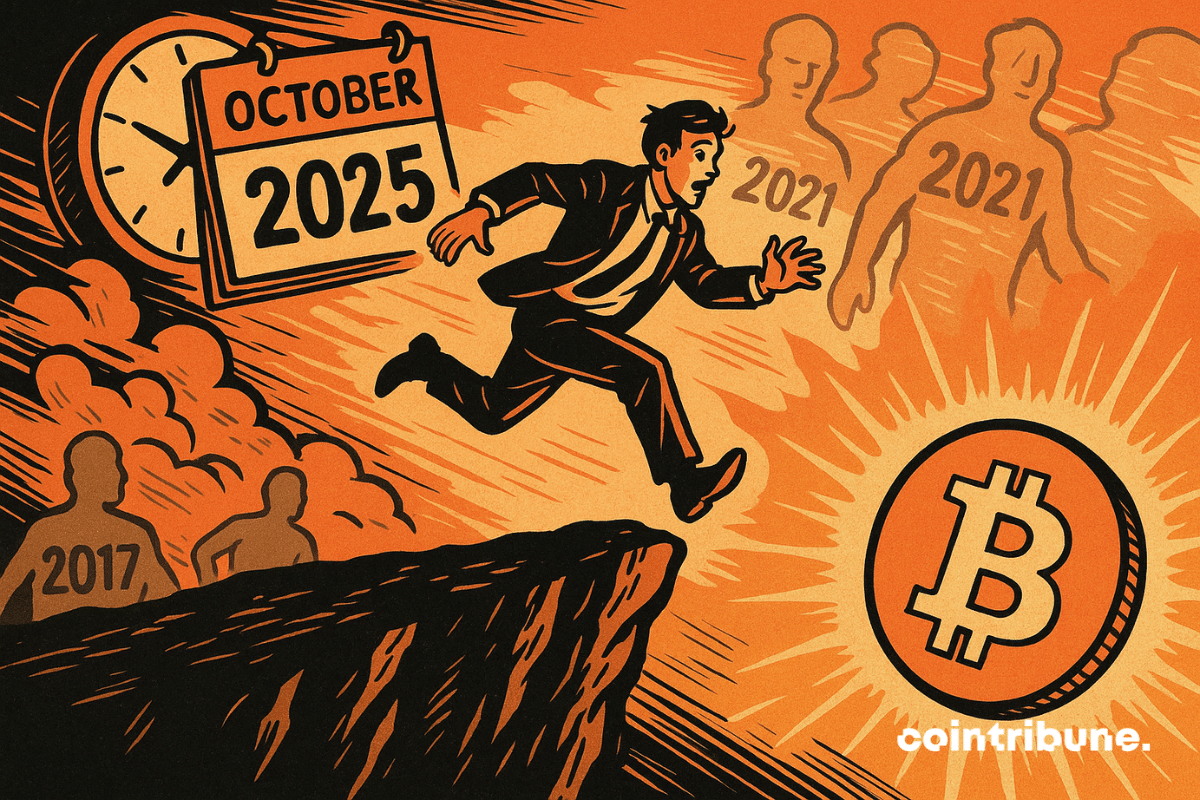

Spot Bitcoin ETFs have just recorded their second-best historical week, with $3.24 billion in net inflows. This spectacular resurgence of interest occurs amidst an still uncertain economic climate, but rekindles hope for a dynamic fourth quarter for the crypto market. Far from a mere rebound, these massive flows reflect a clear reversal in institutional investors’ sentiment, on the eve of an October historically favorable to Bitcoin.

Theme Bitcoin (BTC)

Éric Ciotti triggers a political bomb: what if France mined bitcoin with its nuclear energy? Between energy sovereignty and the battle against the United States, discover how BTC becomes the explosive issue of 2025 – and why it will change everything. #Bitcoin #France #BTC

Strategy Inc. has expanded its Bitcoin holdings to $77.4 billion, reflecting years of strategic accumulation and significant corporate investment.

Amid a budget deadlock in the United States, the crypto market shows an opposite trajectory. In one week, bitcoin appreciated by 14% and approaches its highest historic levels. Meanwhile, the total crypto market capitalization exceeds 4,210 billion dollars. This renewed strength, decoupled from political tensions in Washington, reignites the debate on the growing autonomy of these assets against traditional cycles.

While financial markets waver under the weight of monetary uncertainties and political tensions, a bold projection revives the debate. Bitcoin could reach $135,000, according to Standard Chartered. In a recent note, the British bank disrupts established scenarios by stating that the current market dynamics invalidate historical post-halving patterns. This change of tone, coming from a major player in traditional finance, revitalizes bullish expectations as BTC enters a new phase of acceleration.

Arthur Hayes puts another coin in the machine. This time, his target is not the Fed but the eurozone. And his message is clear: if the ECB falters, Bitcoin benefits.

BlackRock's IBIT Bitcoin ETF has reached a historic milestone by becoming the largest Bitcoin options platform in the world. With 38 billion dollars in open interest, it now surpasses Deribit, the well-known derivatives exchange platform recently acquired by Coinbase.

Coinbase says the corporate crypto treasury market is consolidating, with smaller firms likely to merge or be acquired by larger players.

Bitcoin Reserve: Sweden could join the countries that store crypto to prepare for the monetary future. Details here!

