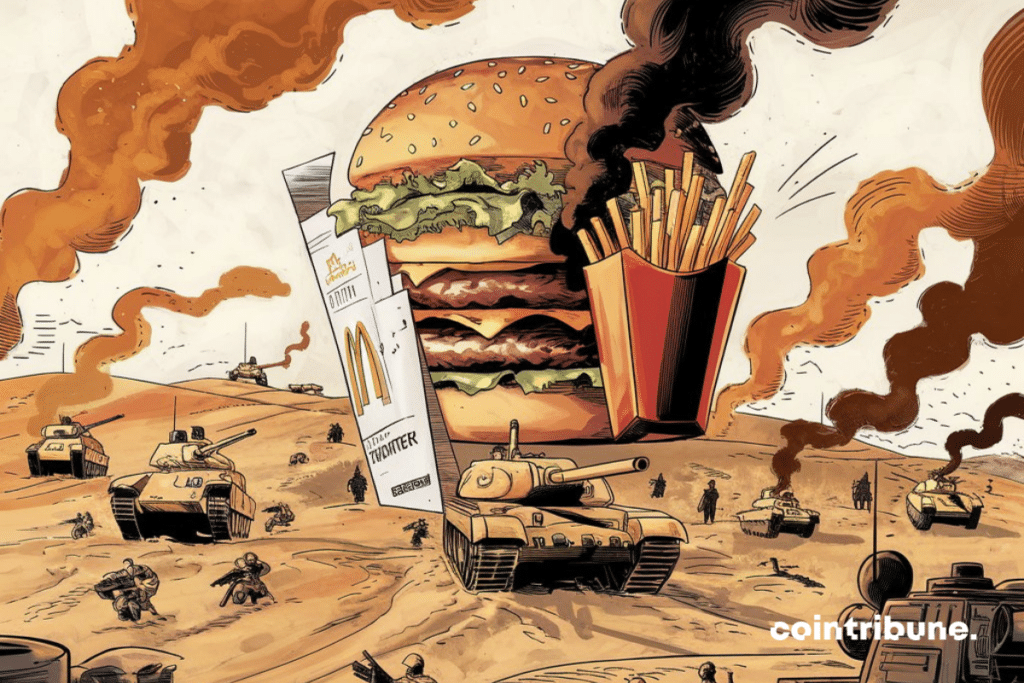

Stock Market: McDonald's Sees Its Sales Plunge, A Consequence Of The Israeli Crisis?

The Israeli-Palestinian tensions are not only disrupting financial markets, oil, or cryptocurrencies: they are even making their way into the world of burgers. The latest victim is McDonald’s, whose results have been weighed down by a decline in sales. Fierce competition, an E. Coli outbreak, and an economic slowdown have combined to lower the figures of the famous chain. A focus on a quarter with a bitter flavor.

McDonald’s: The stock market impacts of a health and economic crisis

The last quarter was not easy for McDonald’s, already a victim of a crypto scam last August. With a 1.5% decline in its global sales, the brand experienced its biggest drop in four years, leaving investors puzzled. The cause: a E. Coli outbreak that forced the chain to temporarily withdraw its famous Quarter Pounders from some restaurants in the United States, a measure that led to a nearly 7% drop in stock in one week.

In an already turbulent market due to economic uncertainties and consumer caution regarding their budget, McDonald’s tried to attract customers with aggressive promotions and economical meals. However, the results disappointed.

Some key points:

- E. Coli outbreak impacting attendance and sales;

- 3% decrease in annual net profit to $2.26 billion;

- McDonald’s shares significantly down, raising doubts among investors.

Despite everything, the American brand is trying to stay the course, but the challenge remains immense in an economic environment where the stock market seems anything but stable.

Israel and the media storm shaking Western chains

Beyond the outbreak, tensions in the Middle East have not spared fast food chains. Indeed, McDonald’s, just like Starbucks, is facing calls for boycotts in its international markets, fueled by the perception of financial ties with Israel.

This movement is gaining momentum in Europe and China, heavily impacting restaurant attendance, with sales declines reaching 2.1% internationally, notably in France and the UK.

In this context, McDonald’s acquired its entire Israeli franchise in the spring, comprising 225 establishments and more than 5,000 employees. This gesture has revived tensions, adding new weight to the burden of a chain already strained by price wars in the sector.

With sales declining by 3.5% in local partner markets, McDonald’s must now deal with growing criticism, dwindling attendance, and consumers increasingly concerned about ethical and financial issues.

Finally, for cryptocurrency enthusiasts, another question arises: in the context of Iran-Israel tensions, will Bitcoin be able to withstand the pressure against gold? A question that makes perfect sense in light of the recent performances of the yellow metal.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.