Review Of Coinbase: What To Think About The Platform In 2025?

Coinbase is today one of the most popular crypto platforms worldwide. Since its creation in 2012, it has established itself as an essential reference for buying, selling, and storing cryptocurrencies. Its ease of use attracts beginners, while its advanced features, such as the Coinbase API, and its enhanced security measures appeal to seasoned investors and developers looking to integrate crypto solutions. In 2024, Coinbase continues its evolution to meet the growing needs of users and rapidly changing markets. In this article, we will analyze its features, fees, security, and advantages, while exploring its limitations.

What is Coinbase?

Coinbase is much more than just a cryptocurrency exchange platform. It represents a gateway to access the complex world of digital assets. With a presence in over 100 countries and millions of verified customers, it has built a solid reputation.

A leading company in the crypto space

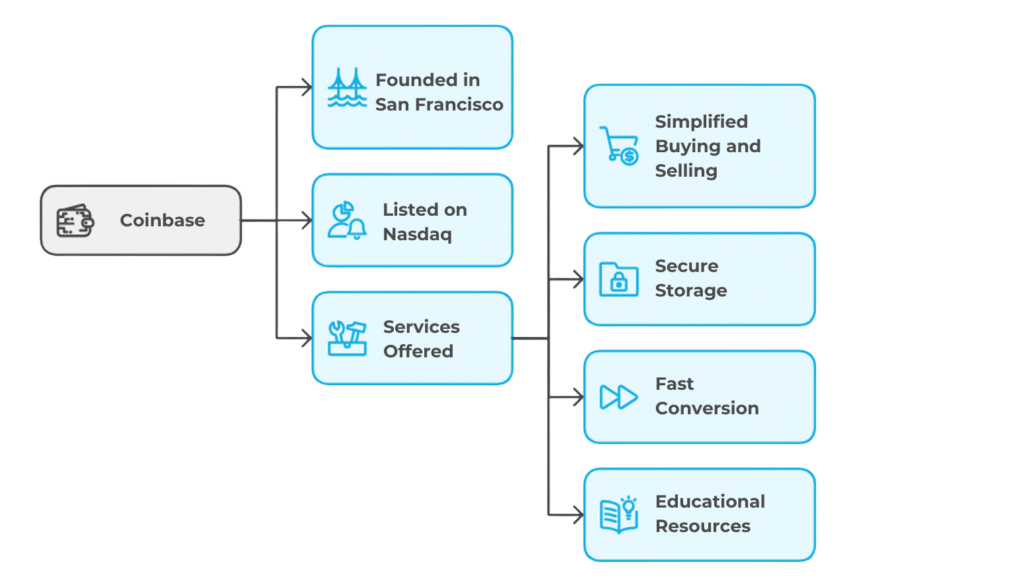

Coinbase was founded in San Francisco by Brian Armstrong and Fred Ehrsam. Listed on Nasdaq since 2021, it embodies the professionalization of the crypto sector. This stock market listing of Coinbase enhances its transparency and inspires confidence among many users, whether individuals or institutional investors.

The platform allows users to buy, sell, exchange, and store cryptocurrencies. It caters to a diverse audience, ranging from curious beginners to active investors looking for advanced tools to optimize their portfolios.

A versatile platform

Coinbase does not limit itself to simple transactions. It offers various services to meet user expectations:

- Simplified buying and selling: users can acquire cryptocurrencies via credit card, bank transfer, or digital wallet.

- Secure storage: Coinbase provides reliable digital wallets and a safe for long-term storage.

- Quick conversion: users can exchange their cryptocurrencies in just a few clicks.

- Educational resources: with programs such as “Learn & Earn”, Coinbase helps newcomers in their learning about cryptocurrencies.

These features explain why Coinbase remains an essential platform in 2024.

What are the main features of Coinbase?

Coinbase offers a wide range of features tailored to different user profiles. Whether you are a novice investor or an active trader, the platform provides tools to simplify and enrich the experience.

An impressive variety of cryptos

Coinbase offers a catalog of over 200 cryptocurrencies. Among them, you’ll find essentials like Bitcoin, Ether, and Litecoin, as well as newer tokens related to decentralized finance (DeFi) such as Aave or Uniswap. Stablecoins like USDC help secure assets against market volatility. This diversity meets the needs of investors looking to diversify their portfolios.

The platform regularly enriches its catalog by adding new assets based on trends and market demand. This allows users to take advantage of opportunities offered by emerging projects.

A powerful mobile app

The Coinbase app, available on iOS and Android, offers a smooth and intuitive interface. It allows users to track their portfolio’s progress in real time, execute transactions, and view market trends. The app’s ergonomics make it easy to use, even for those not accustomed to technology.

Additionally, the app sends notifications to inform users about significant price fluctuations. This helps them react quickly to market changes, a feature particularly useful for active traders.

