PayPal is accelerating into the crypto space by directly integrating Solana (SOL) and Chainlink (LINK) into its wallet. This new feature is currently reserved for American users and associated territories. More than just a technical update, this decision is a significant boost for the massive adoption of cryptocurrencies. The intermediary MoonPay is no longer needed, making the experience seamless: buying, selling, and transferring these tokens becomes as simple as a few clicks. But behind this novelty lie much broader stakes. Here’s what you need to know.

Chainlink (LINK)

Ledgity Yield, a key player in decentralized finance (DeFi) and a member of the Chainlink BUILD program, announces the hosting of an exclusive X Space in collaboration with Chainlink Labs on Wednesday, March 12 at 6 PM CET. This online event will be an opportunity to explore the challenges and opportunities of integrating Real World Assets (RWA) into DeFi in Europe, as well as the evolution of interactions between traditional finance (TradFi) and decentralized finance.

When Trump decrees, cryptos ignite: Bitcoin recently at $109,000, ETPs feast on $1.9 billion.

The world of crypto is evolving at a dizzying pace. Even the most promising collaborations do not always guarantee an immediate price increase. This is exactly what we observe with Ripple and Chainlink, whose partnership has not prevented their tokens, XRP and LINK, from suddenly retreating.

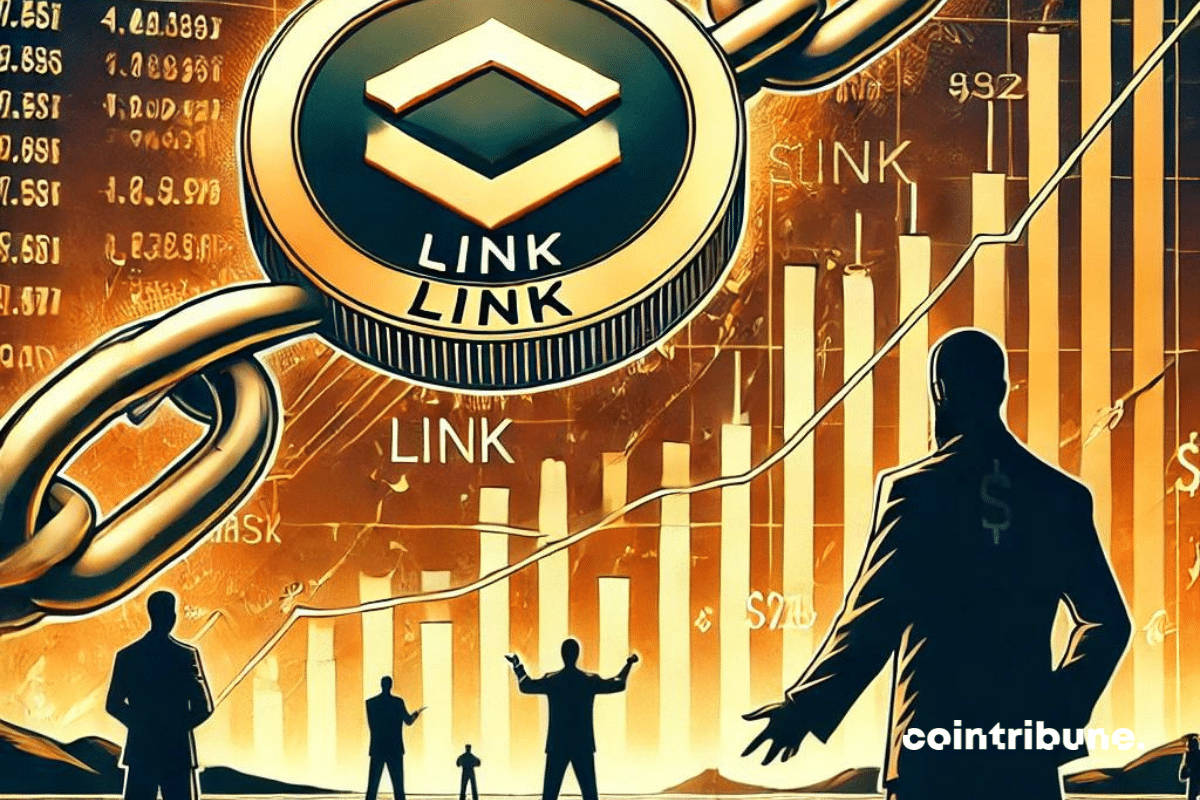

As the crypto market experiences a correction towards the end of 2024, Chainlink (LINK) maintains a remarkable performance with a 53% increase since January. Analysts are forecasting a record year in 2025 for this digital asset that has distinguished itself in the blockchain ecosystem.

The last two weeks of December were tumultuous for the crypto market, marked by a significant drop in prices. However, Chainlink (LINK) could potentially become one of the big winners in 2025, with an anticipated increase of 160%. When could this rebound occur and what factors support it?

