Anthropic unveils the Model Context Protocol (MCP), an open-source standard that revolutionizes the connection between AI and business applications. This standardized protocol facilitates access for models like Claude to external data, paving the way for truly integrated intelligent assistants within workflows.

Tech News

Ethereum has long embodied a technological fortress in the crypto universe. But today, the ship is rocking. As the network prepares to deploy its Pectra update, developers are navigating murky waters. Delays, unexpected bugs, sly attacks... Behind the promises of innovation lies a less glamorous reality: that of an exhausted team facing technical challenges that threaten to push back the long-awaited deadline. A stark spotlight on the backstage of an ecosystem in search of perfection.

Google has just dropped a new bomb in the race for artificial intelligence (AI): Gemini 2.5. Presented as a "thinking" model, it does not merely regurgitate answers; it analyzes, reasons, and reflects before speaking. With a major advancement in coding, reasoning, and multimodality, Google hopes to catch up with OpenAI and its other rivals. But is it enough to disrupt ChatGPT, which remains comfortably at the top of the market with 43% market share?

Meta's artificial intelligence is finally available in Europe after a long tug-of-war with regulators. Meta AI, already integrated into the group's applications in the United States, is gradually rolling out in France and 40 other European countries. It is now appearing on WhatsApp, Instagram, Facebook, and Messenger, profoundly changing the interaction of users with Mark Zuckerberg’s group platforms.

DIV Protocol opens its testnet next week, in collaboration with 15 selected private companies. For over a month, they will explore the capabilities of this innovative cloud, based on blockchain and post-quantum encryption. A major advancement for the cybersecurity of sensitive data in businesses. DIV Protocol launches its testnet reserved…

The hype has faded like a poorly minted NFT: the flamboyant tales of Bitcoin are fading away, leaving only the echo of a promise sold too soon.

Binance boosts its BNB Chain with turbo: with Pascal, crypto transactions zip by like arrows, leaving slow nodes on the sidelines of Web3.

What if blockchain became the new safeguard of humanitarian aid? A persistent rumor is circulating in Washington: USAID, a pillar of international assistance, might undergo a transformation under the influence of Trump advisors. Their idea? To inject a dose of crypto into the bureaucratic veins of the agency. The stated goal: to track every dollar, eradicate leaks, and redefine transparency. A bold shift that combines technological innovation and political calculation.

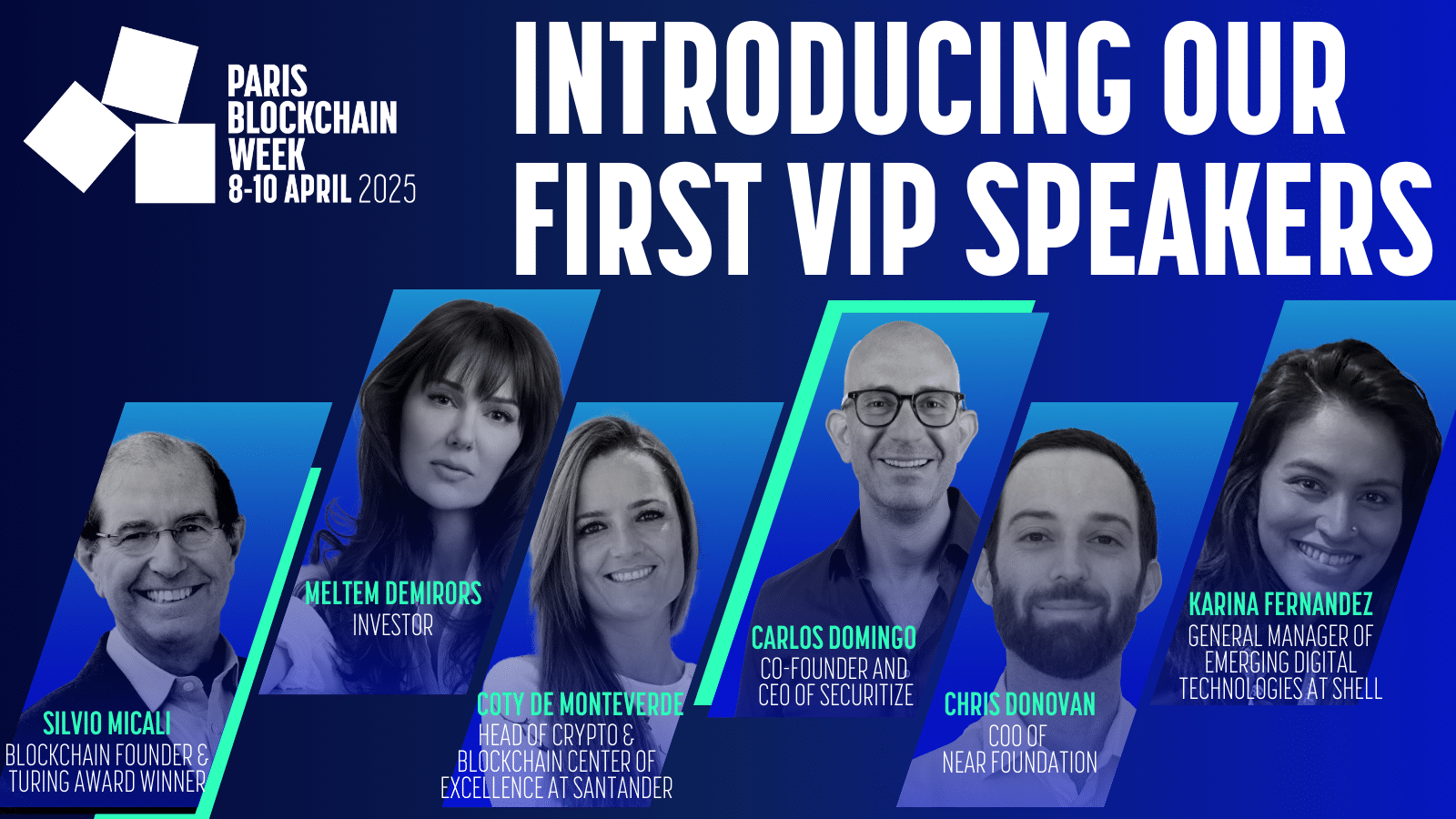

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.

