Like a rising tide, Aave is reshaping its economy: buybacks, redistribution, protection... The fragile balance of decentralized finance wavers under this bold overhaul.

Aave (AAVE)

DeFi protocols had promised a brighter future. The result? 500 million ETH evaporated, stunned investors, and a crypto market that wobbles like a tightrope walker without a net.

The Aave community is exploring new avenues to increase its revenue by considering Bitcoin mining. However, discussions on the Aave governance forum reveal some skepticism among token holders.

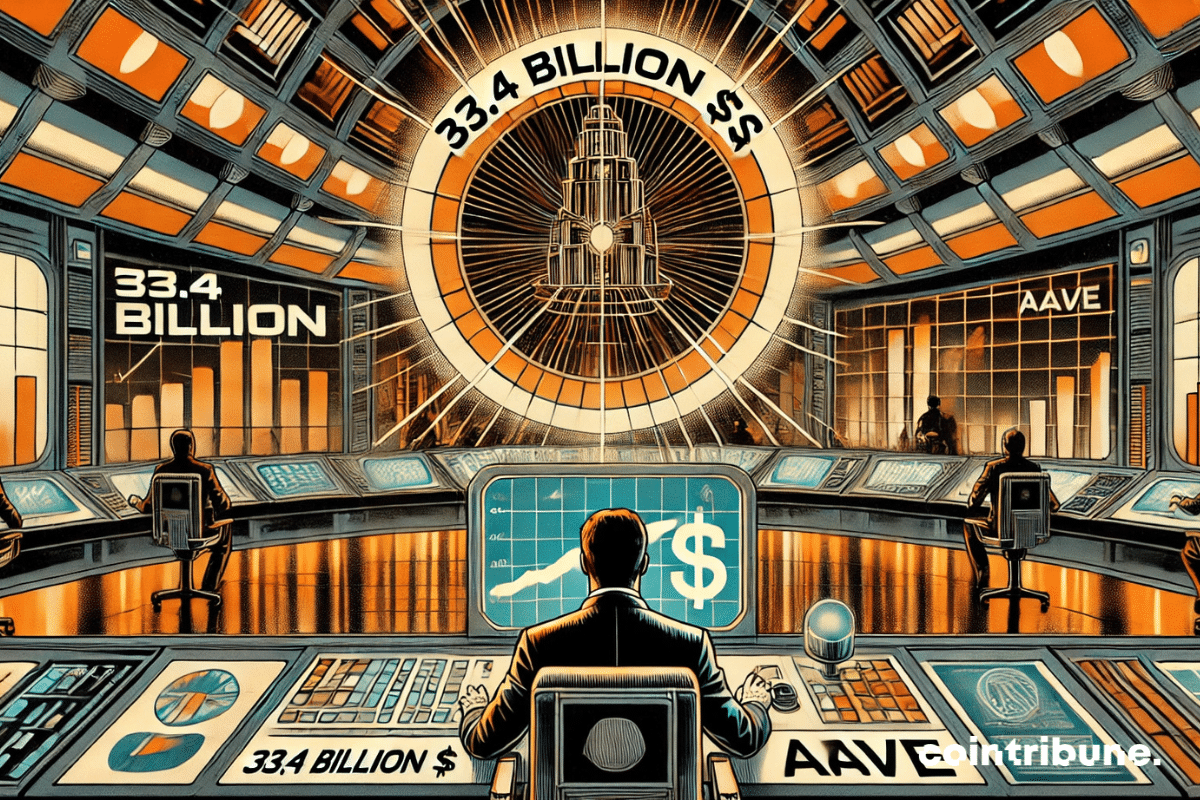

Decentralized finance (DeFi) continues to demonstrate its potential, and Aave is today one of the most eloquent examples of it. Indeed, the platform has reached $33.4 billion in net deposits, surpassing the record levels of 2021, which marked a major turning point for the crypto sector. This staggering figure is not just a simple statistic, but a reflection of an ever-evolving dynamic. The DeFi ecosystem, driven by technological innovations and growing adoption, is transforming into a credible alternative to traditional financial institutions. In this context, Aave is redefining standards by diversifying its markets and strengthening its offerings, attracting both investors and developers. This performance illustrates the platform's robustness, but also the growing maturity of a sector in search of expansion and security.

"Decentralized finance, Trump’s new craze! The sale of WLFI promises mountains and wonders to investors… or not."

Bernstein predicts DeFi returns exceeding 5%! A strong signal for the crypto market with the imminent drop in U.S. rates.

After two consecutive weeks of increase, AAVE undergoes a correction of more than 10%. Let's examine the future prospects for AAVE's price.

Cryptocurrencies are experiencing a rebound. 5 assets are standing out in particular. Details in this article.

DeFi loans hit a record high of 11 billion, with Aave V3 leading, thanks to Ether.fi and Ethena yield strategies.

Blockchain enables many conveniences for people: not least the ability to control their assets and data. Connecting this technology with traditional finance (TradFi) is a challenge that Chainlink has set itself. To this end, the data provider has developed the Cross-Chain Interoperability Protocol (CCIP), which can be easily married with banking chains. Close-up!