The US Commodity Futures Trading Commission (CFTC) warns of the increasing scams fraudulently using artificial intelligence (AI) to attract crypto investors with the promise of whopping returns.

Coin Stats RSS

S&P 500 toward 5,000, Bitcoin in precarious balance: the great show of the American financial market.

Explore the dynamic evolution of Bitcoin as it approaches $45,000. Are we witnessing a new momentum towards unprecedented heights?

ESMA seeks experts' input on the MiCA standard. Open consultation to shape the future of crypto regulation in Europe.

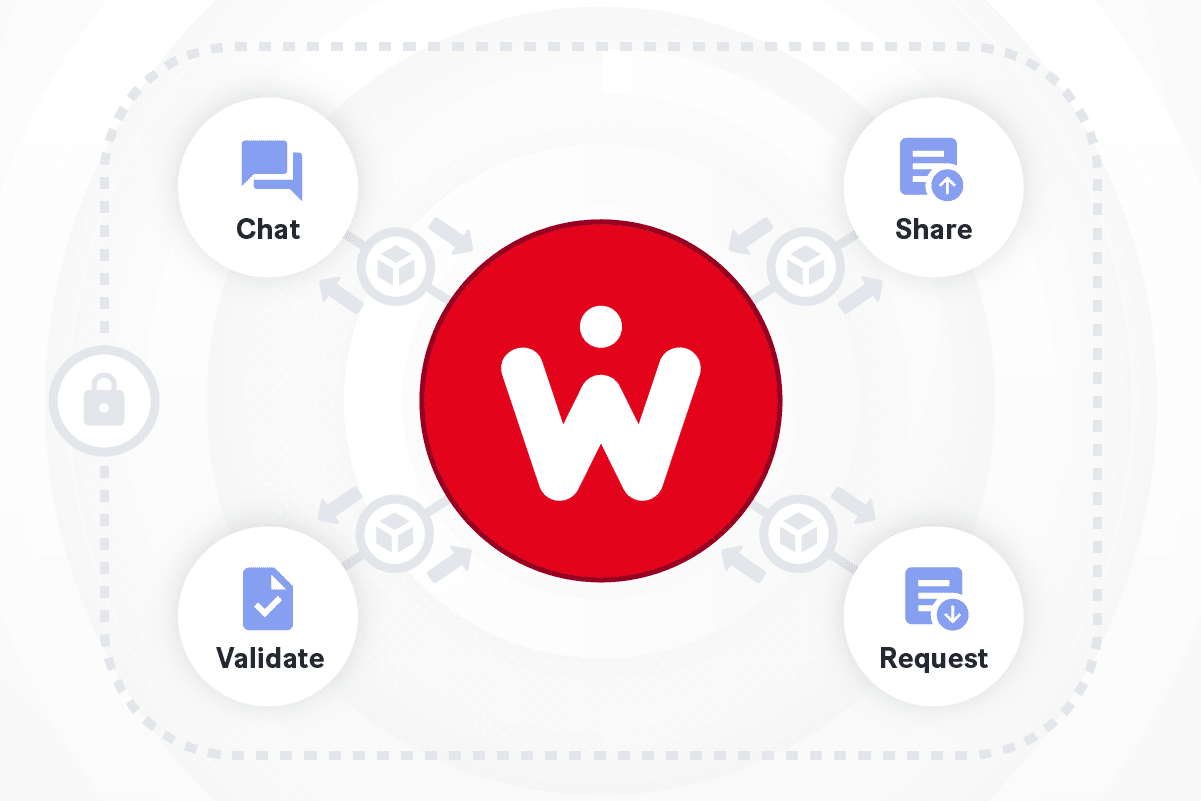

After successfully entering Bitstamp with great success and experiencing a meteoric rise, the Wecan Token is ready to take a new significant step. Wecan Group's cryptocurrency will soon also be available on the Uniswap exchange. A listing that promises to offer new perspectives for investors.

A very reliable financial indicator, the yield curve has recently inverted. And yet, Wall Street has always considered this indicator as a precursor to an impending recession. Will we therefore experience a catastrophic economic year in 2024, which could also affect the stock markets and bitcoin (BTC)?

Bitcoin Spot ETFs have recorded net inflows of $759.4 million since their launch on January 10, despite outflows of $5 billion from the Grayscale Bitcoin Trust (GBTC).

The Shiba Inu team aspires to the extraordinary: 1000 projects, solid partnerships, and Shibarium leading the way.

The next decision from the Fed on interest rates could significantly influence the price of Bitcoin.

