Report Your Coinbase Earnings To The Tax Authorities: Simplified Guide

The gains made through the Coinbase platform, like any other source of income from cryptocurrencies, must be declared for taxes. Tax regulations regarding digital assets have tightened over the years. This practical guide will help you step by step to understand the necessary procedures, calculate your taxable gains, and submit a declaration that complies with French law.

Understanding the crypto taxation

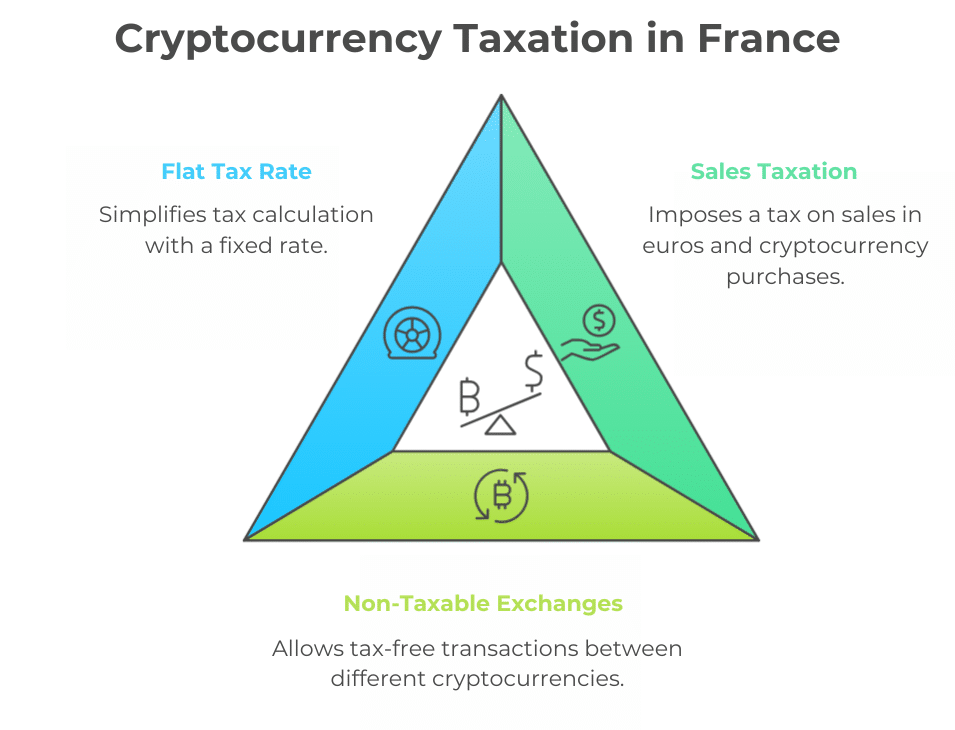

The taxation of cryptocurrencies is governed by specific legislation in many countries. It only applies to profits made when converting cryptocurrencies to fiat currency or when used for purchases. On the other hand, exchanges between cryptocurrencies are not subject to tax.

The law provides for a unique flat-rate scheme for individuals: a flat tax of 30%. This rate includes 12.8% income tax and 17.2% social contributions. This tax applies only if your annual transactions generate gains exceeding 305 euros. If this threshold is exceeded, you must declare your capital gains and fill out the required forms.

The main features of the tax regime

The taxation of cryptocurrencies is based on several key principles:

- Taxation of disposals: only sales in euros or the purchase of goods and services with cryptocurrencies are taxed.

- Non-taxable exchanges: transactions between different cryptocurrencies are exempt from tax.

- Flat tax: a fixed rate simplifies the calculation, regardless of the amount of gains.

Understanding these elements is essential to avoid errors in your tax declaration.

