Solana Surges With Record 12 Million SOL Traded In 24 Hours: Will SOL's Price Soar Next?

The storm has shaken the entire cryptocurrency market in recent days, and despite the turbulence, Solana has not escaped the downward trend. In this uncertain climate, while many altcoins struggled to regain their colors, Solana managed to stand out, with an explosion in trading volumes and significant increases in its TVL. However, the price of SOL still seems to face notable resistance.

Solana shows exceptional volumes: the largest increase in 30 days

The latest news on Solana: in 24 hours, the trading volume of Solana (SOL) recorded an increase of 300%, reaching record amounts, with 12 million SOL exchanged. This spike is the largest in 30 days, indicating a renewed interest in this blockchain, after a period of relative calm.

However, despite this massive influx of transactions, the price of SOL has not reacted as expected, remaining around $100, without being able to breach crucial resistance levels.

This situation raises the question of the relationship between volume and price. On one hand, the strong increase in volumes could be interpreted as a sign of accumulation, possibly indicating an entry of institutional investors, attracted by Solana’s advantages in the DeFi space.

But on the other hand, the resistance around $130 to $140 remains a difficult obstacle for SOL to overcome, despite bullish signals on the weekly charts.

A possible rebound, but the resistances to overcome remain strong

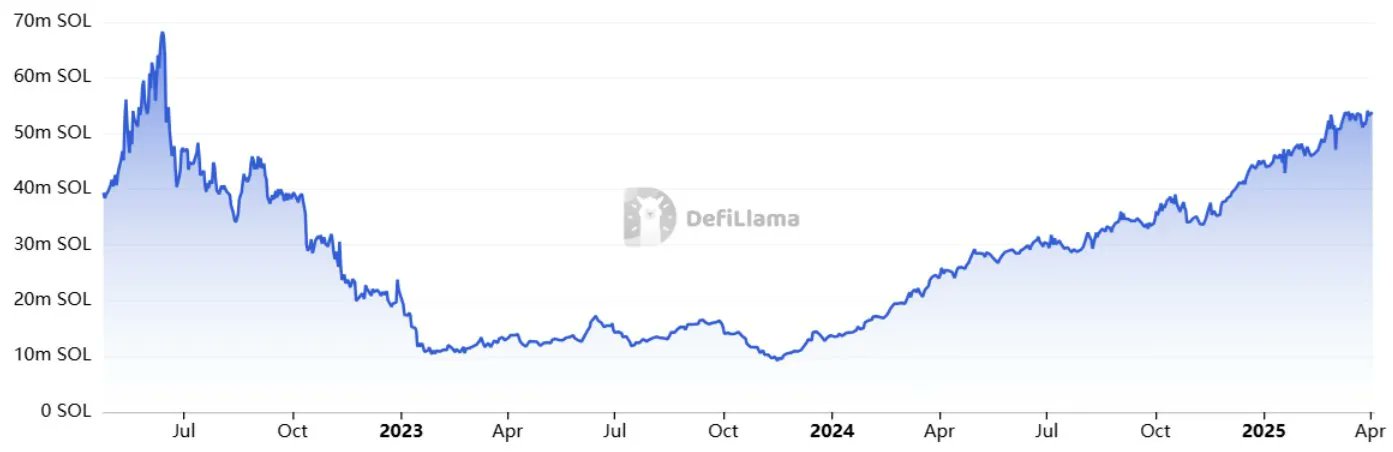

Alongside this explosion in volumes, the Total Value Locked (TVL) of Solana has reached a new high in terms of SOL, strengthening the robustness of its DeFi ecosystem. However, these performances have not directly translated into a price increase for the crypto.

Solana’s DEX network continues to attract users, but the question remains: why have these impressive volumes not yet allowed SOL to break above the $120 mark and initiate a true upward recovery?

The market seems divided. While some technical indicators suggest possibilities for increase, with buy signals, others prefer caution, observing the evolution of moving averages and support and resistance levels on SOL.

Ali (@ali_charts) recently tweeted:

TD Sequential signals a buy on the weekly chart of #Solana! $SOL must stay above $95 and break through $121 to prepare for a rally towards $147.

This shows that even with positive signals on the charts, Solana still needs to overcome important thresholds to contemplate a sustainable rise. Only at that moment will the potential explosion of the SOL price be able to materialize.

Key points to remember:

- 12 million SOL exchanged in 24 hours, marking a record peak in 30 days;

- The TVL in SOL reaches a new peak, signaling strengthened adoption of Solana;

- Solana encounters major resistance around $120 and $130;

- Trading volumes and DeFi interest support the project, but a rally will depend on breaking key technical thresholds;

- Buy signal on the weekly chart, according to Ali, but the price of SOL must stay above $95 and break through $121 to start a rally towards $147.

Last weekend, Solana delivered remarkable performances in DeFi, with record volumes and a TVL that keeps increasing. However, this momentum has not allowed SOL to break through resistance barriers, with a price that remains pending a true breakthrough. If the market maintains its interest in Solana and volumes continue to grow, then SOL could react in the coming weeks. But for now, the road remains fraught with obstacles.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.