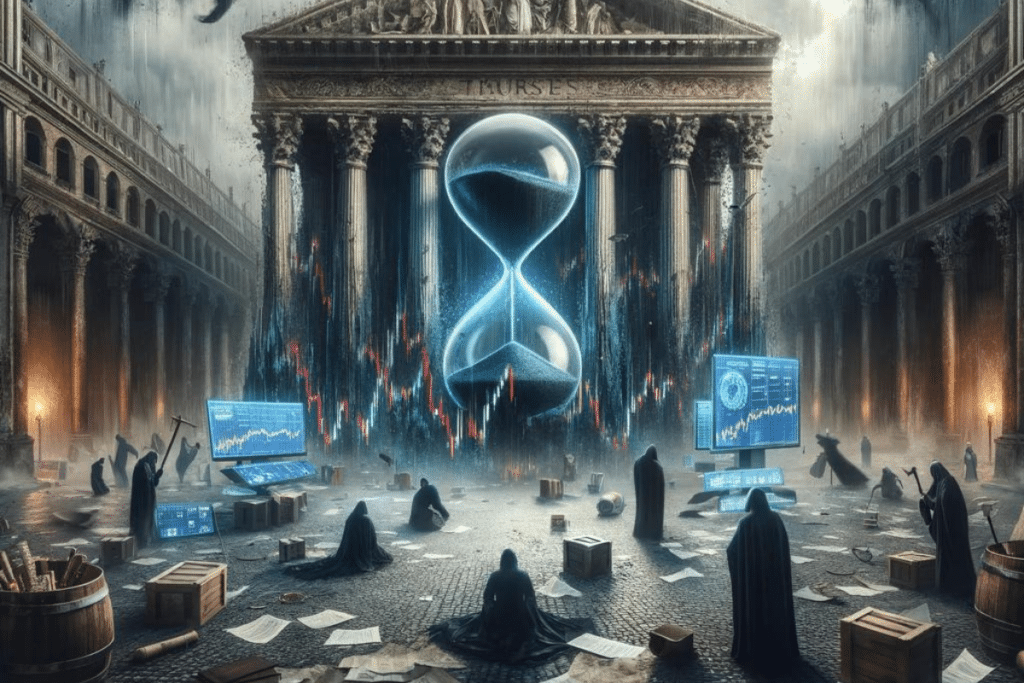

Stock Market: The CAC 40 falls back towards its infernal lows!

The CAC 40 is enacting a scene that seems pulled straight from a Greek tragedy. Instead of ascending to Olympian heights, the flagship index of the Paris stock exchange is plunging once again into hellish meanders, a descent orchestrated to the tune of the global economy’s uncertain heartbeat.

Teleperformance: The Faltering Icon on the Stock Market

In the heart of this financial storm, Teleperformance, once a beacon of the pandemic economy, wobbles under the assaults of a merciless market. This is happening as the market holds its breath.

Its stock, once perched on the pedestal of 400 euros, now seems to be sinking in quicksand, having lost three-quarters of its value since 2022. This debacle, punctuated by an almost theatrical 29% drop on February 28th, could symbolize the end of an era for traditional call centers.

But the story of Teleperformance is not only about a fall; it is also about a struggle against the windmills of artificial intelligence (AI).

Faced with the fears of a market rattled by the promises and threats of AI, Teleperformance’s management is playing the card of cautious optimism. They remind us that adaptation and innovation have always been the guiding principles of their strategy, demonstrating a refusal to succumb to the prevailing pessimism.

Between Innovation and Adaptation

Innovation at Teleperformance is not just for show; it plays a leading role. With its 600 analysts and developers, not to mention the 25,000 “robots” already on stage, the company seems ready to embrace the era of generative AI. This technological fleet, far from replacing humans, aims to enrich customer experience and elevate the quality of service.

The AI challenge is not seen as a threat but an opportunity for reinvention. In this context, Teleperformance positions itself not just as a survivor of technological evolution, but also as a pioneer in content moderation and the fight against deepfakes, promising an invaluable added value to its clients.

The outlook for 2024, although cautious, charts a path for a future where growth, albeit modest, is still on the agenda. In a capricious macroeconomic environment, the goal of an organic revenue growth between 2% and 4% reflects measured but undeniable optimism.

The governance of Teleperformance, in full transformation, is laying the groundwork for a new era of leadership. With a planned separation of the roles of the chairman of the board and the chief executive officer by 2026, the company appears to be laying the foundations for a more agile structure suited to future challenges.

The story of Teleperformance and the CAC 40, with its ups and downs, reminds us that the stock market is a living entity, breathing to the rhythm of innovations, crises, and reinventions. While the descent into shadowy depths seems to be the narrative of the moment, history teaches us that after the fall comes the rise. On the other hand, the BRICS might cause a recession in the American economy.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.