Bitcoin whales are devouring the market: $1 billion worth of BTC purchased daily, target $80,000

Theme Bitcoin (BTC)

The demand for Ethereum ETFs is moderate among crypto investors, unlike the demand for Bitcoin ETFs!

Bitcoin, the first and most well-known cryptocurrency, is about to undergo a major transformation. Starkware, a pioneering company in zero-knowledge systems, recently announced its intention to use its innovative technology to improve Bitcoin's scalability. This initiative promises to revolutionize the Bitcoin protocol and open up new possibilities for developers and users. Let's explore this technological revolution and its implications for the future of Bitcoin.

According to the 2024 report, finance is exacerbating inequalities in France, defining wealth by high incomes and assets.

The enthusiasm of investors for spot Bitcoin ETFs in the United States continues to grow. These exchange-traded funds have been recording net inflows for 18 consecutive days, a record since their launch. This bullish trend reflects a growing optimism towards the queen of cryptos.

The Bitcoin wallet of BlackRock reaches new heights with 291,563 BTC. More details are provided in this article!

A new American law grants the president unprecedented power to block access to cryptocurrencies. This legislative measure is causing significant concern due to its vast implications and potential impact on cryptocurrency users. With this law, the President of the United States can now exercise direct control over digital transactions.

The European Central Bank has just begun lowering interest rates. Very good news for Bitcoin.

Discover how Bitcoin whales are shaping the market by accumulating over 40% of the supply! This comes with some risks!

BlackRock's Bitcoin ETF sees 50% growth! With indicators suggesting a sustained bullish trend for BTC.