Coinbase Wallet: an integrated storage solution

The Coinbase Wallet is a digital wallet that allows users to securely store their assets. It is compatible with a wide variety of cryptos and also supports NFTs (non-fungible tokens). This wallet is decentralized, meaning that users maintain exclusive control over their private keys.

Additionally, Coinbase offers a digital vault providing enhanced security for assets intended to be held long-term. This service includes multi-user verification and validation delays for withdrawals.

The educational program “Learn & Earn”

Coinbase offers the educational program “Learn & Earn,” an initiative designed to make the world of cryptocurrencies accessible to a wide audience. This program offers interactive videos that explain the fundamental concepts of digital assets, such as how blockchains, tokens, or decentralized applications work.

Users take quizzes after each lesson, and those who succeed receive rewards in cryptocurrency. This playful approach allows users to learn while accumulating digital assets, encouraging them to explore this complex ecosystem further.

Fees on Coinbase

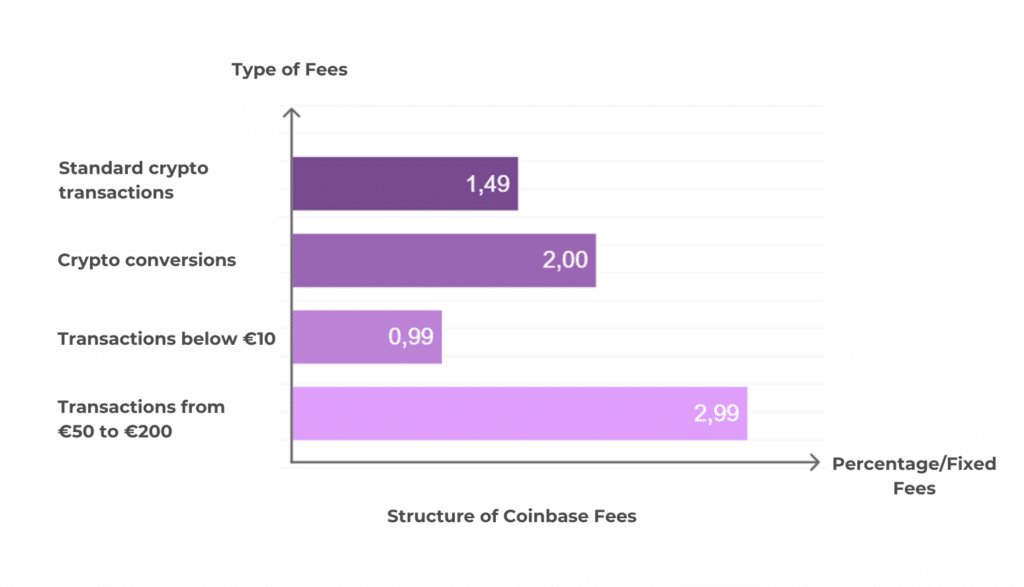

Fees on Coinbase are a major criterion to consider for users, as they directly influence the profitability of transactions. The platform applies a clear pricing structure, including a standard commission of 1.49% on the purchase and sale of cryptocurrencies, and 2% for conversions between digital assets. Fixed fees for small amounts also apply, making transactions under 200€ proportionally more expensive.

Additionally, Coinbase imposes an average spread of 0.50% between buy and sell prices, which can vary depending on market volatility. These fees, although transparent, remain higher than some alternatives like Binance or Kraken, but reflect the security and regulatory standards offered by Coinbase.

The impact of the spread on positions and transactions

As mentioned earlier, Coinbase also applies a spread, which corresponds to the difference between buying and selling prices. This spread, usually around 0.50%, can increase during periods of high volatility. This practice, common on mainstream platforms, can increase the costs for larger transactions.

Coinbase vs Coinbase Advanced

Coinbase and Coinbase Advanced, though belonging to the same company, target different user profiles. Coinbase, designed for beginners, offers an intuitive interface for buying, selling, and storing cryptocurrencies with ease. In contrast, Coinbase Advanced is aimed at experienced traders, offering advanced features and a competitive pricing structure.

Coinbase Advanced adopts a maker-taker model pricing, where fees decrease based on monthly trading volume. “Makers” (users who add liquidity to the market through limit orders) benefit from lower fees compared to “takers” (those who execute orders already present on the market). Fees start at 0.60% for takers and 0.40% for makers and can go down to 0% for volumes exceeding 50 million dollars monthly, thus encouraging active and high-volume trading.

In addition to an advantageous fee structure, Coinbase Advanced offers technical tools such as interactive charts developed by TradingView, indicators like RSI, moving averages, as well as advanced options such as market orders, limit orders, and stop-limit orders. These features allow traders to optimize their trading strategies while benefiting from the security and reliability of the Coinbase platform.

This transition from Coinbase Pro to Coinbase Advanced reflects a desire to unify the Coinbase ecosystem while offering options tailored to users of all levels, from beginners to professionals.

