Coinbase thriving, overshadowing the challenges of 2022, with a soaring performance.

Coin Stats RSS

Three pioneers of decentralized artificial intelligence, Fetch.ai, SingularityNET, and Ocean Protocol, are in talks to merge their tokens into one, named ASI (Artificial SuperIntelligence). This unprecedented alliance aims to democratize AI and counter the dominance of tech giants.

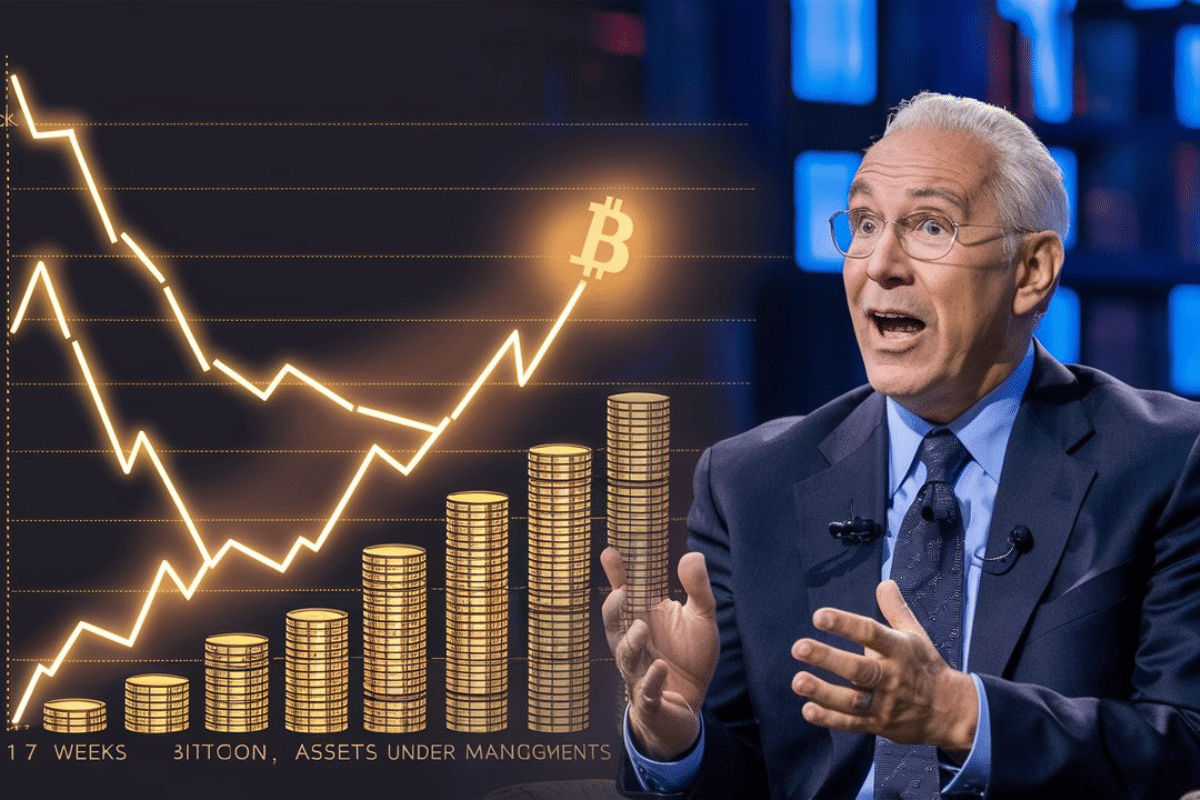

New record: BlackRock's Bitcoin ETF revolutionizes the market with over $17 billion in assets under management! Details here!

A central bank digital currency (CBDC) linked to the SWIFT network is expected to be launched in the coming months. This development challenges the BRICS countries, which are also working on issuing their own currency. Perhaps this is another reason to place more emphasis on this project?

This Friday, the crypto derivatives exchange Deribit is set to experience one of the biggest Bitcoin options expirations in its history. With $9.5 billion in open interest about to expire, the market could see increased volatility in the coming days.

