Strategic Bitcoin Reserve: Oklahoma Leads the Way as Other States Remain Skeptical

After several speeches in favor of integrating Bitcoin into the financial strategies of the United States, Oklahoma has decided to take action with its “strategic Bitcoin reserve” project. Although this initiative divides the 50 states, some, like Oklahoma, are adopting bold positions. The project could evolve the role of cryptos in public finances. However, not all eyes are yet turned toward a Bitcoin-based future.

Bitcoin: Oklahoma Takes a Decisive Step

Oklahoma, a state already familiar with digital assets, has recently given a significant boost to strategic Bitcoin reserve. On February 25, 2025, the HB 1203 law, or “Strategic Bitcoin Reserve Act”, was approved by the state’s governmental commission, with a favorable vote of 12 to 2. This bill could allow the state to invest in digital assets, primarily Bitcoin, using its public funds, including its retirement plans.

The goal? To use Bitcoin as a bulwark against inflation and economic policies deemed unstable.

Representative Cody Maynard, who initiated the project, believes that BTC is a form of economic independence against “bureaucrats printing money left and right“. The idea of investing in a crypto as a strategic reserve is not unanimous, but Oklahoma seems determined to thumb its nose at detractors.

To date, Bitcoin is the only digital asset whose market capitalization exceeds 500 billion dollars, a crucial requirement to be eligible for this strategic reserve.

A tweet from Dennis Porter, a supporter of the project, aptly illustrates the enthusiasm:

“The ‘Strategic Bitcoin Reserve’ goes to committee in Oklahoma with a vote of 12-2. Thank you to Cody Maynard for his leadership on this law.“

Thus, it is a first victory for supporters of Bitcoin as a state asset. But at what cost?

The Divided United States: BTC, a Risky Bet?

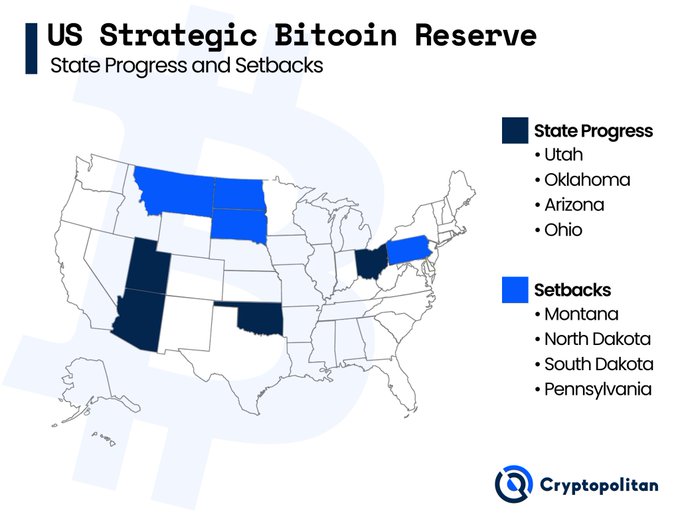

The path is not roses for the Bitcoin strategy. While Oklahoma seems willing to lead the way, several other U.S. states show signs of reluctance. Montana, South Dakota, Pennsylvania, and Wyoming have already rejected similar projects. In some of these states, caution prevails over enthusiasm: the volatility of Bitcoin, increasingly criticized, raises concerns.

Bitcoin has experienced staggering ascents, but also drops of several thousand dollars in just a few days, a phenomenon hard to ignore for public financial officials.

But then, why such rejection?

Here are some answers:

- The volatility of cryptocurrencies worries states, especially those where public finances are fragile;

- Representatives are concerned that taxpayer money is exposed to the risks inherent to such a volatile market;

- Concerns about manipulation and centralization are often cited by detractors;

- The Republican parties, which dominate in many states, are particularly resistant to this kind of investment, considered too risky.

However, according to an analysis by Matthew Sigel, a financial expert, if all the bills underway in 20 states were adopted, it could lead to a purchase of 23 billion dollars, or nearly 247,000 BTC. These figures clearly show that the United States could, in the long run, increase their exposure to Bitcoin.

Oklahoma has always been a strong supporter of disruptive technologies. By seeking to attract Bitcoin miners and adopting laws like the “Commercial Digital Asset Mining Act of 2022”, the state shows its support for cryptocurrencies and wants its place in the digital future.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.