The Security and Reliability of Coinbase: What Do You Need to Know?

Security is one of Coinbase’s major assets. The platform implements rigorous measures to protect digital assets and user data.

Offline Storage of Assets

Coinbase keeps 98% of users’ cryptos in offline wallets, also known as “cold wallets”. These devices, disconnected from the Internet, significantly reduce the risks of hacking. The remaining 2% are stored online to ensure the necessary liquidity for daily transactions.

Enhanced Authentication

Coinbase uses two-factor authentication (2FA) to protect accounts. Users must provide a unique code generated by Google Authenticator or sent via SMS in addition to their password. This method limits the risk of unauthorized access, even if credentials are compromised.

Insurance for Fiat Deposits

For funds in fiat currencies, Coinbase keeps cash balances in separate accounts with partner banks, such as JPMorgan Chase, Cross River Bank or Pathward. These funds are not used for Coinbase’s expenses and remain protected in the event of a business failure.

In the United States, fiat balances are covered by FDIC insurance up to $250,000 per account. This guarantee protects only fiat funds and not cryptocurrencies, which are not covered by the FDIC or SIPC.

Operational Reliability

Coinbase is known for its stability and security, but it has encountered difficulties during spikes in activity, sometimes rendering the platform inaccessible. These interruptions, although rare, can penalize active users in volatile markets.

The Advantages and Disadvantages of Coinbase

Coinbase has many strengths but is not without criticism. These points deserve evaluation before choosing the platform.

The Advantages

- User-friendly interface, ideal for beginners.

- Wide selection of cryptocurrencies, including DeFi tokens and stablecoins.

- Robust security with offline storage options.

- Enriching educational program.

- Intuitive and efficient mobile app.

The Disadvantages

- Relatively high fees compared to other platforms.

- Spread can increase costs during periods of volatility.

- Customer service sometimes criticized for its slowness.

Are There Other Alternatives to Coinbase?

For those looking for options with lower fees or specific features, several alternatives deserve to be considered.

eToro: Simplicity and Social Trading

eToro is a platform recognized for its simplicity and its unique approach to social trading. Users can observe and replicate the strategies of other investors through the copy trading feature, making it particularly suitable for beginners looking to learn by following experienced traders.

In addition to cryptos, eToro offers a wide range of assets, including stocks and ETFs, thus providing interesting diversification. Regulated in Europe, it guarantees a secure and accessible environment. Educational tools and demo accounts enhance its attractiveness for new investors.

Binance: An Offering for Experts

Binance primarily targets experienced traders with its wide range of advanced features. The platform offers some of the most competitive fees in the market, as well as access to derivative products such as futures and options.

Binance also offers technical tools, such as interactive charts and indicators, tailored to complex trading strategies. Users can trade a vast selection of cryptos, including DeFi tokens and emerging projects. Its reliability and comprehensive ecosystem make it a preferred choice for crypto experts.

Zengo: A Unique Mobile Experience

Zengo is a mobile application designed to simplify cryptocurrency management while offering a high level of security. Unlike traditional platforms, it uses facial recognition to replace private keys, ensuring secure and intuitive access.

Zengo allows you to buy, sell, and store cryptos in just a few clicks, providing a smooth and accessible experience, even for beginners. Compatible with numerous cryptos and incorporating staking features, this application represents a perfect alternative for those who prioritize mobility and simplicity.

In summary, Coinbase remains in 2024 an essential platform for users looking to invest in cryptos. Its simplicity, security, and educational program make it a preferred choice for beginners. However, its relatively high fees and spread may discourage active investors. For those seeking more economical alternatives or specific features, options like Coinbase Advanced, Binance, or eToro may better meet their needs. Before choosing a platform, it is necessary to evaluate one’s goals and expectations. Nevertheless, Coinbase remains a reliable and accessible solution for discovering the world of cryptos.

FAQ

Yes, Coinbase offers functionality to buy and store NFTs via Coinbase Wallet. This decentralized digital wallet supports non-fungible tokens, offering users a simple solution for managing their digital assets and exploring the world of NFTs.

Yes, Coinbase offers the Coinbase Card, a Visa card that lets you use your cryptos to make payments in shops or online. Cryptos are automatically converted into fiat currency during transactions. This feature is particularly useful for those who want to use their digital assets on a daily basis.

Withdrawal times vary according to the method used. SEPA bank transfers generally take 1-3 business days, while credit card withdrawals can be instantaneous, but include additional charges. Exact times may also depend on your bank’s policies.

Yes, Coinbase provides detailed transaction reports, accessible from your account. These reports can be used to calculate capital gains and fulfill your tax obligations. However, it is recommended that you consult a tax expert for full compliance.

Yes, it is possible to integrate trading bots into Coinbase via API keys. These tools allow you to automate transactions according to predefined strategies, but you need to configure permissions carefully to protect your account and assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more