Could bitcoin's four-year cycle be living its last moments? This is the unexpected hypothesis put forward by Grayscale in a report published on Monday. According to the asset manager, the crypto king could break free from its historical mechanics as early as 2026, reaching new heights well before the usual deadline. This major challenge to a pillar of crypto analysis sparks as much hope as questions in a rapidly changing market.

Theme Bitcoin (BTC)

Vanguard, asset management giant, has just shaken up the market by opening its doors to crypto ETFs for its 50 million clients. A decision that could cause Bitcoin to explode and redefine institutional investment. Why this turnaround, and what will be the consequences?

After a month of massive disengagement, crypto investment products record a spectacular comeback. In a single week, crypto ETPs attract 1.07 billion dollars, breaking a series of four consecutive weeks of outflows totaling 5.5 billion $. This renewed interest marks an unexpected turning point in a highly uncertain monetary context, where markets scrutinize Fed signals.

Bitcoin is collapsing, miners are coughing, and some flee to AI: when digital gold turns into an electric burden under maximum stress!

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

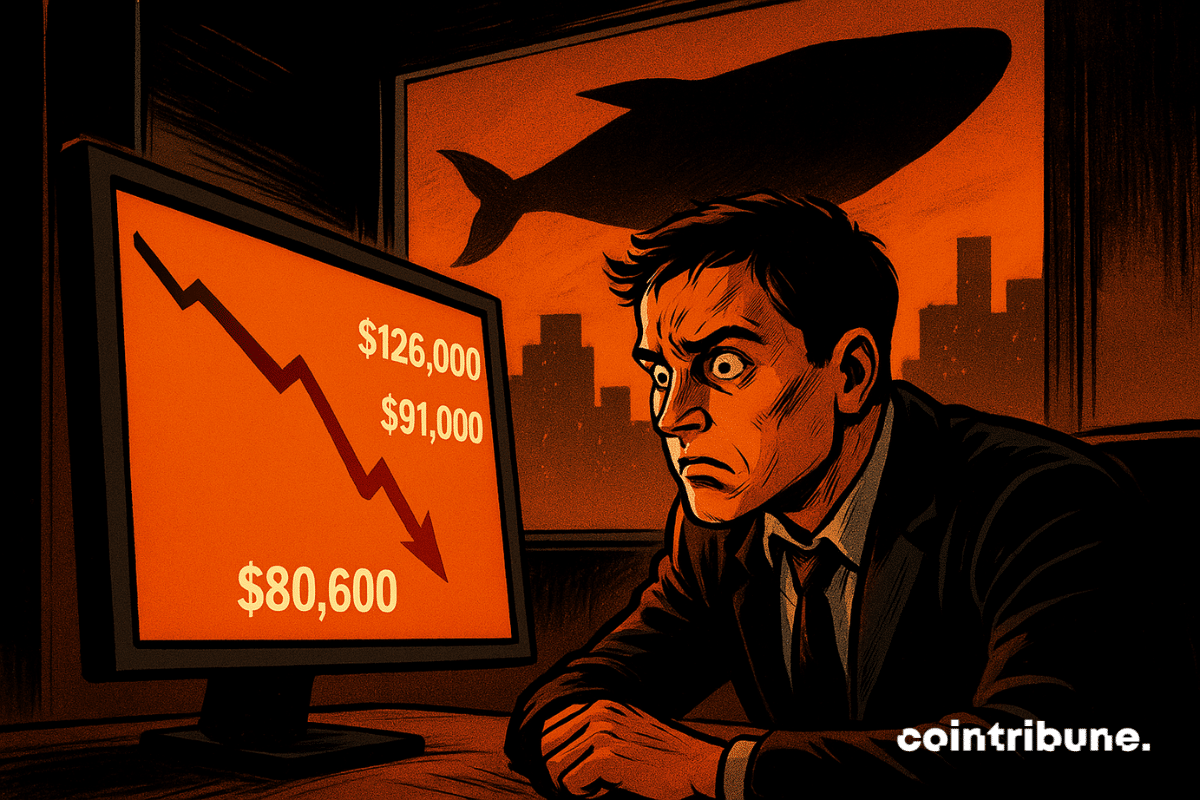

Bitcoin has just crossed a critical threshold by falling below $84,000, plunging investors into uncertainty. This week promises to be decisive for the 2025 year-end closing: rebound or collapse? Analysis of key levels, macroeconomic risks, and opportunities to seize before year-end.

Strategy launches a giant dollar reserve to support its Bitcoin bet. Discover all the details in this article.

David Sacks, a key figure in crypto and Trump advisor, calls the New York Times accusations a pure "nothing burger." Between threats of lawsuits, sharp denials and political stakes, this clash reveals much more than a simple media dispute.