According to the Binance report, 73% of residents in Europe view the crypto future with optimism. More details in this article!

BlackRock's Bitcoin spot ETF continues to break records. In just two weeks since its launch, it has accumulated over 2 billion dollars in assets under management, becoming the first new Bitcoin ETF issuer to reach this symbolic milestone.

Solana in turmoil: SOL is climbing, memecoins in the spotlight, but a claiming window closes, leaving Jupiter in suspense.

The Larry Fink saga with Bitcoin: from initial skepticism to "orange pill" conversion, the turnaround of the year.

The entire crypto market, with bitcoin (BTC) leading the way, is currently going through a rough patch characterized by a significant downward trend. Despite this fact, some analysts expect the flagship cryptocurrency to rebound by the end of the year. They believe that recently approved Bitcoin Spot ETFs will fuel this change.

For the past few days, bad news has been piling up for Bitcoin (BTC). The flagship cryptocurrency has lost ground in recent days. This bearish trend has had a negative impact on smaller BTC portfolios, resulting in a total decline. BTC is clearly under pressure, but has just managed to shake it off.

In terms of crypto transactions involving the euro, there are more than ten exchanges worldwide that offer such services. However, according to a recent study by Kaiko, only five of them, and not just any, share the majority of this crypto transaction volume.

Finance faces the challenge of debt exceeding asset value. Cryptocurrency presents itself as a solution. """

Recent data shows that China is strategically strengthening its oil stocks. For several months, the Middle Kingdom has been benefiting from its partnership with Russia for this purpose. Some believe that this is a way for China to expand its influence within the influential BRICS of which it is a member.

The developers of the Ethereum network have just announced the deployment schedule for Dencun, the long-awaited update that is expected to improve performance and further reduce transaction fees.

The price of Bitcoin is currently experiencing a period of turbulence after falling by 20%. This decline follows the launch of the first Bitcoin Spot ETFs in the United States. But several analysts agree that the bottom has not yet been reached for the flagship crypto.

Bitcoin is preparing to pen an exciting new chapter. Pantera Capital, a leader in cryptocurrency management, has big plans for BTC. The firm anticipates an unprecedented bullish rally, even amidst the current downturn. This article explores their bold forecasts. It also examines the market dynamics of crypto, potentially transformative for digital finance.

Bitcoin ETFs faced with a dilemma: BlackRock criticizes the liquidity creation model and warns the SEC. Details here!

"Blockchain technology is revolutionizing various industries such as finance, supply chain management, and healthcare. Its decentralized and transparent nature ensures security, efficiency, and immutability of data. With the potential to eliminate intermediaries and provide trust in transactions, blockchain is poised to transform the way we do business."

The price of Bitcoin has dropped by 13% since the SEC approved the first Spot ETF in early January. However, some analysts believe that the worst is yet to come for the flagship cryptocurrency before it can bounce back.

In the crypto universe, the transfer of a billion dollars in Ethereum (ETH) by Celsius, a now-bankrupt lending platform, to centralized exchanges is drawing attention. This massive operation has generated a multitude of questions and expectations within the crypto community. A Ballet of Billions Before Our Astonished Eyes Imagine, if…

Bitcoin has recently weathered a storm that has left the crypto sphere in turmoil. A 20% crash since the peak on January 11 has shaken the very foundations of this currency, leaving investors wondering: is this the beginning of the end or just another twist in the Bitcoin saga?

Discover MANTA's meteoric rise on Binance, with a 25% increase in 24 hours! Crypto forecasts also look positive.

The U.S. government is preparing to carry out a sensational sale: 130 million dollars worth of bitcoins from the infamous Silk Road scandal. A virtual black market specialized in money laundering and drug trafficking. A boon for bidders but a persistent shadow over the integrity of the crypto sector. Can criminals truly launder their deeds through government auctions? Authorities seem convinced that crime does pay, at least in bitcoin!

The old Raiffeisen bank is catching up with Bitpanda, integrating crypto trading into its mobile application.

Tether's stablecoin is counted among the most popular cryptos on the market. But this asset, which is pegged to the US dollar, is facing difficult times. Like many of its counterparts, USDT, as it is commonly called, had a particularly tough year in 2023. An analysis by Moody's analysts indicates that during that year, the asset "depegged" several times. In other words, the crypto lost its peg to the dollar, which is the essence of its stability compared to conventional cryptos. In this context, knowing that depeg situations reached new highs in 2023, wouldn't it be wiser to be cautious of USDT? This article will try to answer this important question for investors.