Bitcoin, this cryptocurrency with growing popularity, intrigues as much as it divides. For Jamie Dimon, CEO of JPMorgan, this digital currency has no place. His criticisms have echoed for years in the financial sector. Yet, his viewpoint raises questions: why is he so harsh, and what does his argument really rest upon?

Theme Bitcoin (BTC)

The beginning of 2025 marks a historic turning point for Bitcoin. Technical indicators are looking positive, institutional investors are flocking in massively via ETFs, and macroeconomic prospects are improving. Now, the scenario of $500,000 is highly probable in 2025.

MicroStrategy, under the leadership of Michael Saylor, continues to strengthen its position as the largest holder of bitcoin. Currently, the company has purchased 2,530 BTC for a total of $243 million! This demonstrates its confidence in the long-term potential of BTC, despite the current macroeconomic challenges.

The crypto beacon is slowly dimming below $92,000. The overheating of platforms fuels fears, investors tremble.

This week, the cryptocurrency market is marked by the strength of the US dollar, reaching its highest level since the bear market of 2022. This situation creates challenges for Bitcoin (BTC) traders, who must navigate an environment of increased volatility as the US presidential inauguration approaches.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week concerning Bitcoin, Ethereum, Binance, Solana, and Ripple.

The crypto market continues to show signs of volatility at the beginning of 2025. According to the latest analyses, Bitcoin (BTC) and Ethereum (ETH) are displaying downward trends, while Ripple (XRP) seems poised for a new rise. What direction will these cryptocurrencies take this week?

Technical innovations, the rise of new protocols, and the growing interest of institutions have laid the foundations for a booming decentralized finance (DeFi) landscape. At the heart of this whirlwind, Bitcoin stands out owing to its status as a "safe haven" in the sector. However, its potential remains underutilized in the DeFi space. By 2025, this dynamic could change. Experts are unanimous: Bitcoin's native decentralized finance has everything to become a major phenomenon.

Bitcoin has risen by 120% in 2024, significantly outperforming other major asset classes. 2025 is shaping up to be another exceptional year.

In an absurd ballet, Bitcoin slips below $95,000, mirroring the S&P 500, with $88,000 in sight. Bounce or imminent shipwreck?

Bitcoin (BTC) recently fell below its 20-day exponential moving average (EMA) after reaching a peak of $94,000 a few days ago. This decline signals a strong period of correction as investors prepare for Donald Trump's inauguration.

A shareholder of Meta is proposing to Mark Zuckerberg's company to convert part of its 72 billion dollars in cash into bitcoin to protect against inflation. This initiative is part of a broader movement aimed at urging tech giants to diversify their reserves into cryptocurrency.

In Los Angeles, the fires dance. Burned wallets, forgotten private keys, digital fortunes fade away, taking dreams and cryptos into the oblivion of an apocalyptic blaze.

