While Bitcoin ETFs attract massive institutional inflows and macroeconomic conditions argue for a rebound in risky assets, the price remains surprisingly stuck below 90,000 dollars. This stagnation, out of sync with the prevailing bullish signals, points to invisible forces restricting its progress. Between yield strategies and sophisticated arbitrage, a more discreet mechanism seems to weigh on the market just as investors expect a new momentum.

Baleines

Bitcoin still under $100,000... but the crypto industry is rejoicing. Whales sell, small buyers buy, hopes rise: what if the crypto winter was just an illusion?

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

While the small ones sell, the big ones stuff themselves with ETH. A mysterious update named Fusaka might hide a tricky move... or a boon!

Bitcoin wavers, and the market divides. While crypto suffers a drop of nearly 15% in a few weeks, a clear rift appears between small holders and institutional investors. While the former take advantage of the decline to strengthen their positions, the whales quietly liquidate thousands of BTC. This strategic gap, observed by the Santiment platform, could mark a decisive turning point in the market's evolution.

While the small fry are stirring, crypto whales quietly pile up BTC on Binance... What if the real maneuvers are unfolding in the silence of order books?

Bitcoin wavers, whales sell, Wall Street sulks... and Strategy laughs. The former MicroStrategy continues to fill its vaults, defying volatility and skeptics of a crypto market that is always surprising.

Cardano fans are sulking, whales are stirring, and ADA is bouncing back. Yet another crypto farce where the impatience of small holders fattens the big holders.

When bitcoin falters, whales sell, small holders pick up, and the Fed sneezes. Crypto, this monetary theater where everyone plays their part... often without knowing the script.

When Scaramucci says 180,000, it’s not his salary, but his Bitcoin prophecy. Between ETFs, whales and stablecoins, the small crypto world is heading towards peaks... or traps?

While the crypto market evolves in a climate of macroeconomic uncertainty, a major operation has just redefined the balances. In one week, BitMine Immersion Technologies acquired 1.7 billion dollars in Ethereum, crossing the symbolic threshold of 1% of the total circulating supply.

Within 24 hours, new wallets have acquired nearly 280 million dollars in Ethereum, while the asset trades just below its yearly highs. This sudden accumulation, spotted by on-chain analysts, raises questions: are we witnessing a simple strategic accumulation phase or the precursor signal of a larger bullish movement?

Panic on the crypto planet: panicked whales, small holders bleeding. And Binance picking up BTC like it's raining. Bitcoin itself looks grim…

While Ethereum is losing its whales, Cardano attracts them. But behind these mysterious comings and goings, the crypto ocean hides monsters and a barely concealed war of influence.

While the media spotlight remains on Bitcoin ETFs and the fluctuations of Solana, a quiet yet massive concentration is occurring on Ethereum. Wallets holding more than 10,000 ETH, the famous mega-whales, are increasing their positions at an unmatched pace since 2022. Barely visible, this surge in accumulation hints at the beginnings of a bullish cycle.

While the novices hesitate, the whales fill their coffers with bitcoin... A setup or mammalian instinct? One thing is certain: they never swim by chance.

Ethereum is being hoarded by large holders, like nuts before winter. Meanwhile, the small ones are fleeing, scared. What if the whales are preparing a feast?

Bitcoin: $500 million in profits per hour indicate strong profit-taking activity. Discover the details in this article!

Bitcoin is flirting with 110,000 dollars, but intriguing whales are playing their own game. Who will win: the impatient or the strategists? Discover this secret battle where the future of BTC is at stake!

