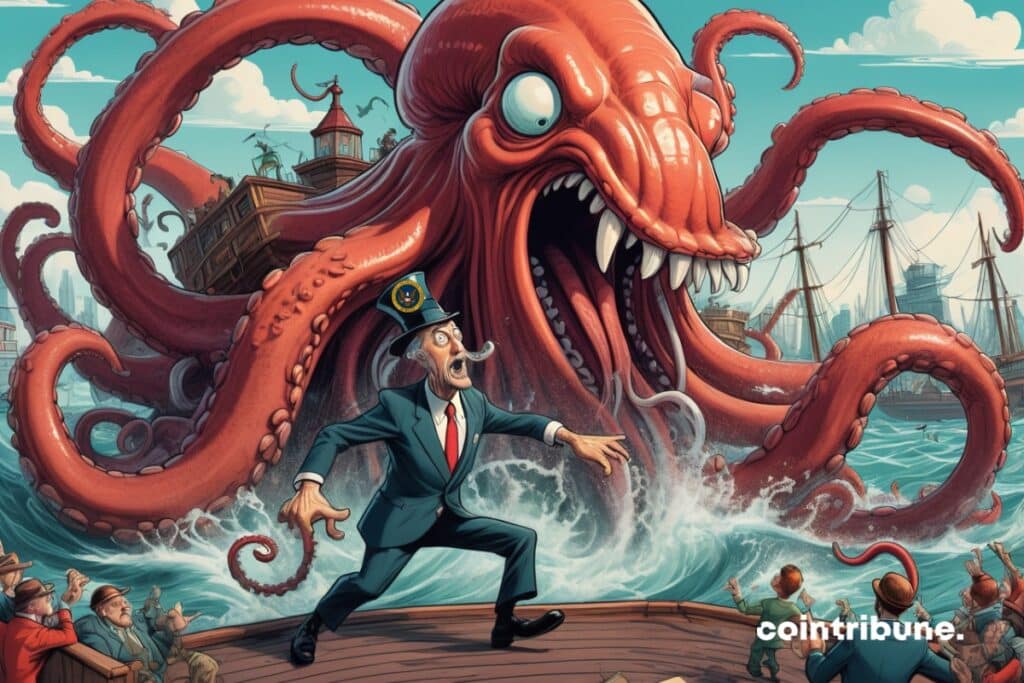

SEC VS Kraken - Prosecutors take a stand against the crypto regulator!

In the legal battle between the SEC and Kraken, an unexpected front of state attorneys general has risen against the securities regulator. Analysis of an alliance that could reshuffle the cards of the crypto regulatory framework.

A Rare Challenge to the SEC’s Authority

Seeing attorneys challenging the SEC head-on is an extremely rare event. These Republican attorneys have chosen to defy the agency’s overall approach to the legal qualification of crypto, particularly in the lawsuit against Kraken.

They believe that the SEC goes too far by systematically equating cryptos with financial securities. According to them, this extensive interpretation threatens the balance of the regulatory framework and consumer interests.

The states also judge that their own legal protections have historically filled federal gaps. They do not want to see their role diminished by an encroachment of the SEC under the guise of investor protection.

The Political Controversy Escalates for Crypto

This stance marks a new phase in the growing controversy around the regulatory scope of the SEC over the crypto sphere.

The agency and its chairman Gary Gensler are being accused of their intransigence and declared hostility towards crypto. Some crypto political figures have called the action against Kraken “illegal.”

Political pressure is therefore growing stronger, to the point that some are talking about reducing the SEC’s budget if it does not change its approach.

Towards a Rebalancing of Power?

This revolt by the states could potentially lead to a rebalancing in favor of local jurisdictions over time.

Indeed, the crypto consumer protections provided for by state legislations are often stricter than the federal framework. It would therefore be paradoxical to see the SEC impose its extensive conception of securities laws at the expense of local safeguards.

Moreover, this challenge brings back into focus the profound legal debate on the adequate qualification of crypto-assets.

In the long run, this tug of war could lead to a welcome clarification of the regulatory framework applicable to cryptos.

Political and judicial pressure could force the SEC to review its current doctrine, which is considered too extensive. A more precise definition would allow players to develop without fear of being abusively assimilated to securities.

Although symbolic at this stage, the initiative of these state attorneys general undoubtedly marks a turning point. It paves the way for a gradual clarification of the legal framework applicable to the new asset class of cryptos. Far from being anecdotal, this legal-political tug of war could eventually lead to the establishment of a more harmonious balance between the SEC’s federal competencies and local protections for crypto consumers.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.