SEC demands asset freeze on Binance

The Binance-SEC case seems to be progressing very quickly. Just one day after filing a complaint against the crypto exchange, the regulator is taking a new step. The SEC is currently seeking to freeze Binance’s assets and even wants to go further by blocking any access of Binance and its CEO Changpeng Zhao to the funds of U.S. clients.

Towards an imminent asset freeze, the cryptosphere in turmoil

On June 5th, the SEC filed a complaint against Binance. Just one day after this legal action, the U.S. regulator requested a restraining order to freeze the assets of BAM Trading, the American branch of the exchange. According to reports, this restraining order would also affect other entities related to one of the largest crypto exchanges. The goal is to prevent any dissipation or transfer of funds to another jurisdiction. This move by the SEC would also help maintain the status quo.

In its filing, the SEC explains the main objective of the request for a restraining order: to remove any authorization or involvement of Binance and its CEO in the transfer or withdrawal of assets of U.S. clients. The SEC also asks Binance US to transfer all crypto assets to a different wallet with new private and administrative keys. These measures aim to ensure the protection of client funds. But that’s not all! It will also prevent any interference from Binance or its related entities.

Binance and CZ reassure users

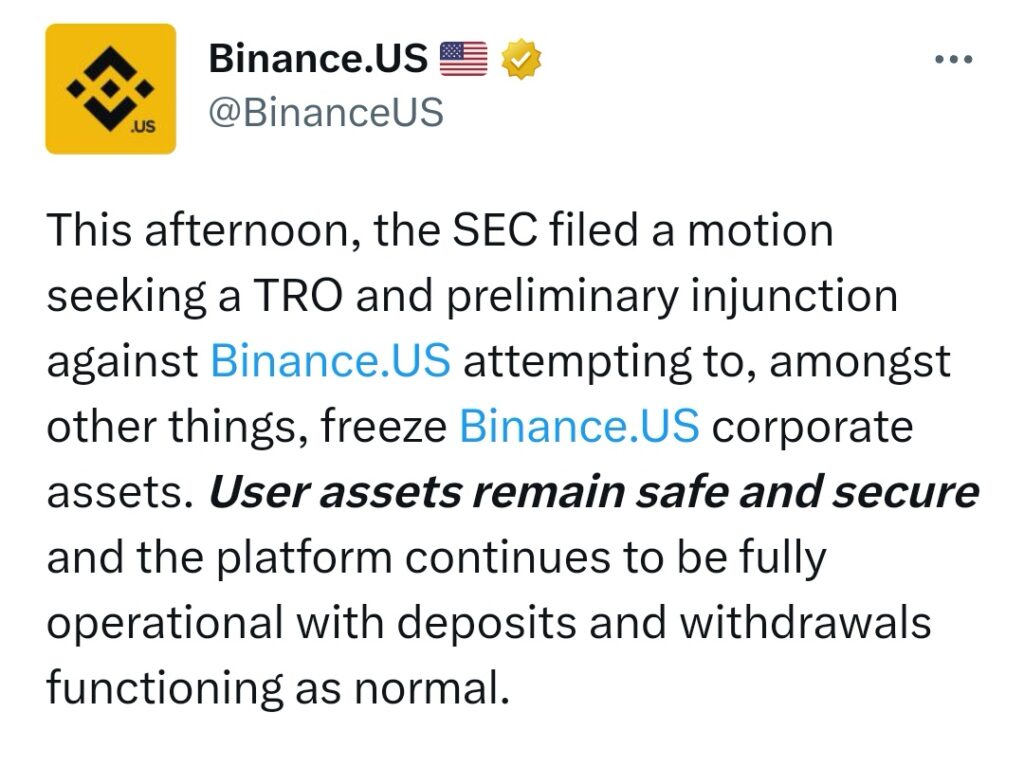

Following the complaint filed by the U.S. regulator, Binance US responded on Twitter. According to their team, the filing of the preliminary injunction is unwarranted. The American branch of Binance also expressed disappointment with the situation. However, they emphasized their willingness to cooperate with authorities to resolve this legal dispute.

The CEO of Binance also responded on Twitter. “The actions of the SEC only pertain to Binance US and do not affect the parent company. User funds are safe,” he explained, attempting to reassure the crypto community.

The asset freeze marks a major turning point in the Binance vs. SEC case. The outcome of this legal debacle will inevitably affect the future of crypto exchanges in the United States.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.