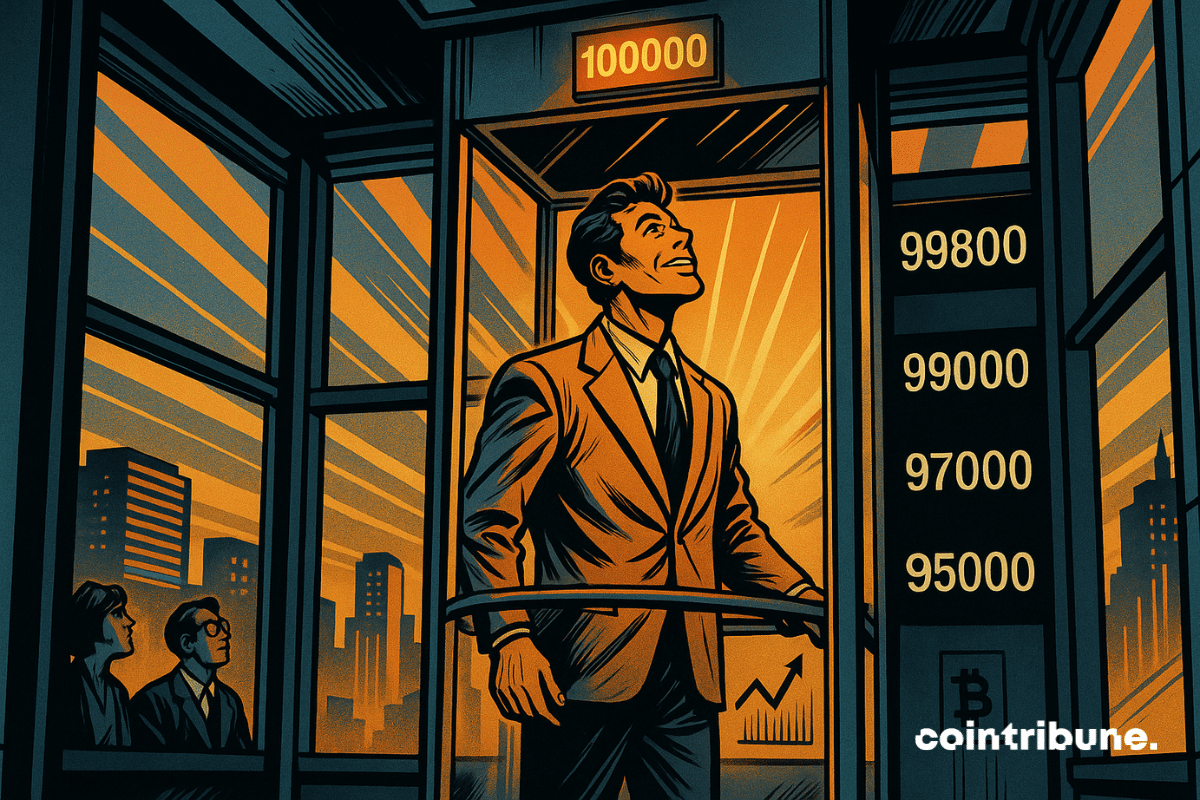

While bitcoin remains above $100,000, a targeted accumulation phase emerges quietly. Far from the tumult of derivatives, it is the spot flows and on-chain data that shape the market's new tempo. Behind this recovery, strategic investors are strengthening their positions, operating within a precise price range. A discreet yet structuring dynamic that could well redefine the foundations of the next bullish cycle.

In a crypto market driven by spectacular announcements, some signals go unnoticed while revealing deep dynamics. This is the case with discreet, yet massive movements around XRP on Binance. Unusually high volumes circulate in strategic silence, capturing the attention of analysts. Behind this silent accumulation could be a significant buying pressure, often heralding a trend reversal. Away from the spotlight, XRP seems to be gearing up for a phase.

In the unpredictable world of cryptocurrencies, certain movements reveal a well-established logic. On the XRP network, the surge in activity, more than 4 million transactions in three days, intrigues analysts. It is neither a speculative surge nor a simple frenzy. Everything points to a methodical accumulation, probably orchestrated by large entities. And when the whales move, the market tends to follow. This sudden increase in volume could well signal a strategic shift to watch closely.

While panic looms over small investors, the whales are resurfacing at Binance, depositing their digital gold, and patiently waiting for the storm to pass.

As Bitcoin breaks through new psychological thresholds, it reshapes the landscape of digital economic cycles. A consensus is now emerging among experts: support around $90,000 could become a sustainable strategic base. Between validation from on-chain data and projections from recognized valuation models, this hypothesis is gaining traction and fueling market expectations, already buoyed by the rise of institutional adoption.

Dogecoin (DOGE) is at a decisive turning point. Indeed, far from its image as a mere "memecoin", it is facing a price zone that could seal its immediate future. Stuck below the key technical threshold of $0.17, it oscillates between a bullish breakout and the risk of a sharp drop. In a crypto market seeking benchmarks, DOGE embodies the tension between speculation and reality. This critical moment could redefine its legitimacy and role in the crypto ecosystem.

While markets struggle to regain their momentum, a silent accumulation of bitcoin by the largest holders, the famous "whales," is reshuffling the cards. By absorbing much more than the newly issued supply, these players are changing the market balance. This discreet but massive movement reignites speculation: is it the beginning of a new bullish rally, or just a strategic repositioning out of sight?

While the crypto market remains unsettled by speculative shocks, a subtle signal is capturing the attention of insiders: Bitcoin whales are strengthening their positions. The number of addresses holding between 1,000 and 10,000 BTC has just reached 2,014, a peak since April 2024. This dynamic, far from insignificant, reflects a thoughtful accumulation strategy. Behind this silent movement, some already see the early signs of a possible bullish turnaround.

As Donald Trump revived his trade war with China, causing sudden volatility in the markets, bitcoin whales seized the opportunity. On April 9, 2025, so-called "accumulation" addresses received 48,575 BTC, worth $3.6 billion — the largest daily influx since February 2022.

The amount of Ethereum available on exchanges has just dropped to its lowest level since 2016. A strong signal, as on-chain movements trigger growing interest among analysts looking for leading indicators. This scarcity on exchanges could signal an imminent imbalance between supply and demand, which could lay the groundwork for a potential tightening of availability in the market.

While the crypto market seeks new breath after a dynamic start to the year, XRP is sinking into a bearish spiral. Ripple's asset has already lost more than 35% since its peak in January, and technical indicators point to a possible worsening. An unfavorable chart setup could lead to an additional drop of 25% this month. In this climate of uncertainty, XRP appears to be one of the most fragile assets at the moment, exposed to increasing selling pressure and disengagement from major investors.