Wall Street saw the arrival of Bitcoin ETFs in January 2024. Since then, they have attracted billions of dollars and broken all records.

BlackRock

The SEC delays approval of Ethereum ETFs, while predictions differ on potential future validation.

The rise of cryptocurrencies has opened new avenues in the investment world, notably through Bitcoin ETFs. These funds, which replicate Bitcoin's performance while being traded on traditional exchanges, represent a fascinating fusion between digital finance and conventional investment. For investors eager to enter the cryptocurrency universe without the complexities of directly managing these assets, Bitcoin ETFs present an attractive solution. This article provides a comprehensive guide on buying Bitcoin ETFs, covering the platforms where to find them, the key steps to acquire them, and the pitfalls to avoid for a successful investment.

The bearish pressure imposed on bitcoin by the GBTC ETF is clearly diminishing. Is the Bull Run about to resume?

The SEC approves ETFs, ARK Invest stacks billions of BTC and predicts up to $2.3 million per bitcoin. HODL, patience will be rewarded.

Bitcoin ETFs advertised on Google! BlackRock and VanEck wasted no time positioning themselves.

BlackRock's Bitcoin spot ETF continues to break records. In just two weeks since its launch, it has accumulated over 2 billion dollars in assets under management, becoming the first new Bitcoin ETF issuer to reach this symbolic milestone.

The Larry Fink saga with Bitcoin: from initial skepticism to "orange pill" conversion, the turnaround of the year.

It seems that the bearish pressure related to the GBTC ETF is fading a bit. Do we foresee the end of the tunnel for bitcoin?

Bitcoin ETFs faced with a dilemma: BlackRock criticizes the liquidity creation model and warns the SEC. Details here!

BlackRock wants an Ethereum ETF, but the SEC, the guardian of the rules, is delaying, leaving uncertainty hanging over the crypto future.

Discover how the SEC's approval of Bitcoin ETFs is redefining the financial landscape with unique perspectives on Bitcoin.