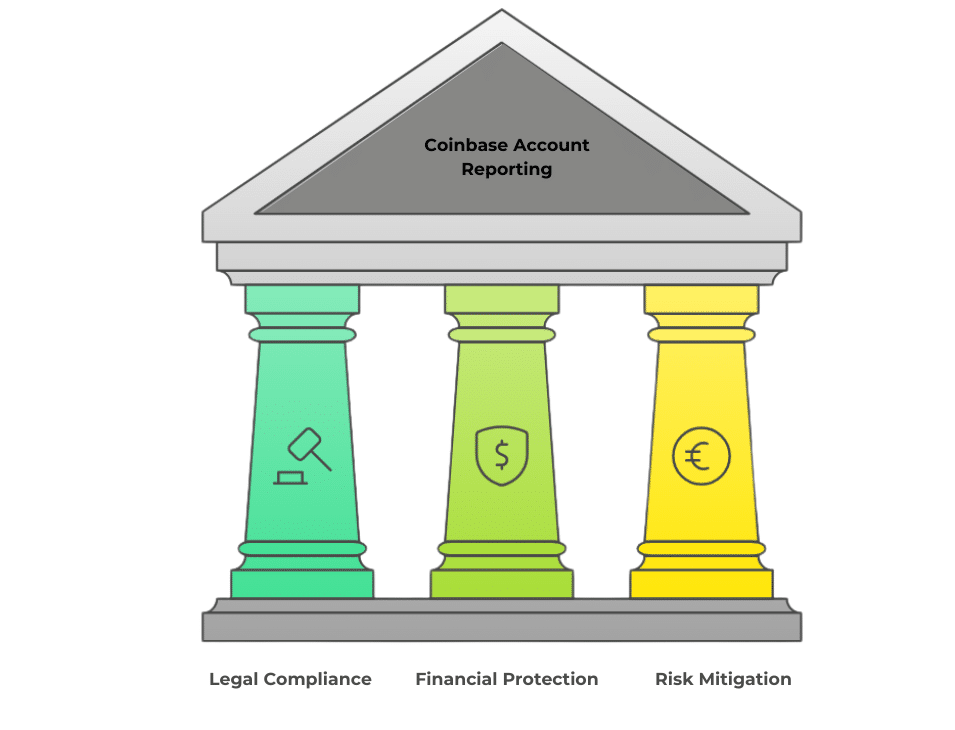

Why is it necessary to declare your Coinbase account?

French tax residents must declare any digital asset account opened, used, or closed abroad. Coinbase, being headquartered in Dublin, is considered a foreign account. The declaration of this type of account is mandatory and protects against potential sanctions.

Declaring your Coinbase accounts ensures your compliance with French tax regulations. In the event of non-declaration, you risk fines ranging from 750 euros to 10,000 euros, depending on the severity of the offense. This process is thus essential to avoid financial and legal complications.

Form 3916-bis: how to use it

Form 3916-bis allows you to declare your foreign accounts. To fill out this document, you will need to provide the following information:

- Name of the organization: Coinbase Europe Limited;

- Address: 70 Sir John Rogerson’s Quay, Dublin D02 R296, Ireland;

- Website URL: www.coinbase.com.

This data must be accurate to avoid errors. Also make sure to specify the date of opening and, if applicable, closure of your Coinbase account.

Calculate and declare your capital gains

The calculation of capital gains is a central step in the tax declaration of cryptocurrencies. It involves assessing the profits made during each taxable disposal. This means determining the difference between the acquisition price and the disposal price.

How to calculate your taxable gains?

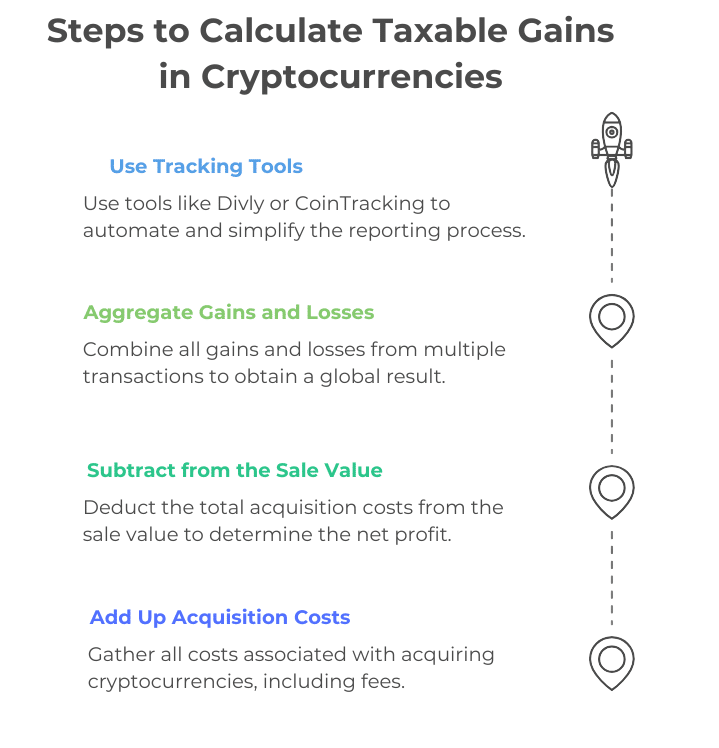

The calculation of gains follows a precise methodology:

- Add the acquisition values of your cryptocurrencies (including fees).

- Subtract this total from the disposal value to obtain your net profit.

- If you have multiple transactions, total the gains and losses to obtain an overall result.

This calculation can be complex, especially for active investors. Tools like Divly or CoinTracking can simplify this task by generating automatic reports compliant with tax regulations.

Form 2086 to detail your transactions

To declare your capital gains, you must fill out form 2086. This document allows you to detail all taxable transactions of the fiscal year. Each disposal must be recorded there, with the exact amounts. Once completed, form 2086 allows you to transfer the total gains to form 2042 C.

