Despite a 40% drop in trading activity, derivatives open interest rose $2 billion in December, driven by Bitcoin and Ethereum futures positions.

Theme Bitcoin (BTC)

In 2026, cryptos could experience an unprecedented boom. Record public debt, finally clarified regulation, and massive adoption by institutions: Grayscale predicts a historic bull run. Bitcoin, Ethereum, and stablecoins are at the heart of this financial revolution. A year that will be decisive for investors!

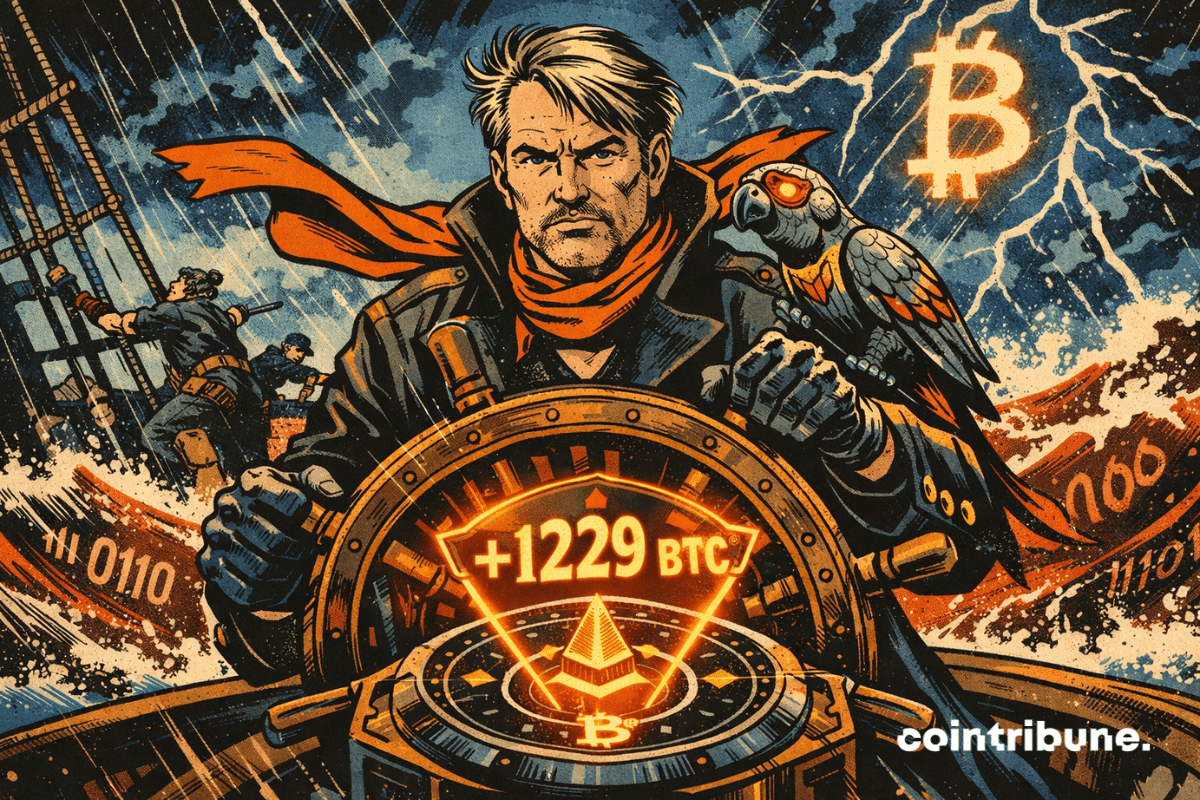

Metaplanet just signed an end-of-year move that looks less like a "trade" and more like a statement. The Tokyo-listed company added 4,279 bitcoins for an acquisition cost of about $451 million, bringing its treasury to 35,102 BTC, around $3 billion at the current rate.

Bitcoin wavers as the New Year's Eve approaches: whales, options, silver ratios... What if 2026 rhymes with hangover in the crypto jungle? Holy tree!

Michael Saylor's company Strategy resumes its weekly bitcoin purchases at a time when the markets are doubtful. Details here!

We've seen louder trends pass by. But rarely such a corporate trend. In 2025, the CTAs, those companies that put Bitcoin or other crypto-assets at the heart of their treasury, multiplied at an almost suspicious speed. And already, some leaders in the sector are talking about 2026 as a narrow corridor where many will not pass.

Bitcoin threatens to finish the year in the red. Can it still rebound before the end of 2025? An analyst warns of a crucial technical threshold.

Gold and silver surge in 2025 as Bitcoin dips, with analysts pointing to rotation, seasonal trends, and a possible rebound ahead.

They promised the moon, but XRP falls silently. Even robots are worried... What if the dreamed crypto became the forgotten anecdote of New Year's Eve?

Bitcoin is playing big at the end of this year. For the first time since its creation, the flagship crypto could close a post-halving year in the red. An unprecedented scenario that would call into question one of the historic pillars of crypto analysis: the famous 4-year cycle theory. While BTC stagnates below $88,000, investors and analysts hold their breath. A bearish close would mark a symbolic and potentially structural turning point for the entire market.

Crypto is plunging, Google is coughing, and retail traders are running away. The market is now just a VIP lounge for insiders lacking an audience. When will the sheep return?

