Bitcoin at $180,000 in 2026? Not so fast, according to Barclays. While some analysts predict a historic bull run, the British bank anticipates a bleak year for crypto. Between caution and optimism, who is right?

Cmc RSS

Bitcoin increasingly moved independently from US stocks in the second half of 2025. While equities benefited from rate cuts and strong earnings, Bitcoin entered a correction after its October peak, highlighting a clear market divergence.

BONK continues to face steady selling pressure, with price action offering no clear signs of a rebound. Recent moves reflect hesitation rather than strength, leaving traders cautious. As expected, the market remains without a clear direction, and volatility stays muted.

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

The Bank of Japan is about to break with three decades of accommodative monetary policy. An almost certain rate hike puts markets under pressure. Contrary to usual expectations focused on the Fed or the ECB, it is Tokyo that worries. For bitcoin, the prospect of a stronger yen and the drying up of the carry trade revives fears of a liquidity shock. In an already fragile market, this pivot could redefine short-term balances.

While markets remain under pressure, bitcoin is moving in an unusual calm. Stuck around 90,000 dollars, the asset shows volatility at its lowest. For several analysts, this phase of stagnation signals a major movement to come. Technical signals converge towards an imminent range breakout.

The XRP market shows encouraging signs as retail investor optimism reaches new highs on social platforms. Meanwhile, exchange-traded funds linked to this crypto continue an impressive streak of capital inflows.

Ethereum faces short-term volatility but shows strong long-term potential, with intrinsic value projected to reach trillions as the network grows.

Crypto companies are returning to public markets after several years on the sidelines. Listings in 2025 reflected renewed confidence following a prolonged slowdown. The larger test, however, still lies ahead. White & Case partner Laura Katherine Mann says 2026 will determine whether crypto IPOs can maintain investor trust beyond market cycles.

One week after the launch of the new version of Read2Earn, Cointribune steps up the pace. This time, the program is enriched with a special quest in partnership with the crypto exchange Kraken, one of the most recognized players in the sector. Objective: to help you better understand how to invest in crypto with complete peace of mind, while giving you access to an exclusive contest with rewards at stake.

While Powell gives mixed signals, bitcoin wavers: between rally promises and upsetting votes, traders hesitate... and ETFs sneeze.

Rodney Burton, aka "Bitcoin Rodney", now faces a series of federal charges in the United States. Former promoter of the HyperFund project, renamed HyperVerse, he is charged with wire fraud, money laundering, and illegal transmission of funds. According to the indictment, millions of dollars of investments were allegedly diverted. The case marks a new step in the crackdown on abuses related to the promotion of unregulated crypto projects.

Markets are watching closely as the race to lead the US Fed continues, with political pressure on interest rates building. Recent comments from Jamie Dimon and Donald Trump suggest the outcome remains uncertain, with potential consequences for monetary policy and risk assets, including crypto.

Bitcoin is positioned for strong growth in 2026 as shifting market dynamics and supportive macro conditions take effect.

Tether, the stablecoin giant, made a staggering $1 billion offer to acquire Juventus. But Exor, the historic shareholder, said no without hesitation. Why this rejection? What consequences for football and crypto? A battle where money isn't everything.

While Solana is losing ground in the crypto market, its ETFs show an unprecedented series of seven days of net inflows. In a downtrend, this institutional flow is intriguing: why inject so much capital into a declining asset? This contrast, between disinterest in the spot and enthusiasm for regulated products, raises questions about the real perception of the Solana project and its medium-term prospects.

While Bitcoin ETFs attract massive institutional inflows and macroeconomic conditions argue for a rebound in risky assets, the price remains surprisingly stuck below 90,000 dollars. This stagnation, out of sync with the prevailing bullish signals, points to invisible forces restricting its progress. Between yield strategies and sophisticated arbitrage, a more discreet mechanism seems to weigh on the market just as investors expect a new momentum.

