North Korea Becomes One Of The Largest Holders Of Bitcoin In The World

There are several ways to increase one’s Bitcoin treasure. Some, like El Salvador or MicroStrategy, prefer to buy at regular intervals. Others, like Bhutan, bet on mining to accumulate BTC. But there are also those who prefer the dark path: pure and simple theft. And in this regard, North Korea stands out as the absolute master, thanks to the exploits of its infamous hacker group, Lazarus. Their latest achievement? A lightning heist of $1.4 billion on the Bybit exchange. An exploit that propels Pyongyang into the ranks of major BTC holders, surpassing even countries like Bhutan and El Salvador.

When North Korea Turns Hacking into a Bitcoin Jackpot

Two years ago, the White House estimated that nearly 50% of North Korea’s ballistic program was funded by cyberattacks and cryptocurrency theft. Today, that number does not seem likely to decrease. On February 21, the Lazarus group distinguished itself with a masterstroke: siphoning $1.4 billion on Bybit.

And the most remarkable part? In just 10 days, they managed to launder 100% of that amount via DeFi protocols like THORChain. A speed that leaves one speechless and shows the extent of their expertise.

Lazarus doesn’t stop there. Before this record, they had already hit numerous platforms. Some notable exploits:

- 2022: $615 million stolen on the Ronin Network;

- 2023: $308 million stolen from DMM Bitcoin (Japan);

- 2020 – 2023: Over $200 million laundered via 25 crypto hacks.

U.S. authorities are closely monitoring these misdeeds. They estimate that these attacks have become an essential source of revenue for Kim Jong-un’s regime. As Anne Neuberger, Deputy National Security Advisor of the United States, pointed out, “Pyongyang has made cyber an indispensable economic lever for its survival“.

Sanctions, asset freezes, and legal proceedings are multiplying, but the cat-and-mouse game continues.

So, how far will the North Korean hackers go? Can the crypto community really stop them?

BTC-Holding Countries: North Korea Plays in the Big League

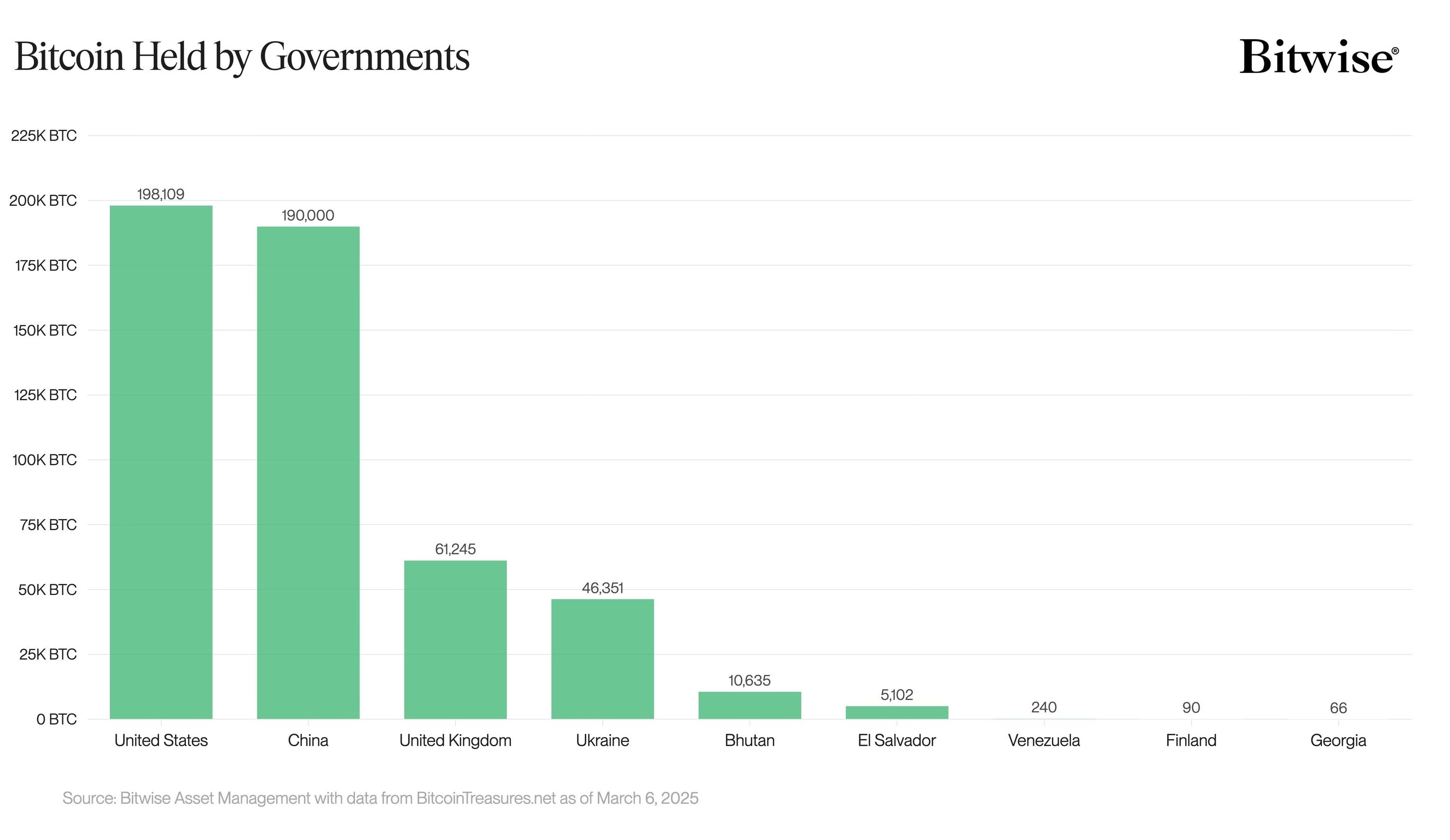

With 13,518 BTC in hand (about $1.13 billion), North Korea is no longer just a shadow player. It surpasses nations like Bhutan (10,635 BTC) and El Salvador (6,118 BTC), which have nonetheless relied on legal and official strategies to bolster their Bitcoin holdings.

El Salvador, for example, has been continuously buying BTC since it made cryptocurrency legal tender in 2021. As for Bhutan, its accumulation is based on an intensive mining strategy, utilizing its abundant hydropower to produce Bitcoin at lower costs.

However, North Korea has not yet caught up with the true Bitcoin behemoths. At the top, the United States dominates with 198,109 BTC, primarily sourced from judicial seizures.

Right behind, the United Kingdom boasts 61,245 BTC in its coffers, strengthening its position among the major crypto nations. It is also noteworthy that the Chinese government, although silent about its exact holdings, still reportedly possesses significant stocks of BTC seized after the closure of fraudulent platforms.

In this race for digital gold, North Korea has found a questionable but devilishly effective shortcut. How far will it climb before a wall rises in its path? Will the international response eventually clip its wings?

The Bybit affair has not only impacted the hacked exchange. Its shockwave has also shaken OKX, suspected of having acted as an intermediary for laundering the stolen funds. The exchange had to quickly deny any involvement, under the watchful eye of European regulators. Another proof that the crypto world is still on edge.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.