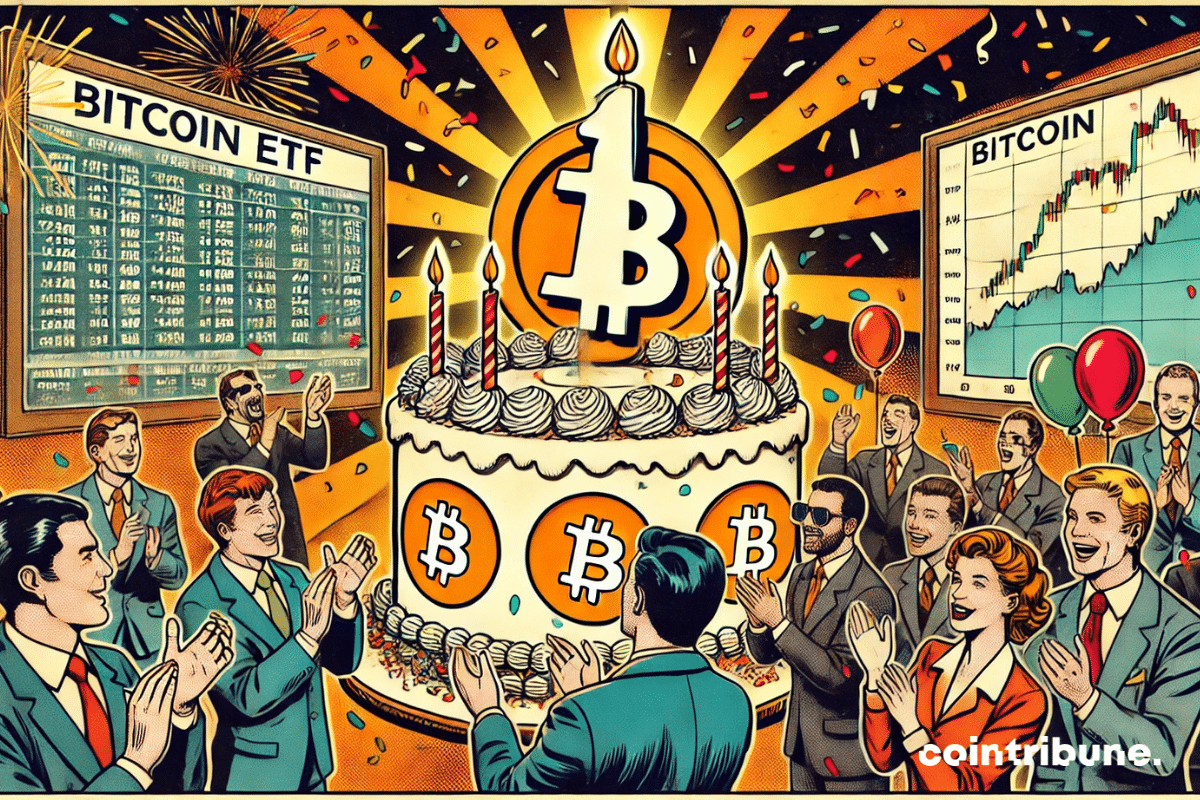

The history of financial markets is marked by breakthroughs, those moments when an asset or an innovation disrupts established rules. 2024 will be remembered as the year when Bitcoin definitively crossed a milestone with the rise of spot ETFs. Long awaited, these financial products attracted record inflows, with $129 billion in assets under management in less than a year. From their launch, they generated unprecedented enthusiasm, allowing institutional investors to access Bitcoin in a regulated and secure framework. However, the impact goes beyond the numbers. Bitcoin is no longer just a speculative asset. It now competes with gold as a store of value. In November, BlackRock's Bitcoin ETF surpassed its gold-backed equivalent, a strong symbol of the changing perception among investors. As prospects for 2025 take shape, one question dominates: can this momentum be sustained? Between market consolidation, a possible expansion towards other cryptos like Solana and XRP, and the potential entry of new players like Vanguard, the year 2025 could very well redefine the balance of power in the financial markets.

Bitcoin is facing a new setback, shaken by a market that is reevaluating its expectations. Indeed, the publication of a solid economic report in the United States has strengthened the dollar, which reduces the likelihood of an imminent interest rate cut by the Federal Reserve. Such a reaction has led to a correction below $93,000. This has temporarily stalled the bullish momentum of crypto. However, Grayscale remains confident and views this pullback as mere turbulence rather than a reversal of trend. According to Zach Pandl, head of research at the company, the strength of the dollar and the restrictive monetary policy are temporarily weighing on the market, but the fundamentals of Bitcoin remain strong. With rising institutional adoption and a changing regulatory environment, the bullish trajectory seems intact despite short-term fluctuations.

Raoul Pal, CEO of Real Vision, announces a new explosive phase in the altcoin market that he calls "banana singularity," characterized by a widespread increase in prices. This prediction comes as Bitcoin consolidates around $93,000 after having crossed the $100,000 mark in early January.