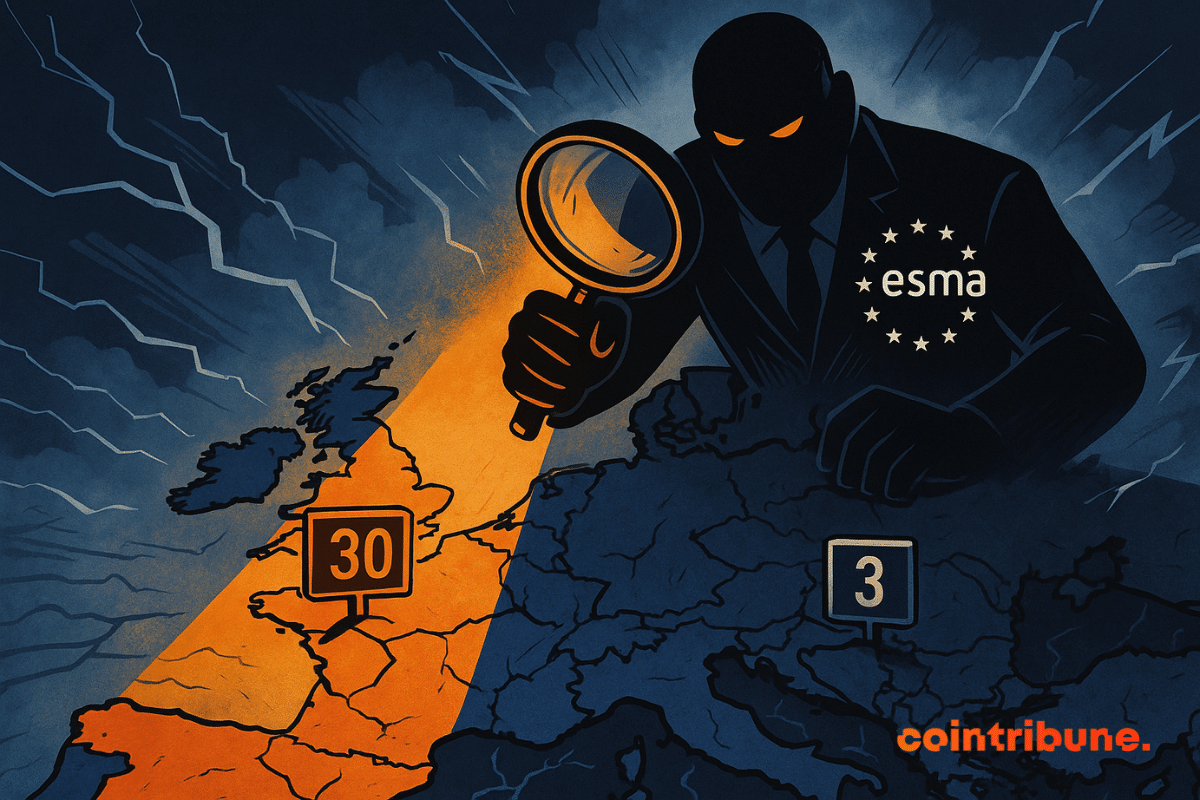

When the EU regulates, it sometimes tailors the rules... MiCA stalls, ESMA heats up, states hesitate: in the crypto jungle, Brussels dreams of cutting local freedoms short.

The continuous decline of bitcoin reserves on Binance attracts the attention of analysts as the asset trades near $93,000. The latest data from CryptoQuant confirms an unprecedented drop, raising questions about the current market structure. This movement, far from indicating immediate weakness, invites examination of what drives these fund outflows and what they truly reveal about bitcoin's dynamics.

There are companies that enter an index like entering a club. And others that enter like triggering an awkward conversation at the table. Strategy clearly belongs to the second category: a listed company, ex-MicroStrategy, becoming primarily a bitcoin accumulation machine. However, during the annual Nasdaq 100 rebalancing announced on December 13, 2025, it did not drop out. The first real test passed since its arrival last December.

John Ameriks does not believe in Bitcoin. The Vanguard executive even compares it to those Labubu plush toys that went viral. Surprising, when you know that the financial giant actually allows its clients to trade crypto ETFs on its platform. A revealing inconsistency of the persistent discomfort in traditional finance.

Cardano shows weakened momentum. Its price remains under pressure after several weeks of decline, and some retail investors are gradually reducing their exposure. However, major ADA holders are strengthening their positions while small wallets decrease theirs. This divergence between the activity of large investors and that of retail frequently appears in the final phase of a bearish trend.

The crypto market has just experienced a spectacular collapse: spot volumes have dropped by 60%, a level unseen for months. But behind this apparent lull may lie a rare opportunity. Experts are divided: historical rebound or trap to avoid?

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

As the Bitcoin network crosses the zetahash threshold, the profitability of mining companies collapses. The hash price has fallen below 40 dollars per PH/s/day, a critical level that threatens the viability of many players. Faced with this paradox, companies in the sector are redirecting their strategies towards renewable energies. However, behind the ecological argument, it is an economic survival logic that dominates, revealing a profound transformation of the mining energy model.

The Office of the Comptroller of the Currency has just opened a historic door for five major players in the crypto sector. Ripple, Circle, Paxos, BitGo, and Fidelity Digital Assets have received conditional approval to operate as national trust banks. A breakthrough that reshapes the contours of American finance.

Crypto settles at the heart of Wall Street: DTCC launches the tokenization of US markets. Discover the details in this article!

Solana falters. Long presented as one of Ethereum’s most serious competitors, the blockchain today faces a significant decline in its fundamentals: liquidity drop, user disengagement, innovation slowdown. After months of euphoria, the ecosystem shows clear signs of slowdown.

Ethereum is stagnating: whales are accumulating, ETFs are flowing, but the breakout is on strike… Behind the scenes, there is movement, but the chart breakout still boycotts the party.

Hollywood director Carl Rinsch defrauded Netflix of $11 million, spending on crypto and luxury items. He now faces multiple charges and a potential long prison term.