What if Bitcoin became the new pillar of global finance? According to Bitwise, the trajectory is underway. The crypto index manager anticipates an unprecedented wave of investments: up to 420 billion dollars by 2026. A projection that outlines a strategic turning point for major fortunes, states, and asset managers.

Theme Bitcoin (BTC)

Bitcoin is walking a tightrope between bulls and bears. If $110,000 gives way, it's champagne; otherwise, the options expire, along with the illusions.

In a market where volatility is constant, James Wynn stood out with an extraordinary maneuver: a long position of $1.25 billion on bitcoin with a 40x leverage via Hyperliquid. A controversial figure in speculative trading, Wynn seemed to be riding a bullish wave... until an announcement from Donald Trump about a massive tax against the EU. Within a few hours, the geopolitical shock reversed the trend, melting away $29 million in potential gains, a bold bet caught up by the reality of the markets.

Solana, accused of everything and its opposite, could well outsmart Ethereum. Scaramucci is ecstatic, but the crypto industry remains cautiously watchful of this dazzling promise.

Lines are moving in Europe, and not always where we expect them. While European economic policies get bogged down in the dogmas of the Central Bank, an unexpected yet assured voice is rising: that of Conor McGregor. On May 22, 2025, the UFC icon reiterated his candidacy for the Irish presidency with an unequivocal message: to become the first president to include bitcoin on Europe's balance sheet.

Crypto is sparkling! Ethereum, still in the shadow of Bitcoin, is on the rise. Does this resurrection hide a new windfall or just a flash in the pan?

Semler Scientific, the Nasdaq-listed medical technology company, continues to accelerate its bitcoin strategy with a new massive purchase of 455 BTC. This acquisition brings its total reserves to 4,264 bitcoins, valued at over $450 million. A successful strategy that perfectly illustrates the rise of companies within the crypto ecosystem.

The return of Donald Trump to the global economic arena was enough to shake the markets. On Friday, a terse statement on Truth Social ignited the powder keg: 50% tariffs on European imports starting June 1. The reaction was swift. Wall Street wavered at the opening, traders hurriedly adjusted their positions, and the crypto market felt the shock: Bitcoin dropped by 4%, leading to liquidations of over 300 million dollars.

Bitcoin recently climbed above $111,000, marking a fresh all-time high and stirring new interest across the crypto space. After a small pullback, the focus is turning to altcoins, with several showing early signs of movement. Solana rose 4%, XRP lifted 1%, and Cardano saw a 2% gain. These numbers have led some to believe that the next stage of the market cycle could be near.

"By 2045, 50% of bitcoins could be concentrated in the hands of large corporations, according to an expert. This troubling scenario threatens the very essence of bitcoin. Once a symbol of decentralization, it could become a tool controlled by a financial elite, undermining the freedom and future of crypto."

Is it important for Bitcoin to become a popular means of payment? Michael Saylor reignited the controversy in a tweet published on the occasion of "Pizza Day."

After reaching a new peak of 111,000, Bitcoin triggers excitement among traders.

