Russia, an influential member of the BRICS bloc, has just crossed a historic monetary milestone: in February, more than half of its imports were settled in rubles. This strategic advancement, confirmed by the Central Bank, is part of a clear break with the dollar-dominated system. As tensions with the West escalate, Moscow is redirecting its trade towards partners deemed "friendly," thus redefining global financial balances and accelerating its trajectory towards strengthened economic autonomy.

BRICS

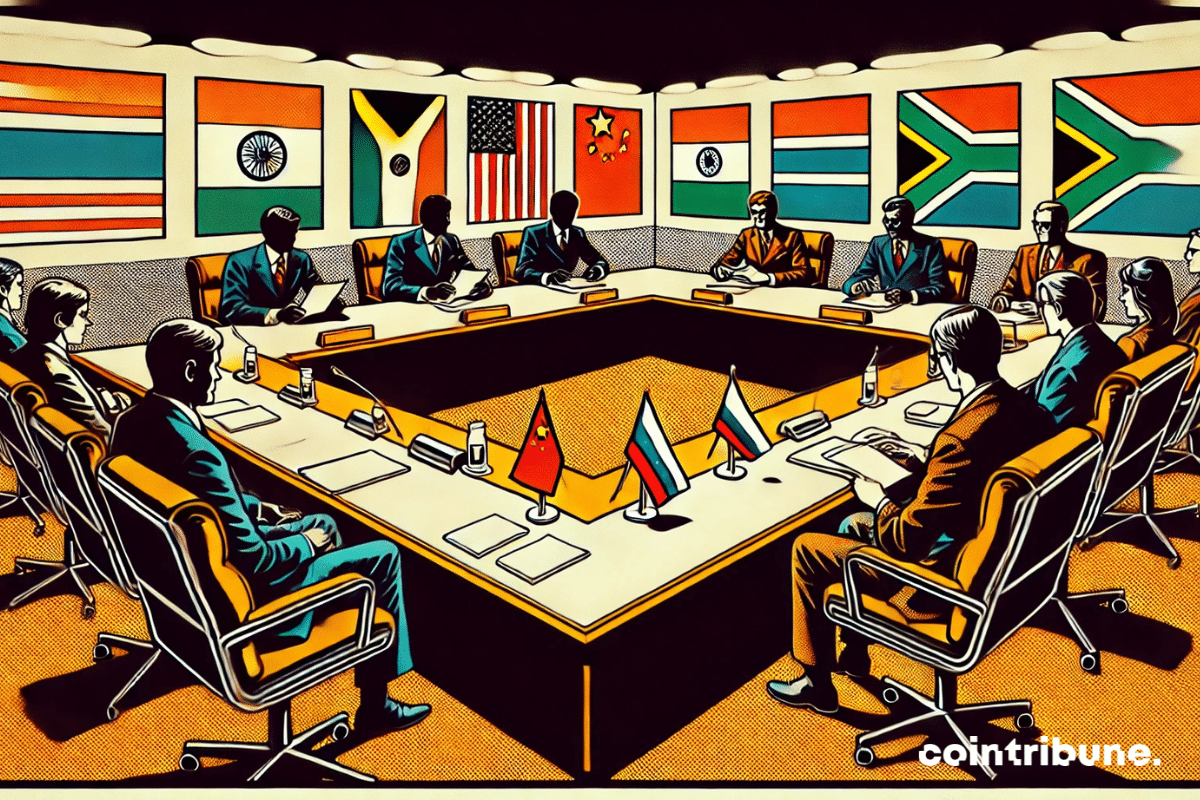

As geopolitical tensions reshape global balances, the BRICS are accelerating the establishment of their own payment network. Led by Russia, this infrastructure aims to free itself from SWIFT and open a financial pathway outside of Western control. The announcement of its accessibility to non-member countries marks a strategic rupture. Beyond being a regional tool, BRICS Pay becomes a lever of global influence and a strong signal in favor of a multipolar monetary order.

In a geopolitical context undergoing a major reshuffle, two significant initiatives are shaking the hegemony of the dollar. Brazil and China are making a strategic shift by favoring their national currencies for bilateral exchanges. For their part, Russia and Iran are announcing the launch of a new common currency to circumvent Western sanctions. These distinct yet converging movements illustrate a shared desire among influential BRICS members: to build a financial system that is less dependent on the greenback and to assert monetary sovereignty in the face of external pressures.

And if independence no longer came through weapons, but through blocks of code? The BRICS dream of sovereignty in cryptocurrencies, with Siluanov as a digital scout.

Gold is no longer just a safe haven. It has become an instrument of economic power. In 2024, the BRICS have massively accumulated the precious metal, anticipating a tightening of American trade policies. This bet is proving to be worthwhile, as the new tariffs announced by Donald Trump triggered a historic surge in gold prices. As the trade war intensifies, the yellow metal is asserting itself as the monetary weapon of emerging powers against the dominance of the dollar.