Artificial intelligence has reached a decisive milestone with the rapid rise of ChatGPT, revolutionizing both the general public and businesses. However, in the face of the limitations of giant models, a new approach is emerging: intelligent agents. Capable of acting and interacting with their digital environment, they are redefining the future of AI by moving from simple text generation to the execution of concrete, autonomous tasks.

Join Qubic & Vottun in Madrid for an exclusive hackathon where top Web3, blockchain, and AI developers will push the boundaries of decentralized computing. Compete for over €80,000 in prizes, network with industry leaders, and gain hands-on experience building on Qubic’s decentralized computing platform.

Nvidia unveils its new chips and triggers a crash in AI crypto tokens! We provide all the details in this article.

Siemens, a pillar of the European industry, is accelerating into crypto. Its integration of the Minima blockchain into its connected machines goes beyond mere innovation. The group is redefining digital trust with a decentralized network capable of transforming entire sectors. IoT and crypto are joining forces to secure critical infrastructures and automate industrial processes.

Is Ethereum at risk of a crash? On-chain data and ETFs indicate a significant downturn ahead. Full analysis here!

Google officially launched Android 15 on March 17, 2025, and this new version is set to be one of the biggest evolutions of the mobile operating system. Initially scheduled for October 2024, the final public version of this major update brings impressive improvements that will change the way we use our smartphones. Here are the 7 most revolutionary features of Android 15.

Trezor believed its vaults were impenetrable, but Ledger blew on the lock. A sealed flaw, a shaken trust, and the crypto security war is back in full swing.

A tiny device challenging the monsters of Bitcoin mining, a chance worthy of a miracle, and there is a solitary miner pocketing $260,000 under the astonished gaze of the industry.

Ethereum Pectra update postponed! A new testnet is scheduled for March, but the final date remains uncertain. Details in this article!

Nuclear energy and cryptocurrencies: an unlikely marriage? Marine Le Pen, a significant figure in the French political landscape, has shaken things up by linking these two worlds. During a visit to the Flamanville EPR, she outlined a vision where surplus nuclear electricity would power Bitcoin mining.

OpenAI has just announced the launch of new tools for developers, making it easier to create advanced AI agents. This initiative comes as Chinese startups, such as Monica and DeepSeek, are offering high-performing alternatives, often at a lower cost.

Ledgity Yield, a key player in decentralized finance (DeFi) and a member of the Chainlink BUILD program, announces the hosting of an exclusive X Space in collaboration with Chainlink Labs on Wednesday, March 12 at 6 PM CET. This online event will be an opportunity to explore the challenges and opportunities of integrating Real World Assets (RWA) into DeFi in Europe, as well as the evolution of interactions between traditional finance (TradFi) and decentralized finance.

The social media platform X suffered a large-scale cyberattack on March 10, 2025, disrupting user access. Elon Musk suggests a coordinated operation on a large scale, possibly orchestrated by a state.

As the crypto ecosystem held its breath for Ethereum's Pectra update, an anonymous actor disrupted the Sepolia test network. A subtle attack, exploiting an unexpected vulnerability, revealed weaknesses that raise as many questions as they provide insights. Decoding an incident that lies halfway between a technical bug and psychological warfare.

Bots everywhere, humans nowhere! X, the temple of spam and greedy algorithms, makes CZ from Binance scream scam. Musk, on the other hand, proposes... to charge for entry.

Artificial intelligence has just crossed a new milestone, and this time, a storm is brewing. GPT-4.5, the latest creation from OpenAI, is crushing the track with an outrageous ambition: to dominate by size. While 2025 is already overwhelmed by announcements of rival models – such as Claude from Anthropic or…

The Trump Organization, the company led by the family of current American president Donald Trump, is making a bold move into the digital realm. According to a recent filing with the United States Patent and Trademark Office (USPTO), the organization has submitted a request to register the trademark "Trump" as part of an ambitious expansion into NFTs and the metaverse.

The crypto market is often the stage for spectacular movements, where euphoria can propel an asset to dizzying heights before a brutal reversal sweeps everything away. Indeed, the Pi Network (PI) embodies this phenomenon today in all its excess, with a surge of 35% in its price on February 26, 2025, and a trading volume that exceeds $2.3 billion, with a market capitalization approaching $16 billion. While some investors see this as a sign of a bullish rally still in the acceleration phase, others fear an imminent correction, reinforced by contradictory technical indicators. Is this resurgence of interest in PI the beginning of a lasting ascent or simply a flash in the pan doomed to extinguish quickly?

MetaMask sets sail, goodbye gas fees, hello Bitcoin and Solana. A revolution is blowing through crypto, shaking up certainties and driving competitors wild.

Nvidia has revealed impressive financial results for the fourth quarter and the fiscal year 2025, driven by exceptional demand for its artificial intelligence (AI) chips. With a record revenue of $39.3 billion and a 80% increase in its net income, the company confirms its technological leadership.

MetaMask facilitates the conversion of crypto assets to fiat! 10 new blockchains supported. Discover the details in this article.