Bitcoin wavers after its surge beyond 100,000 dollars. The ongoing correction rekindles tensions in the markets, fueling doubts about the strength of the bullish trend. While the threshold of 65,000 dollars resurfaces in analysts' projections, the specter of a reversal looms. Between hopes of consolidation and fears of a bearish cycle, uncertainty prevails.

Theme Bitcoin (BTC)

The hype has faded like a poorly minted NFT: the flamboyant tales of Bitcoin are fading away, leaving only the echo of a promise sold too soon.

Normandy could soon host the first bitcoin mining farm in France, financed by the Sultanate of Oman. This unique project, at the intersection of energy, technological, and geopolitical issues, crystallizes French ambitions in the digital economy. At a time when energy sovereignty is becoming central, this initiative raises questions about the role that France wants to play in the global crypto ecosystem.

Ethereum is collapsing, but reserves on crypto platforms are evaporating even faster. Is a historic rebound near? Analysis!

The Bitcoin bull hesitates, the crowds are not rushing... or perhaps they already have, quietly, through an unexpected path that no chart had traced.

2025 could mark a point of no return for crypto. As traditional markets navigate between uncertainties and capricious interest rates, financial institutions seem to have found their new compass: digital assets. According to a recent study by Coinbase and EY-Parthenon, 83% of institutional investors plan to increase their allocations to crypto starting next year. A shocking figure that conceals a more complex reality, but above all, a profound transformation of investment strategies. Far from clichés about volatility, crypto is becoming a pillar of institutional portfolios.

The alignment of the planets continues. While the United States wants to accumulate "as many bitcoins as possible," the global money supply is climbing again.

Ah, the SEC... that watchdog of the crypto markets that sometimes gives us cold sweats. But this time, it has decided to put away its whistle and offer us a little breath of fresh air. On March 20, 2025, in an (almost) historic statement, the Securities and Exchange Commission clarified a point that many miners were waiting for like the thaw of spring: NO, mining in Proof-of-Work (PoW) does not constitute an offer of securities!

Bitcoin remains around $84,000 after a turbulent and disappointing session for investors, marked by President Trump's statements at the Digital Asset Summit, which did not meet the high market expectations.

Is the euro doomed to drift according to monetary policies and geopolitical tensions? Michael Saylor, a prominent figure in bitcoin, is convinced of this. In a striking tweet — "EUR gonna need BTC" — the CEO of MicroStrategy warns about the future of the European currency. While the United States is massively adopting cryptocurrencies, the Eurozone hesitates, caught between sovereignty and the risk of obsolescence.

The euphoria of the February peaks has evaporated. Bitcoin, after flirting with $109,000, is now wobbling around $82,000, revealing a reality more complex than it appears. According to the latest report from Glassnode, signed by researchers Cryptovizart and Ukuria OC, the market faces an unprecedented liquidity crisis, compounded by a growing rift among investors. A contrasting picture that raises the question: is Bitcoin at a critical turning point or simply in a phase of consolidation?

In recent weeks, the US dollar index (DXY) has fallen significantly, but contrary to investors' expectations, Bitcoin is not showing the parabolic growth typically associated with this phenomenon. This article analyzes the causes of this anomaly and its potential implications.

Long-term Bitcoin investors are firmly maintaining their positions despite the recent price drop to $76,600, their lowest level in four months. This persistent confidence, documented by new research, suggests a deep conviction in the market's recovery.

Powell, the guardian of the threshold, shapes the moment. Frozen rates, blurred hopes. The economy wavers, suspended between the fire of inflation and the ice of slowdown. The markets shiver.

Nvidia unveils its new chips and triggers a crash in AI crypto tokens! We provide all the details in this article.

The crypto market is once again in a period of uncertainty, suspended on a single question: what will be the next decision of the American Federal Reserve? While bitcoin fluctuates below $85,000 and the crypto market's fear and greed index collapses to 23, investors hold their breath. The Federal Open Market Committee (FOMC) meeting concludes today, and all eyes are on Jerome Powell.

The Trump administration seems to want to make Bitcoin a strategic asset for the United States. At the Digital Asset Summit 2025, Bo Hines confirmed that the government will seek to accumulate as much BTC as possible, without impacting taxpayers. An announcement that marks a turning point in American crypto policy.

Bitcoin dominates at 61.6% and altcoins struggle to survive. Are we witnessing the definitive end of altseason? Analysis and figures to support!

The president of the Russian central bank ridiculed herself by trying to rein in bitcoin.

Metaplanet, smelling a good deal, is offering 150 BTC at a discounted price. A bargain? A ticking time bomb? The future will decide.

In response to criticism and predictions regarding the emergence of a superior cryptocurrency, Anthony Pompliano, an investor and influential Bitcoin advocate, firmly maintains his position. This statement directly addresses claims made by Jason Calacanis, co-host of the All In podcast, who envisions the imminent arrival of a "better Bitcoin."

Is the bitcoin market entering a phase of prolonged retreat? This is the question that is stirring the crypto community after the shocking statement from Ki Young Ju, CEO of CryptoQuant. Indeed, known for his precise on-chain analyses, he claimed on the social network X (formerly Twitter) that the bitcoin bull cycle is over. This radical shift in rhetoric is all the more surprising given that he asserted as recently as early March that the bull run was still in place, although slowed down.

