While Bitcoin, the most emblematic of cryptocurrencies, is experiencing a period of relative calm in the media, memecoins are emerging as true stars of the moment. A drastic drop in Google search volumes for Bitcoin reflects this unexpected dynamic. Meanwhile, memecoins, driven by platforms like Solana and Tron, are attracting unprecedented attention. Is this shift indicative of a lasting change or merely a passing situation?

Theme Bitcoin (BTC)

After a period of relative stability, Bitcoin awoke with a bang, crossing the $64,000 mark and triggering a wave of liquidations in its wake. This sudden movement hit traders who had bet on a market decline hard, causing short position liquidations exceeding $100 million. For many observers, this unexpected rise…

The era of secure cryptography may well be living its last days. Chinese researchers, using the capabilities of a quantum computer produced by D-Wave Systems, have recently reached a milestone: for the first time, a quantum computer has concretely threatened current encryption systems. Could the global crypto-system be shaken on…

This week, the price of bitcoin could experience a significant increase due to several major economic and geopolitical events. Here are the four main factors to watch to understand why bitcoin might explode in the coming days.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

When Bitcoin rises, traders tremble: the golden beast ascends, but the shadow of the bears is never far away.

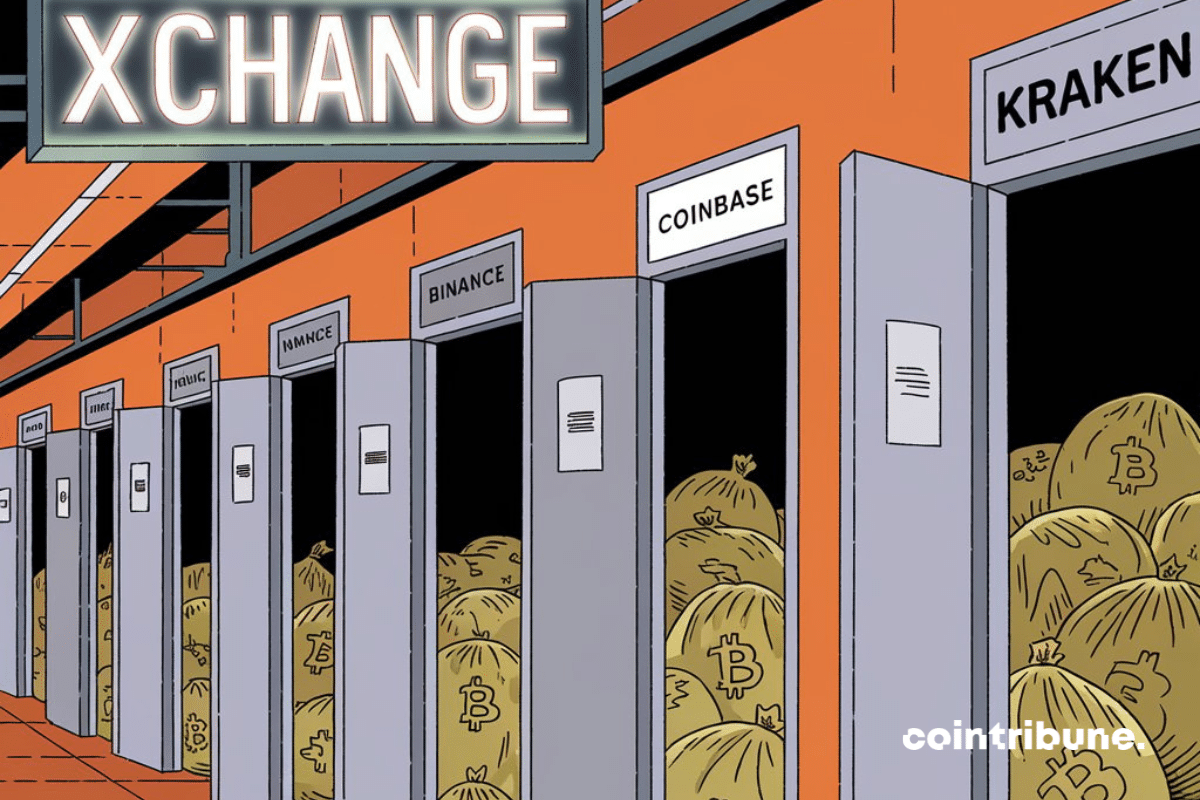

Traders are leaving exchanges: Bitcoin now prefers the calm of a cozy wallet to the stress of turbulent markets.

Craig Wright, the self-proclaimed Satoshi Nakamoto, is intensifying his legal battle against the Bitcoin ecosystem. Despite a crushing defeat in British courts, Wright is launching a new showdown against the developers of Bitcoin Core, demanding an astronomical sum exceeding one trillion for the alleged unauthorized use of the $BTC ticker.

