Bitcoin is playing the star, but altcoins are sharpening their promises. Between wild memecoins, restrained regulators, and creative projects, 2025 could well offer a dance of outsiders.

Theme Crypto regulation

Imagine a president, builder of skyscrapers and scandals, minting money at will based on the laws he writes. The USD1 is not just a stablecoin; it is the gateway to finance without safety nets.

Christine Lagarde has confirmed the planned launch of the digital euro for October 2025, pending approval from European authorities. This initiative comes in a context where a recent survey reveals a marked disinterest among Europeans for this central bank digital currency.

The financial systems encountered significant disturbances at the start of 2025 after President Donald Trump enacted extensive import tariffs affecting Canada, Mexico, and China. President Trump initiated the new trade regulations, which imposed 25% duties on products from Canada and Mexico and 10% duties on Chinese exports to safeguard domestic businesses and correct commercial discrepancies. The tariffs caused disruptive effects throughout world markets, particularly in the cryptocurrency industry.

Between ideology and regulation, the debanking war rages: a battle where crypto and "risky" industries fight for their survival.

At the heart of a debate as lively as it is surprising, the crypto universe is under the spotlight. The digital revolution and financial freedom clash with the imperatives of national security. This article boldly and clearly explores the issues related to crypto-friendly regulations and the potential excesses of an exacerbated surveillance state.

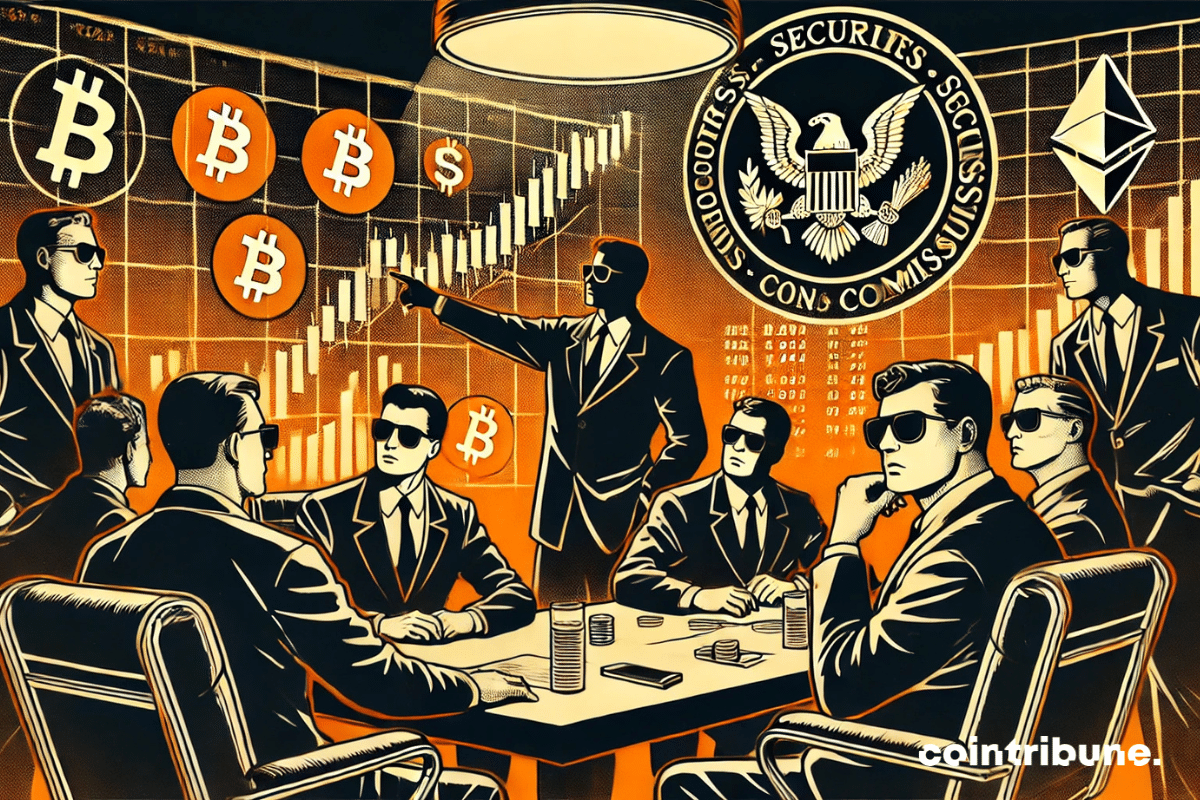

The Securities and Exchange Commission (SEC) has recently intensified its efforts to clarify the regulation of crypto assets. On March 3, 2025, the SEC announced that its Crypto Task Force would hold a series of roundtables entitled "Spring Sprint Toward Crypto Clarity" to discuss key issues related to the regulation of cryptocurrencies. The first session, scheduled for March 21, will focus on "How Did We Get Here and How to Get Out – Defining the Status of Security."

