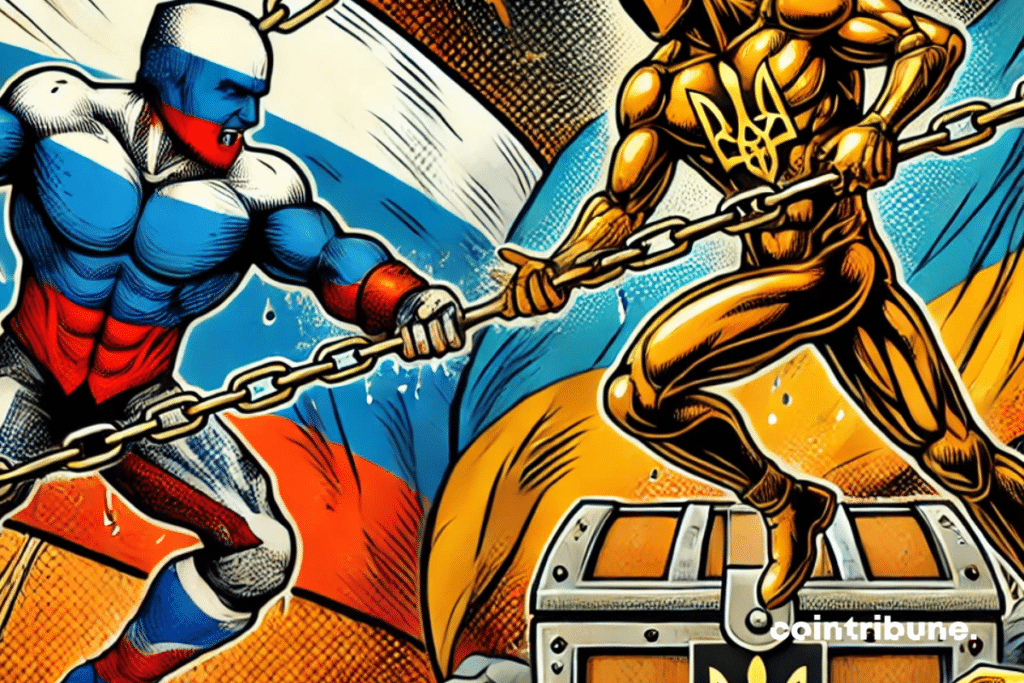

Russia vs G7 : Could Russia's frozen assets trigger a global economic crisis ?

As the G7 considers tapping into frozen Russian assets to support a massive loan to Ukraine, the Kremlin does not hide its concern. Through the warnings of its senior officials, Russia warns of consequences that could weaken the supremacy of the dollar and redefine international monetary balances.

Russia’s Warnings in the Face of Sanctions

Russia, through its Deputy Minister of Finance, Ivan Chebeskov, has warned that any attempt to use its frozen financial assets could have “deep systemic consequences for the international monetary and financial system.” This statement comes as the G7 considers using the blocked funds to finance a $50 billion loan to Ukraine, which alarms the Kremlin. Indeed, Chebeskov has stated that “the use of these assets could encourage developing countries to turn away from the US dollar, which calls into question its dominance in international transactions.” Such a statement highlights the possibility of seeing a diversification of currencies used in international exchanges.

Russia views these actions as a “militarized” use of the dollar and reminds that the American currency can be used as a weapon in geopolitical conflicts. Thus, the Russian government emphasizes that this situation could accelerate the search for alternative currencies by emerging countries, thereby creating additional instability in the markets. The G7’s plan to use frozen assets to support Ukraine is therefore seen as a potential catalyst for monetary transformations on a global scale.

Russian Economic Strategies to Counter Sanctions

In response to the intensification of economic sanctions, Russia is not remaining idle. Finance Minister Anton Siluanov has stated that Russia has already begun to leverage foreign assets present in its territory, used as a countermeasure to offset the effects of Western sanctions. This approach is part of a series of measures aimed at supporting the Russian economy in times of crisis. Siluanov specified that these revenues are used to strengthen Russia’s resilience against international restrictions, which have notably cut the country off from global financial networks like Swift.

Such a response is accompanied by a strengthening of internal economic policies aimed at reducing Russia’s dependence on Western markets. Moreover, the sanctions have led to a redefinition of economic alliances, with increasing collaboration between Moscow and powers like China and India, members of the BRICS alliance. European diplomats, for their part, continue to discuss potential new sanctions, with growing concern that the election of Donald Trump to the U.S. presidency could weaken the Western position against Russia.

As Russia intensifies its economic countermeasures and Western sanctions harden, the risk of upheaval in global markets increases. The use of frozen Russian assets could weaken the supremacy of the US dollar. The repositioning of developing countries in response to these tensions would redefine the architecture of the global financial system, with implications that are still difficult to measure.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.