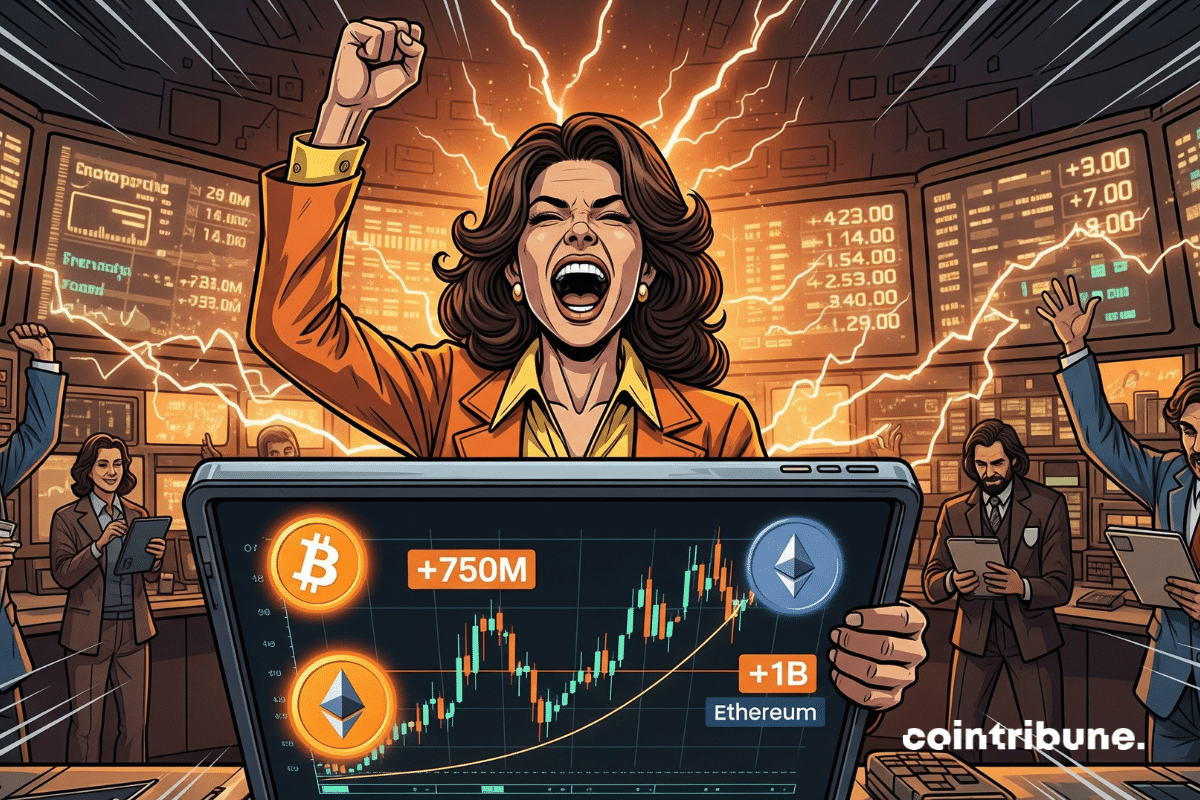

Bitcoin and Ethereum ETFs reach historic levels of investment, not seen since January 2025. Details here!

Bitcoin has just shattered a new record, but behind this displayed euphoria, a more complex dynamic is emerging. Behind the scenes, short-term investors are multiplying their profit-taking, cashing in billions of dollars in just a few weeks. This massive movement, which intrigues analysts, could well signal a turning point in the mechanics of the market, where traditional indicators are still struggling to draw conclusions.

Bitcoin has reached a new historic high of over $111,000, but without the usual tumult of an excited market. On May 22, 2025, the ascent of the queen of crypto took place in a puzzling calm, far from past speculative eruptions. Such a divergence between price performance and market restraint intrigues analysts. Some see it as the beginnings of a regime change: a more mature dynamic, supported by solid fundamentals rather than irrational exuberance.

Vitalik wants to simplify Ethereum in a Bitcoin style. But who will pay the energy bill for the ZK proof? A little millionaire ready to heat his basement?

For most of us, May 22 does not evoke anything particular. Yet, for the crypto community, this date marks the advent of Bitcoin as a real exchange currency. Fifteen years ago, two pizzas forever changed the course of global financial history. Today, that legendary order is worth more than $1.1 billion. Ready to discover the most expensive bill in history?

Bitcoin passed $111K, and Binance’s CZ feels sorry for those who sold under $77K. He urges a long-term view.

Bitcoin has just broken a mythical ceiling of 111,000 dollars, heightening the hope for a financial revolution. But behind this euphoria, the threat of a sharp drop looms. This new record reveals as much the strength as the fragility of a market shaken by scarcity, regulation, and global tensions.

Microsoft Fabric integrates blockchain through Space and Time: an innovation that accelerates the Web3 digital transformation!

Bitcoin has just set a new historical record by reaching the symbolic threshold of 110,000 dollars. This spectacular surge confirms the meteoric rise of the queen of crypto, fueled by massive enthusiasm and an exceptional market dynamic. This crucial threshold marks a decisive step, reinforcing BTC's position as an essential asset in the global financial landscape.

Bitcoin shatters a new historical record of over $109,000, rekindling investor enthusiasm. This unprecedented peak marks a victory against geopolitical uncertainties, revealing the resilience and growing attractiveness of crypto in a rapidly changing financial world.

A new record is in the works for bitcoin. Good news from the US is piling up and even better news is on the way soon.

The world of traditional finance has just experienced a decisive turning point. Jamie Dimon, one of the most vocal critics of bitcoin, has finally capitulated. This spectacular turnaround by the CEO of JPMorgan Chase signifies much more than just a change in business strategy: it is the entire financial establishment that is reluctantly acknowledging the growing legitimacy of Satoshi Nakamoto's invention.

Bitcoin surpassed the symbolic threshold of 107,500 dollars yesterday, nearing its historical record at just 2% off the peak. Despite a dip to 106,200 dollars today, the queen of cryptos still shows remarkable health. This outstanding performance continues to be fueled by a massive influx of institutional capital and an overall euphoric market sentiment. Will the psychological barrier of 110,000 dollars be crossed this week?

Open interest in bitcoin reaches a record $72 billion. Discover how this could propel BTC to new heights.

Bitcoin takes a decisive step: states are increasing their exposure via Strategy, circumventing regulatory barriers. This growing institutional adoption fuels the projection of a bitcoin at 500,000 dollars by 2029, heralding a major revolution for financial markets and the role of BTC in the global economy.

Bitcoin moves forward, stumbles at times, but never fails to intrigue. Today, Jack Dorsey, co-founder of Block, challenges a belief set in stone for 15 years: the place of satoshis. Supporting the controversial BIP 177, he aims to rename the smallest unit of bitcoin and abolish the endless decimals forever. The goal: to make crypto payments as intuitive as a tap on a smartphone.

The Chinese printer manufacturer Procolored has allegedly distributed drivers infected with malware that steals Bitcoin. This information was reported this week by the press in the Asian country and indicates that 9.3 BTC were stolen. The manufacturer stated that it has removed the infected drivers, but they were made available for global download. This issue is said to have been discovered through the insistence of a YouTuber.

Bitcoin could surpass $110,000 this week, propelled by several key signals indicating a rapid increase. This crucial threshold rekindles hopes and tensions, where every movement from investors will determine whether the market soars or experiences a sharp decline. Is a new ATH underway for BTC?