Bitcoin’s price swings have not deterred Michael Saylor’s Strategy Inc., which continues to increase its position, adding millions in Bitcoin despite market pressures. Strategy remains the largest public holder of the firstborn crypto, and its steady buying strategy keeps drawing attention from both investors and analysts.

Theme Bitcoin (BTC)

As the fourth quarter begins, the specter of a shutdown in the United States worries the markets. If Congress fails to pass a budget extension by this Tuesday at midnight, a large part of the federal administration will stop. This scenario would also disrupt the release of the employment report, a key indicator for anticipating the Fed's decisions. In such a fragile context, the crypto market, especially bitcoin, finds itself on the front line facing a new period of uncertainty.

Most Bitcoin is controlled by a small number of wallets, with experts revealing that just 20,000 addresses hold over 60% of the supply.

Bitcoin hovered around $110,000 on Sunday evening after a turbulent September, with traders weighing ETF outflows, technical support, and macroeconomic pressures. The market has entered consolidation mode, with volatility easing and traders watching for direction. With October approaching, the focus turns to whether “Uptober”—a month often associated with positive crypto momentum—will ignite the next breakout.

After five years of absence on social media, the legendary cypherpunk Nick Szabo returns to the public arena. His intervention comes at a time when Bitcoin Core developers are preparing to deploy a major update, version 30, which already divides the community. Between technical innovation and fear of drift, the battle of ideas is raging.

The crypto market finds bullish momentum again. Some altcoins benefit from massive short covering. Details in this article!

The cryptocurrency market faces renewed pressure, with both Bitcoin and Ethereum testing key support levels after a week of declines. Predictably, this market dip has left traders weighing whether this downturn signals further weakness or a chance to re-enter. Amid the uncertainty, President Donald Trump's son, Eric Trump, has stepped in with a familiar message, urging market participants to “buy the dips.”

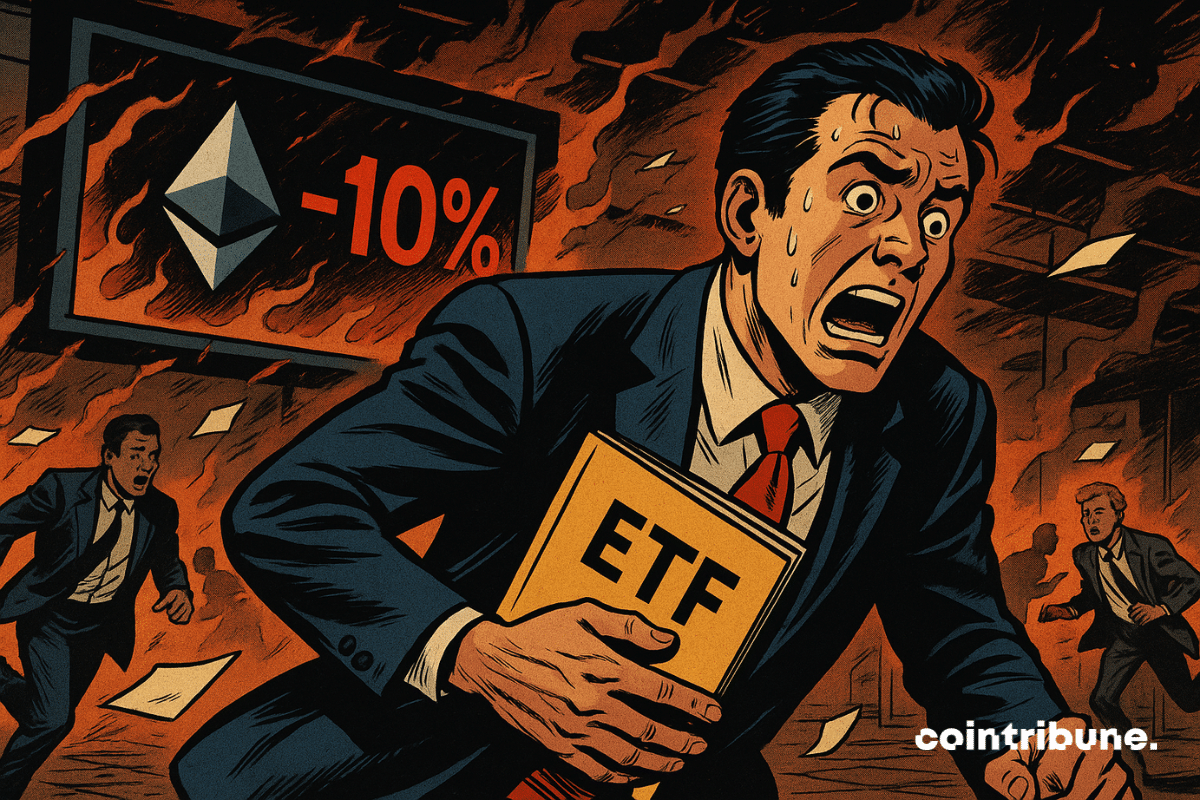

The signals have turned red on crypto ETFs. Within a few days, spot products backed by bitcoin and Ethereum recorded net outflows exceeding $1.7 billion, breaking with weeks of positive inflows. This sudden reversal, driven by an unstable macroeconomic climate, reveals a notable shift in institutional positioning on these assets. Such a drop raises questions about the strength of the link between traditional finance and crypto, at a time when uncertainties are mounting.

