India announces 5 revolutionary measures for the crypto sector at the G20

Cmc RSS

This week, the crypto market has experienced notable turbulence, orchestrated mainly by bitcoin. A shadow of decline now looms, leading to a widespread and immediate plunge in altcoins.

Concernant l'affaire Ripple vs SEC, le PDG de la société crypto est optimisme quant à l’issue du procès. Il explique pourquoi...

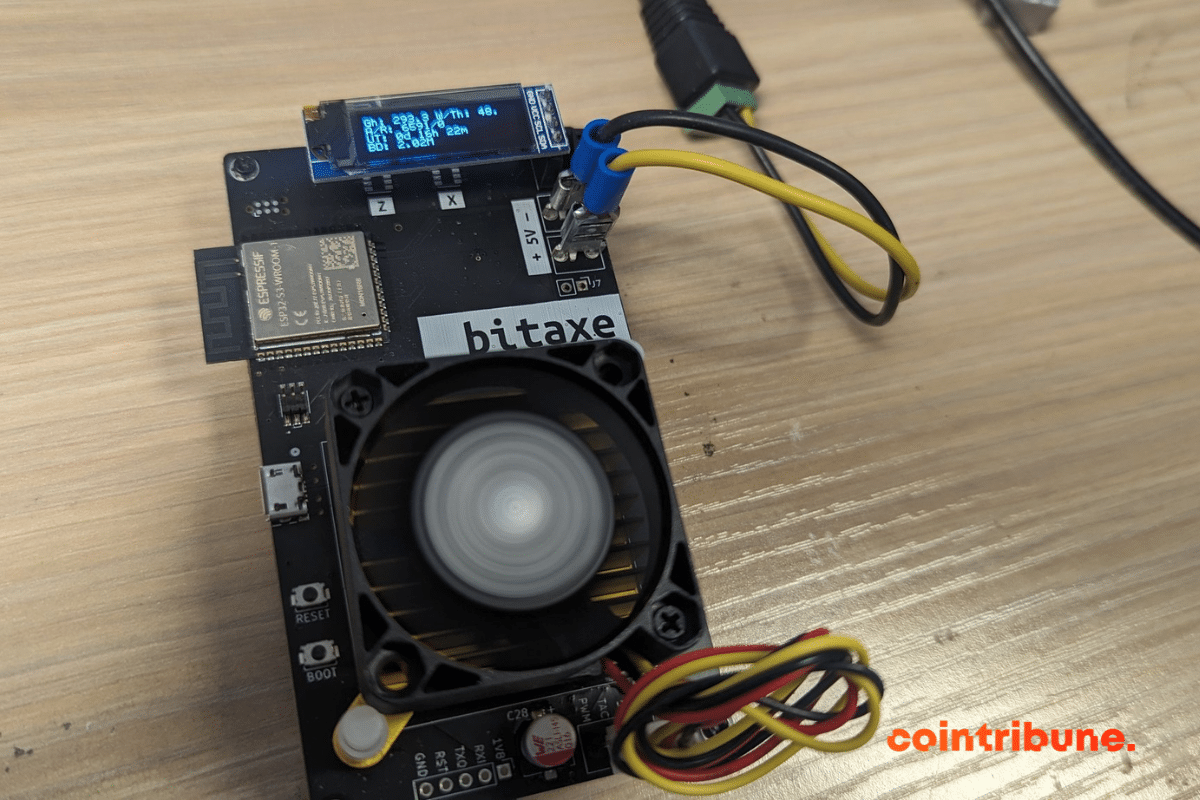

Is the decentralization of the Bitcoin network about to improve thanks to minimalist miners such as Nerdminer and Bitaxe?

In the vast crypto universe, every week brings its share of revelations and surprises. As enthusiasts and investors alike scrutinize the evolution of Bitcoin, the crypto giant has a week full of developments in store for us. Without further ado, let's dive into the fascinating world of Bitcoin, exploring the five major alerts that are on everyone's lips.

In a sector where crypto is upending traditional financial paradigms, India is emerging as a revolutionary leader, leading the BRICS in a bold turn at the heart of the G20. This transformation, epitomized by the G20's keen interest in the crypto roadmap proposed by the IMF and FSB, is just the premise of a radically reimagined economic future. Let's dive into the heart of this epic where crypto intertwines with global politics, finance and a futuristic vision embodied by India.

China is one of the United States' fiercest competitors for global hegemony. At least in economic terms. To achieve this, the country seems to be pursuing a strategy of limiting or even reducing its investments in the United States. Saudi Arabia, which has just joined the BRICS, also seems to be doing the same, further confirming its plans to leave the dollar behind.

On the crypto market, Shiba Inu (SHIB) is making news today due to its skyrocketing burn rate in just 24 hours. A rise which is having a considerable impact on the price of the crypto as well as the crypto market in general.

In the crypto world, a revolutionary dynamic is underway. Recent figures confirm this unequivocally: Tron, Bitcoin, and BNBChain are currently the titans of the sector.

The eventual validation of the Ether Futures ETF by the US SEC could shake up the crypto sector. Beyond Ethereum, iconic Ethereum network currencies such as Polygon and Uniswap could feel significant impacts.

