The US government currently holds 200,000 Bitcoin (BTC). Yet it seems in no hurry to sell this colossal treasure.

Cmc RSS

Glassnode, the cryptocurrency analysis company, has suggested a decrease in liquidity in the altcoin market. This situation is said to be linked to a waning appetite for cryptocurrencies. The company specifically points out a market weakness based on the fundamental parameters of altcoins, which are at critically low levels.

The cryptocurrency sphere has always been a fertile ground for debates, controversies, and technological advancements since its inception. China, one of the world's largest economies, has now contributed a new chapter to this ongoing saga, particularly concerning Tether. This story isn't just about an unpaid loan; it delves into the very essence of what cryptocurrencies mean in a country where the rules of the game are constantly being redefined.

At the crossroads of financial giants, the crypto arena has become the scene of a legal drama that could redefine the future of digital currencies. At the center of this storm, Binance finds itself in the crosshairs of the dreaded US SEC. And, as the stakes continue to rise, Circle, the issuer of stablecoin USDC, invites itself to the negotiating table.

Russia, frequently criticized for its discreet involvement in the crypto sphere, is now at the center of a major scandal: the lightning-fast hacking of FTX.

It's a fact: decentralized finance (or DeFi) and crypto are well and truly present on the European market. In a detailed report, the European Securities and Markets Authority (ESMA) takes a close look at this new financial era. Read on for more details!

When we talk about a monetary revolution, it's not just about crypto. Russia, in particular, stands out as a key player. With an ambitious plan for 2025, the country aims to reshape the global financial landscape, going beyond merely integrating its digital currency and forging deep strategic alliances. Let's decode this bold Russian strategy together.

The crypto sphere is abuzz, and Ethereum (ETH) is at the heart of this excitement. As the second-largest cryptocurrency prepares for a potential rise to $8,000, many experts and financial institutions have expressed their opinions, ranging from the most optimistic to the most cautious. Let's delve into the intricacies of this prediction and discover the factors that could support or contradict this view.

Fervent Bitcoin (BTC) advocate, Arthur Hayes, has predicted that the asset will see its price skyrocket to reach a valuation of one million dollars. This could happen if the company BlackRock obtains the Bitcoin ETF they have filed for. However, this perspective, although initially interesting for the crypto industry, does not reassure the investor.

The crypto space is a constantly evolving arena, and in the midst of this dynamism, Cardano (ADA) boldly emerges, redefining industry standards.

Jim Cramer, CNBC host, has once again expressed concerns about the future of Bitcoin (CRYPTO: BTC). He shared his apprehensions during CNBC's 'Squawk on the Street' show while discussing potential investment opportunities.

Découvrez les opinions de Justin Bons sur la gouvernance de la blockchain Ethereum et sur l’univers de la crypto en général.

Satoshi Nakamoto, the creator of Bitcoin, has resurfaced on Twitter recently, and has just announced that he will reveal his identity in 2024. This declaration has piqued the interest of the crypto community, leading to increased speculation and skepticism surrounding this account.

The advent of BitVM promises to bring a new dimension to the Bitcoin sphere, introducing Ethereum-style smart contracts. This innovation could bridge the gap between the capabilities of the two leading blockchains, while preserving the fundamental characteristics of Bitcoin.

In the ever-fluctuating realm of the crypto sphere, northern lights are not uncommon. But sometimes, one star shines brighter than the rest, altering the nighttime landscape of the financial sphere. That star today is Binance with its Copy Trading introduced on October 9, 2023.

Entre le tumulte et le déchirement d’un conflit ancien et persistant, le monde observe, souvent impuissant, la dévastation au Proche-Orient. Cependant, dans ce tourbillon de tragédies et de violences, le Bitcoin demeure un roc apparemment inébranlable, dont la résilience interpelle autant qu’elle étonne.

“Polygon in a Rough Patch? The news of Jaynti Kanani's departure comes in a context where the company is gearing up to launch Polygon 2.0. Of the 4 individuals behind this sidechain project aimed at evolving the parent Ethereum blockchain, 2 have departed, within a 6-month interval. What's really happening? Let's investigate!

Billionaire Elon Musk purchased Twitter last year, a highly publicized acquisition that continues to make waves. Meanwhile, the platform's leaders are strategically positioning it within the crypto ecosystem.

The Iraqi government will ban all cash withdrawals and transactions in US dollars starting from January 1, 2024.

Following the FTX incident, Binance opted for transparency to maintain the trust of its hundreds of millions of users. Thus, in November 2022, the crypto giant engaged Mazars, an international auditing firm, to facilitate access to reliable data concerning customers' holdings in BTC, ETH, USDT, and more. In early October, Binance released its 11th Proof-of-Reserves (PoR) report. Details follow.

