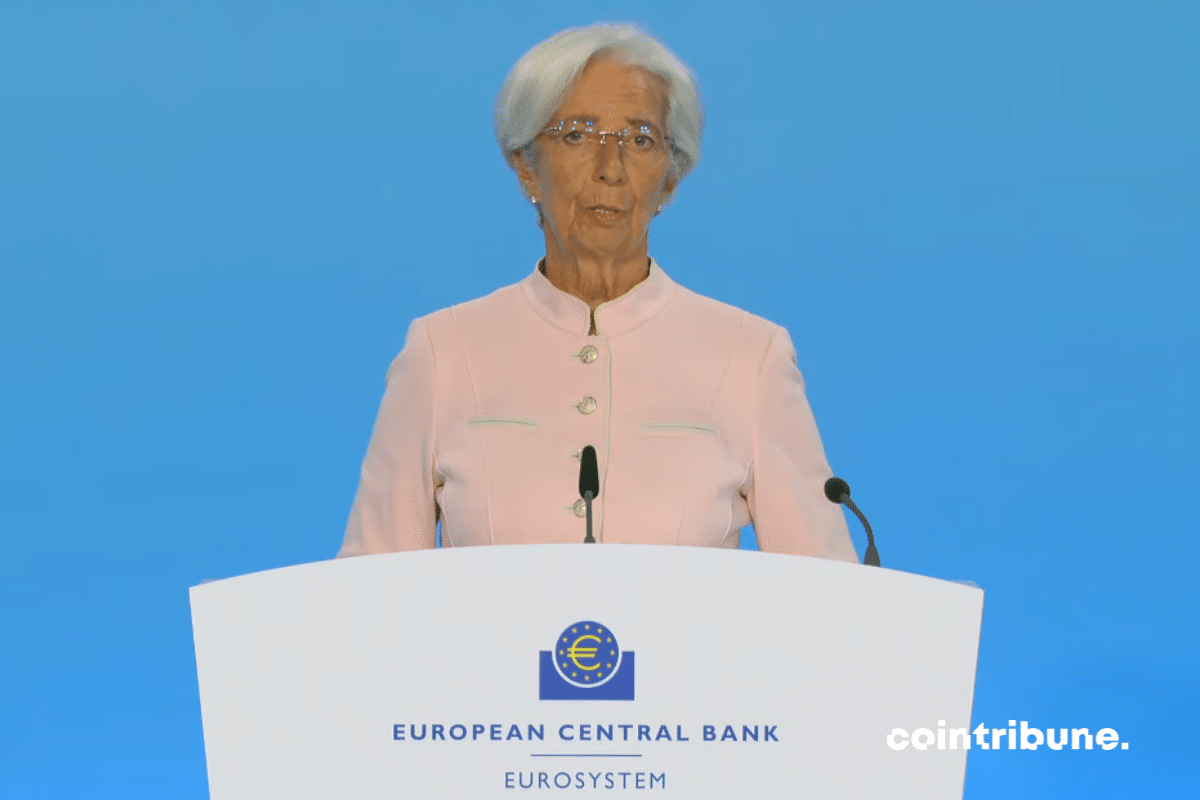

Will the ECB stop raising its key interest rate soon? Some governors hope so.

The Emir of Qatar, Sheikh Tamim bin Hamad Al Thani, is set to step foot in El Salvador during an official visit scheduled for this week. As El Salvador recently made headlines by adopting Bitcoin, this diplomatic initiative piques curiosity. Could Qatar be considering a similar adoption?

India announces 5 revolutionary measures for the crypto sector at the G20

In a sector where crypto is upending traditional financial paradigms, India is emerging as a revolutionary leader, leading the BRICS in a bold turn at the heart of the G20. This transformation, epitomized by the G20's keen interest in the crypto roadmap proposed by the IMF and FSB, is just the premise of a radically reimagined economic future. Let's dive into the heart of this epic where crypto intertwines with global politics, finance and a futuristic vision embodied by India.