Stock Market: Luxury Takes A Dive, Is China Really Threatening Giants Like LVMH And Kering?

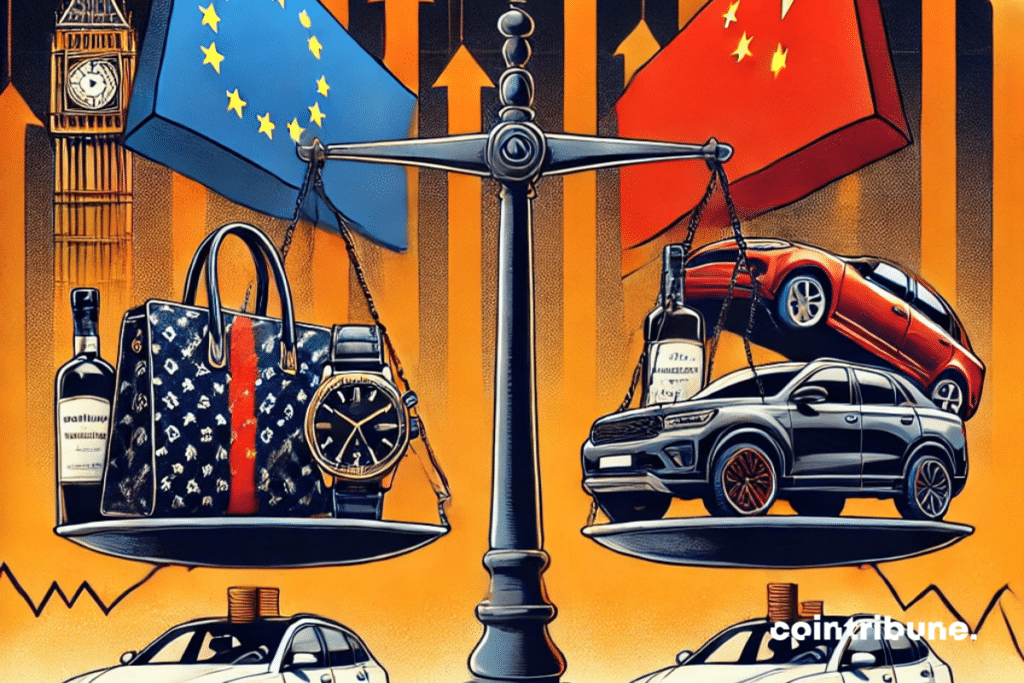

The trade war taking place between the European Union and China is taking an unexpected turn. While the first sanctions are hitting sectors as strategic as electric vehicles or spirits, a new player is entering the turmoil: European luxury goods. This economic bastion, which symbolizes both creativity and prosperity in Europe, is now at the heart of speculations about possible Chinese retaliations. But behind this apparent storm, a more subtle balance is emerging. Experts, aware of the colossal economic stakes for China itself, are wondering: Will Beijing really take the risk of stifling one of the engines of its domestic consumption? In this article, we will first analyze the immediate consequences of this crisis on the financial markets of European luxury goods. Then, we will delve into the long-term perspectives and scenarios that could shape the relations between these two economic giants.

Luxury Values Weakened by Trade Uncertainty

Last Tuesday, the European luxury sector suffered a significant setback on the stock market, marked by a drop in the largest houses, such as LVMH (-3.57%) and Kering (-4.45%). This investor panic followed the announcement of China’s new protectionist measures targeting European spirits.

In a climate of growing trade tensions between Brussels and Beijing, the fear that luxury items might become the next target of Chinese retaliations immediately weighed on stock prices, leading to notable volatility across the entire market. The major brands, emblems of European economic strength, thus find themselves at the center of speculation as the conflict extends to different strategic sectors.

This market reaction follows a series of measures initiated by the European Union against Chinese electric vehicles, accused of benefiting from illegal subsidies. In response, Beijing quickly retaliated by targeting imports of European spirits, chilling investor forecasts. Analysts now fear an escalation that could affect the luxury sector, which is nonetheless essential for China’s domestic growth. An attack on this segment would risk not only destabilizing the European economy but also harming China’s own strategic interests.

Luxury, a Strategic Sector China Might Spare

Despite investors’ concerns, many experts believe that targeting the luxury sector would run counter to Beijing’s economic interests. Jacques Roizen, of the Digital Luxury Group, points out that China has every reason to maintain a favorable environment for luxury brands, which represent an important source of tax revenue and contribute to the development of domestic consumption.

The province of Hainan, for example, has become a nerve center for duty-free luxury goods sales, proof that Chinese authorities are looking to keep consumer spending within their territory. Imposing protectionist measures on this sector would encourage Chinese consumers to shop abroad, a scenario Beijing seeks to avoid at all costs.

Moreover, the size and importance of the luxury industry in China make it less vulnerable to dumping accusations, unlike electric vehicles, where state subsidies are easier to demonstrate. As noted by Jelena Sokolova, an analyst at Morningstar, it is difficult to justify dumping practices on such exclusive goods as handbags or luxury watches, whose prices are largely conditioned by brand image and product rarity. Furthermore, recent statements from Beijing and Brussels show a willingness on both sides to maintain dialogue, hinting at the possibility of a compromise to avoid an escalation that would harm their shared economic interests.

While European luxury is currently spared from Chinese protectionist measures, the sector remains under pressure due to market volatility and geopolitical tensions. However, analysts point out that Beijing has little interest in engaging in an economic battle in this area, given the importance of luxury brands to the Chinese economy. Ongoing negotiations between the European Union and China will be decisive for the future of the conflict, but for now, it seems that luxury might continue to evolve on the margins of trade reprisals.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.