⚡️Currency of War? 💵 Dollar is a Weapon Used to Solve Political Needs – Lavrov

— RT_India (@RT_India_news) January 31, 2024

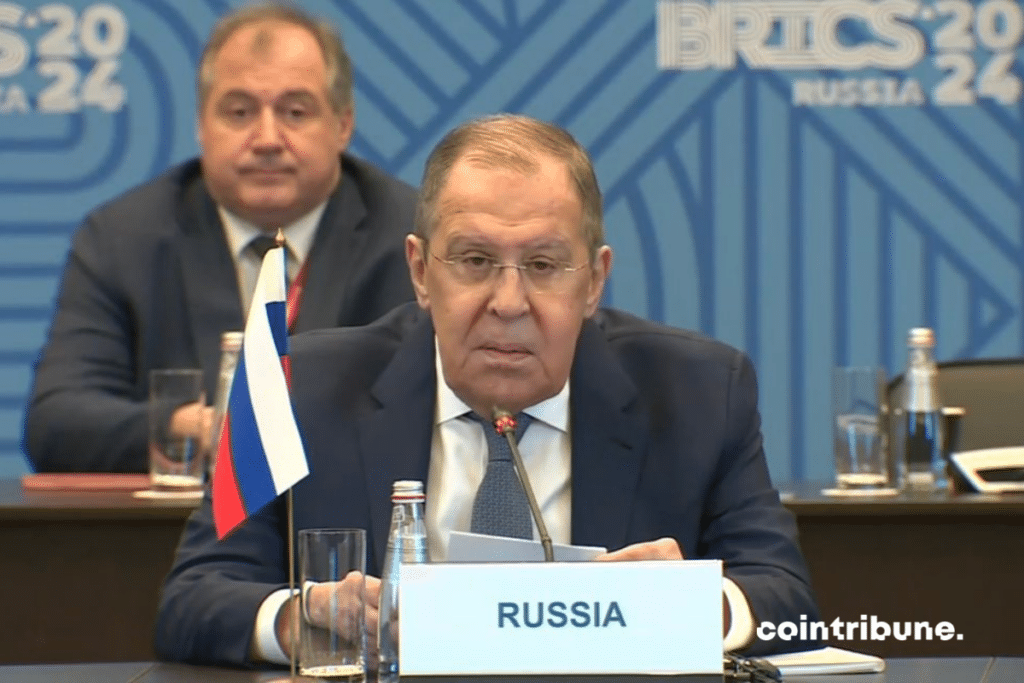

The Russian FM is speaking at the first BRICS Sherpas meeting of 2024, under Russia's presidency of the bloc. pic.twitter.com/hZirDViB19

A

A

Russia takes the presidency of BRICS and reaffirms the goal of de-dollarization

Wed 31 Jan 2024 ▪

4

min read ▪ by

Getting informed

▪

Payment

Russia Takes BRICS Presidency in 2024. Dedollarization to Accelerate, along with Cross-Border Payments involving CBDCs.

Moscow Takes the BRICS Presidency

The first meeting of the BRICS Sherpas is currently being held in Moscow. Representatives from the five new members (Saudi Arabia, Egypt, Iran, United Arab Emirates and Ethiopia) participated for the first time.

Following the theme that guided the BRICS alliance throughout the past year, Russia reiterated that moving away from the US dollar was the main priority for 2024.

“In line with the decision made by the BRICS leaders in Johannesburg, we will explore ways to expand the use of national and local currencies and payment instruments in our cross-border transactions. The goal is to reduce the negative side effects of the current international monetary system [dollar + swift],” the Russian Sherpa Sergey Ryabkov stated.

Chinese Sherpa Ma Zhaoxu also called for the use of national currencies in international settlements. “We should strengthen our cooperation and promote the development of the new BRICS Development Bank (NDB),” he added.

Iranian counterpart Mehdi Safari indicated that Tehran also expected an intensification of the transition to settlements in national currencies during Russia’s presidency of the alliance.

“In the 2024 plans, I hope that these economic and financial pillars, especially banking and financial issues, payment systems, digital currency, common currency, exchanges in national currencies, etc., will accelerate and become operational,” he launched.

Dedollarization will intensify in 2024. And it’s probably no coincidence that US military threats towards Iran are becoming increasingly insistent… Washington seems ready to wage war to prevent dissuade Middle Eastern countries from joining the monetary defiance.

This is why the world needs a stateless currency and payment system. This uncensorable currency, and moreover non-inflationary, is Bitcoin!

It’s about time for the BRICS to realize this rather than relying on CBDCs and the Bank for International Settlements.

China and the UAE Bypass the SWIFT Network

The first cross-border payment using the digital dirham (CBDC) was successfully initiated by the United Arab Emirates.

Sheikh Mansour bin Zayed Al Nahyan, the Deputy Prime Minister and the Governor of the Central Bank of the United Arab Emirates (CBUAE) spearheaded the payment amidst fanfare this Monday. The transaction took place during a celebration marking the 50th anniversary of the CBUAE.

This historical cross-border payment was destined for China. The operation was conducted through the “mBridge” platform, which is developed under the auspices of the Bank for International Settlements.

mBridge aims to replace the SWIFT network. The Hong Kong Monetary Authority, the central banks of China, Thailand, and the United Arab Emirates are in charge of the project.

The goal is to connect different countries’ CBDCs through a single common infrastructure “to enable cross-border payments to be immediate, inexpensive, and universally accessible.”

We can read on the website of the Bank for International Settlements:

“This infrastructure is based on a blockchain: the Ledger mBridge. It facilitates peer-to-peer cross-border payments and foreign exchange transactions using CBDCs. The use case is for international trade.”

Very good, but if this blockchain is “distributed,” is it also “decentralized”? Put another way, could nations be disconnected from it as with the SWIFT network? And what about liquidity?…

Regardless, these developments indicate that BRICS countries will use the greenback less and less. This is ultimately very promising for bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.