Bitcoin climbs, Wall Street applauds, but the RSI coughs: does too many ETFs kill the ETF? The king asset flirts with euphoria… and traders already feel the chill.

At the beginning of October 2025, Bitcoin (BTC) confirms its resurgence as "digital gold". While the precious metal smashes its records at $3,895 an ounce, BTC soars and smashes through $118,000, rekindling a correlation that could well redefine global investment strategies. After months of divergence, the two assets finally move in concert... But why is this synchronization happening now, and what does it mean for the markets?

When London gets its hands on a treasure in bitcoin, it hesitates: justice for the victims or crypto jackpot for the Treasury? Who benefits from the digital crime?

While the American economy wavers, bitcoin surprises with its unexpected strength. On October 2, the crypto nearly touched 119,451 dollars, reaching its highest level since mid-August. This surge, far from being anecdotal, fits into a tense macroeconomic context, marked by a deterioration in the job market. For investors, economic weaknesses fuel hopes for a monetary shift, giving momentum back to risky assets.

While the American administration is paralyzed by a new shutdown, the queen crypto offers an unexpected rebound, defying the ambient volatility. This gap between political chaos and crypto dynamism raises questions: are we witnessing a lasting shift? In a climate of mistrust towards institutions, decentralized assets could well benefit from this situation.

September was a pivotal month for the crypto ecosystem. Bitcoin declined despite MicroStrategy's continuous accumulation. Meanwhile, stablecoins reached new highs, reinforcing their central role in the markets. Finally, the number of crypto millionaires hit a record, signaling adoption that remains strong.

Strasbourg could soon become the first major French city to adopt a municipal crypto. What was yesterday reserved for Web3 activist circles is now entering the local public debate. The City Council has adopted an unprecedented motion: to study the feasibility of a local digital currency. The goal is to explore new economic, social, and technological avenues. An unprecedented initiative for a major French metropolis, which explores digital levers serving the local economy and citizen participation.

Bitcoin is about to close September with a gain of 4.5%, a rare performance that historically precedes spectacular year-end rallies. On-chain data also confirms increased demand, notably driven by American investors. Will this historic setup be enough to propel BTC to $170,000 by December?

Bitcoin consolidates above 100,000 dollars, driven by institutions and the anticipation of the outcome of the "BITCOIN Act."

Massachusetts lawmakers will soon consider whether the state should create a Bitcoin reserve. A bill introduced earlier this year calls for using state funds and seized crypto assets to build a strategic stockpile. The proposal comes as several U.S. states weigh similar measures, with mixed results across the country.

Bitcoin’s price swings have not deterred Michael Saylor’s Strategy Inc., which continues to increase its position, adding millions in Bitcoin despite market pressures. Strategy remains the largest public holder of the firstborn crypto, and its steady buying strategy keeps drawing attention from both investors and analysts.

As the fourth quarter begins, the specter of a shutdown in the United States worries the markets. If Congress fails to pass a budget extension by this Tuesday at midnight, a large part of the federal administration will stop. This scenario would also disrupt the release of the employment report, a key indicator for anticipating the Fed's decisions. In such a fragile context, the crypto market, especially bitcoin, finds itself on the front line facing a new period of uncertainty.

Most Bitcoin is controlled by a small number of wallets, with experts revealing that just 20,000 addresses hold over 60% of the supply.

Bitcoin hovered around $110,000 on Sunday evening after a turbulent September, with traders weighing ETF outflows, technical support, and macroeconomic pressures. The market has entered consolidation mode, with volatility easing and traders watching for direction. With October approaching, the focus turns to whether “Uptober”—a month often associated with positive crypto momentum—will ignite the next breakout.

After five years of absence on social media, the legendary cypherpunk Nick Szabo returns to the public arena. His intervention comes at a time when Bitcoin Core developers are preparing to deploy a major update, version 30, which already divides the community. Between technical innovation and fear of drift, the battle of ideas is raging.

The crypto market finds bullish momentum again. Some altcoins benefit from massive short covering. Details in this article!

The cryptocurrency market faces renewed pressure, with both Bitcoin and Ethereum testing key support levels after a week of declines. Predictably, this market dip has left traders weighing whether this downturn signals further weakness or a chance to re-enter. Amid the uncertainty, President Donald Trump's son, Eric Trump, has stepped in with a familiar message, urging market participants to “buy the dips.”

The signals have turned red on crypto ETFs. Within a few days, spot products backed by bitcoin and Ethereum recorded net outflows exceeding $1.7 billion, breaking with weeks of positive inflows. This sudden reversal, driven by an unstable macroeconomic climate, reveals a notable shift in institutional positioning on these assets. Such a drop raises questions about the strength of the link between traditional finance and crypto, at a time when uncertainties are mounting.

While bitcoin is going through a consolidation phase around 110,000 dollars, the prevailing euphoria clashes with signals of caution. Analysts believe that the trajectory toward a new ATH will not be linear. Corrections, volatility, and regulatory uncertainty could mark the path. In a market dominated by optimism, some remind that peaks must be earned, and pullbacks are part of the journey.

Bitcoin in full panic, the index collapses... what if the storm was announcing a clearing? While the charts are turning red, some are arming themselves with patience.

Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally.