Donald Trump accepts Bitcoin, XRP, and SHIB for his presidential campaign. Discover what this decision implies for the crypto market.

Coin Stats RSS

The Shibarium hard fork is boosting Shiba Inu transactions, recording an impressive 209% increase.

In the ever-evolving landscape of blockchain, Ethereum remains one of the major players, continuously attracting disruptive innovations. It is in this stimulating context that Silent Protocol makes a striking entrance with its Ghost layer, a cutting-edge L1.5 infrastructure designed to propel Ethereum to new heights. This bold solution promises to revolutionize the entire crypto ecosystem.

The stock market is experiencing a period of relative calm, awaiting news on the Federal Reserve's monetary policy. Details in this article.

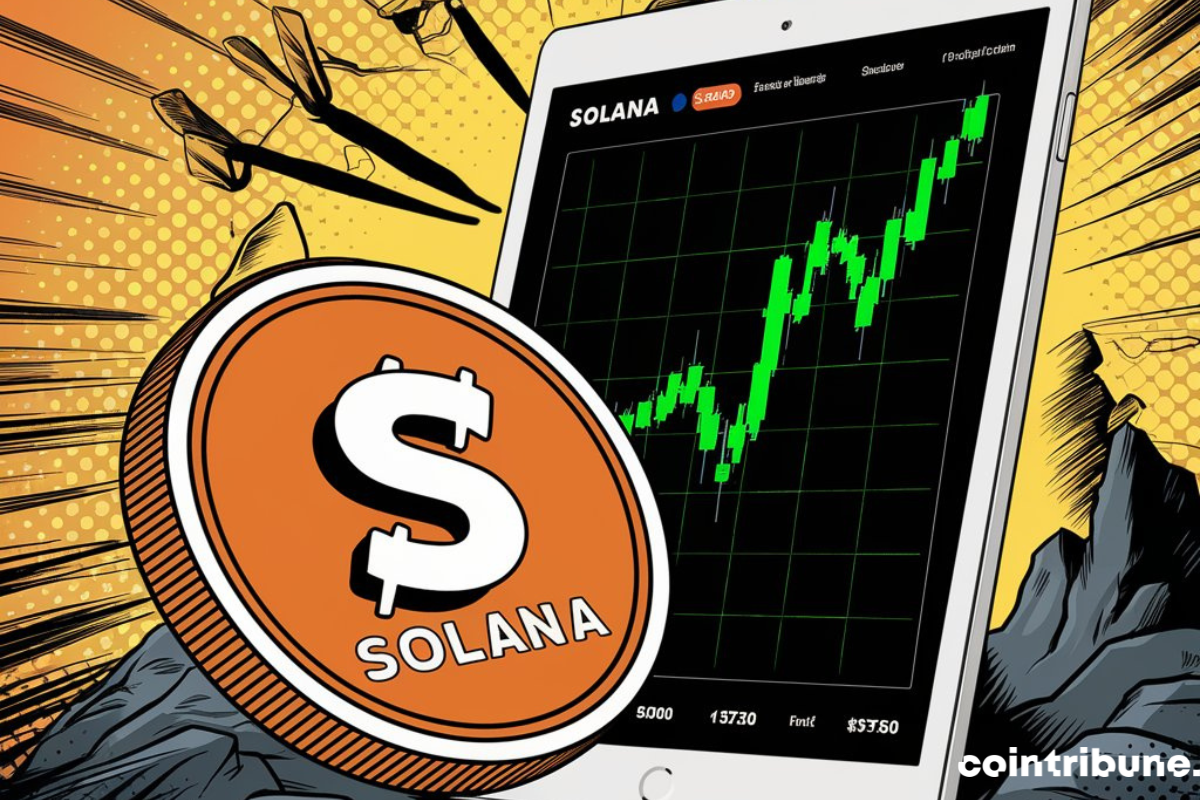

The Solana (SOL) price has been skyrocketing in recent days, reaching all-time highs by testing the key resistance of $188. This impressive surge is fueling excitement among crypto investors. Deciphering the factors propelling SOL to new heights.

The recent announcement by the US Securities and Exchange Commission (SEC) regarding the potential approval of a spot Ethereum ETF has sparked a major surge in Ether prices. This news, which could mark a significant milestone for Ethereum, has attracted massive interest from investors and propelled Ethereum to new heights. But the stakes are high: a spot ETF would allow trading of Ether on traditional markets, paving the way for broader adoption and potential significant revaluation.

Altcoins, these alternative cryptocurrencies to Bitcoin, are generating increasing interest among analysts and investors. In a context of prolonged bear market, some experts believe that the time has come to invest in these digital assets. Michaël van de Poppe, an influential crypto analyst, recently reiterated his support for altcoins, predicting a spectacular bullish performance in the months ahead. This article explores the reasons behind this recommendation and the potential implications for investors.

Bitcoin is generating renewed interest and excitement in the financial markets. As its price approaches $67,500, analysts and investors are closely watching this surge. Why is this moment so important, and what could be the implications of this upward trend for the future of bitcoin?

On this Whit Monday, the Paris Stock Exchange is expected to open slightly higher, supported by optimism in Asian markets and expectations of monetary policy easing. Meanwhile, gold and copper are reaching historic levels.

At the seventh edition of the Choose France summit, France reached a decisive milestone by attracting foreign investments amounting to 15 billion euros, a historic record. This event, held at the Palace of Versailles on May 13, 2024, highlights a major geopolitical shift: while American companies now dominate investment flows, China, once a key player, is gradually stepping back. This dynamic not only reflects a global strategic shift but also the increasing attractiveness of France as a hub for innovation and economic growth.

Despite a recent correction, Ethereum (ETH) is holding above the psychological threshold of $3,000. This resilience could signal an interesting bullish potential for the second largest crypto in the market. Let's decrypt the key levels to watch.

The crypto and precious metals world was shaken this year by an unexpected turn of events: silver outperformed Bitcoin, regaining its place among the most valuable assets. This development has disrupted analysts’ forecasts and captured the attention of investors worldwide. How did silver manage to dethrone the king of cryptos?…

Between revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic struggles. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

After a period of stagnation, Bitcoin shows signs of recovery, supported by Saylor's optimism.

Several countries, including China, are working to reduce their dependence on the dollar by promoting the use of their own currencies in international transactions. However, despite the ambitious attempts at monetary diversification undertaken by this BRICS member, some experts remain skeptical about their success. According to their analyses, the dollar will withstand external pressures and retain its supremacy over the Chinese currency.

Bitcoin is gaining more and more favor among institutional investors. Major names in the global finance industry are beginning to adapt their strategies to include the queen of cryptos. The Chicago Mercantile Exchange (CME), a global leader in futures exchanges, is also considering entering the bitcoin spot trading market. An initiative that could have profound repercussions for the crypto market.

IBEX Pay, a payment company based on the Bitcoin Lightning network, has announced its withdrawal from the US market. Starting on May 31, 2024, the company's Bitcoin payment services will no longer be available in the United States.

ShibaSwap, now on Shibarium, sees a rush of SHIB purchases by sharks and whales, boosting confidence in the ecosystem.

A recent study reveals the concerning impact of crypto influencers' tweets on investors' returns. While short-term effects appear positive, losses accumulate quickly in the long term, raising questions about the real motivations of these personalities.

The value of the altcoin market has surpassed the impressive milestone of $276 billion, driven by Bitcoin's rise beyond $66,000. Faced with this surge, investors are turning to altcoins, hoping to capitalize on potential gains. However, CryptoBullet, a renowned crypto analyst, advises caution. He warns against blind investments in altcoins despite the prevailing euphoria. He points out that the market, while on the rise, is not immune to potential corrections. According to him, altcoins stuck between Fibonacci levels of 0.382 and 0.236 may struggle to surpass their 2021 historical highs.

Bitcoin promised a bright future, but facing fierce competition from CBDCs

The first quarter of 2024 marks a turning point in the adoption of Bitcoin ETFs by institutional investors. According to recent reports, over 1500 investment companies now hold significant stakes in these innovative products.

The crypto market is experiencing a real frenzy around memecoins. Since April 1st, over a million new tokens have been launched, with nearly half of them on the Solana network alone. A trend that is generating as much excitement as criticism.

The crypto sphere is often marked by sudden and unpredictable fluctuations. Recently, a notable phenomenon has caught the attention of investors and analysts: a spectacular 25% increase in stablecoins. This rebound is not just a mere increase in numbers, but it represents a strong market signal, indicating a potential comeback…

Charles Hoskinson, the founder of Cardano, has just announced the imminent arrival of Ouroboros Genesis, a major update to the consensus protocol of its blockchain. A crucial development that promises to significantly enhance the security and performance of the network.

One might think that the world of combat sports and that of crypto are quite distinct. However, a recent announcement reiterates the many emerging links between the two universes. A former kickboxing world champion has announced his intention to invest a colossal sum in Bitcoin.

Cryptos gone wild: Shiba and Doge dance the meme waltz

The Depository Trust and Clearing Corporation (DTCC) successfully conducted a pilot project to tokenize funds in collaboration with Chainlink and several major US financial institutions. This initiative aims to standardize and accelerate the tokenization process of traditional assets on blockchains.

Bitcoin miners are losing money due to energy costs. Is a price increase imminent?

Not approved in France, BYBIT faces legal action. The AMF urges investors to be cautious and to withdraw.