Fitch has downgraded France's sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

Theme Bitcoin (BTC)

Standard Chartered sounds the alarm: crypto treasury companies, built around the accumulation of Bitcoin, Ethereum, and Solana, face a major crisis. The collapse of the mNAV weakens their business models and signals a consolidation phase where only the strongest players will be able to continue growing.

U.S. spot Bitcoin exchange-traded funds (ETFs) are flying high at the moment, pulling in investments totaling $2.3 billion over the past week. Following a five-day inflow streak from September 8 to September 12, BTC investment vehicles recorded their best weekly outing in the past three months.

PayPal plays the magician: a simple link, and hop, your cryptos fly by SMS. But behind the sparkling innovation, who really holds the strings of your digital payments?

Bitcoin wavers, whales sell, Wall Street sulks... and Strategy laughs. The former MicroStrategy continues to fill its vaults, defying volatility and skeptics of a crypto market that is always surprising.

Large Bitcoin holders have resumed selling after a brief price surge, while long-dormant wallets reactivate and ETFs boost demand.

Wednesday, bitcoin is at stake: between the Fed's boost, the 117,000 $ wall and hungry whales, guaranteed suspense for the crypto market star.

Ethereum’s ETH/BTC ratio remains under 0.05 as the cryptocurrency navigates price swings, investor activity, and market trends.

According to the latest on-chain data, 92% of the bitcoin supply is now in profit. A figure that attests to the strength of the market... but also marks a potentially delicate turning point. Historically, this level has preceded both rallies and sharp corrections. As euphoria gains ground, several indicators suggest the market could waver.

Capital Group’s crypto investment appears to have paid off, according to recent reports, with its $1 billion Bitcoin-related stock surging by over 400%. The American asset management firm entered the Bitcoin treasury market a few years ago, following significant investments in Metaplanet and Strategy.

While the crypto market stalls, Arthur Hayes tempers the prevailing impatience. The cofounder of BitMEX believes that criticisms directed at bitcoin ignore a fundamental lever: global monetary policy. In a recent interview, he suggests that continued money printing by central banks could extend the crypto bull cycle until 2026. This macroeconomic analysis contrasts with the widespread pessimism and invites investors to reassess their benchmarks.

The co-founders of Glassnode predict a new peak for bitcoin, Ethereum and Solana within a month. This announcement contrasts with the prevailing caution and reignites the debate on the strength of the bullish cycle. Between on-chain data and uncertain macroeconomic context, this projection immediately attracted the attention of investors, dividing the community between hope for an imminent record and fear of excess optimism.

Institutional capital is returning strongly to the crypto market. This week, spot Bitcoin ETFs recorded their highest inflows in two months, pushing the total capitalization beyond 4.1 trillion dollars. Such a symbolic threshold reflects a massive renewed interest in cryptos.

