Silent Ascension of Tron (TRX): December 21, 2023 Crypto Analysis

With a rise of nearly 150% over the course a year, Tron has established itself as a key player in the cryptocurrency universe. Let’s examine the future outlook for the price of TRX together.

The Situation of Tron (TRX)

After hitting a low of $0.04550, the Tron price began an upward trend, which it has followed since the end of November 2022. One year later, TRX broke through a major resistance at $0.093. This level corresponded to a former high, which is 38.2% of the Fibonacci retracement from Tron’s ATH (All-Time High). Since then, TRX continued its rise, reaching the 50% Fibonacci threshold of $0.113, where it has recently failed.

Tron is now trading around $0.10. It is just below its 50-day moving average, but well above its 200-day moving average. Each of these moving averages continues to trend upwards, thus supporting Tron’s bullish trend in the medium and long term. On the oscillators side, they indicate a slowdown in TRX’s bullish momentum. Moreover, a bearish divergence seems to be forming, suggesting a period of consolidation or correction to come.

The current technical analysis was conducted in collaboration with Elie FT, an investor and trader by passion in the cryptocurrency market. He is currently a trainer at Family Trading, a community with thousands of private traders active since 2017. There you will find Lives, educational content, and peer support around financial markets in a professional and warm atmosphere.

Focus on Derivatives (TRX/USDT)

Since the beginning of October, open interest has decreased by 46%, representing nearly $30 million in positions (long and/or short) unwound on the TRXUSDT contracts. The open interest for Tron therefore diverges from its price, and this without significant liquidations. This suggests that traders lack conviction, interest, or are simply taking profits.

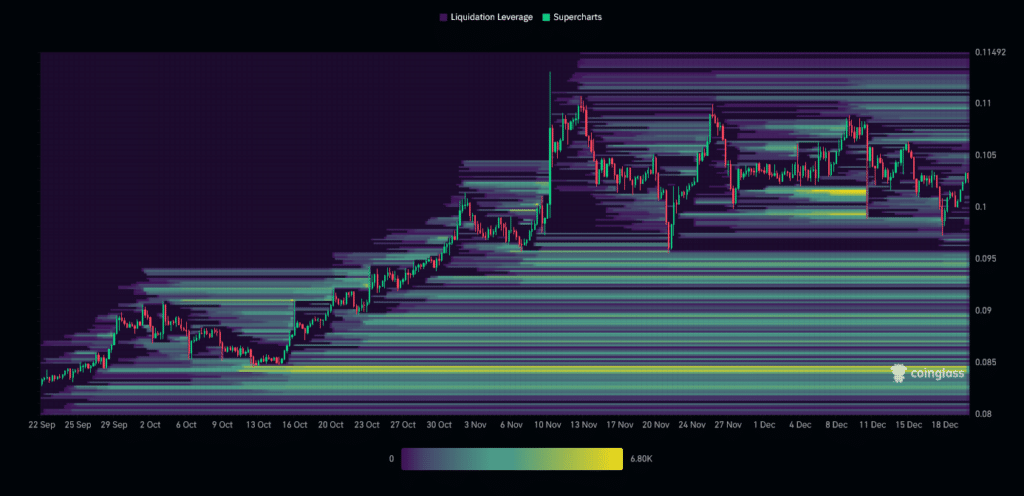

The liquidation heat map for Tron reveals that it has recently reached an area with a high concentration of orders around $0.10. Judging by the market’s reaction, most of these orders were buy orders. However, this potential demand did not prevent the price of TRX from falling below this level. Now, the peak liquidation of recent months is slightly below $0.085. As the market approaches these levels, it could trigger a large number of orders, which naturally could increase the cryptocurrency’s volatility. Consequently, this area makes for an attractive price level for investors.

Potential Scenarios for Tron Price (TRX)

If the price of Tron maintains above $0.093, we could anticipate a continuation of the bullish run up to the $0.113 level. The next resistance to consider, if the bullish movement continues, would be the $0.123 threshold. At that point, this would represent a rise close to +19%.

If the price of Tron does not hold above $0.093, we might envisage a retest of the $0.085. The next support to consider, if the bearish movement persists, would be roughly at the $0.072 levels. At that point, this would represent a drop close to -29%.

Conclusion

Tron is one of the few cryptocurrencies that has outperformed the crypto market for more than a year. It appears that this trend may continue. However, TRX’s weakening momentum suggests that a phase of consolidation or even correction is possible. Therefore, it is imperative to closely monitor price reactions at various key levels to confirm or refute current hypotheses. Beware of potential fake outs and market squeezes in each situation. Furthermore, let’s not forget that these scenarios are based solely on technical analysis. Cryptocurrency prices can move more or less rapidly depending on other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more