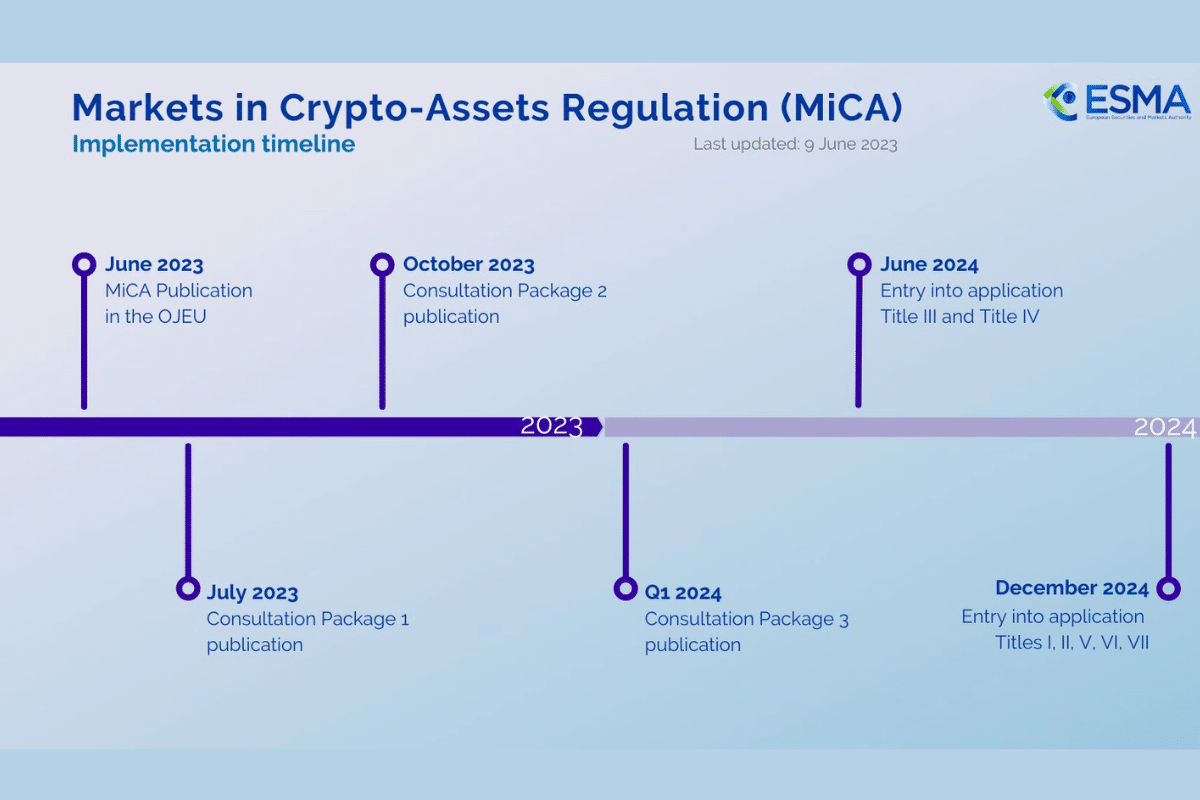

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.

Controversy is brewing in the Solana ecosystem, fueled by allegations that the Solana Foundation and Alameda Research are heavily subsidizing the network's validators. The debate is crystallizing around the impact of these subsidies on the decentralization and sustainability of SOL, Solana's native crypto.

One Step Forward, Two Steps Back: SEC Approves Bitcoin/Ethereum Futures ETFs, but Remains Cautious on Bitcoin Spot ETFs. Crypto Community, Financial Institutions, and U.S. Officials Grow Impatient. When Will Gary Gensler's Team Decide on Bitcoin Spot ETFs? A Former BlackRock Executive Shares Insights.

In an interview with Bitcoin Magazine, a candidate in the U.S. presidential election once again expressed his support for Bitcoin.

No cryptocurrency transaction should go unnoticed by the Bank for International Settlements (BIS), as they develop a suitable system to track cryptocurrency exchange flows throughout the European territory. Several European central banks have joined them in this initiative. Let's take a closer look!

The crypto community continues to closely monitor the legal battle between Ripple and the SEC. The reason is simple: the outcome of this legal saga will be crucial for the cryptocurrency market. And precisely, some news could change the game definitively. At the very least, it hints at a victory for Ripple against the SEC.

Before November 2022, no one expected the American crypto exchange FTX, valued at over $32 billion, to meet such a tragic end. Colossal losses for the company, its creditors, and its founder Sam Bankman-Fried, investments worth thousands, if not hundreds of thousands, of dollars lost for its creditors (including individuals and institutions), plummeting cryptocurrency prices (Bitcoin, Ethereum, etc.). The toll is heavy. Now that the fallen young CEO of FTX is summoned to court to answer for his actions, we share some details that will send shivers down your spine.

At the heart of a monetary revolution, Bitcoin challenges conventions and shakes the foundations of finance. Financial turmoil has always been the stage for engaging debates, conflicts of interest, and strong opinions. In this world where fiat currencies reign supreme, a recent statement by tech magnate Elon Musk has stirred the pot: according to him, fiat currency is the biggest scam of our time. But to understand this bold declaration, one must first delve into the complex world of Bitcoin.

An expert recently insinuated that the Binance exchange may have contributed to the downfall of the high-profile FTX exchange, a story that has been making headlines. This allegation has sent shockwaves through the crypto community, prompting responses from John Deaton, Ripple's lawyer, and Changpeng Zhao (CZ), the founder of Binance.

Global financial regulators are increasingly concerned about the rapid growth of the cryptocurrency market. The International Monetary Fund (IMF) has just proposed a matrix for assessing national-level cryptocurrency-related risks to countries worldwide. This was on September 29th. Details follow.