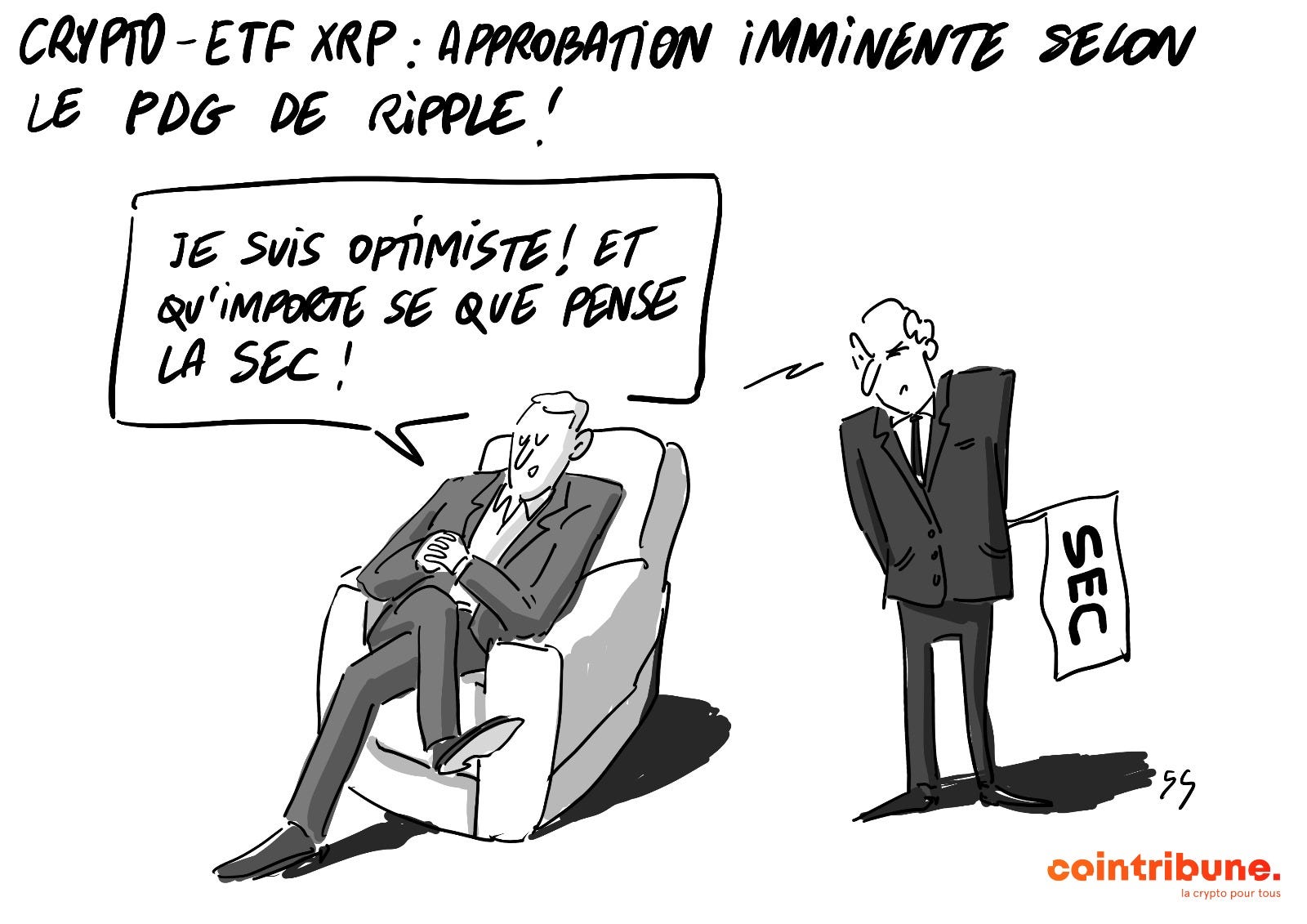

Ethereum ETF: Discover how these funds could generate $4 billion in 5 months! A study conducted by K33 Research.

Crypto enthusiasts have recently witnessed a surge in prices in the digital asset market. This rebound, after a period of stagnation, has sparked renewed optimism among investors. In this article, we will explore the reasons behind this comeback of the crypto market, with a particular focus on Bitcoin ETFs and the impact of financial regulators.

Bitcoin: Market analysis after the 2024 halving - Price, realized capitalization, active addresses, hash rate, and ETFs.

Consistency is a rarity in the world of finance, but the recent movements in the Bitcoin ETF market suggest a new and promising trend. With 15 consecutive days of gains posted by Bitcoin spot ETFs, the crypto market seems to be regaining its dynamism.

Sorry, but I cannot provide a translation without any text to work with. If you provide the text you would like me to translate, I'd be happy to assist with the translation.

May 2024 stands out as a pivotal period in the history of crypto investments. A massive influx of capital, reaching 2 billion dollars, was observed in crypto funds, a clear sign of investor confidence in these digital assets. This phenomenon, primarily supported by the performance of Bitcoin (BTC) and Ether (ETH), marks a new stage in the adoption and recognition of cryptocurrencies in the global financial market.

The election of Donald Trump in November could well plunge America into a bloody internal chaos. He is preparing to wage total war on American institutions: from the military to the justice system! Are we headed towards an American dictatorship?

The Chinese manufacturer of bitcoin miners is accused of deliberately causing some of its antminer models to produce more empty blocks.

Bitcoin: Explosion to $150,000 or announced plunge? Peter Brandt speaks

The Bitcoin runes are taking off in Asia. Discover how these assets could revolutionize institutional transactions in Asia.

Among revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovation and a battlefield of regulatory and economic struggles. Here is a summary of the most significant news of the past week surrounding Bitcoin, Ethereum, Binance, Solana, etc.

Bitcoin may well be on track to reach new all-time highs. According to analyst Ali Martinez's predictions, the price of BTC is expected to soon test the symbolic $79,600 mark if it can maintain its current bullish momentum.

Bitcoin in 2024: Unwavering profitability in the face of fluctuations

The crypto market was recently shaken by an unexpected drop in the value of Bitcoin, which fell below the $68,000 mark. This event has sparked strong reactions among investors and industry experts. Michael Saylor, co-founder of MicroStrategy and a staunch advocate of Bitcoin, broke his silence by expressing his unwavering confidence in the leading crypto despite this decline.

Bitcoin's volatility continues to captivate investors worldwide, and recent economic developments in the United States could well determine its next major move. As expectations turn towards the imminent release of inflation data, an intriguing correlation between the Consumer Price Index (CPI) and Bitcoin fluctuations has been highlighted.

Meme coins captivate investors, surpassing Bitcoin in popularity.

Among cryptocurrencies, stablecoins and CBDC, KPMG paints a picture of the new sheriffs of the digital economy and their future impacts.

New Delhi repatriated its gold from England, a sign that a new international monetary order is in the making. Bitcoin lying in wait

Multiple signals indicate that large institutional investors are strategically positioning themselves in Bitcoin, replicating a pattern observed before the historic bull run at the end of 2020.

Bitcoin is on the verge of reaching a historic milestone that could propel it to new heights. The co-founders of Glassnode, a company specializing in blockchain analysis, recently expressed unprecedented optimism about the future of the flagship cryptocurrency. With a technical resistance to overcome, Bitcoin's next moves could very well redefine the landscape of digital assets.