Bhutan is pushing its digital economy forward by placing portions of its traditional reserves on blockchain infrastructure. As tokenized real-world assets gain momentum, the country is securing an early foothold. The introduction of TER, a gold-backed token from Gelephu Mindfulness City (GMC), strengthens Bhutan’s ongoing blockchain plans.

Theme Bitcoin (BTC)

Wall Street vibrates for a ghost! Satoshi Nakamoto appears at the NYSE… with a statue. From code to statues, bitcoin claims its place in the temple of capitalism.

The $100,000 threshold for bitcoin fascinates as much as it divides. A symbol of global adoption and a completed bull cycle, it remains, approaching the end of the year, a goal that is moving away. On predictive markets, conviction is eroding: bettors no longer believe in it. Between uncertain monetary policy and the exhaustion of bullish flows, the momentum seems suspended. The dominant scenario is no longer the explosion, but waiting. And in this in-between, bitcoin plays a more strategic than euphoric game.

Bitcoin could explode in 2026, according to traders. After the Fed rate cuts, bets focus on ambitious targets: $130,000, even $180,000. Why do experts ignore the "Santa rally" to bet on next year?

Crypto markets have started coughing again. No spectacular crash this time, but a slow loss of breath: crypto trading volumes are declining, prices are correcting, and even spot bitcoin ETFs are turning red. For JPMorgan, the picture is clear: the appetite for risk is fading, and the market stalls just as it was supposed to confirm its strong comeback.

Bitcoin pauses in the balance sheets, but some actors buy more than ever. Here are the numbers worrying analysts.

GameStop is going through a turbulent period after betting heavily on Bitcoin. The video game retailer sees its cryptocurrency holdings shrink by 9.2 million dollars in three months, causing its stock to fall by more than 5%. Faced with this setback, the company is now considering liquidating part of its digital assets.

Michael Saylor’s company, Strategy, is facing growing pressure as it challenges MSCI’s plan to exclude crypto-treasury firms from major stock indexes. Strategy, which holds the world’s largest corporate Bitcoin reserve, warned that the proposal misjudges how digital-asset treasuries operate. More so, the plan risks distorting fair index standards.

Trump’s growing footprint in digital assets now reaches into mobile gaming, as a new Trump-licensed crypto title moves toward release. Early previews show a project that combines light strategy mechanics with token-based rewards. The timing comes as several Trump-linked crypto assets face steep volatility and rising political attention.

Recent trends show large holders holding back and fewer coins hitting exchanges, easing market pressure and pointing to a calmer Bitcoin market in the near term.

American banking giants are now playing the bitcoin card. Michael Saylor lifts the veil on a massive and silent adoption: eight of the ten largest banks offer loans secured in BTC. Figures, players, and stakes of a revolution that is disrupting finance.

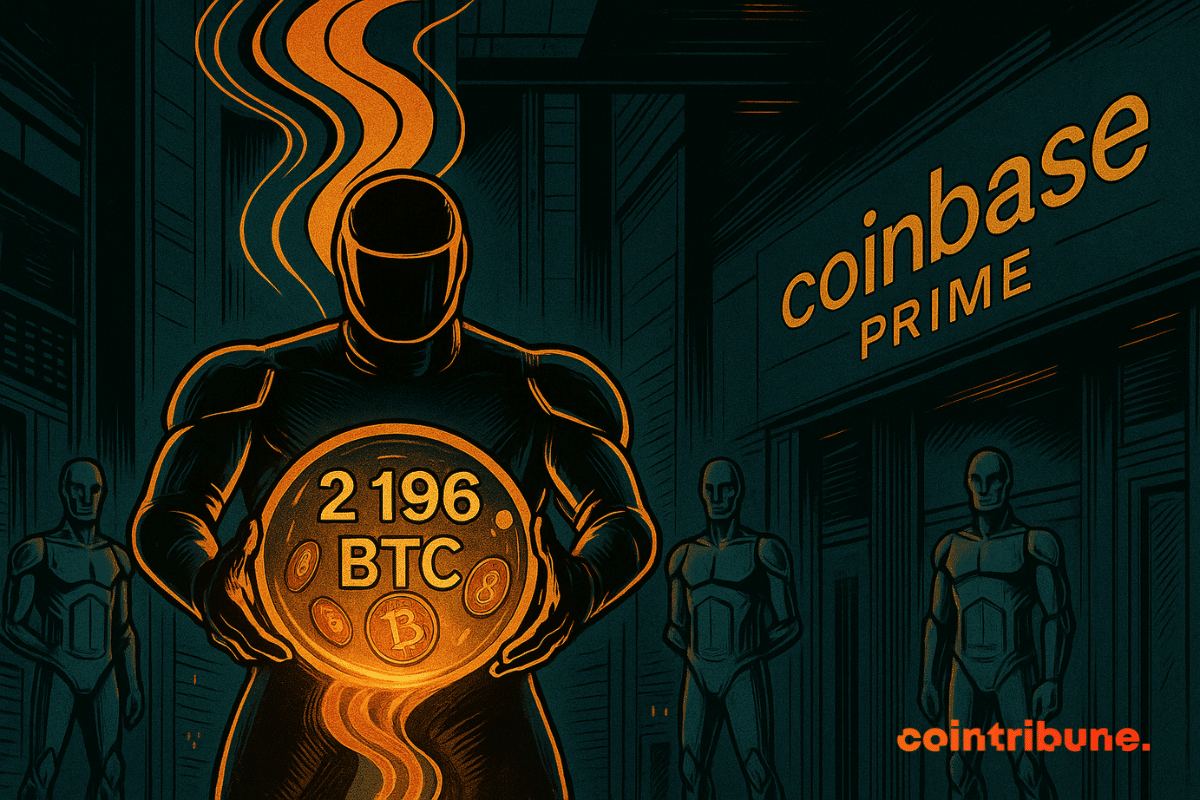

BlackRock transfers 2,196 BTC to Coinbase Prime. A decision that could shake the Bitcoin market. Details here!

