Paris Bourse Falters Amid Trump’s Trade Threats

The crypto market is currently experiencing a period of uncertainty, as Bitcoin, which had recently reached historic highs, shows signs of weakness. Experts from CryptoQuant have identified concerning indicators suggesting a possible bearish phase ahead.

Warning signals multiply in the Bitcoin market

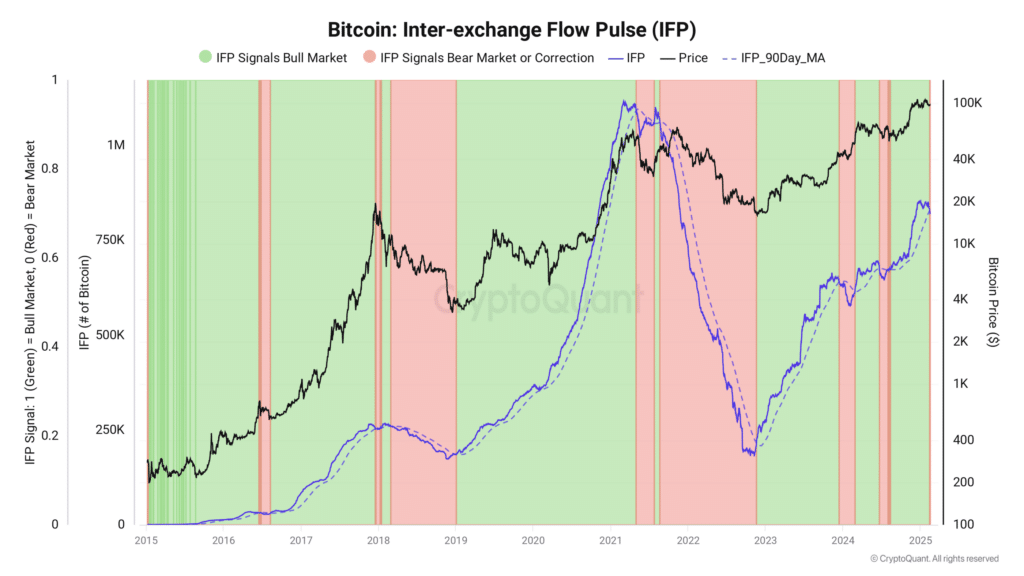

On February 15, 2025, the blockchain analysis platform CryptoQuant published a revealing report on the movements of Bitcoin. The key indicator Inter-Exchange Flow Pulse (IFP) shows a worrying trend: investors are massively withdrawing their bitcoins from derivatives trading platforms to transfer them to spot exchanges. This behavior is historically associated with a reduction in risk exposure among large investors.

According to JA Maartunn, an analyst at CryptoQuant, this movement is generally a sign of caution. Indeed, when investors move their bitcoins to traditional platforms, it is often to protect themselves from a potential decline in prices. Conversely, during periods of increase, investors tend to transfer their BTC to speculative platforms to maximize their gains.

Another worrying signal comes from the history of the IFP. In March 2021, this indicator reached a record level just before Bitcoin climbed to $58,000. In contrast, during the recent peak of $109,000 in January 2024, the IFP remained surprisingly low. This is unusual, as traditionally, each new Bitcoin record is accompanied by a new IFP record.

The macroeconomic context weighs on the prospects

The current situation of Bitcoin fits into a complex macroeconomic context, particularly in the United States. Recent reports on inflation have led the U.S. Federal Reserve (Fed) to maintain a cautious stance, likely delaying the easing of its monetary policy until 2025. This decision has a direct impact on risk assets like Bitcoin.

Global liquidity conditions, essential to support the crypto market, largely depend on these monetary policy decisions. Analysts suggest that a durable recovery of Bitcoin will require a significant improvement in global liquidity conditions, which seems unlikely in the short term.

Nevertheless, whales are under increased scrutiny by analysts, who are looking to identify reliable support levels for the price of Bitcoin. Their behavior could provide valuable clues about the market’s future direction.

In summary, although technical signals suggest a possible correction phase, many experts maintain their optimism regarding Bitcoin’s long-term prospects. However, the combination of technical indicators and macroeconomic context invites caution in the weeks to come, especially for investors with short-term investment horizons.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.