There will be some rumblings in the crypto industry in the next few days. Because if approved, FTX will liquidate a large number of its digital assets. There's talk of a plan to sell $200 million in cryptocurrencies. Something to keep an eye on!

Cybercrime continues to plague the crypto world. Vitalik Buterin, co-founder of Ethereum, suffered a compromise of his X account, leading to considerable financial consequences for victims who followed a fraudulent link.

Renowned investor Warren Buffett doesn't like cryptocurrencies, bitcoin (BTC) included. And he's not hiding it. On several occasions, the billionaire has explained why, in his opinion, this asset is not worth investing your money in. Yet there is evidence that the businessman has missed an opportunity to increase his fortune.

The crypto industry has been rocked by news of Bitcoin ETFs, a financial product that could revolutionize the way institutional investors interact with Bitcoin. Gracy Chen, CEO of Bitget, offers her perspective on the subject in this exclusive interview.

Recently, no fewer than 6 countries joined the BRICS in what is now known as BRICS+. Although the organization has rejected the membership applications of some countries, it seems to be calling on others to join. Such is the case of Indonesia.

The first domino of the bull run has fallen. U.S. companies will soon be able to account for their Bitcoin holdings at their fair value.

The financial sector in the United States is anticipating a significant revision in the accounting of cryptocurrencies, particularly Bitcoin. This recent decision aims to enhance clarity, accuracy, and confidence in the valuation of digital assets by businesses.

In the vibrant financial hub of Mumbai, an announcement rings out, echoing like the dawn of a new era in the crypto universe. India's Finance Minister, Nirmala Sitharaman, has revealed that the Indian presidency of the G20 has initiated crucial discussions, aiming to establish a global regulatory framework for cryptocurrencies. But what does this move mean for the sector? And what role is India playing in this regulatory revolution?

The cryptocurrency landscape is evolving rapidly. The XRP Ledger (XRPL), in particular, is on the verge of a significant milestone with the highly anticipated XLS-30d amendment. This update is critical as it has the potential to transform XRP into the cryptocurrency of the future.

For the past few months, Bitcoin ETFs have been among the most closely followed news items on the crypto market. The reason for this is their potential role in the explosion of asset prices, starting with bitcoin. Indeed, the eventual arrival of a Bitcoin ETF on the market is seen as good news. But it seems, according to some experts, that it could thwart the ambitions of crypto exchanges. Here's why.

Scammers are stepping up their attacks on MetaMask crypto wallet users. Some are even using official government websites. Aware of the need to protect cryptocurrency investors, MetaMask has reacted quickly. Its security team has implemented sophisticated measures.

Once upon a time, on October 28, 2021 to be precise, SHIB reached an ATH of $0.000 081. Since that day, this cryptocurrency has been on a long downward spiral, to the detriment of the Shiba Inu community. Many crypto traders believed that the advent of Shibarium would right this wrong. Three weeks on, but the SHIB bull run has yet to show its face. However, Shytoshi Kusama, the lead developer of Shiba Inu, is said to have a solution, including the SHIB crypto burn. Zoom in!

On the night of September 5, the Coinbase Layer 2 “Base” protocol experienced its first major outage, lasting almost 45 minutes. Let's analyze this event and its repercussions in the crypto world.

The BRICS want to get rid of the dollar's influence in international transactions. The organization reaffirmed this objective at its recent summit in South Africa. As the group's currency strategy is gradually unveiled, we learn that Ripple's XRP could contribute to this dynamic.

In the hectic world of crypto, alarmist predictions are not uncommon. Yet when these predictions emanate from a player as pivotal as Vitalik Buterin, the community is left hanging on his every word. In a recent talk, Ethereum's co-founder sketched out a tortuous and rocky road to its creation. Let's delve into the depths of this prophecy, where technical innovation and growing concerns are intertwined.

In the bubbling vortex of the digital age, India is waking up to a message that is resonating in every corner of the globe. The nation, which proudly stands as a pioneer of the crypto revolution, is throwing a stone into the pond of established conventions, by advocating a global harmonization of regulations framing the cryptocurrency sector. An impetus driven by an unexpected figurehead, marking a decisive chapter in the digital odyssey of our century.

Considered to be the most important crypto, Bitcoin continues to spread to the four corners of the globe. The adoption of this crypto even extends to the level of institutions and governments, raising questions. What if it were to influence the global financial system?

“Not your key, not your coin”, cryptocurrency investors keep chanting. In other words, when keys are secure, assets remain safe from any theft or hoarding initiative. However, Ivan Bianco, a Brazilian crypto influencer, inadvertently exposed his private keys. The result: a good part of his cryptocurrency holdings evaporated.

Vitalik Buterin, whose crypto portfolio is worth around 244,000 ETH, has recently disposed of several thousand tokens. No explanation for this voluminous transfer of cryptocurrencies from the Ethereum co-founder. Would he need them to develop other projects? Or simply to cover personal expenses? No one knows what he's up to. Crypto-enthusiasts are panicking. Let's find out!

Blockchain is gaining ground. More and more entities are adopting it as an ally to ensure greater operational relevance. London's stock market is part of this trend, as it looks to take its performance to the next level.