Bitcoin lost momentum during U.S. trading hours, keeping the broader crypto market confined to a narrow range. XRP followed the same pattern, slipping to $1.86 even as demand through spot exchange-traded funds remained steady. The gap between rising ETF assets and muted price movement suggests the market is still absorbing supply near key levels.

What if 2025 was not the beginning of a long decline, but the end of a bearish cycle? While fear settles on the markets and bitcoin remains far from its peaks, Samson Mow, founder of Jan3, challenges certainties. According to him, the bear market is already behind us, and what many fear for 2026 could actually mark the start of a historic bull run... lasting ten years.

While the asset oscillates around 87,000 dollars, the derivatives markets send a clear signal: open interest on Bitcoin futures contracts has dropped to its lowest level in eight months. This decline marks a net disengagement from leveraged positions, revealing a tactical withdrawal of speculative capital, in a context where the bullish momentum seems to be fading without an immediate catalyst.

Bitmain, the world's leading manufacturer of mining machines, has launched a series of exceptional discounts on its equipment, including its latest models. This decision comes in a context of strong pressure on the sector: decline in hashprice, bitcoin crash, profitability in decline. Far from a classic commercial strategy, this operation reflects the tensions that the mining ecosystem is going through. Thus, the market leader is looking to quickly clear its stock.

Trump launches a stablecoin, Binance rolls out the red carpet, and here is USD1 at the top. Political coincidences or decentralized finance with a MAGA twist? The crypto story is written in capital letters.

The crypto market enters 2026 in a climate of caution. Despite several rate cuts decided by the Fed in 2025, the expected rebound did not materialize. Bitcoin, Ether, and major assets declined, contrary to expectations. Monetary policy remains unclear, economic data are weakened, and the Fed hints that a pause could occur as early as the first quarter. This context rekindles tensions in an already weakened market.

Hyperliquid progresses as a crypto desk that doesn't want to waste time with slogans. No big speeches "DeFi for all." Instead, two very concrete levers in pre-alpha: portfolio margin and BLP Earn vaults. Translation: more flexible risk management, and a yield and borrowing component directly connected to Hypercore. The kind of addition that makes no noise, until the day traders understand what it changes.

Bitcoin did not offer a gift this year. On December 25, in full "holiday" liquidity (that is to say almost empty), the price slipped below $87,000 before bouncing back timidly. And the market’s psychological gauge hardened: fear shifted into extreme mode.

A spectacular hack hits Trust Wallet: 6 million $ vanish in a few hours after a compromised update. Who is responsible? How to recover your funds? Discover the scam details, mistakes to avoid, and solutions to protect your crypto before it's too late.

As the year ends in a climate of economic uncertainty, Elon Musk reignites the debate with a shocking statement. The head of Tesla and SpaceX foresees double-digit growth in the United States as early as 2026, even triple-digit by 2030 thanks to the rise of artificial intelligence. This prediction did not fail to elicit reactions from the crypto community, always on the lookout for macroeconomic signals. The link between technological innovation and the bitcoin market seems stronger than ever, but is the optimism justified?

In five days, Bitcoin ETFs listed in the United States lost more than 825 million dollars, according to Farside Investors. This series of withdrawals marks a clear decline in institutional demand approaching 2026. After a year marked by enthusiasm around BTC-backed funds, the trend reversed during this December.

In 2025, the crypto derivatives market shattered all records with $86 trillion traded, averaging $265 billion per day. Binance, CME, and historic liquidations marked this crazy year. Who benefits? What are the risks? Dive into the analysis of a phenomenon redefining finance.

In a crypto market marked by euphoria and panic, Changpeng Zhao, founder of Binance, gives decisive advice. For him, the best Bitcoin investors do not buy at the top, but in the dips, when fear dominates. A strategy that makes perfect sense at a time when the market experiences extreme volatility. CZ's words are more relevant than ever for those looking to operate in this uncertain environment.

If we start looking at the price of bitcoin from the perspective of "adjustment," aren't we simply recreating the same system? Aren't we, by thinking in terms of seasonal adjustments, becoming the new central bankers?

On December 25, bitcoin briefly dropped to 24,000 USD on Binance's USD1 pair before rapidly returning to more usual levels. Such an unexpected move raises questions about the stability of low liquidity pairs and risk management on trading platforms. In a rapidly evolving crypto market, this incident reveals challenges related to liquidity and regulation.

Gold nears $4,500, silver exceeds $71. Facing this rush for precious metals, cryptos position themselves as a modern alternative. Will Bitcoin and altcoins benefit from this trend? Analysis of correlations, forecasts, and strategies for investing in this booming market.

Bitcoin and Ethereum are seeing ongoing ETF outflows as institutional investors pull back, signaling cautious sentiment and weaker market momentum.

El Salvador is once again under scrutiny as talks with the International Monetary Fund advance over its Bitcoin strategy. Although negotiations to sell the state-run Chivo Bitcoin wallet are nearing completion, disagreements persist over continued government Bitcoin purchases. Public statements by President Nayib Bukele continue to conflict with IMF conditions under a major loan agreement.

Altcoins may slow next year as Bitcoin and top cryptos are expected to draw most investor attention, leaving smaller tokens behind.