As the wind of the resumption of its upward momentum continues to make people happy, there is already interesting news about bitcoin (BTC). According to some experts, we are heading straight towards a supply shortage of the flagship crypto. A possibility that would not be without consequences for the broader crypto market.

Significant influx into Bitcoin Spot ETFs, a sign of increasing adoption by institutional investors. Details in this article.

The asset management giant BlackRock is making a notable entry into the tokenization sector with the launch of its first fund on the Ethereum blockchain. A decision that could well accelerate the institutional adoption of digital assets.

Bitcoin had reached a new price record of over $73,000 a few days ago. After disappointing investors with a sharp correction towards $65,000, the flagship cryptocurrency once again hit the $71,000 mark. Here, in this article, are the reasons that could justify such a strong comeback.

The SEC is tightening its stance in the crypto world. The US regulator demands $2 billion from the crypto company Ripple.

Solana took the lead in the crypto ranking in terms of weekly stablecoin transfer volume, surpassing Ethereum and other major blockchains. This remarkable performance is driven by the growing interest in memecoins, DeFi, and the widespread adoption of USDC.

In finance, crypto has become an indispensable player, pushing back the traditional boundaries of investment and paving the way for unprecedented innovations. At the heart of this revolution, Ether exchange-traded funds (ETFs) are garnering attention, embodying both hope and challenge in the face of regulators. Grayscale, a pioneer in the field of crypto investment, boldly positions itself against the hesitations of the U.S. SEC, carrying the torch of optimism for the future of Ether ETFs.

Bitcoin (BTC) has been in a gloomy trend for the past few days. However, investors seem to be holding onto their position regarding the leading cryptocurrency. A trend that could change as Bitcoin regains strength.

Fred Thiel warns of the upcoming challenges for small Bitcoin miners following the halving.

In the crypto markets, the battle between Bitcoin and Altcoins is raging this week. While BTC consolidates, Altcoins are gaining ground in the market. Are we on the cusp of the famous altcoin season?

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic challenges. Here is a summary of the most impactful news of the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

Discover the outcome of the legal battle between the crypto exchange Binance and the SEC. Also delve into the details of the face-off.

The future of Bitcoin hanging in the balance: investors are closely watching critical levels, fearing an imminent plunge.

The crypto market has been in turmoil lately. The same cannot be said for Chainlink, which, despite a decrease in the value of its native crypto (LINK), has shown remarkable performance in terms of development activities. According to the latest news, no other blockchain is doing better in this regard.

Massive outflows at Grayscale: Bitcoin under pressure, market on alert.

Binance Coin (BNB), the native token of crypto giant Binance, is on the verge of reaching new all-time highs. Let's dive into the key drivers propelling its massive adoption and growth potential.

Apologies, but it seems like there is no text provided for translation. If you would provide the text that needs to be translated, I'd be happy to assist you with the translation into the desired language.

The US Department of Justice (DOJ) has launched a major antitrust offensive against Apple. According to the DOJ, the rules of the tech giant's App Store restrain competition and stifle innovation, especially in the crypto sector, arbitrarily penalizing developers in favor of Apple's monopoly.

Cryptocurrencies are taking off: Google displays crypto wallet balances and ENS simplifies addresses. Details!

Despite price volatility, Solana is experiencing exponential network growth, defying expectations.

Gensler emphasizes the importance of increased regulation in a rapidly growing crypto market, calling for more resources.

The price of Bitcoin has experienced a significant resurgence, gaining nearly 10% since its recent low at $60,800. However, key resistances stand in the way of BTC's return to above $70,000. Let's analyze the market outlook.

The Ripple-SEC legal battle experiences a double twist: an agreement to seal the key details of the upcoming sessions, and a report from the ECGI asserting XRP's utility crypto status. This could influence the outcome of the trial and the future of Ripple.

The price of Ethereum (ETH) jumps by more than 10%, surpassing $3,400. Here is an analysis of the key resistances and supports to watch.

The decision of the Federal Reserve regarding the interest rate cut was particularly anticipated. The Fed defies the predictions of some analysts by keeping them at their current level. A prudent choice that could change as the inflation of the US economy slows to 2%.