In an ecosystem where every decision by crypto leaders reshapes market balance, Tether showcases its ambitions. From the Bitcoin 2025 stage in Las Vegas, Paolo Ardoino revealed that the issuer of USDT holds more than 100,000 bitcoins and 50 tons of gold. It is no longer just a stablecoin company: it is a strategic asset player. By unveiling these reserves, Tether not only reassures but asserts its role in the new global financial architecture.

Theme Bitcoin (BTC)

Interest rates are raising concerns. François Bayrou warns that the topics of pensions and debt will need to be revisited. New generations would do well to turn to bitcoin...

BlackRock shatters all records with its Bitcoin ETF IBIT: over 6.2 billion dollars invested in one month! Discover how this phenomenon could transform Bitcoin and disrupt the crypto market.

While the crypto market is buoyed by a bullish cycle, a silent shift is taking place: Ethereum appears to be gaining ground against a slowing Bitcoin. Driven by clear institutional signals and a more favorable yield mechanism, the momentum of ETH is no longer just a market rotation, but a structural repositioning. This potential reversal of hierarchy, supported by concrete indicators, is reshaping the power dynamics within the crypto ecosystem.

"Ledger sorts its Visa crypto card in the USA with Bitcoin cashback. Discover all the details in this article."

Large and small cryptocurrency wallets were making massive profits with Bitcoin and at least five high-cap altcoins on Wednesday afternoon (28). This was indicated by a mapping from Santiment, highlighting the "zero-sum game" of cryptocurrencies due to the profit-taking potential of these packed sardines and whales. In another post, the on-chain monitoring platform suggested that cryptocurrency investors need to be cautious with the ebb and flow of Donald Trump's narratives. According to Santiment's analysis, those who bet against the President of the United States in recent months have fared well.

The European crypto landscape has just undergone a strategic turning point: Bybit, one of the global heavyweights in exchange platforms, has secured the valuable MiCA license in Austria and has established its European headquarters in Vienna. This is a dual-impact operation, both regulatory and geopolitical, which opens the doors of a market of nearly 500 million Europeans to Bybit. A bold maneuver at a critical moment for the global crypto industry.

While financial giants tread cautiously in the realm of cryptocurrencies, Paris Saint-Germain creates a surprise by incorporating bitcoin into its cash reserves. This bold choice goes beyond a mere branding operation. It marks a turning point in the way cryptocurrencies are perceived outside the financial sector. By positioning itself as a pioneer in the professional sports world, PSG illustrates the gradual extension of bitcoin into unexpected spheres and confirms its increasing foothold in institutional strategies.

The debate between gold and bitcoin is no longer theoretical. It is now decided by those who shape global markets. At the Bitcoin 2025 conference, BlackRock made an impression. Its message: the future is digital. And bitcoin now has the upper hand.

Slowly but surely, the power is preparing minds for the end of cash. Fortunately, there will always be bitcoin.

Bitcoin never sleeps. While attention is focused on ETFs and geopolitical debates, a silent yet consequential activity is unfolding behind the scenes: former holders of BTC, long silent, are reappearing on the radar. Since February, over $4.02 billion in bitcoins have been spent, a signal as intriguing as it is concerning. Far from a mere detail, this massive movement of funds reveals an ongoing tectonic shift in the Bitcoin ecosystem.

Pakistan reverses course: after shunning crypto, it now acquires a nice treasure of bitcoin. We await the IMF's reaction, not sure it will be gentle.

Adam Back sees Donald Trump as a catalyst for the adoption of bitcoin. We provide all the details in this article!

Not seen Trump, but his pro-bitcoin envoys proclaimed in Vegas: America wants to mine, regulate, and dominate the crypto-world, while Beijing tightens the screws.

May 2025 will go down in history: Bitcoin has surpassed 111,970 dollars, an unprecedented peak that electrifies the market. However, behind the euphoria, analysts are tempering expectations. This surge comes on the eve of a historically fragile third quarter for the asset. Amid speculative excitement and signs of consolidation, uncertainty grips investors. Should this be viewed as the beginning of a new cycle or the start of a strategic pullback? Doubt settles in, fueled by lessons from the past and upcoming tensions.

GameStop is betting big on Bitcoin: $513 million invested to revive its future. Discover how this bold gamble could revolutionize retail and shake up the crypto world. Ready to understand this revolution?

The former chief economist of the IMF, Kenneth Rogoff, accuses Bitcoin of contributing to the de-dollarization movement of the economy and weakening the supremacy of the dollar.

The symbolic surpassing of $100,000 by Bitcoin has pushed the total capitalization of crypto-assets beyond €3 trillion. Fueled by this momentum, the neobank bunq has launched bunq Crypto, a crypto tab alongside regular checking accounts. The service has been available since April 29, 2025, in six European countries (France, Ireland, Netherlands, Spain, Italy, and Belgium), with Germany set to follow later in the year.

Christine Lagarde dreams of a digital euro supplanting the dollar in global exchange reserves. The United States, on the other hand, is betting on bitcoin.

The announcement had the effect of a shockwave: Donald Trump gives his full support to the Bitcoin Act, an ambitious bill planning for the purchase of one million bitcoins by the U.S. government. Far from the usual controversies, this initiative marks a decisive turning point in the country’s economic strategy, with profound geopolitical implications.

Bitcoin: historically low fees while the price hovers around $109,430! Is this the beginning of a new bullish cycle? Analysis.

Is El Salvador stopping its bitcoin hunt? The IMF confirms the stability of reserves, but Nayib Bukele is playing hide and seek with his crypto ambitions. What will happen next?

After reaching a new historic peak, Bitcoin is entering a slight stabilization phase. Discover our complete technical analysis and the scenarios to watch for BTC.

Trump, the king of communication, denies a crypto fundraising. Fake news or a bluff? The behind-the-scenes of a series where nothing is really certain.

The price of Bitcoin is reaching historic peaks, but the interest it generates has never been so divisive. While some see it as a final opportunity, others question the relevance of an investment at this stage. This year, signals from financial institutions, influential investors, and the markets themselves are fueling a strategic debate: should we still buy Bitcoin, or has that train already left?

The wind is blowing strong in the crypto market, and Blockchain Group has just poured digital oil into it. The French company listed in Paris has raised no less than 72 million dollars to acquire nearly 590 new Bitcoins. A bold, frontal move, and especially unprecedented in France. While others talk about diversification, Blockchain is buying the future at face value.

How long will Japan be able to absorb the surge in borrowing rates without resorting to printing money?

Bitcoin is flirting with 110,000 dollars, but intriguing whales are playing their own game. Who will win: the impatient or the strategists? Discover this secret battle where the future of BTC is at stake!

Trump accelerates in crypto: raising $3 billion for bitcoin. Amid scandals and strategy, the Trump saga in blockchain continues to shake Washington.

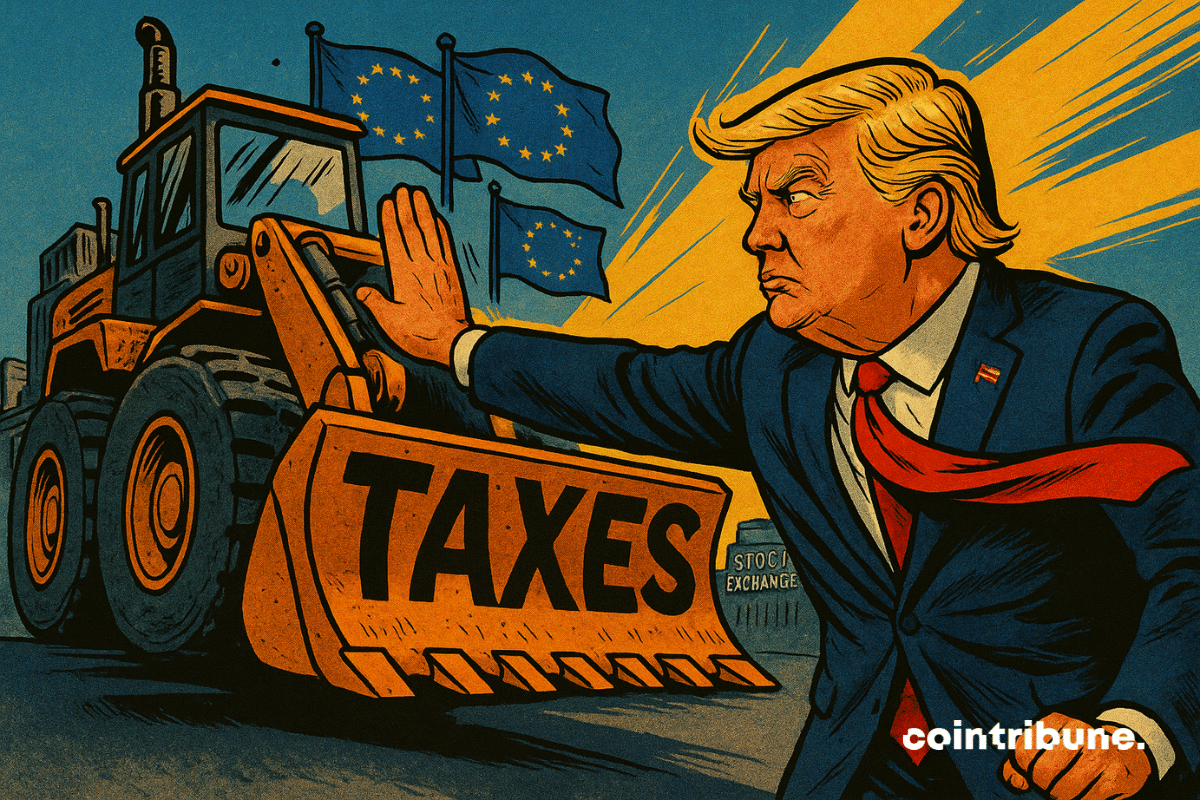

Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?