Crypto ETFs blocked, Trump put on hold, and the SEC playing for time: behind regulatory delays, a strange political ballet resembling regulatory poker.

Theme Bitcoin (BTC)

A solo Bitcoin mining success earned an independent miner $365,000 from block number 910,440.

Google took a 14% stake in the bitcoin mining company, TeraWulf. This operation follows an increase in its financial commitment in a colocation agreement with Fluidstack. Thanks to this move, the tech giant becomes the main shareholder of TeraWulf and thus strengthens the credibility of its model between crypto and high-performance hosting.

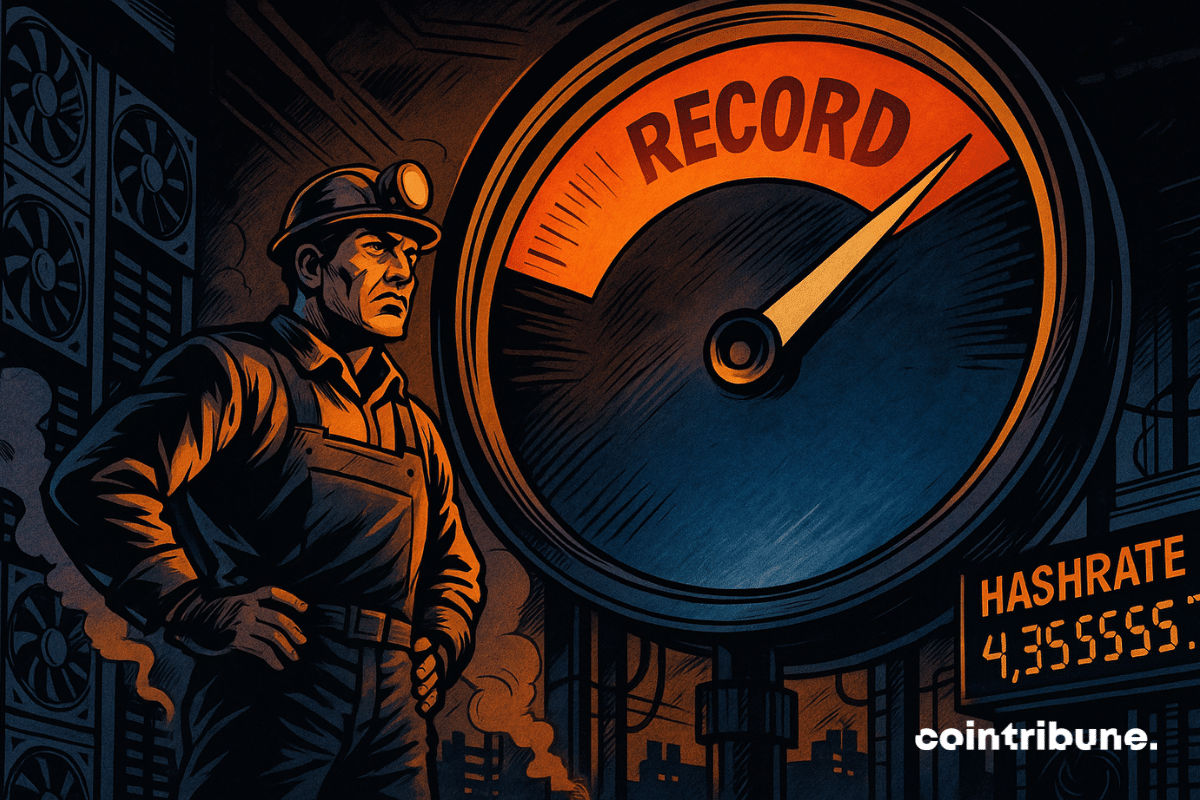

While mining profitability erodes and hashprice declines, the Bitcoin network records an unprecedented power rebound. On August 18, the hashrate climbed to 966 EH/s, nearing a historic peak, despite nearly zero transaction fees and growing economic pressure on mining companies. This striking contrast between economic tension and technical robustness raises questions: how does the mining ecosystem manage to maintain, or even strengthen, its security in such an unfavorable context?

After weeks of bullish euphoria, the crypto market violently corrected, revealing an underlying tension ignored for too long. In just 24 hours, over 500 million dollars of long positions were liquidated, dragging down bitcoin, Ethereum, and XRP in their fall. This brutal wave revealed the fragility of a market fueled by leverage, where technical indicators, sidelined by optimism, suddenly regain all their importance. A return to reality is necessary for investors.

Bitcoin in free fall, "hidden hands" at work, and the Fed lying in ambush: who is manipulating the market while traders play prophets?

The crypto market remains paradoxical. While Ether records a sharp drop of nearly 6% in a single session, ETFs linked to the world's second largest crypto continue to capture record volumes and inflows. A contradictory dynamic that illustrates the growing maturity of institutional investors: short-term corrections are no longer enough to slow the rush towards financial products backed by Ethereum.

Bitcoin giant Strategy has added another 430 BTC to its balance sheet, according to a fresh SEC filing. The company spent $51.4 million at an average price of $119,666 per coin, raising its total holdings to 629,376 BTC, worth more than $72 billion at current market prices.

The broader crypto market took a tumble overnight, sending top assets including Bitcoin (BTC) and Ethereum (ETH) below key price levels. Market observation tools have linked this sudden price action to profit-taking activities by large asset holders.

What if bitcoin exploded to $280,000 by the end of 2025? This is not just another rumor, but the projection of a respected trading veteran in traditional circles. Peter Brandt, a prominent figure in financial markets for over 40 years, supports a chart model that is making a big noise in the crypto sphere. Built on the analysis of historical cycles, this scenario anticipates a new peak for bitcoin… well beyond current expectations. A forecast that reignites debates as a key market moment approaches.

Jack Dorsey revives Satoshi Nakamoto's vision: making bitcoin a universal currency for exchange. Faced with speculation and financial markets, can it become everyday money?

Ethereum is soaring, ETFs are rushing in, but beware of overflow: exchange platforms are filling up and ether heats up faster than an insomniac trader's coffee.

Bitcoin is showing signs of slowing momentum. BTC trading volume fell by 28% this week, even as the price climbed modestly to around $117,582. Is capital quietly rotating into altcoins?

Bitcoin wavers below 117,000 dollars as the "Ghost Month" threatens to lead to a drop to 100,000. Between sustained demand in the United States and Korea, and seasonal pressures, the market plays a decisive game.

The crypto market is coming out of its lethargy: the open interest on Bitcoin futures has just exceeded $82.4 billion, an unprecedented level since speculative euphoria phases. While BTC's price remains stable, derivatives are experiencing a clear resurgence in activity. This dynamic, driven by institutional investors and rising leverage, could mark a turning point. Rising futures, options in frenzy: signals are multiplying, and the market seems to be preparing for a new cycle.

The bullish momentum of bitcoin seems to be fading. After reaching a peak above $124,000, the leading cryptocurrency shows signs of fatigue. Meanwhile, retail investor interest is shifting towards altcoins and Ethereum. Could this capital rotation signal a new phase in the crypto cycle?

Gemini, the exchange founded by the Winklevoss brothers, has officially filed its S-1 with the SEC for a Nasdaq IPO. In a context marked by the multiplication of crypto IPOs, this initiative raises as much enthusiasm as questions. The platform's repeated losses and the market's persistent volatility indeed call for a thorough analysis. Will Gemini manage to attract Wall Street despite disappointing financial results?

Less than 48 hours after hovering near a peak at 124,000 dollars, bitcoin falls below 117,000 while ether drops to 4,400. This brutal but seemingly classic correction exposed a weak link in the ecosystem: publicly traded companies exposed to cryptos. Thus, this segment long supported by bullish euphoria takes the reversal full on. The market, meanwhile, reminds that it never rewards excess for long.

When energy-hungry AI comes to steal the watts from bitcoin, things heat up in data centers! And the miners, they dig... to stay connected.

On August 14, ambiguous remarks by Secretary Scott Bessent triggered a mini-crash, wiping out tens of billions of dollars in capitalization within minutes. While investors feared an official renouncement of any BTC acquisition, a backpedal published on the X platform a few hours later sowed even more confusion about the real strategy of the United States.

This week, the cryptocurrency market was marked by new records and the spectacular rise of certain assets. ADA, the native token of the Cardano blockchain, stood out with a notable performance, exceeding the dollar threshold for the first time in five months.

Citigroup bank, once hesitant, now wants to keep your crypto like you keep gold bars: stablecoins in the vault, ETFs in the pocket, all under Washington's watchful eye.

The crypto market has just suffered one of its most significant setbacks of the year. In a few hours, bitcoin lost over $5,000, causing a widespread rout among other assets. Indeed, the release of a US Producer Price Index (PPI) well beyond expectations rekindles the specter of persistent inflation. This statistic, which surprises both Wall Street and the crypto ecosystem, upends monetary policy expectations and triggers a cascade of liquidations on leveraged positions, increasing downward pressure.

Bitcoin reached a historic peak before dropping sharply. Is this the beginning of the end for BTC or just a temporary correction? Discover the reasons behind this downward trajectory and what investors should watch for.

Bitcoin drops below $120,000 following Scott Bessent's statements. What should be expected from the market in the coming days?

Trump draws a line under Bitcoin purchase by the United States. Bitcoiners will have to settle for legal seizures. A decision that causes crypto to plunge and leaves the economy in suspense.

The appetite of large institutions for Bitcoin remains intact, but it often manifests where it is least expected. In 2025, the Norwegian sovereign wealth fund, a major player in public asset management, has nearly tripled its indirect exposure to the leading cryptocurrency. No direct BTC purchases are planned, but a well-thought-out strategy allows it to establish a solid foothold in the crypto ecosystem.

In a now structured market, each bitcoin record acts as a revealer of the deep tensions crossing the ecosystem: shortage of supply, institutional pressure and shifting macroeconomic climate. On August 14, by breaking 123,500 dollars, bitcoin not only broke its previous high. It confirmed the entrance into a new maturity phase, fueled by precise technical and financial dynamics. This movement is neither fortuitous nor purely speculative, but the product of a structured sequence of converging signals.

Crypto-focused funds are leading U.S. ETF launches, with Ethereum and Bitcoin attracting record inflows and growing investor interest.

In a few days, one of the key indicators of the robustness of the Bitcoin network experienced a striking turnaround. On August 8, the hashrate reached a historic peak before declining sharply, a sign of a sudden adjustment in the computing power mobilized to secure the blockchain. This reversal, occurring while BTC still hovers near its annual highs, rekindles debates on the balance between technical performance and economic constraints for mining specialists.