China has just made a big move: the central bank is further tightening its crackdown on crypto and stablecoins, calling them a major threat. Why this radical decision? What impacts for the global market and investors?

Bitcoin ends this year on a familiar note. Down more than 36% from its annual highs, the asset eerily replicates the movements of the 2022 bear market. This correlation alarms analysts as crypto ETFs register positive inflows again. Between the return of institutional capital and memories of a previous crash, the market oscillates between concern and hopes of a rebound.

Bitcoin stumbled into the new month after a sharp weekend drop erased days of calm trading and reignited market-wide fear. Prices plunged without warning on Sunday, triggering heavy liquidations and closing out the asset’s weakest November in years. Traders now question whether the fall signals deeper trouble or a reset that clears the way for a rebound.

Self-custody and financial privacy have returned to the forefront of the U.S. crypto conversation after SEC Commissioner Hester Peirce reaffirmed them as core individual rights. Her remarks come amid regulatory uncertainty, rising ETF adoption, and renewed debate over Bitcoin’s founding principles.

Heavy withdrawals hit BlackRock’s flagship Bitcoin ETF in November, but company executives say the activity reflects normal market behavior, not a shift in long-term sentiment. Momentum from earlier in the year continues to guide the firm’s outlook, supported by the strong demand that once pushed IBIT toward a major milestone.

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

Strategy, the Bitcoin giant will only relinquish its precious reserves under one condition, which one? A condition that may reveal dark days ahead for BTC.

The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

The crypto market gave way under the pressure of its own leverage. In a few days, nearly 8 billion dollars of open interest on Bitcoin futures contracts were liquidated, triggering a brutal purge of speculative positions. Behind this shock, a rebalancing is emerging, suggesting that a stabilization cycle could begin.

While the Bitcoin market remains under pressure, an analyst suggests that the bottom may have been reached. Contrary to the climate of distrust, he envisions a rebound towards 100,000-110,000 dollars, reigniting speculation about a trend reversal. This scenario, based on precise technical indicators, contrasts with the prevailing sluggishness and captures investors' attention.

Solana is booming, but CoinShares is backing down: the ETF leaves the stage before entering. The crypto market, meanwhile, is still applauding... Go figure where the real show is.

After 18 days in the extreme fear zone, the crypto market shows a first sign of relief. The Crypto Fear & Greed Index rises slightly, finally leaving its lowest level. This rebound occurs while November, traditionally favorable to Bitcoin, ends in uncertainty.

Arthur Hayes is stirring debate across the crypto market with sharp criticism of Monad, a new layer-1 chain that launched with significant attention and industry backing. His remarks challenge the project’s early momentum and raise broader questions about high-valuation tokens supported by venture capital.

What if the market was massively wrong about bitcoin? For André Dragosch, head of research at Bitwise Europe, the current context oddly resembles that of March 2020, during the crash caused by the pandemic. In a tense post-halving climate and facing contradictory macroeconomic signals, he believes bitcoin today offers one of its best risk/reward profiles since the health crisis. This statement shakes certainties and reignites the debate on the timing of market entry.

BitMine is drawing fresh attention as its aggressive buying spree in Ethereum continues. New on-chain activity suggests the company may be preparing another significant purchase, prompting traders to watch whether continued accumulation can steady sentiment in an uneven market. Interestingly, BitMine’s recent purchase activity comes amid broad macro pressures that remain a persistent drag on digital assets.

Bitcoin still under $100,000... but the crypto industry is rejoicing. Whales sell, small buyers buy, hopes rise: what if the crypto winter was just an illusion?

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

The imminent launch of a structured product on bitcoin by JPMorgan is causing reactions. For part of the crypto community, this is not just a simple financial innovation, but a targeted offensive against actors like Strategy. As bitcoin gains ground as a reserve asset, the divide between traditional finance and pro-BTC strategies becomes clearer. Behind the apparent neutrality of the markets, some denounce an attempt to influence aimed at weakening the companies most exposed to the asset.

After months of tension, BTC finally crosses $90,000, offering unexpected relief to BlackRock Bitcoin ETF holders. How does this historic rebound redefine the crypto investment landscape? Dive into the analysis of a turnaround that changes everything for institutional and retail investors.

Bitcoin and USDT maintain an inverse relationship that directly influences crypto market movements. According to Glassnode, this negative correlation could well dictate the trends towards the end of 2025. An exclusive analysis that sheds light on investors' strategies and projections for December. Not to be missed.

DeFi is no longer a promise, but a revolution underway. According to Chainlink, it could dominate global finance by 2030—under one condition: regulation. How are institutional funds and stablecoins accelerating this historic adoption? All the answers here.

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.