SpaceX has just transferred 94 million dollars in bitcoin, according to on-chain data analyzed by Arkham Intelligence. These movements are part of a series of regular transfers observed over the past two months, after several years of inactivity. They occur as information points to a possible IPO of the company in 2026, with a valuation that could reach 1.5 trillion dollars. This coincidence raises questions about SpaceX's financial strategy and the role bitcoin could play in it.

Crypto is shaking up the rules of the financial game. With a bold decision, the CFTC opens a breach that could change everything. Is traditional finance in danger? Who will come out victorious in this battle? Discover an exclusive analysis of the issues and prospects.

Bitcoin is playing roller coasters: Powell sneezes, whales wave their fins, and traders shout "to the moon"... or crash. The economy, meanwhile, is tense.

On the eve of a decisive Fed meeting, Bitcoin surprises by crossing the $94,000 mark, a symbolic threshold that reignites the debate over a possible bullish comeback. This rebound occurs after several days of hesitation and in a climate of macroeconomic tension, where markets scrutinize the slightest monetary signal. Between technical rebound and investor caution, the crypto market is stirring but remains suspended to the FOMC announcements.

Is bitcoin shaking in the face of the Japanese rate hike? While markets fear a return of "yen carry trade," experts reveal why this threat is overestimated — and where the real dangers for BTC lie.

Dogecoin struggles to convince institutional investors. Despite a strong capitalization and a media-covered launch, crypto-backed ETFs show volumes in free fall. In a sector where Bitcoin and Ethereum concentrate the bulk of flows, the disinterest in DOGE illustrates the limits of assets perceived as too speculative.

Bitcoin is soaring, Binance is struggling, shrimps flee, whales dance… and ETFs scoop up the stakes. Here's a crypto-comedy that would be funny if it weren't so serious.

Bitcoin stays over 90,000 dollars after a volatile weekend, with traders watching key levels and the Fed meeting to gauge whether momentum can return.

Bitcoin slipped below $90,000 at Wall Street's opening, wiping out gains made in Asia. This reversal comes despite signs of accumulation on exchanges, revealing a gap between short-term moves and a long-term holding trend. Selling pressure temporarily takes over in a market still torn between speculation and conservation strategy.

The United States takes a decisive step in integrating cryptos into the traditional financial system. Caroline Pham, acting chair of the CFTC, has just authorized the use of bitcoin, Ethereum, and USDC as collateral in the U.S. derivatives markets. A decision that could well redefine the rules of the game.

What if bitcoin became the foundation of the future global banking system? Michael Saylor, executive chairman of Strategy, now urges nation-states to create digital banks backed by bitcoin. Far from an isolated provocation, this proposal fits into a climate of financial market shifts, marked by growing distrust of traditional banks and a global search for more profitable and resilient solutions against economic uncertainties.

While bitcoin hovers around $91,000 after its October peak, Strategy surprises the markets with a massive purchase of over 10,000 BTC. This billion-dollar bet, amid a prolonged downturn, reignites debates on the viability of the "Bitcoin treasury" model. The move fascinates as much as it worries: should it be seen as a strategic conviction or a major financial risk for an already pressured company?

These companies thought they were riding the bitcoin wave, but they are drowning in their own debts. The crypto king is nosediving, and the kings of leverage are getting slapped.

Ether has entered an important phase as exchange balances drop to their lowest level in nearly ten years. Supply continues moving into staking and long-term holding, leaving fewer tokens available for trading. Market structure is tightening even as investor sentiment remains cautious. Recent network events and steady institutional demand are also adding to this overall market trend.

Bitcoin has just crossed $91,000, but the euphoria is not spreading to all market segments. Mining company stocks fell 1.8% over the week, while trading volumes dropped 25%. This decline reflects less a simple technical pause than a deeper malaise in a sector weakened by rising production costs.

BPCE, a heavyweight in the French banking sector, launches its crypto trading service this week through its mobile applications. A revolution: buying Bitcoin will become as easy as checking your balance.

While bitcoin is bogged down under the spotlight, fleeing ETFs and traders under Lexomil: the crypto star rediscovers the joys of the plunge, 2022 version, remixed 2025.

Financial commentator Peter Schiff is back in the news as tensions rise between him and President Donald Trump over the state of the U.S. economy. Schiff’s warnings about rising prices clash with Trump’s claims that affordability is improving across the country. At the same time, Schiff has also renewed his public dispute with Binance founder Changpeng Zhao (CZ), giving his comments even more visibility.