October starts on a lukewarm note for bitcoin, which, at $63,110, struggles to initiate the much-anticipated “Uptober” rally. Yet, despite this calm, bullish prospects are not lacking. Indeed, macroeconomic factors and market trends suggest that bitcoin could hold surprises for investors this month. Let’s explore the five reasons why October…

The Bitcoin bull cycle is still ongoing and the crypto queen is expected to experience a sustainable explosion in 2025!

Since 2020, Michael Saylor, founder and executive chairman of MicroStrategy, has transformed his company into a Bitcoin pioneer, accumulating more than 252,000 BTC. Now, he sees an even bigger opportunity. During a recent presentation to Bernstein analysts, Saylor unveiled his ultimate project: turning MicroStrategy into a “Bitcoin bank” worth a…

Innovations in artificial intelligence continue to astonish, but not all serve noble intentions. This October, the cybersecurity company Cato Networks reveals an AI tool named ProKYC, designed to bypass KYC (Know Your Customer) security measures in cryptocurrency exchanges. This tool opens the door to new forms of fraud, at the…

As inflation runs rampant, USDT trots in as a savior! Tether, proud of its stablecoin, is preparing a tribute film.

The Bitcoin network has recently reached a historic milestone by achieving a new record! This impressive milestone was achieved on October 10, 2024, despite ongoing challenges in the market.

Millennials? Always fully invested in crypto, treating themselves to a little ETF to cushion the digital shocks!

The crypto market is going through a turbulent period. Bitcoin is teetering below the $61,000 mark, sowing panic among individual investors. However, far from being intimidated, giants like BlackRock and Metaplanet are showing opportunism. Taking advantage of this decline, they are strengthening their positions and once again highlighting their confidence…

Inflation, often seen as one of the important economic indicators, shapes the trajectory of global financial markets. This time, the new data on inflation in the United States reveals a potentially crucial change for the crypto sector, and in particular for Bitcoin.

The announcement of the nominees for the 2024 Nobel Peace Prize has sent shockwaves: Julian Assange, the controversial founder of WikiLeaks, is among the favorites. His atypical journey, combining investigative journalism and Bitcoin, could very well appeal to the Norwegian committee.

The Bitcoin market is in perpetual flux, influenced both by external events and the silent movements of large whales. These historical investors, holding vast amounts of Bitcoin for over seven years, play a decisive role in market fluctuations. Yet, according to an analysis by CryptoQuant, these whales remain strangely inactive, casting a veil of uncertainty over the direction the market might take in the coming months.

The Bitcoin network is currently facing a quiet but serious threat. Approximately 13% of the nodes that maintain and secure the blockchain are vulnerable to a critical flaw that could cause them to fail. This vulnerability, identified in May 2023, still persists on several nodes that have not yet been updated with the latest version of the Bitcoin Core software. While Bitcoin's security is often touted for its robustness, this issue reveals systemic flaws related to the management of essential software for the proper functioning of the network.

drop in price below the symbolic level of 50,000 dollars. This worrying outlook can be explained by evolving liquidity conditions and concerning technical signals.

The president of the SEC remains skeptical about the widespread adoption of crypto as a means of payment, despite their growing popularity.

October 2024 is currently marked by notable declines in the crypto market. Investors, very concerned, are wondering if Uptober will ultimately take place, or if they should already consider other solutions. In any case, the analysis of this week 41 of 2024 will allow them to position themselves and make informed decisions for the end of the year.

A wave of massive ETH sales from the PlusToken affair, an old Ponzi scheme that wreaked havoc in 2019, is bringing back ghosts from the past. This situation, reminiscent of the events of 2021, is putting pressure on the price of Bitcoin and causing panic among some investors.

Bitcoin is soaring, but Wall Street is snoozing. While Americans are counting sheep, Asians are driving up BTC!

Vitalik, the teenager who tinkered with Ethereum in his garage, on his way to a Nobel Prize? Just need to put on the tie!

On Polymarket, it’s 12.7% that take the prize… the others remain in "dreamer" mode with their Bitcoins.

The identity of Satoshi Nakamoto intrigues the world. This anonymous creator of Bitcoin, revolutionary in his time, is at the center of many speculations, but no one has ever been able to lift the veil on his identity… until today. HBO, with its documentary Money Electric: The Bitcoin Mystery, has…

After showing signs of recovery in September, Bitcoin starts October on a downtrend. Let’s analyze the future prospects of BTC price together. Bitcoin (BTC) Price Situation After reaching a peak at $65,000, Bitcoin plunged again below $60,000 and then reached $52,500. It is from this price level that the cryptocurrency…

As the year 2025 looms on the horizon, crypto investors are closely monitoring the forecasts from major financial institutions. The report from Standard Chartered could well redefine market expectations. Indeed, the British bank anticipates a major upheaval among the leading cryptos, with Solana (SOL) potentially surpassing Ethereum (ETH) and even Bitcoin (BTC), should Donald Trump be re-elected as President of the United States. Beyond the usual fluctuations, it is the correlation between American economic policies and the evolution of cryptocurrencies that is highlighted.