Ripple (XRP) Imminent bullish resurgence? Crypto analysis of January 24, 2024

Ripple did not escape the crypto market downturn this first month of the year. Let’s look at the upcoming prospects for the XRP price.

Ripple (XRP) Situation

After rebounding from $0.47, the XRP price reached a peak of around $0.73. It was at this price level that it started to falter, eventually positioning itself below its previous peak, at $0.55. Currently, XRP is in an area where a significant volume of transactions has been recorded. This could indicate that the cryptocurrency is in a key zone, witnessing significant investor interest.

At the time of writing this article, XRP is trading at around $0.51. Although Ripple’s medium-term trend seems bullish, the 50 and 200-day moving averages leave something to be desired. Indeed, without forming a ‘death cross’, they are currently above the actual price, which could indicate the possibility of a trend reversal. This development urges investors to be more vigilant. As for the oscillators, they are now below their median threshold, suggesting that Ripple’s course might be in an oversold state. From an optimistic point of view, this could indicate that Ripple is undervalued. However, from a pessimistic perspective, it could signal a potential shift in momentum towards a bearish trend. Having said that, a bullish divergence seems to be forming on the daily RSI.

The current technical analysis was conducted in collaboration with Elie FT, an investor and trader passionate about the cryptocurrency market. Now a trainer at Family Trading, a community of thousands of private traders active since 2017. There you will find Live sessions, educational content, and mutual assistance on financial markets in a professional and warm atmosphere.

Focus on Ripple Derivatives (XRP/USDT)

In the first week of January, XRP’s open interest decreased by about -36 %. This represents an elimination of approximately $174 million on the XRP/USDT perpetual contracts. Since then, the open interest has fluctuated in the same way as its price. This suggests a return of traders, presumably mostly on the buyer’s side. These claims can be defended by the liquidations that have been predominantly on the long side during the token’s price declines up to now. Thus, this phenomenon reflects a possible exaggerated bullish conviction on the part of traders at these levels and therefore hints at a possible capitulation of buyers to come if this continues. On this topic, while concerning, it could represent an opportunity for contrarian investors.

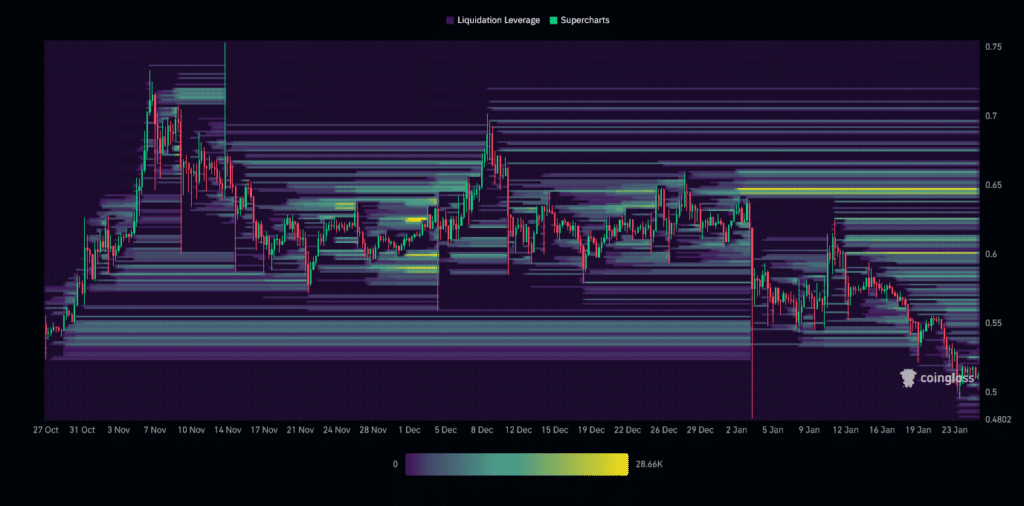

According to the XRP Liquidation Heatmap, the downturn at the beginning of the month drove its price toward a significant liquidation zone, as highlighted in the analysis of November 16, 2023. The enthusiasm of the buyers seemed marked, however, the price seems willing to test this interest. Currently, the most significant liquidation zone over the last three months is around $0.65. The price’s approach towards this level could trigger a massive triggering of orders, increasing the possibility of a period of heightened volatility on XRP. This zone thus represents a crucial point of interest for investors.

Possible Scenarios for the Ripple (XRP) Price

If the XRP price maintains above $0.51, we could anticipate a bullish continuation up to $0.6 – $0.65. The next resistance to consider, if the bullish movement continues, would be the $0.73 threshold. At this stage, it would represent a nearly + 43% increase.

If the XRP price fails to hold above $0.51, a return to $0.47 could be envisioned. The next support to consider, if the bearish movement continues, would be around $0.42 – $0.41. At this stage, it would represent a decline of nearly – 19%.

Conclusion

A misstep for XRP. While the cryptocurrency has risen from its support, it unfortunately did not have enough momentum to surpass its last peak. Does it need a new impetus to achieve this? What is certain is that it will be crucial to closely observe the price reaction at different key levels to confirm or invalidate the current hypotheses. It is also important to remain vigilant against potential “fake outs” and market “squeezes” in each scenario. Finally, let’s remember that these analyses are based solely on technical criteria and that the cryptocurrency prices may also move quickly based on other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more