Below $92,000, Bitcoin wavers, and the Fear & Greed index, like a nervous barometer, shifts from vertigo to apathy.

Despite regulatory restrictions, Asia is emerging as the global epicenter of crypto, capturing 60% of users worldwide. A recent study by Foresight Ventures and Primitive reveals that the Asian continent generates the largest share of global liquidity, with five Asian countries ranking in the top 10 of the global crypto adoption index in 2024.

Crypto industry experts doubt Trump’s commitment to keep all his promises: "It is clear that the Republican Party has relied on a pro-crypto political position to gather votes from citizens holding crypto assets." And what about bitcoin… what will become of it?

After Bitcoin dropped to $92,000 on January 9, 2025, the question on everyone's lips was: Is the Bitcoin Bull Run coming to an end? Analysts have examined the issue and present 3 factors that prove the BTC rally is far from over.

The year 2025 could very well start with a bang for Bitcoin, thanks to a massive injection of liquidity from the FED, which could propel BTC to a new ATH in March 2025.

The IMF, like a perplexed teacher, advises Kenya to abandon its old recipes for a fresher and more digestible crypto-regulation, not forgetting to eliminate the scammers from the menu.

The evolution of the price of bitcoin in 2025 will depend on three main parameters: macroeconomics, geopolitics, and bitcoin's ability to attract investors.

The year 2025 begins under the sign of instability for the crypto market. After briefly exceeding the symbolic threshold of 100,000 dollars on January 7, Bitcoin experienced a dramatic reversal, falling to 92,500 dollars in just a few hours. This sudden decline cannot be explained by a technical factor but rather by major macroeconomic elements. Investors are closely monitoring the monetary policy of the U.S. Federal Reserve (Fed), whose decisions directly influence financial markets. So far, many had anticipated a drop in interest rates as early as the first quarter of 2025. However, the latest economic data in the United States indicate stronger-than-expected growth, which challenges this assumption. As a result, markets are reassessing their expectations and adjusting their positions. This uncertainty has triggered a wave of liquidations that has contributed to Bitcoin's decline.

As the U.S. dollar index (DXY) reaches new highs, bitcoin struggles to maintain its critical support. Investors are closely watching the movements of the DXY and the monetary policies of the Federal Reserve, anticipating a short-term target of $80,000 for the queen of crypto.

Fidelity Digital Assets predicts massive adoption of Bitcoin by nation-states in 2025. Discover the analyses and forecasts.

Bitcoin is facing significant downward pressure as markets react to uncertainties in U.S. politics. A sharp drop of $5,000 in a single day suggests a possible test of $88,000 in the coming weeks, according to analysts.

Financial markets have been shaken by a wave of tension, causing a sharp correction in bitcoin (BTC) and major altcoins. In just a few hours, the flagship crypto fell below the critical threshold of $100,000, while Ethereum (ETH) collapsed below $3,400. This pullback occurs against a backdrop of deteriorating global economic conditions. Several factors explain this storm in the crypto market: on the one hand, the rise in U.S. Treasury yields, and on the other, the monetary policy of the U.S. Federal Reserve (Fed) continues to weigh heavily on market confidence. Meanwhile, the global economic environment remains marked by additional stress factors. In light of these disturbances, the crypto market is undergoing a period of high volatility, where investor caution is mingled with panic movements. This correction now raises the question of a potential short-term rebound or a continuation of the bearish trend due to an uncertain macroeconomic environment.

Bitcoin is gaining ground around the world. However, the idea of seeing this cryptocurrency appear in the vaults of a central bank may seem crazy. Yet, it is the scenario mentioned by Aleš Michl, the governor of the Czech National Bank, who is considering diversifying its reserves with Bitcoin. Why such boldness? Let's find out.

The convergence between artificial intelligence (AI) and asset tokenization is set to redefine the global financial landscape in 2025, according to Hunter Horsley, CEO of Bitwise. This major transformation should particularly benefit small businesses, paving the way for a new "long-tail capital market."