The United Arab Emirates, now members of the BRICS, will invest 1.4 trillion dollars in the United States over ten years. Announced after a meeting with Donald Trump, this maneuver reshapes global balances. Between technological ambition, diplomatic calculation, and projection of influence, Abu Dhabi is shaking up the lines of a world now structured by variable geometry economic alliances.

In his recent intervention, Subrahmanyam Jaishankar sought to dispel any ambiguity about India's position regarding the dollar: "there is no policy on our part aimed at replacing the dollar. At the end of the day, the dollar as a reserve currency is a source of international economic stability."

The USA-Ukraine summit was recently held in Riyadh and resulted in more ambitious ceasefire proposals than expected. "The ball is now in Russia's court" has become the American talking point on this issue. Meanwhile, Europe appears to be accelerating its military reassertion in an increasingly tense geopolitical context.

In the shadow of the economic restrictions imposed by the West, Moscow is charting a new path for its energy trade. In the face of exclusion from the international financial system, Russia has found an alternative solution: the use of Bitcoin (BTC) and Tether (USDt) to bypass sanctions and ensure the continuity of its oil exports.

The global economy is evolving under the pressure of increasing trade tensions. As the United States imposes new tariffs, Europe finds itself facing a strategic dilemma. Balancing its traditional alliances and diversifying its economic partnerships, the continent is now looking towards the BRICS. This organization, once seen as a counterweight to the G7, is today consolidating its position by forging closer ties with Europe. This shift could redefine the economic and political power dynamics on a global scale.

The foreign policy of the United States could undergo a major shift. As diplomatic tensions between Washington and Moscow have intensified in recent years, Donald Trump appears ready to rewrite the rules of the game. The American president, a favorite in the race for the White House, is considering an economic rapprochement with Vladimir Putin's Russia, aiming to break with the sanctions strategy imposed under Joe Biden. Is this a maneuver intended to undermine the BRICS alliance?

In an already geopolitically tense context marked by increasing economic tensions, Donald Trump has rekindled trade hostilities and is once again targeting the BRICS. The American president called the economic alliance "dead" and threatened to hit its members with a 100% tax on their exports to the United States if they continued to challenge the supremacy of the dollar. This statement immediately provoked a diplomatic reaction from China, which condemned a destructive protectionism and affirmed its commitment to strengthening cooperation among emerging economies.

The BRICS continue to redefine the global geopolitical landscape. As the group expands and seeks to strengthen its influence, its relations with the West become strained. The latest episode: Iran, a new member of the bloc, has categorically rejected any negotiation with the United States. "Negotiating with America does not solve any of our problems," Tehran stated. This is a firm refusal of any diplomatic opening with Washington. This positioning, much more than a simple political statement, illustrates a growing rift between the BRICS and Western powers.

Rumors about a common BRICS currency frequently resurface, fueling speculation about a possible counterweight to the dollar. As several nations seek to reduce their dependence on the greenback, the prospect of a shared currency raises concerns in the United States. Donald Trump has threatened to impose sanctions on countries considering an alternative. However, the Kremlin has just defused the debate: no such project is under discussion. Instead, the bloc prioritizes joint investment platforms, leaving doubt about its true monetary strategy.

Donald Trump unveils his radical strategy to counter the monetary ambitions of the BRICS. In response to their proposal for a common currency, he threatens to impose 100% tariffs against any country that adopts it. This tough approach masks secret negotiations that could reshape the global monetary order.

In a constantly changing world, where every political decision redraws the contours of power, a major phenomenon is emerging: the rise of the BRICS. This acronym, once seen as a symbolic grouping of major emerging economies, now asserts itself as a driving force of geopolitical balance. With the recent expansion of this bloc to new influential members, the global landscape is enriched with unprecedented dynamics, challenging the hegemony of Western institutions. While Donald Trump embarks on a second term in the United States, focused on a protectionist and isolationist policy, the rise of the BRICS represents a strategic challenge with profound implications.

Monetary tensions are intensifying as the BRICS accelerate their quest for independence from the US dollar. This dynamic is upending global economic strategies and prompting major powers to rethink their financial reserves. Currently, the Trump administration has announced the creation of a "strategic crypto stock," reigniting an explosive debate between bitcoin supporters and those of XRP. Some see it as an official recognition of the role of these assets in monetary policy, while others question which cryptos will actually be integrated. Beyond technological rivalry, this confrontation reveals major geopolitical stakes: the choice of the BRICS between bitcoin, XRP, or another crypto could reshape the balance of global reserves and redefine power dynamics among states.

For several decades, global economic alliances have been evolving due to geopolitical and economic transformations. The BRICS bloc embodies this dynamic through its expansion to new members in order to consolidate its influence on the international stage. In 2023, Saudi Arabia, the world's largest oil exporter, received an official invitation to join this strategic alliance. However, unlike other countries such as Iran or the United Arab Emirates, which quickly accepted, Riyadh is adopting a cautious stance. Faisal Al-Ibrahim, the Saudi Minister of Economy and Planning, emphasized that the kingdom continues to carefully assess the implications of membership. This strategic choice raises questions about Saudi Arabia's true intentions and its future role in this new economic balance.