The sharp-toothed memecoin bites into blockchain innovation with Chainlink, flirting with 12 chains in a disconcertingly elegant technological dance.

Despite a 13% drop, Chainlink attracts crypto investors. Imminent rebound or just a bet? We tell you everything in this article!

The world of blockchain continues to profoundly transform digital finance, but not all projects succeed in combining innovation and relevance. Among the most remarkable initiatives, Chainlink, the decentralized oracle network, stands out as a key pillar in the field of Real-World Assets. According to the latest data from the analysis platform Santiment, Chainlink dominates its sector thanks to particularly intense development activity. Thus, over the last thirty days, it recorded 394 notable events on GitHub, surpassing renowned competitors like Synthetix and Dusk Foundation, which recorded 176.6 and 34.7 events respectively.

Chainlink (LINK) soars to $25.32 and crypto oracles celebrate: the "bank coin" is here, XRP has become just a banking joke.

The blockchain oracle giant Chainlink has unveiled a major innovation: the "Chainlink Runtime Environment," a revolutionary framework aimed at creating a unified gateway between traditional finance and the blockchain universe. This technological advancement promises to radically transform the interaction between legacy banking systems and smart contracts.

The World Liberty Financial crypto project, launched by Donald Trump, has just announced a strategic partnership with Chainlink for the integration of price oracles. This collaboration marks a significant step in the expansion of traditional DeFi, as the project relies on Ethereum's blockchain technology.

The Swift and UBS giants, armed with Chainlink, attempted a blockchain twist to make tokenized finance dance.

Is Chainlink ready for a comeback? In recent weeks, on-chain data shows a marked trend: LINK is massively leaving cryptocurrency exchanges. As the crypto ecosystem closely observes this record exit, many are wondering if this accumulation could propel Chainlink to new heights. The wave of Chainlink exits: a sign of…

The Chainlink token (LINK) is experiencing remarkable momentum, with a spectacular 293% increase in whale activity. Indeed, this sudden influx of capital, coupled with a massive unlocking of tokens, has led to numerous speculations regarding the influence of large financial entities. Chainlink, already well-established in the smart contract ecosystem, seems to be reinforcing its position, which could herald major developments.

Chainlink (LINK), the decentralized oracle network, confirms its leadership position in the crypto ecosystem by showing exceptional development activity. According to the latest data from the analysis platform Santiment, Chainlink outperforms all other ERC-20 projects, including Ethereum itself.

The race for technological dominance never weakens in the crypto sphere. Yet, amidst this fierce competition, Chainlink continues to hold its own against all rivals, including giants like Binance.

A strategic accumulation of $LINK is capturing the interest of crypto analysts. We provide more details in this article!

Chainlink (LINK), the native token of the decentralized oracle network, recently took the lead in real-world asset (RWA) crypto assets in terms of development activity, surpassing popular projects such as Synthetix and Centrifuge.

Between revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic struggles. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

The Depository Trust and Clearing Corporation (DTCC) successfully conducted a pilot project to tokenize funds in collaboration with Chainlink and several major US financial institutions. This initiative aims to standardize and accelerate the tokenization process of traditional assets on blockchains.

With the current dynamics of prices in the crypto markets, now is the time to invest the most in altcoins. And if you still don't know which altcoins to prioritize, we will help you. Here are the top 4 altcoins you could invest in now to increase your chances.

Heavy investments in PEPE, LINK, and MKR signal increased confidence in the future appreciation of these assets.

The world of cryptocurrencies is vast and diverse, extending far beyond famous names like Bitcoin and Ether. Small cryptocurrencies, often less known, are gaining ground, offering unique opportunities and growth prospects. These digital assets, while smaller in terms of market capitalization, stand out for their innovation and adaptability. This article delves into the fascinating world of small cryptocurrencies, analyzing their growth potential in 2024, the key factors influencing their success, and highlighting some of the most promising options.

The crypto market has been in turmoil lately. The same cannot be said for Chainlink, which, despite a decrease in the value of its native crypto (LINK), has shown remarkable performance in terms of development activities. According to the latest news, no other blockchain is doing better in this regard.

Since early February 2024, a mysterious whale appears to be taking a keen interest in the LINK cryptocurrency and has already accumulated over $83 million.

Bitcoin Almost Dips Below $42K Amidst Soaring Interest Rates, While Chainlink’s LINK Bucks the Trend

As the Federal Reserve is making its first announcement regarding interest rates in 2024, the crypto market is watching closely to see how it will be affected.

Solana and Chainlink ignite the DEX market, promising a bull run for altcoins. Analysts anticipate a fruitful Q1.

The Chainlink crypto network becomes a DeFi engine in 2023 by revolutionizing financial collaborations and use cases.

Chainlink (LINK) is taking off with crypto whales: +17% in just 24 hours, a strong sign for 2024. Details here!