Bitcoin is wobbling. In three months, a staggering drop of 30%: from $109,590 to $77,041. Bitfinex dissects this debacle. Behind the sawtooth charts, a narrative is woven: panic of small investors, desertion of institutions, and a grinding macroeconomy. But is this crisis a shipwreck or a wave to surf?

The crypto landscape is staggering. Exchange-traded products (ETPs), those much-admired investment vehicles, are facing an unprecedented hemorrhage. Since mid-February, 1.7 billion dollars have evaporated from crypto funds, according to CoinShares. A sequence of 17 consecutive days of outflows. Behind these brutal figures lie complex dynamics: increased mistrust, chain reactions, and surprising paradoxes.

When some dig, others pillage: while Bhutan mines Bitcoin, Lazarus steals it. A robbed Bybit, an inflated treasure, and Pyongyang becomes one of the kings of crypto loot.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The crypto market starts this week under pressure, with a notable drop in Bitcoin and more! According to recent data, BTC has lost 2% in the last 24 hours, leading to a broader decline in the market, where major altcoins have crashed. What is happening? What does this week hold for us?

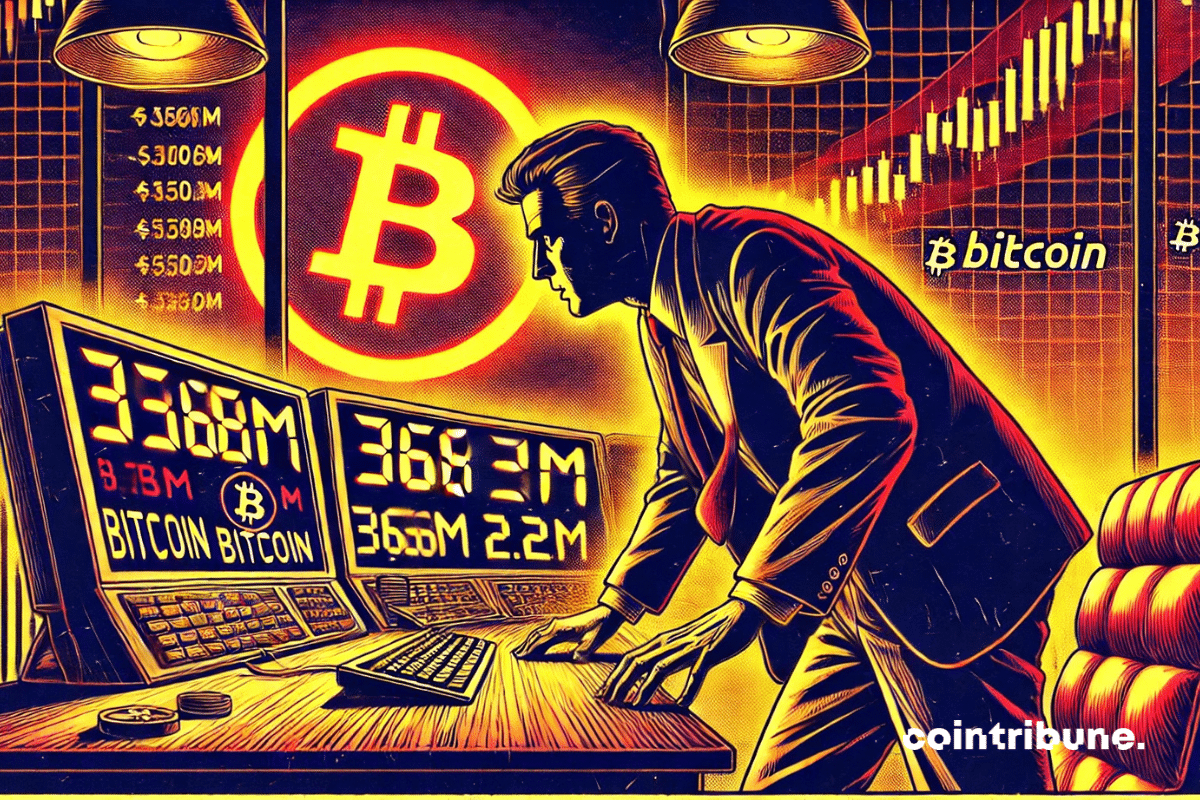

A crypto whale bet $368 million against bitcoin, already raking in $2 million in profits despite enormous risk ahead of crucial Fed decisions this week.

As the crypto market shows signs of consolidation, a recent analysis suggests that Bitcoin could reach $126,000 by June 2025. Currently, BTC is trading at the lower end of its historical seasonal range, but several indicators suggest a strong return of the bullish market and the achievement of a new ATH!

For several weeks now, bitcoin has been swaying. A drop of 22% from its historical peak at $109,000 in mid-January is fueling doubts. Is this the end of a four-year cycle, deeply embedded in the crypto market's DNA, or just a simple turbulence before a new surge? Analysts lean towards the latter option, but the nuances deserve to be explored.