Economic tensions between major powers are reaching a new level. The President of the United States, Donald Trump, has issued a direct threat to the member countries of the BRICS alliance, which are seeking to reduce their dependence on the U.S. dollar. In response to these de-dollarization initiatives, he announced 100% tariffs on their exports to the United States. This stance, accompanied by the establishment of a new agency to collect these customs duties, reflects a clear intent to defend the supremacy of the dollar and to counter any challenges to American economic hegemony. As the BRICS explore alternative payment systems, this statement could redefine the power dynamics on the global geopolitical and commercial stage.

The global economic landscape is rapidly evolving, driven by alliances that reflect the ambitions of emerging countries to reshape traditional centers of influence. In this context, Nigeria, the largest economic power in Africa, has joined the circle of BRICS partners. This initiative, orchestrated under Brazil's presidency, highlights the bloc's desire to promote enhanced cooperation among the nations of the global South. Although this partnership does not yet confer a decision-making role to Nigeria, it reflects a growing dynamic of economic integration and a shared quest for financial sovereignty in the face of dominant Western models.

The BRICS project to create a common currency is generating growing interest among economists and analysts, as it could redefine global financial balances. For decades, the US dollar has dominated as the main reserve currency, giving the United States substantial economic and geopolitical power. During their summit in 2024 in Kazan, Russia, the leaders of the BRICS intensified their discussions on establishing an alternative called "Unit," designed to facilitate exchanges within the bloc. This project fits into a broader strategy aimed at reducing their dependence on the dollar, in the context of increasing geopolitical tensions and economic sanctions. At a time when many countries are seeking to diversify their reserves and bypass the constraints imposed by the current monetary system, can this initiative truly shake the dollar's supremacy?

Indonesia, the largest economy in Southeast Asia, officially joined the BRICS bloc in January 2025, marking a major turning point in the reconfiguration of global economic alliances. This membership significantly strengthens the group's weight, which now represents over 51% of the world's population and 40% of global GDP.

Taiwanese youth are enjoying life as if nothing were happening. Yet, the threat of a Chinese invasion has never been more present. And when the Chinese Communist Party launches the offensive, we will officially enter a 3rd world war.

The center of gravity of the global economy is gradually shifting towards new alliances. In the face of the waning influence of Western institutions, another bloc is consolidating its power. Since January 1, 2025, the BRICS have taken a new step by welcoming nine partner states. This expansion, decided at the Kazan summit in October 2024, reinforces their political and economic weight and broadens their grip on emerging markets. Now, the organization represents 51% of the global population and generates 40.4% of global GDP in purchasing power parity.

The BRICS are ushering in a new economic era with a historic expansion planned for January 2025. This group, which unites some of the largest emerging economies, is set to welcome nine new partners, marking a decisive step in its quest for strengthening its position on the international stage. Such a move comes at a time when geopolitical rivalries are intensifying and traditional alliances are being questioned. Through the extension of their geographical and strategic reach, the BRICS aim to consolidate their influence, but also to provide a credible alternative to Western-dominated economic models. This shift reflects a reorganization of global economic powers, in response to growing demands for a more balanced and multipolar system.

The Syrian regime of Bashar al-Assad is on the verge of collapsing after 13 years of civil war, and it changes absolutely everything!

In the face of intensifying global economic tensions, the central role of the dollar in international exchanges is increasingly being called into question. At the heart of this upheaval, the BRICS nations are seeking to break free from this dependency by exploring alternative solutions. According to economist Jim Rickards, these countries already have an unofficial common currency: gold. This discreet yet strategic approach allows them to bypass the financial pressures exerted by the United States, particularly through economic sanctions. As the United States intensifies the use of the dollar as a geopolitical weapon, the BRICS are mounting a resistance that could redefine the rules of global trade. This strategy raises questions about the future balance of the international monetary system.

Global economic dynamics are evolving, and the hegemony of the US dollar seems to be wavering. Two influential members of the BRICS alliance, Russia and Iran, have just announced a major change: a complete abandonment of the dollar for their trade exchanges. While this decision reflects a desire for economic sovereignty in the face of external pressures, it could also pave the way for a profound upheaval of international financial balances.

As the world closely watches the BRICS efforts to reshape the global economic order, a new trend seems to undermine their ambitions. Foreign banks, far from aligning with the alliance's de-dollarization agenda, are instead bolstering their reserves in US dollars. This development, in a context where the local currencies of the BRICS are collapsing, raises further questions about the future of economic multipolarity and the resilience of the global financial system.

The 2024 American presidential election resulted in a landslide victory for Donald Trump, who wins the popular vote this time and improves his score from 2020. The Republicans regain control of the Senate and the House of Representatives!