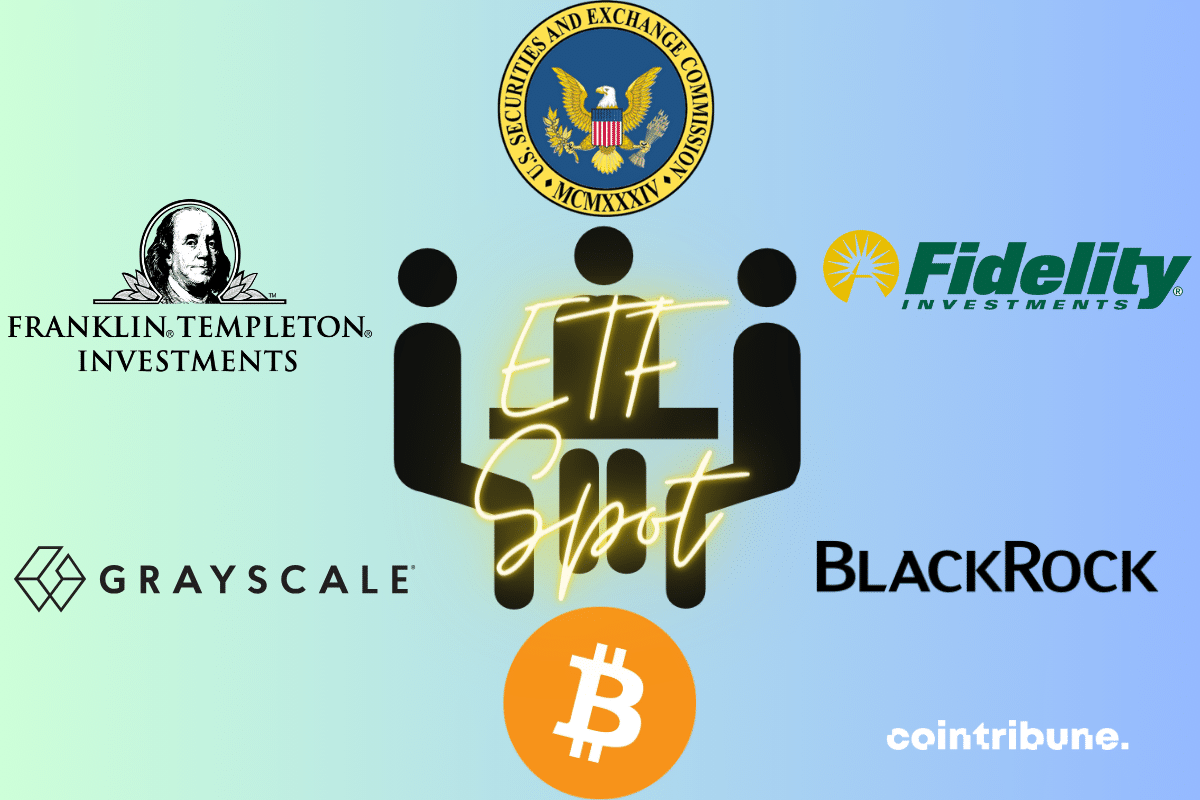

Recently, there have been significant movements in the Bitcoin ETF sector in the United States. Heavyweights like Fidelity, ARK 21Shares, and BlackRock have significantly increased their holdings in BTC. Is this a buying signal for small investors?

BlackRock's Bitcoin ETF didn't take long to surpass the billion-dollar mark, making this financial giant a major player in the crypto frenzy. This is why investors are flocking to this financial instrument, seduced by the magic of Bitcoin, the modern "digital gold." Despite a recent 15% drop, Bitcoin remains an attractive playground for the bold. This new milestone marks the transition of BTC from a niche to a major asset class.

Bitcoin falls despite the launch of ETFs. Blame it on the outflows from Grayscale's ETF that could still last 40 days...

This is not yet evident on BTC/USD, but ETFs continue to consume massive quantities of bitcoins.

The trading volumes on Bitcoin ETFs launched by BlackRock, Fidelity, Ark Invest, and others are phenomenal.

The Bitcoin spot ETFs generated nearly $10 billion in trading volumes in 3 days, driven by Grayscale, BlackRock, and FBTC.

Explore the radical shift in perspective of BlackRock on Bitcoin, going from severe criticism to support for ETFs

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

Here is everything you need to know about Bitcoin ETFs launching this Thursday, January 11th.

The Bitcoin ETF has broken all records, but absurd facts have come to spoil the party, preventing Bitcoin from appreciating for now.

" Bitcoin Spot EFTs have faced several rejections before reaching this stage. "

What do BlackRock, Invesco Galaxy, WisdomTree, and Fidelity have in common? Obviously, at first glance, they are all companies in the finance sector, each with its own specificities. But those who have been following the trends in the crypto industry in recent months know that each of these companies has, in one way or another, engaged in this industry. Good news for the latter, which sees its financial influence expanding, confirming somewhat its relevance in terms of investment. However, what seems to be a sustained adoption of crypto by institutions in the finance ecosystem does not hide significant systemic risks. It is these risks that we will be interested in in this article.

Yesterday, the United States Securities and Exchange Commission released information stating that Bitcoin ETFs had been approved. However, according to recent news, this announcement turns out to be false, even though it was disseminated on the official X account of the financial watchdog. Two hypotheses emerge: either the SEC’s account…

The SEC's decision on bitcoin ETFs is imminent. Is it an opportunity to sell the news? Or not...

As the prospective dates for approval of Bitcoin Spot ETFs approach, BlackRock, Fidelity, Valkyrie, Bitwise and other applicants for authorization of these financial instruments are fine-tuning their dossiers. Lately, many of them have once again filed documents in which they designate the “authorized participants” for their trackers. The cream of…

The moment of truth is approaching. Will the SEC soon approve Spot Bitcoin ETF applications? Or will it go as far as to postpone its decision? Recently, issuers of similar requests have been increasing meetings with officials from this U.S. financial regulatory body. Gary Gensler and his team must be under pressure.

BlackRock wants to make its Bitcoin spot ETF more accessible to Wall Street banks. The asset manager has indeed revised the functioning of its index fund to allow banking giants to participate in the Bitcoin market without violating the regulations they are subject to.

Ether goes green again! Rekindling investors' hopes after a brief dip below $2,000 last week. ETH whales have contributed to this rebound, some analysts believe.