While bitcoin is going through a consolidation phase around 110,000 dollars, the prevailing euphoria clashes with signals of caution. Analysts believe that the trajectory toward a new ATH will not be linear. Corrections, volatility, and regulatory uncertainty could mark the path. In a market dominated by optimism, some remind that peaks must be earned, and pullbacks are part of the journey.

Bitcoin in full panic, the index collapses... what if the storm was announcing a clearing? While the charts are turning red, some are arming themselves with patience.

Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally.

Bitcoin derivatives activity remained intense over the weekend, with futures and options showing strong liquidity but mixed sentiment. On Saturday, Bitcoin traded at $109,449, with the $110,000 mark acting as a key zone for both bullish bets and protective hedges. Market signals now point to caution as technicals lean bearish, while futures and options flows reveal deep positioning.

James Wynn, the man who flirted with billions in crypto, now bets on ASTER… An airdrop, a 3x leverage, and a lot of boldness: hold-up or hara-kiri?

Haider Rafique warns that a national Bitcoin reserve could unsettle markets and trigger significant downward pressure on Bitcoin prices.

Deutsche Bank analysts highlight Bitcoin’s growing role alongside gold as a potential asset for central bank reserves and global finance.

While bitcoin establishes itself as a reference asset on a global scale, it is the very architecture of its market that is evolving deeply. Beyond prices and regulatory controversies, a mutation is underway. Indeed, the rise of derivatives, particularly options, is redefining market balances. This often overlooked shift could well mark bitcoin's entry into a new era of maturity and financial integration.

Ethereum shunned, Wall Street panics, BlackRock empties its bags... Crypto smells burnt, but some billionaires seem to sense a good buyout scent. The smell of sales?

What if an overly soft banker awakened the bitcoin beast? Behind the Trumpian nominations, a financial parabola ready to explode… Novogratz lights the fuse, hide the dollars!

Bitcoin’s rally is showing signs of fatigue after a sharp sell-off pushed prices under $109,000. Long-term holders have realized billions in profits while exchange-traded fund inflows slow, raising concerns that the market may be entering a cooling phase similar to past cycle tops.

BlackRock has filed for a new Bitcoin Premium Income ETF designed to generate yield through a covered-call strategy, expanding its crypto offerings.

The U.S. exchange-traded product (ETP) market for digital assets is taking another step forward. With regulators broadening the framework for crypto funds, XRP has now been included in a Nasdaq-listed multi-asset spot crypto ETF, giving investors easier access to a wider set of cryptocurrencies.

Bitcoin briefly plunged below $109,000, recording a three-week low. Hours before the expiration of $22 billion in options scheduled for this Friday, pressure is mounting among investors. In a context of increased volatility and macroeconomic uncertainties, positions are being urgently readjusted. The crypto market is entering a decisive sequence where each level crossed could amplify upcoming movements.

Facing a tense economic context and persistently high rates, some companies are revising their cash management strategies. The latest is the Chinese company Jiuzi Holdings. Listed on Nasdaq but little known to the general public, the Chinese company has just authorized an investment of up to 1 billion dollars in cryptocurrencies. This is an unexpected shift for an actor outside Web3, who is now betting on Bitcoin.

Cryptocurrency activity is growing worldwide, led by the Asia-Pacific region, with Latin America and Africa also seeing notable increases.

Bitcoin, once called a bubble, is now creating millionaires in series: 145,000 in one year. Bankers are grinding their teeth, speculators are popping champagne.

What if bitcoin entered a new era, where scarcity would no longer be a speculative narrative but an accounting reality? Michael Saylor, executive chairman of Strategy, warns of a tipping point: institutional demand, driven by ETFs and listed companies, now exceeds supply from mining. As bitcoin oscillates between $111,000 and $118,000, a structural imbalance, but potentially explosive for the price, is settling in.

Despite leading global crypto transactions, the majority of U.S. investors remain largely uninvolved, with just 14% holding digital assets.

Exit Gensler, here comes Atkins: the SEC shifts from the brake to the accelerator. "Innovation exemption", multi-crypto ETP, stablecoins… Washington finally discovers that blocking costs more than moving forward.

Investors pulled back from Bitcoin and Ethereum ETFs on Monday, reflecting caution amid market shifts and pending economic data.

Bitcoin consolidates around $112,500 after a bounce on support, but fails to regain clear momentum. Discover the technical outlook for BTC's future evolution.