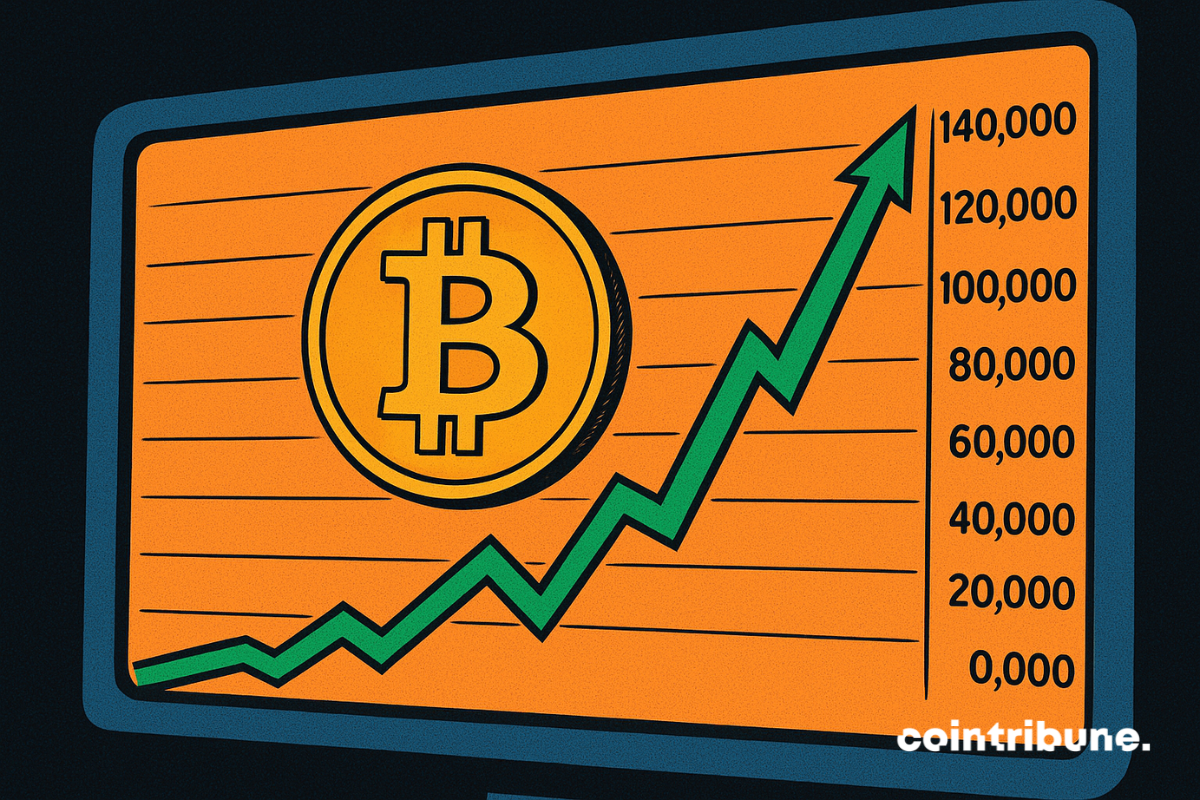

Bitcoin has broken records ten times this year. Spending Christmas closer to 150,000 dollars than to 100,000 dollars is not far-fetched.

Digital repression reaches its limits. In Nepal as in Indonesia, social media censorship has propelled Bitchat, Jack Dorsey’s decentralized application, to the level of a protest tool. Deprived of traditional platforms, thousands of citizens adopt it massively. Like Bitcoin which disrupted finance, Bitchat opens a space for free expression, beyond the reach of States.

This Friday, the bitcoin market faces an extraordinary deadline: $4.3 billion worth of options expire. Such a shift could decide the short-term trajectory of BTC, suspended at the strategic threshold of $113,000. Its crossing or loss could offer buyers an unprecedented leverage... or give control back to sellers.

October 10 could mark a turning point for Solana. Bitwise CIO Matt Hougan sees this deadline as a catalyst comparable to the movements that propelled Bitcoin and Ethereum in recent months. Should we prepare for a "Solana season"?

BlackRock, which has already cashed in with its bitcoin ETF, now dreams of putting its ETFs into blockchain tokens. Markets wonder: digital revolution or financial snake oil?

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

The latest US inflation data propels bitcoin to new heights, but analysts remain divided on the short-term trajectory. The flagship crypto flirts with $115,000 as speculation about a Fed rate cut intensifies. Could a new correction precede the long-awaited surge?

Apple’s iPhone 17, launched this month at a stable $799, is drawing attention for reasons beyond design and performance. For crypto holders, the device has suddenly become far cheaper in digital asset terms. Buyers now need only 0.0072 BTC or 0.1866 ETH to purchase it. That is almost half of what was required for the iPhone 16 a year ago.

S&P 500 rejected Strategy’s inclusion despite its Bitcoin holdings, with JPMorgan calling it a blow to crypto treasuries.

While the Fed blows hot and cold, the whales are dozing off… and here come the stablecoins, discreet stewards of the crypto market, imposing themselves as masters of the party.

The speculative momentum around bitcoin clashes with the reality of markets. Driven by the fervor of records and the unexpected support from Donald Trump, several publicly traded companies that based their financial strategy on accumulating BTC are undergoing a severe correction. Their shares sometimes fall below the value of their crypto holdings, exposing the limits of a model relying almost entirely on bitcoin's volatility.

This Wednesday, the publication of a falling PPI for August immediately revived speculation around a Fed rate cut. Bitcoin gained 0.5% within the hour, driven by this signal perceived as favorable to monetary easing. Approaching the FOMC, investors now scrutinize every economic indicator, aware that the slightest variation can trigger a market repositioning.

More and more businesses are accumulating bitcoins, but also more and more countries. The latest is Kyrgyzstan, a small Central Asian country.

BitMEX research shows BRC-20 tokens dominate Bitcoin activity, while ordinal images shape storage and node performance differently

GameStop's crypto strategy is starting to pay off. The iconic video game retailer, once chronically struggling, has managed to limit its losses in the second quarter of 2024 thanks to a bold decision: to record bitcoin on its balance sheet. A bet that illustrates how the boundary between traditional finance and digital assets is increasingly fading.

A tidal wave of bitcoin is pouring into company treasuries and things finally seem to be clearing up in France.

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.