In a crazy quest to save the American economy, VanEck sees bitcoin as a miracle cure. Could a strategic reserve of cryptocurrency really wipe out 21 trillion in debt by 2049?

The SEC, once a bastion of conservatism, is finally awakening to the enchanting song of cryptocurrencies. ETFs are making a grand entrance, and the agency, once inflexible, seems to be discovering the virtues of compromise.

The SEC, once inflexible, is making a turn towards crypto: Dogecoin and XRP are entering the fray, and time is working against the regulator, stuck in a tight schedule until October.

813,000 washed-out investors, a memecoin that evaporates, 100 million in the pockets of insiders. The SEC looks the other way, Trump smiles: welcome to the Wild West of crypto!

A key step has been taken in the regulation of the crypto market in the United States. Under the leadership of Mark Uyeda, acting chair, the Securities and Exchange Commission (SEC) has announced the creation of a Crypto Task Force, an entity responsible for providing more clarity to the rules governing cryptocurrencies. To structure its actions, the SEC has launched a dedicated website that offers companies and investors a space to submit their proposals and better understand regulatory requirements. This initiative comes as the crypto sector calls for clear guidelines and as the SEC faces off against the Commodity Futures Trading Commission (CFTC) over the issue of jurisdiction for cryptocurrencies. In addition to defining the boundary between securities and unregulated assets, this task force could shape the future of crypto ETFs and influence the oversight of trading platforms. However, its real impact will depend on its ability to establish a constructive dialogue with the industry, an approach that is still lacking in the SEC's current policy.

In the grand theater of power, Trump outlines a bold move: perhaps a crypto-friendly sovereign fund. Between a bluff and strategic genius, the suspense remains intact.

The French economy ends the year 2024 on a worrying note with a contraction of 0.1% of its GDP in the fourth quarter. This situation arises in a particularly tense context, where the public deficit reaches the alarming level of 6% of GDP, placing France among the worst performers in the eurozone.

The plot thickens in the FTX crypto case: SBF's parents are seeking clemency from Trump! The details in this article.

The dance stops for American TikTokers. Between Chinese threats and political pirouettes, TikTok is stretching itself thin. Trump promises, but ByteDance resists. The suspense continues.

As Gensler packs his bags, the SEC is overwhelmed by a tsunami of crypto ETFs, with Solana and XRP at the forefront.

The world of cryptocurrencies continues to shake up the codes of traditional finance. This time, it is the Swiss public bank PostFinance that takes a new step by making Ethereum staking accessible to its 2.7 million clients. A bold initiative that reflects a growing enthusiasm for digital assets in Switzerland…

Pump.fun, the kingdom of crypto, falls into the abyss: ethical scandals, imminent lawsuits, and ruined users. A saga where the glitzy turns dark.

The IMF, like a perplexed teacher, advises Kenya to abandon its old recipes for a fresher and more digestible crypto-regulation, not forgetting to eliminate the scammers from the menu.

Crypto and strained borders: Beijing strengthens its nets. Tracked identities, scrutinized funds, banks become guardians of a game now locked down.

Bitcoin is Donald Trump's plan B if he fails to persuade the BRICS to stop their rebellion against the dollar.

When a former footballer dons the jersey of innovation, and Trump orchestrates, the crypto-sphere stirs: a promise of growth or just a bluff?

An Ohio lawmaker, Derek Merrin, proposes a pioneering law to create a strategic reserve of bitcoins within the State Treasury. In the face of the dollar's devaluation and the rise of bitcoin, this initiative marks a turning point in the institutional adoption of crypto in the United States.

A two-faced ETF: Bitcoin and Ethereum, brought together for a balanced dance. The SEC, the great orchestrator, is about to disrupt the rules of the crypto game.

Faced with the growing risks of censorship, WikiLeaks launches a major initiative to preserve Afghan war archives on the Bitcoin blockchain. The Spartacus project, unveiled on December 5, 2024, aims to permanently inscribe more than 70,000 confidential documents on the Bitcoin network.

Paul Atkins' appointment as head of the Securities and Exchange Commission (SEC), announced by Donald Trump, could redefine the future of crypto regulation in the United States. This choice, far from being trivial, comes at a critical moment when the sector is facing increasing uncertainties and policies perceived as hostile. Under the previous administration, the SEC's management faced sharp criticism due to an approach deemed too restrictive towards these assets. With the selection of a candidate known for his pro-innovation stance and expertise in crypto, Trump appears to be sending a clear signal in favor of a change of course.

Buying Bitcoin in Asia has never been so easy: a major bank opens its digital vaults for you.

The return of Donald Trump to the White House could mark a historic turning point for Bitcoin. The proposal for a national strategic reserve of Bitcoin, pushed by Republican legislators, is gaining credibility with Trump's victory in the 2024 presidential election. This initiative could propel the price of BTC to unprecedented heights, according to experts.

Bitcoin reaches $90,000 and long-term holders are taking profits. However, can BTC really reach $100,000?