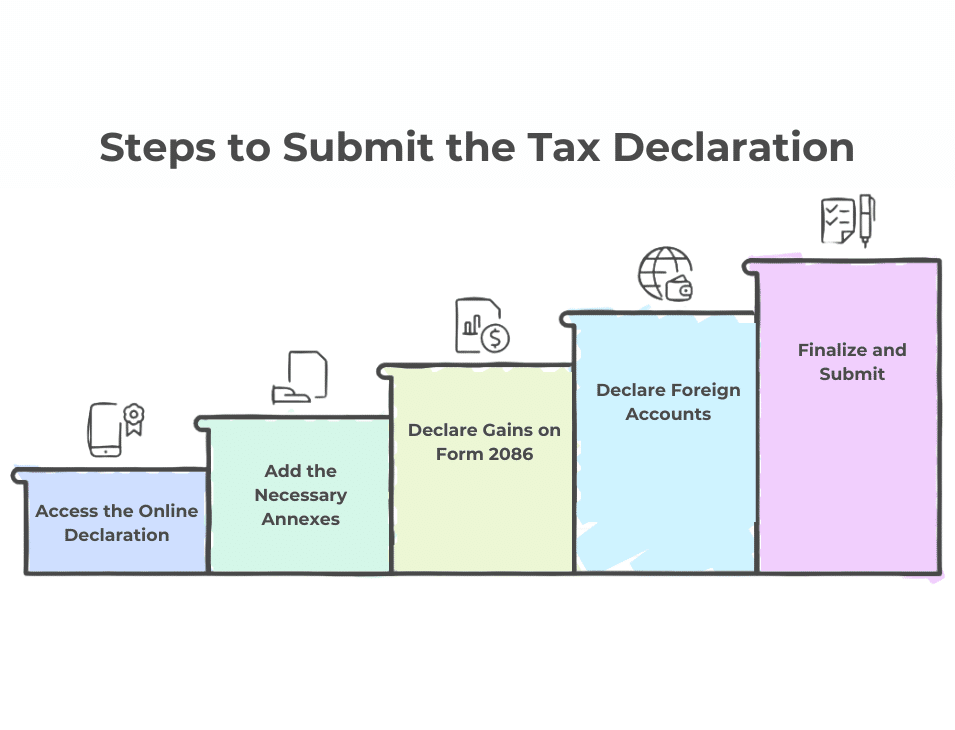

Practical steps to submit your declaration

Declaring your income from Coinbase involves following a well-defined process. By respecting each step, you can ensure the compliance of your declaration.

Step 1: Access the online declaration

Log in to your country’s official tax portal and make sure your personal information is up to date before proceeding.

Step 2: Add the necessary annexes

When declaring, be sure to include the required forms:

- 2042 C for the overall assessment of capital gains.

- 2086 for taxable transactions.

- 3916-bis for accounts held abroad.

These annexes provide all the mandatory information about your income and accounts.

Step 3: Fill in the gains on form 2086

Form 2086 requires precise information about your transactions:

- Number of disposals made.

- Purchase and sale amounts.

- Gains or losses for each transaction.

Once this form is completed, transfer the results to form 2042 C.

Step 4: Declare your foreign accounts with form 3916-bis

In form 3916-bis, report the data from your Coinbase account. Specify its usage (trading, holding, etc.) and the periods during which it has been active.

Step 5: Finalize and submit your declaration

After completing all forms, carefully review your declaration before submitting it. Adhere to deadlines based on your geographical area.

Use tools to facilitate the declaration

For investors with numerous transactions, automation tools like Divly are particularly useful. These platforms allow you to directly export your Coinbase history and generate a complete tax report. This solution avoids calculation errors and speeds up the declaration process.

Deadlines for declaring your crypto income

The deadlines for declaration vary according to tax zones. For example, in France:

- Zone 1 (departments 01 to 19): end of May.

- Zone 2 (departments 20 to 54): early June.

- Zone 3 (departments 55 to 976): mid-June.

Meeting these deadlines is crucial to avoid late penalties. Failing to declare your accounts or gains can lead to severe sanctions. Fines range from 750 euros to 10,000 euros per undeclared account. Additionally, in case of concealment of gains, further penalties may be applied. These sanctions aim to ensure tax transparency and compliance with legal obligations.

Declaring your income and Coinbase accounts for taxes requires a good understanding of tax obligations and the forms to fill out. This guide provides you with essential information to make a complete and compliant declaration. By using appropriate tools and meeting deadlines, you can simplify the process while remaining compliant with the law. Take action now to secure your cryptocurrency investments and enjoy your trading activity on Coinbase peacefully.

FAQ

Yes, cryptocurrencies received as gifts or donations must be declared. You will need to assess their value at the time of receipt and possibly pay gift tax depending on the amount and relationship to the donor.

If you haven’t made any cash conversions or taxable purchases, you don’t need to declare any capital gains. However, if you are a French tax resident, you must still declare your Coinbase account using form 3916-bis.

Yes, income generated by staking or airdrops is considered taxable income. You must include them in your tax return as extraordinary income and calculate their value at the time of receipt.

Coinbase transaction fees can be deducted from winnings when calculating taxable capital gains. Be sure to keep detailed records of your transactions to justify these fees to the tax authorities.

Yes, if you incur losses on your investments, you can deduct them from the gains you made in the same year. If your losses exceed your gains, they cannot be carried forward to subsequent years.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more