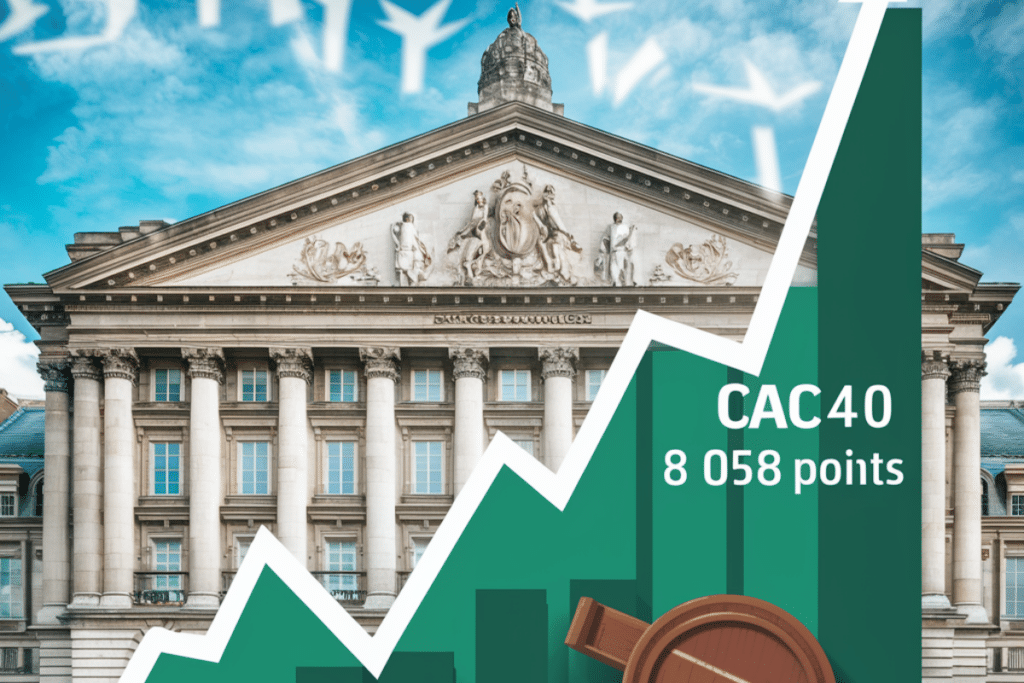

Stock Market: The CAC40 defies economic uncertainties and once again reaches a historic high

This Tuesday morning, the CAC40 reached a new all-time high at 8,058 points right at the opening. Despite a slight moderation in late morning, the flagship index of the Paris stock exchange remains in positive territory.

The Paris stock exchange sets new all-time record at the start of trading

The CAC 40, the flagship index of the Paris stock exchange, began Tuesday on an optimistic note by clinching a new all-time high at the open. The index reached 8,058 points in the early trades.

This performance comes in a market context that is relatively uncertain, with investors remaining vigilant to the latest macroeconomic developments. Today’s awaited American inflation figures will be particularly scrutinized to try to decipher the Federal Reserve’s monetary policy schedule.

According to FactSet consensus, inflation should be +0.4% compared to the previous month and +0.3% excluding food and energy. On an annual comparison, these numbers would be +3.1% and +3.7% respectively. These data will be crucial for anticipating the timing of the Fed’s first rate cut, which is currently expected for June.

Despite the uncertainties linked to inflation and monetary policy, several stocks are standing out on the upside in the Parisian market. This is notably the case for Teleperformance, which rebounds by 5% to 89 euros, supported by favorable analyses despite a downward adjustment of the target price by Société Générale. The consensus of analysts remains largely positive on the stock, with 14 buy recommendations and none selling.

For its part, Maisons du Monde gains 6% to 4.37 euros following the presentation of its annual results and its new strategic plan. Although faced with a declining furniture market, the group limited the impact on its operating margin, which amounts to 4.1% compared to 5.5% a year earlier, demonstrating its adaptive capacity.

Diverging performances within the CAC 40

While some values excel, others face downward pressures. This is the case for Nexity, which plunges by nearly 10% to 9 euros, penalized by statements from the Minister of Housing, Guillaume Kasbarian, who does not foresee new tax measures in favor of the sector. This announcement is a blow for the real estate developer, whose growth prospects could be impacted.

However, hopes for an easing in inflation and for a soft landing of the economy fuel investor optimism. Indeed, even if Europe and the United States still risk a recession in 2024, its extent could prove to be more limited than what analysts originally feared.

Moreover, the massive injections of liquidity by central banks in recent years and valuations that have become more reasonable after the correction in 2022 also encourage investors to return to stocks, especially European ones, which had lagged behind Wall Street.

Finally, China’s reopening and the end of the zero-Covid policy are significant supports for luxury goods values, which are highly dependent on Chinese demand and represent a significant portion of the Parisian listing.

In conclusion, despite an uncertain economic context, the Paris stock exchange continues to demonstrate resilience by setting new records. While certain stocks like Teleperformance and Société Générale are performing well, others, like Nexity, suffer from the lack of government support. The forthcoming US inflation statistics will be decisive for the upcoming market trend.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.